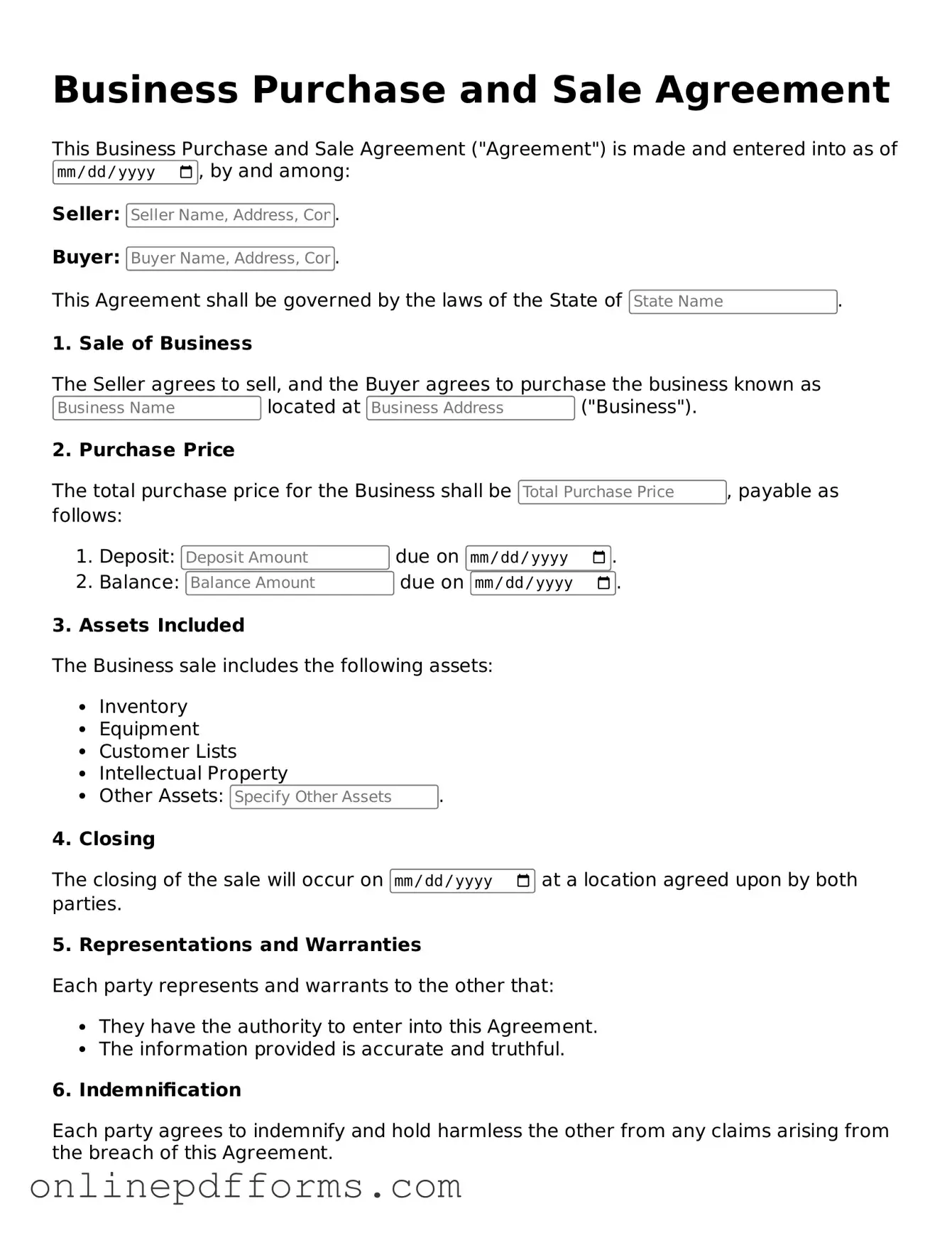

Legal Business Purchase and Sale Agreement Form

Documents used along the form

When engaging in a business transaction, the Business Purchase and Sale Agreement is a crucial document. However, several other forms and documents are often used in conjunction to ensure a smooth and legally sound transfer of ownership. Here’s a brief overview of some of these essential documents.

- Letter of Intent (LOI): This document outlines the preliminary agreement between the buyer and seller. It expresses the intention to move forward with the sale and often includes key terms and conditions that will be negotiated in the final agreement.

- Due Diligence Checklist: This checklist helps the buyer gather and review important information about the business. It typically includes financial records, contracts, and other essential documents to ensure that the buyer fully understands what they are purchasing.

- Asset Purchase Agreement: If the sale involves purchasing specific assets rather than the entire business entity, this document details the assets being sold. It outlines terms, conditions, and responsibilities of both parties regarding the assets involved.

