Fill in Your Business Credit Application Template

Documents used along the form

When applying for business credit, several other documents may be needed alongside the Business Credit Application form. These documents help lenders assess your business's financial health and creditworthiness. Below is a list of commonly required forms and documents.

- Business Plan: This document outlines your business goals, strategies, and financial projections. It gives lenders insight into your business's potential for success.

- Financial Statements: These include your balance sheet, income statement, and cash flow statement. They provide a snapshot of your business's financial status.

- Tax Returns: Typically, lenders request personal and business tax returns from the last few years. This helps verify income and assess financial stability.

- Bank Statements: Recent bank statements show your cash flow and help lenders understand your spending habits and financial management.

- Personal Guarantee: This document may be required if the lender wants assurance that you will be personally responsible for the debt if the business cannot pay.

- Credit Report: A business credit report provides a history of your credit usage and payment behavior, helping lenders evaluate your creditworthiness.

- Resumes of Key Management: Lenders may want to see the resumes of the business's key management personnel. This helps them assess the experience and skills of those running the business.

- Legal Documents: Depending on your business structure, you may need to provide articles of incorporation, operating agreements, or partnership agreements to verify your business's legitimacy.

Having these documents ready can streamline the credit application process and improve your chances of approval. Be sure to check with your lender for any specific requirements they may have.

More PDF Templates

Affidavit of Support - The form helps ensure that new immigrants will not become a public charge.

Form 1098 Mortgage - Review payments due to see if they have been fully paid or remain unpaid.

Similar forms

The Business Loan Application form serves a similar purpose to the Business Credit Application form. Both documents are used by businesses seeking financial support, whether through credit or loans. They typically require information about the business's financial history, ownership, and operational structure. By providing this information, businesses can demonstrate their creditworthiness to lenders, helping them secure necessary funds for growth or operational expenses.

The Vendor Credit Application is another document akin to the Business Credit Application. This form is specifically used when a business seeks credit from a supplier or vendor. It includes details about the business's financial stability and payment history, similar to the Business Credit Application. The goal is to establish a trusting relationship between the vendor and the business, ensuring that the vendor feels confident extending credit terms.

A Personal Guarantee form often accompanies the Business Credit Application. While the Business Credit Application focuses on the business itself, the Personal Guarantee form requires an individual, usually a business owner, to pledge personal assets as collateral. This document reinforces the commitment of the business owner to repay any debts, providing additional security to the lender.

The Business Partnership Agreement can also be compared to the Business Credit Application. Although it primarily outlines the terms of a partnership, it often includes financial information about the business and its partners. Lenders may request this agreement to understand the financial responsibilities and liabilities of each partner, which can influence their decision on extending credit.

The Financial Statement is another crucial document that shares similarities with the Business Credit Application. This statement provides a snapshot of a business's financial health, detailing assets, liabilities, income, and expenses. Lenders often require this document alongside the Business Credit Application to assess the business's ability to repay any credit extended.

The Business Plan is a forward-looking document that outlines a company's strategy and goals. While the Business Credit Application focuses on past financial performance, the Business Plan provides insight into future prospects. Lenders may review both documents together to gauge not only the current state of the business but also its potential for growth and success.

The Trade Reference Form is a document that businesses can use to provide references from other companies with whom they have established credit relationships. This form complements the Business Credit Application by offering potential lenders a way to verify the business's credit history and payment behavior with other vendors, adding credibility to the application.

The Credit Report is another document that parallels the Business Credit Application. A credit report provides a detailed history of a business's credit activity, including payment history and outstanding debts. Lenders often review this report in conjunction with the Business Credit Application to assess the risk associated with extending credit to the business.

The Business Registration Certificate is a document that verifies a business's legal existence. While the Business Credit Application focuses on financial aspects, the registration certificate assures lenders that the business is legitimate and compliant with local regulations. This document helps establish trust between the lender and the business.

Lastly, the Accounts Payable Aging Report is similar to the Business Credit Application in that it provides insight into a business's financial obligations. This report details outstanding invoices and payment timelines, helping lenders understand the business's cash flow and ability to meet its obligations. By reviewing this report, lenders can make informed decisions regarding the creditworthiness of the business.

