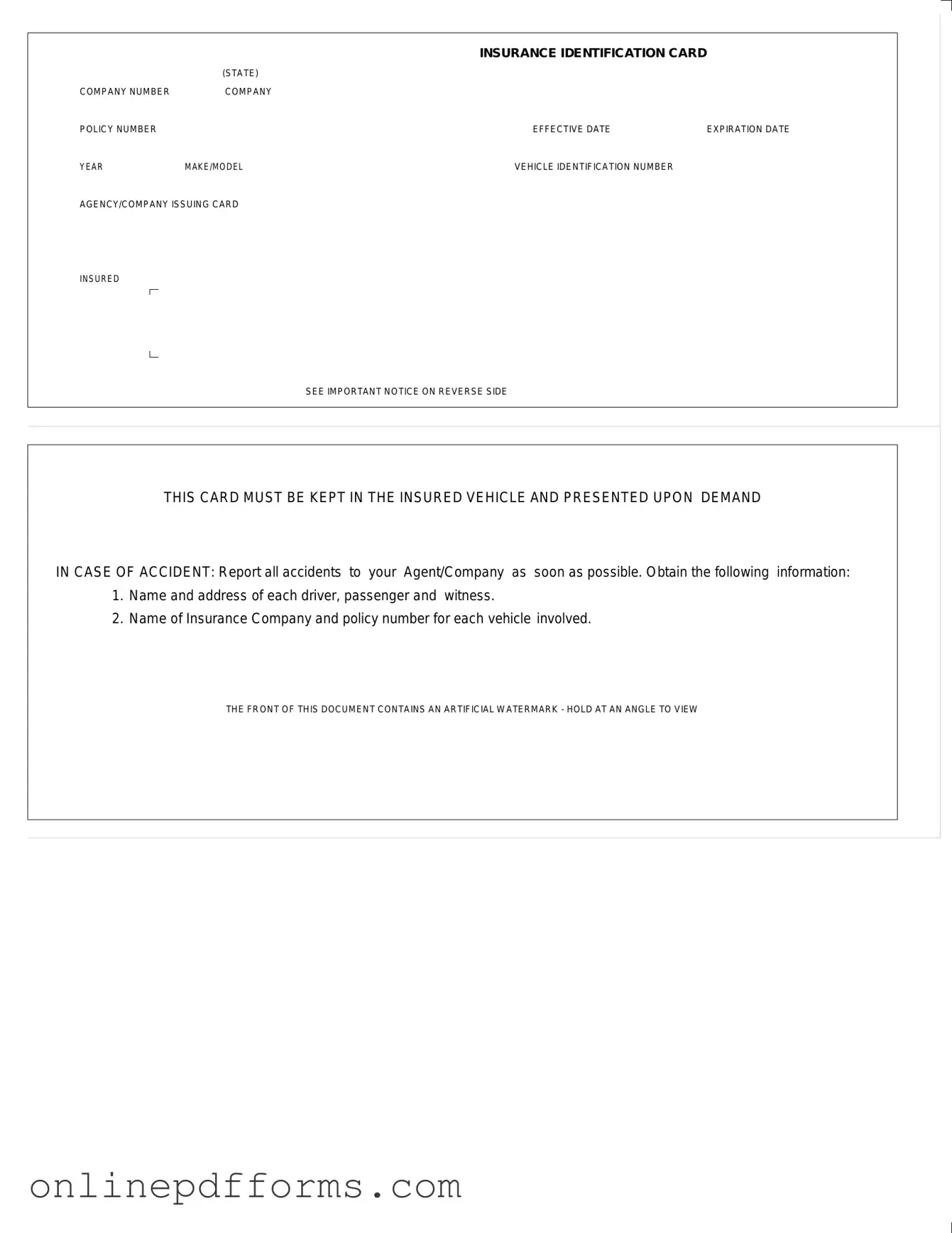

Fill in Your Auto Insurance Card Template

Documents used along the form

The Auto Insurance Card is a crucial document for vehicle owners, providing proof of insurance coverage. Along with this card, several other forms and documents are often necessary for managing insurance claims, vehicle registration, and legal compliance. Below is a list of related documents that may be required.

- Claim Form: This document is used to formally report an incident to your insurance company. It outlines the details of the accident and initiates the claims process.

- Vehicle Registration: This form proves that a vehicle is registered with the state. It includes information about the vehicle and its owner, and must be kept current.

- Proof of Financial Responsibility: Some states require this document, which shows that a driver can cover damages in case of an accident. It can be in the form of an insurance card or a bond.

- Accident Report: This report is usually filed with local law enforcement after an accident. It contains details about the incident and can be crucial for insurance claims.

