Fill in Your Broker Price Opinion Template

Documents used along the form

The Broker Price Opinion (BPO) form is a crucial document in real estate transactions, particularly for evaluating property value. Along with the BPO, several other forms and documents are commonly used to support the process. Here are five important ones:

- Comparative Market Analysis (CMA): This document provides an analysis of similar properties that have recently sold in the area. It helps determine the fair market value of a property by comparing it to others with similar features and conditions.

- Listing Agreement: This is a contract between a property owner and a real estate broker. It outlines the terms of the listing, including the commission structure and the duration of the agreement, ensuring both parties understand their responsibilities.

- Mobile Home Bill of Sale Form: To facilitate mobile home transactions, refer to our comprehensive Mobile Home Bill of Sale document for accurate ownership transfer.

- Property Disclosure Statement: Sellers often provide this document to disclose known issues with the property. It includes information about the condition of the home, any repairs made, and potential hazards, helping buyers make informed decisions.

- Purchase Agreement: This is a legally binding contract between a buyer and seller. It outlines the terms of the sale, including the purchase price, contingencies, and closing date, ensuring both parties are on the same page.

- Inspection Report: After a property is inspected, this report details the condition of the home, highlighting any repairs needed. It can influence negotiations and final sale prices, providing critical information to both buyers and sellers.

These documents work together to provide a comprehensive view of the property, its value, and the terms of sale. Understanding each one is essential for anyone involved in real estate transactions.

More PDF Templates

What Are Column Graphs Used for - Organization: Arrange information logically across the columns.

While preparing to establish your corporation in Arizona, it's essential to complete the necessary paperwork, starting with the Arizona Articles of Incorporation form. This form clearly outlines the corporation's name, purpose, and incorporator details. To streamline the process, you can visit arizonaformspdf.com/ for the necessary resources and guidance.

W-9 Example - Non-profit organizations also utilize the W-9 when collecting donations or grants.

Similar forms

The Broker Price Opinion (BPO) form shares similarities with a Comparative Market Analysis (CMA). Both documents aim to assess the value of a property by comparing it to similar properties in the area. A CMA typically provides a detailed analysis of recently sold homes, active listings, and pending sales, while the BPO focuses more on the current market conditions and the specific property in question. Both tools are essential for real estate agents and brokers to determine a competitive price for listing or selling a property, but the CMA often includes more extensive data and analysis than the BPO.

Another document akin to the BPO is the Appraisal Report. Appraisals are conducted by licensed appraisers and provide an unbiased estimate of a property's value. Like the BPO, an appraisal considers comparable sales, property condition, and market trends. However, appraisals are more formal and often required by lenders for mortgage purposes. While both documents evaluate property value, the appraisal is generally more comprehensive and follows strict guidelines set by regulatory bodies.

For those navigating the complexities of rental agreements, it's important to familiarize yourself with the Texas Notice to Quit form, a critical document that facilitates communication between landlords and tenants regarding the need to vacate or address lease violations. This form is not only a formal request but also lays out the rights and responsibilities of both parties, making it essential for a smooth resolution. To ensure compliance and clarity in this matter, download the document now to get started.

The Listing Agreement is also similar to the BPO in that it outlines the terms under which a property will be marketed and sold. This document includes details such as the listing price, duration of the agreement, and the responsibilities of the agent and seller. While the BPO provides an estimate of value based on market conditions and comparable properties, the Listing Agreement formalizes the relationship between the seller and the agent, setting the stage for the marketing process.

Lastly, the Seller’s Disclosure Statement bears resemblance to the BPO in that it provides crucial information about the property. This document typically includes details about the property’s condition, past repairs, and any known issues that could affect its value. While the BPO focuses on market analysis and property valuation, the Seller’s Disclosure Statement ensures transparency and helps potential buyers make informed decisions. Both documents are essential for facilitating a smooth transaction in the real estate market.