Steps to Filling Out Business Credit Application

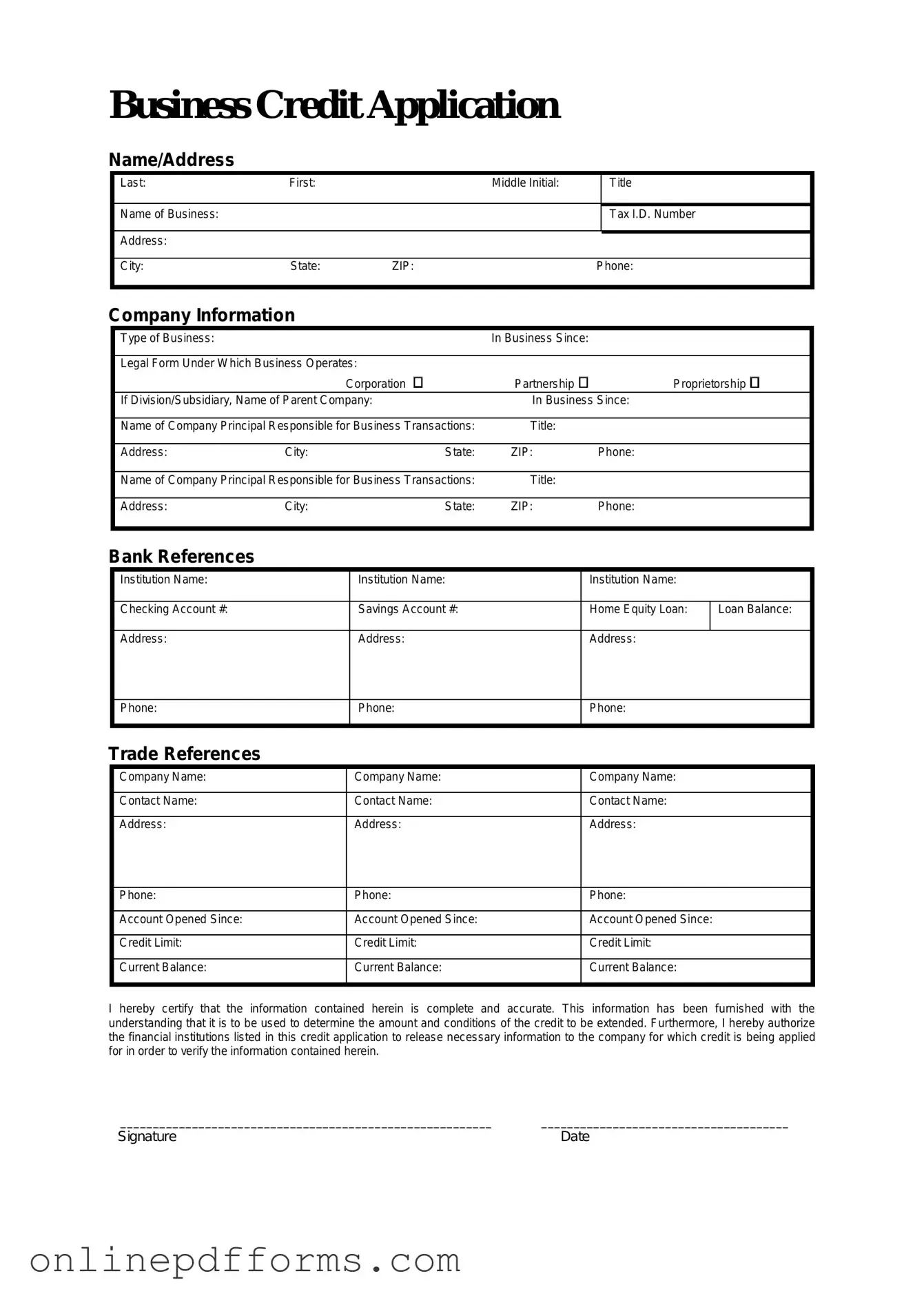

Completing the Business Credit Application form is an important step in establishing a credit relationship with a lender or supplier. This form collects essential information about your business to facilitate the credit evaluation process. Follow these steps to accurately fill out the application.

- Begin by entering your business name in the designated field. Make sure to use the official name as registered with the state.

- Provide your business address, including street, city, state, and ZIP code. Ensure that the address is current and complete.

- Fill in the business phone number and email address. This information is crucial for communication purposes.

- Indicate the type of business structure, such as sole proprietorship, partnership, corporation, or LLC. Choose the option that best describes your business.

- List the names and titles of the owners or principal officers. Include their contact information if required.

- Provide the business’s Federal Tax Identification Number (EIN) or Social Security Number if applicable.

- Detail your business’s annual revenue and years in operation. This information helps assess your financial stability.

- Complete the section regarding trade references. Include the names and contact information of at least three suppliers or vendors you have worked with.

- Review the application for accuracy. Ensure all fields are filled out correctly and completely.

- Sign and date the application at the bottom. This signature confirms that the information provided is true and complete.

Once you have completed the form, submit it according to the instructions provided by the lender or supplier. This may involve mailing a physical copy or submitting it electronically through their website.