- Policy Declarations Page: This document summarizes the key details of your insurance policy, including coverage limits and deductibles. It’s important for understanding your insurance terms.

- Endorsement Forms: These forms modify your insurance policy. They can add or remove coverage, change limits, or update information about the insured vehicle.

- Inspection Report: If required by your insurer, this document verifies the condition of your vehicle. It may be necessary for certain types of coverage or claims.

- Mechanics Lien California Form: This is a legal tool used by contractors and suppliers to secure payment for their work, vital for those involved in property improvements. For more information, visit californiapdf.com/.

- Release of Liability: This form is signed when one party agrees not to hold another party responsible for damages after an incident. It is often used in settlements.

Having these documents organized and accessible can streamline the process of managing your auto insurance. Always ensure you understand the requirements specific to your state and insurance provider.

More PDF Templates

Schedule Availability Form - Share any limitations on your daily hours.

For those looking to complete the Texas Employment Verification form, it is essential to have the right resources and information at hand. You can access the form and get started on the verification process by following the link here, ensuring that all required details are accurately filled to facilitate the processing of state benefits.

How to Check How Many College Credits You Have - Mail requests should be sent to Everest University's designated address in Tampa, FL.

Similar forms

The Vehicle Registration Document serves as proof that a vehicle is legally registered with the state. Similar to the Auto Insurance Card, it includes essential information such as the vehicle identification number (VIN), make and model, and the owner's name and address. Both documents must be kept in the vehicle and presented during traffic stops or accidents, ensuring compliance with state laws.

The Driver's License is another critical document that shares similarities with the Auto Insurance Card. It identifies the individual authorized to operate a vehicle and includes personal details such as name, address, and date of birth. Like the insurance card, it must be presented upon request by law enforcement and is often required during accident reporting.

The Title of a Vehicle is a legal document that proves ownership. It contains information about the vehicle, including the VIN and the owner's name. While the Auto Insurance Card focuses on coverage details, the Title establishes who has the legal right to the vehicle. Both documents are crucial for vehicle transactions and must be available when needed.

The Wisconsin Articles of Incorporation form is essential for establishing a corporation in the state, as it serves as the formal record that legally creates your business entity while outlining key details such as its name and purpose. To begin your journey into entrepreneurship, you can find the necessary documentation at https://pdftemplates.info/wisconsin-articles-of-incorporation-form.

The Proof of Insurance Document is specifically designed to confirm that a vehicle is insured. This document includes details such as the insurance company's name, policy number, and coverage dates. Like the Auto Insurance Card, it must be presented when requested by law enforcement and serves as evidence of compliance with state insurance requirements.

The Bill of Sale is a document that records the transaction of a vehicle purchase. It includes the buyer's and seller's information, vehicle details, and the sale price. While it differs in purpose from the Auto Insurance Card, both documents are essential during vehicle ownership transfers and may be required for registration and insurance purposes.

The Emissions Test Certificate is required in many states to ensure that vehicles meet environmental standards. It includes details about the vehicle and the results of the emissions test. Similar to the Auto Insurance Card, this document must be presented during vehicle registration and can impact the ability to legally drive the vehicle.

The Safety Inspection Certificate verifies that a vehicle meets safety standards. This document, like the Auto Insurance Card, is often required for vehicle registration and must be kept on hand. Both documents ensure that vehicles are safe to operate on public roads and comply with state regulations.

The Rental Agreement is a contract between a renter and a rental company that outlines the terms of vehicle use. It includes information such as the renter's name, vehicle details, and rental duration. While it serves a different function than the Auto Insurance Card, both documents are crucial for responsible vehicle operation and can involve insurance coverage in the event of an accident.

The Warranty Document provides details about the manufacturer's guarantee for a vehicle's parts and services. It outlines coverage specifics, including duration and limitations. While not directly related to insurance, both the Warranty Document and the Auto Insurance Card are vital for vehicle owners, ensuring protection against potential issues and financial liabilities.

Steps to Filling Out Auto Insurance Card

Completing the Auto Insurance Card form is a straightforward process. Follow the steps below to ensure that all necessary information is accurately provided.

- Begin by entering the Company Number in the designated field.

- Next, input the Company Policy Number associated with your insurance coverage.

- Fill in the Effective Date of your policy, indicating when the coverage begins.

- Provide the Expiration Date, which signifies when your coverage will end.

- List the Year, Make/Model of your vehicle in the appropriate sections.

- Enter the Vehicle Identification Number (VIN), ensuring it is accurate.

- Identify the Agency/Company Issuing Card by writing the name of your insurance provider.

Once you have completed the form, keep it in your vehicle as it must be presented if requested during an accident. Remember to report any accidents to your insurance agent or company promptly, gathering all necessary details as outlined in the notice on the reverse side of the card.