- Non-Disclosure Agreement (NDA): Often used to protect sensitive information, this agreement ensures that both parties keep confidential information private during negotiations and after the sale is completed.

- Trailer Bill of Sale: This form is essential for documenting the sale and transfer of ownership of a trailer in Virginia. For additional resources, refer to Auto Bill of Sale Forms.

- Bill of Sale: This document serves as proof of the transfer of ownership. It includes details about the transaction and is signed by both the buyer and seller, providing legal evidence that the sale has occurred.

Each of these documents plays a vital role in the process of buying or selling a business. Understanding their purposes can help both buyers and sellers navigate the complexities of business transactions more effectively.

Other Templates:

Revocation of Power of Attorney Form - The Revocation of Power of Attorney form contributes to your ongoing legal and financial protection.

The Investment Letter of Intent form serves as a preliminary agreement between parties interested in making an investment. This document outlines the essential terms and conditions that will guide future commitments. Often considered a first step in negotiations, it helps lay the groundwork for a more formal investment agreement, which can be further explored at documentonline.org/blank-investment-letter-of-intent/.

I-9 - An employment verification form confirms a person's job details.

Living Will Requirements - This form can help in creating a comprehensive approach to health and wellness decisions.

Similar forms

The Business Purchase and Sale Agreement (BPSA) shares similarities with the Asset Purchase Agreement (APA). Both documents facilitate the transfer of ownership, but while the BPSA typically encompasses the sale of an entire business entity, the APA focuses on the sale of specific assets. This could include equipment, inventory, or intellectual property. In both cases, clear definitions of what is being sold and the terms of the sale are essential to avoid misunderstandings.

Another closely related document is the Stock Purchase Agreement (SPA). This agreement is used when an individual or entity purchases shares of a corporation. Like the BPSA, the SPA outlines the terms of the transaction, including purchase price and payment methods. However, unlike the BPSA, which may involve various forms of business structures, the SPA is specifically tailored for corporations and addresses shareholder rights and obligations.

In the context of critical medical decisions, it is important to understand how a California Do Not Resuscitate Order form works, allowing individuals to specify their healthcare preferences clearly. Those seeking further information can visit californiapdf.com/, which provides helpful resources and guidance on completing these vital legal documents.

The Letter of Intent (LOI) is also relevant in the context of business transactions. While it is not a binding agreement, the LOI outlines the preliminary understanding between the parties involved. Similar to the BPSA, it includes key terms such as price and timeline but serves primarily as a framework for negotiation. The LOI sets the stage for the formal agreements that follow, ensuring both parties are aligned before proceeding.

The Confidentiality Agreement, or Non-Disclosure Agreement (NDA), plays a crucial role in business transactions. This document protects sensitive information shared during negotiations. Like the BPSA, the NDA emphasizes the importance of confidentiality and trust between parties. Both documents require clear definitions of what constitutes confidential information and the obligations of the parties involved.

The Due Diligence Checklist is another document that complements the BPSA. It serves as a guide for the buyer to assess the business's health before finalizing the purchase. While the BPSA outlines the terms of the sale, the due diligence checklist helps ensure that the buyer is making an informed decision. Both documents are integral to the transaction process, providing structure and clarity.

Finally, the Partnership Agreement is relevant for businesses structured as partnerships. This document outlines the roles, responsibilities, and profit-sharing arrangements among partners. While the BPSA focuses on the sale of a business, the Partnership Agreement provides a framework for ongoing operations and governance. Both documents require careful consideration of the parties' rights and obligations to foster a successful business relationship.

Steps to Filling Out Business Purchase and Sale Agreement

Filling out a Business Purchase and Sale Agreement form is an important step in the process of buying or selling a business. This document outlines the terms and conditions of the sale, ensuring that both parties are on the same page. Follow these steps carefully to complete the form accurately.

- Start with the date: Write the date on which the agreement is being made at the top of the form.

- Identify the parties: Clearly state the names and addresses of both the buyer and the seller. Make sure to include any relevant business names.

- Describe the business: Provide a detailed description of the business being sold. Include information such as the type of business, its location, and any assets included in the sale.

- Purchase price: Specify the total purchase price for the business. Include any payment terms, such as deposits or financing options.

- Closing date: Indicate the date when the sale will be finalized. This is when the buyer will take ownership of the business.

- Contingencies: List any conditions that must be met before the sale can proceed. This might include financing approvals or inspections.

- Signatures: Ensure that both the buyer and seller sign and date the agreement. This makes the document legally binding.

After completing the form, review it carefully to ensure all information is accurate and clear. Both parties should keep a copy for their records, as this agreement will serve as a key reference throughout the transaction.