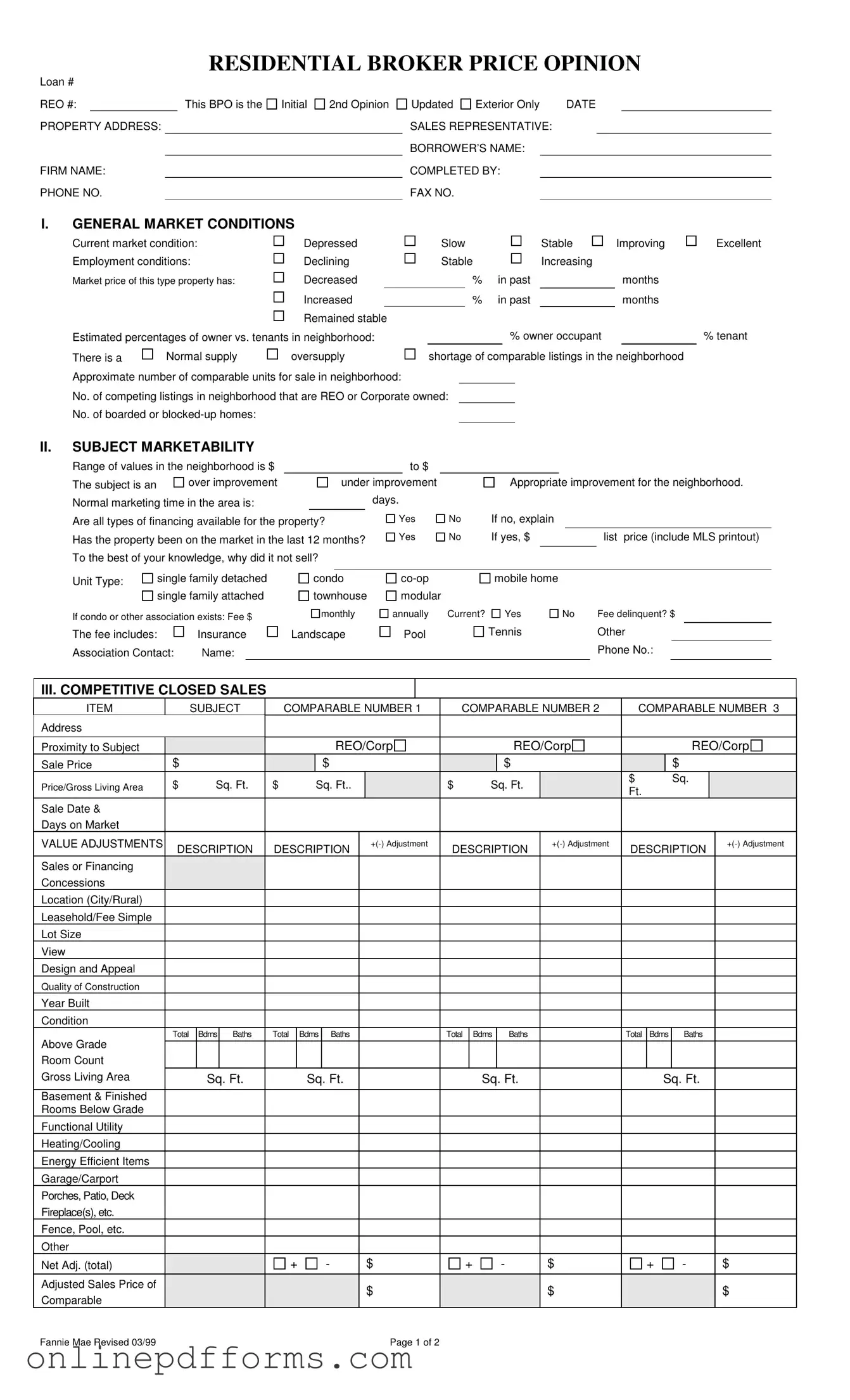

Steps to Filling Out Broker Price Opinion

Filling out the Broker Price Opinion (BPO) form requires careful attention to detail and accurate information. Each section of the form plays a crucial role in determining the property's value and marketability. Below are the steps to guide you through the process of completing the BPO form.

- Begin with the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS, FIRM NAME, and PHONE NO..

- Indicate whether this is an Initial, 2nd Opinion, or Updated BPO.

- Enter the DATE and the name of the SALES REPRESENTATIVE.

- Provide the BORROWER’S NAME and the name of the person COMPLETED BY.

- Include the FAX NO. if applicable.

- In the GENERAL MARKET CONDITIONS section, assess the current market condition and employment conditions, selecting the appropriate options.

- Estimate the market price changes and owner vs. tenant percentages in the neighborhood.

- Note the supply of comparable listings and approximate number of comparable units for sale.

- In the SUBJECT MARKETABILITY section, provide the range of values and marketing time.

- Answer whether all types of financing are available for the property and if it has been on the market in the last 12 months.

- Specify the Unit Type and any association fees, if applicable.

- Move to the COMPETITIVE CLOSED SALES section and fill in details for comparable properties, including address, sale price, and adjustments.

- Make necessary adjustments based on various factors and calculate the adjusted sales price for each comparable.

- In the MARKETING STRATEGY section, indicate whether the property will be sold as-is or if repairs are required.

- Document the occupancy status and itemize all necessary repairs.

- Calculate the grand total for all repairs needed.

- In the COMPETITIVE LISTINGS section, provide details for additional comparable properties, similar to the previous section.

- Determine the MARKET VALUE based on the competitive closed sales and suggest a list price.

- Finally, include any relevant comments about the property and sign with the date.