Fill in Your Adp Pay Stub Template

Documents used along the form

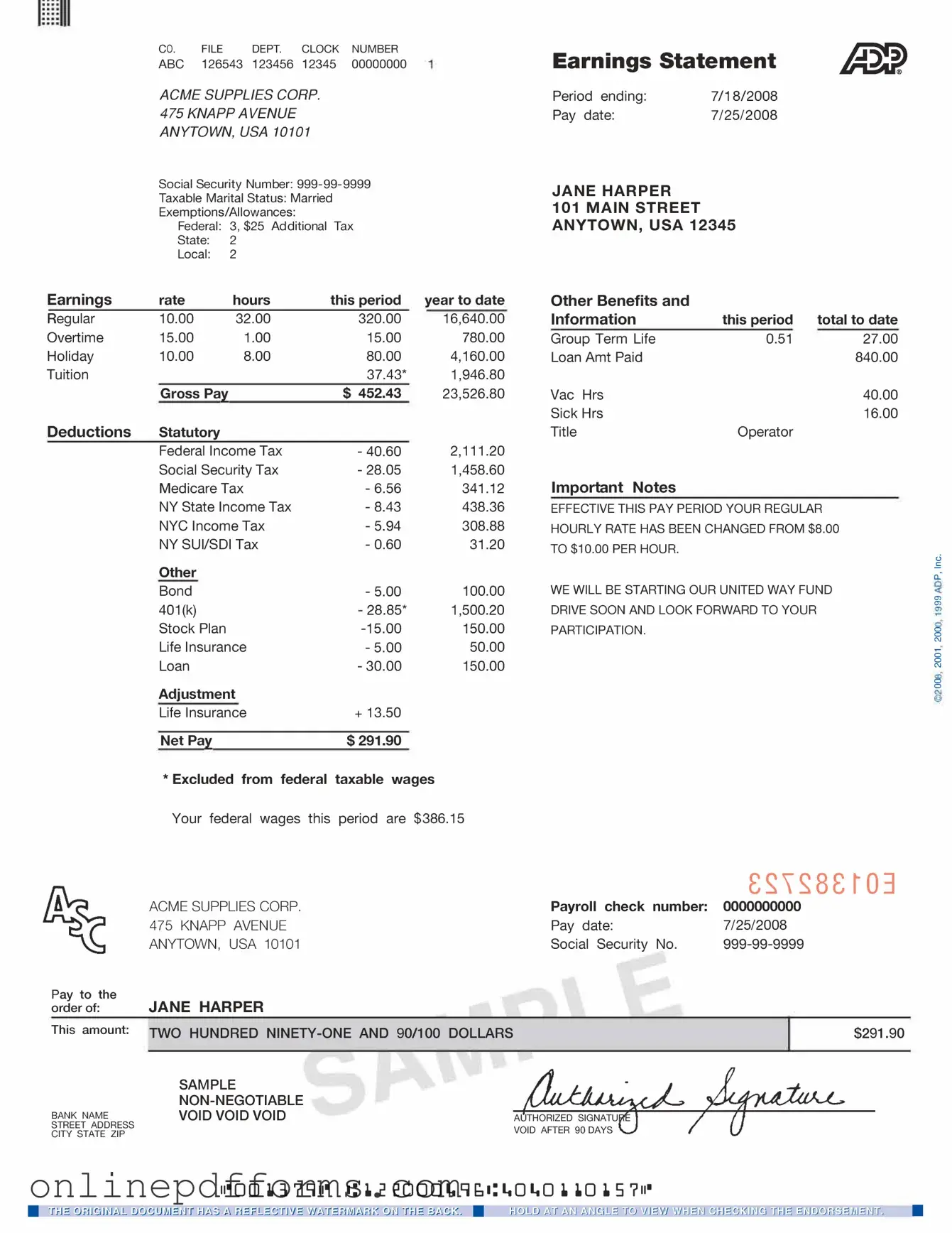

The ADP Pay Stub form is an important document for employees and employers alike. It provides a detailed breakdown of earnings, deductions, and net pay for a specific pay period. However, there are several other forms and documents that are often used in conjunction with the ADP Pay Stub to ensure accurate record-keeping and compliance with regulations. Below is a list of these documents, each serving a unique purpose.

- W-2 Form: This form reports an employee's annual wages and the amount of taxes withheld. Employers must provide this to employees by January 31st each year.

- W-4 Form: Employees fill out this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from each paycheck.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account, simplifying the payment process.

- Time Sheets: Employees use these forms to track hours worked, which helps employers calculate wages and ensure accurate pay on the ADP Pay Stub.

- Payroll Change Form: This form is used to report any changes in an employee's payroll information, such as salary adjustments, tax withholding changes, or changes in direct deposit accounts.

- Benefits Enrollment Form: Employees complete this form to enroll in employer-sponsored benefits like health insurance, retirement plans, or other perks, which may affect deductions on the pay stub.

- Leave Request Form: This document is submitted by employees to request time off, which can impact payroll calculations and the details reflected on the pay stub.

- Employee Handbook Acknowledgment: Employees sign this document to confirm they have received and understood the company’s policies, which can include payroll practices.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state taxes and allows employees to specify how much state tax should be withheld from their paychecks.

These documents play a crucial role in the payroll process, ensuring that both employees and employers are on the same page regarding earnings, deductions, and compliance with tax regulations. Keeping these forms organized and up-to-date can help streamline payroll operations and enhance financial accuracy.

More PDF Templates

Form 6059B Customs Declaration - Be honest about the items you are bringing to avoid legal issues.

Vaccine Records - Parents must harness this form's information to advocate for their child's health.

Similar forms

The W-2 form is a key document that employees receive from their employers. It summarizes an employee's annual earnings and the taxes withheld from their paycheck. Similar to the ADP Pay Stub, the W-2 provides a breakdown of income, but it focuses on the entire year rather than individual pay periods. Both documents are essential for understanding compensation and preparing for tax filing, making them critical for financial planning.

The pay statement, often issued by employers, serves a similar purpose to the ADP Pay Stub. It details an employee's earnings for a specific pay period, including gross pay, deductions, and net pay. While the ADP Pay Stub is a specific format used by ADP, a pay statement can vary in design and terminology. Both documents help employees track their earnings and understand their take-home pay.

The 1099 form is used for reporting income received by independent contractors and freelancers. Like the ADP Pay Stub, it provides a summary of earnings but focuses on payments made outside of traditional employment. Both documents are crucial for tax reporting, as they help individuals understand their income and the taxes owed. They serve different types of workers but share the goal of providing clarity on earnings.

The direct deposit receipt is another document that shares similarities with the ADP Pay Stub. This receipt provides confirmation of the funds deposited into an employee's bank account after a pay period. While it may not detail deductions like the ADP Pay Stub, it confirms the net pay received. Both documents are important for tracking payments and ensuring that employees receive their correct compensation.

The payroll summary report, often generated by employers, offers a broader view of payroll expenses for a specific period. It includes total wages paid, deductions, and employer contributions. While the ADP Pay Stub focuses on individual employee earnings, the payroll summary report aggregates this information for the entire workforce. Both documents are valuable for financial oversight and budgeting within a business.

Steps to Filling Out Adp Pay Stub

Completing the ADP Pay Stub form is a straightforward process. This form is essential for recording your earnings and deductions accurately. Follow the steps below to ensure you fill it out correctly.

- Begin by entering your employee ID at the top of the form.

- Next, fill in your name as it appears on your payroll records.

- Provide your address, including street, city, state, and zip code.

- In the designated section, input your pay period dates.

- Enter your hours worked for the pay period.

- List your gross pay, which is your total earnings before any deductions.

- Detail any deductions, such as taxes or retirement contributions.

- Finally, calculate your net pay, which is the amount you take home after deductions.