Blank California Deed in Lieu of Foreclosure Form

Documents used along the form

When navigating the process of a Deed in Lieu of Foreclosure in California, several other forms and documents often accompany this transaction. Each of these documents plays a crucial role in ensuring a smooth and legally sound process. Below is a list of commonly used forms that may be required.

- Grant Deed: This document transfers ownership of the property from the borrower to the lender. It serves as proof of the transfer and includes details about the property.

- Authorization to Release Information: This form allows the lender to obtain necessary information about the borrower’s financial situation from third parties, such as credit agencies.

- Loan Modification Agreement: If applicable, this document outlines any changes to the original loan terms, which may be proposed before considering a Deed in Lieu of Foreclosure.

- Notice of Default: This document notifies the borrower that they have defaulted on their loan payments. It is often a precursor to foreclosure proceedings.

- Property Condition Disclosure: The borrower may need to provide information about the property's condition, including any known defects or issues.

- Settlement Statement: Also known as a HUD-1, this document summarizes the financial aspects of the transaction, including any fees and costs associated with the deed transfer.

- Loan Agreement Form: For those considering borrowing options, consult the vital Loan Agreement document details to ensure all terms are explicitly outlined and understood.

- Release of Liability: This form releases the borrower from any further obligations related to the mortgage once the Deed in Lieu of Foreclosure is executed.

- Affidavit of Title: This document certifies that the borrower holds clear title to the property and has the right to transfer ownership.

- Power of Attorney: If someone is acting on behalf of the borrower, this document grants them the authority to sign necessary documents related to the transaction.

- IRS Form 1099-C: This form is issued by the lender to report the cancellation of debt, which may have tax implications for the borrower.

Understanding these documents can help streamline the process of a Deed in Lieu of Foreclosure. Being prepared with the right forms ensures that all parties involved are informed and that the transaction proceeds smoothly.

Other Popular State-specific Deed in Lieu of Foreclosure Templates

Deed in Lieu Vs Foreclosure - Understanding the implications of signing a Deed in Lieu of Foreclosure is critical for homeowners facing choices.

Foreclosure Vs Deed in Lieu - Sometimes lenders impose restrictions on future loans following a deed in lieu agreement.

The Texas Homestead Exemption form is an essential document for homeowners seeking to reduce their property taxes. Specifically designed for properties that serve as the owner's principal residence, the form offers eligibility for various exemptions under the state's Tax Code. To get started, you can download the Harris County Homestead Tax Relief Form and take the first step towards lowering your property taxes. Ready to lower your property taxes? Click the button below to fill out your form today.

A Deed in Lieu of Foreclosure - A legal consultation may be beneficial to fully understand the implications of entering into a Deed in Lieu.

Similar forms

The California Deed in Lieu of Foreclosure is similar to a short sale agreement. In both cases, the homeowner seeks to avoid foreclosure by transferring ownership of the property. A short sale involves selling the property for less than the mortgage balance, with the lender's approval. This allows the homeowner to settle their debt without the lengthy process of foreclosure, while the lender recoups some of their losses through the sale proceeds.

Another document that bears similarity is the mortgage modification agreement. This agreement allows homeowners to change the terms of their existing mortgage, making it more manageable. Like a deed in lieu, a mortgage modification aims to prevent foreclosure. However, in this case, the homeowner retains ownership of the property while negotiating new terms, such as a lower interest rate or extended payment period.

The Texas Motorcycle Bill of Sale form is a crucial document when purchasing a motorcycle, ensuring that all details related to the transaction are accurately recorded. This form captures essential information about the buyer, seller, and the motorcycle itself, thus legitimizing the sale and providing legal protection for both parties. If you're looking to understand the specifics of filling out this form, you can read more about the form to ensure a smooth transaction process.

The forbearance agreement is also comparable. In a forbearance agreement, the lender allows the homeowner to temporarily pause or reduce mortgage payments. This option provides immediate relief to those facing financial hardship, similar to the deed in lieu, which serves as a last resort to avoid foreclosure. However, the homeowner remains responsible for the mortgage and must eventually resume payments.

A quitclaim deed shares some similarities with the deed in lieu of foreclosure. A quitclaim deed transfers ownership of property without any warranties. It is often used between family members or in divorce settlements. While a quitclaim deed does not specifically address foreclosure, it can be a tool for transferring property ownership in situations where the homeowner wishes to relinquish their interest in the property.

The assumption of mortgage agreement is another related document. In this arrangement, a buyer takes over the seller's mortgage payments. This can help sellers avoid foreclosure by allowing someone else to assume their debt. While this differs from a deed in lieu, both aim to relieve the homeowner from the burden of mortgage payments and prevent foreclosure.

The bankruptcy filing is also a relevant document. When a homeowner files for bankruptcy, they can stop foreclosure proceedings temporarily. This legal process can provide the homeowner with a fresh start, similar to a deed in lieu, which allows for the transfer of property to the lender. However, bankruptcy can have more extensive implications for the homeowner's financial future.

The loan modification application is another similar document. This application is submitted by homeowners seeking to change the terms of their mortgage to make payments more affordable. Like a deed in lieu, it seeks to prevent foreclosure. However, in this case, the homeowner remains in possession of the property while negotiating new terms with the lender.

The power of attorney document is also relevant in this context. A power of attorney allows one person to act on behalf of another in legal matters. In the case of a deed in lieu, a homeowner may grant power of attorney to someone else to facilitate the transfer of property. This can simplify the process and ensure that all necessary steps are taken to avoid foreclosure.

Lastly, a release of lien is similar to the deed in lieu of foreclosure. When a lender agrees to release their claim against a property, it allows the homeowner to move forward without the burden of the mortgage. This document can be part of a larger agreement, such as a deed in lieu, where the homeowner voluntarily gives up the property to the lender in exchange for the release of the debt.

Steps to Filling Out California Deed in Lieu of Foreclosure

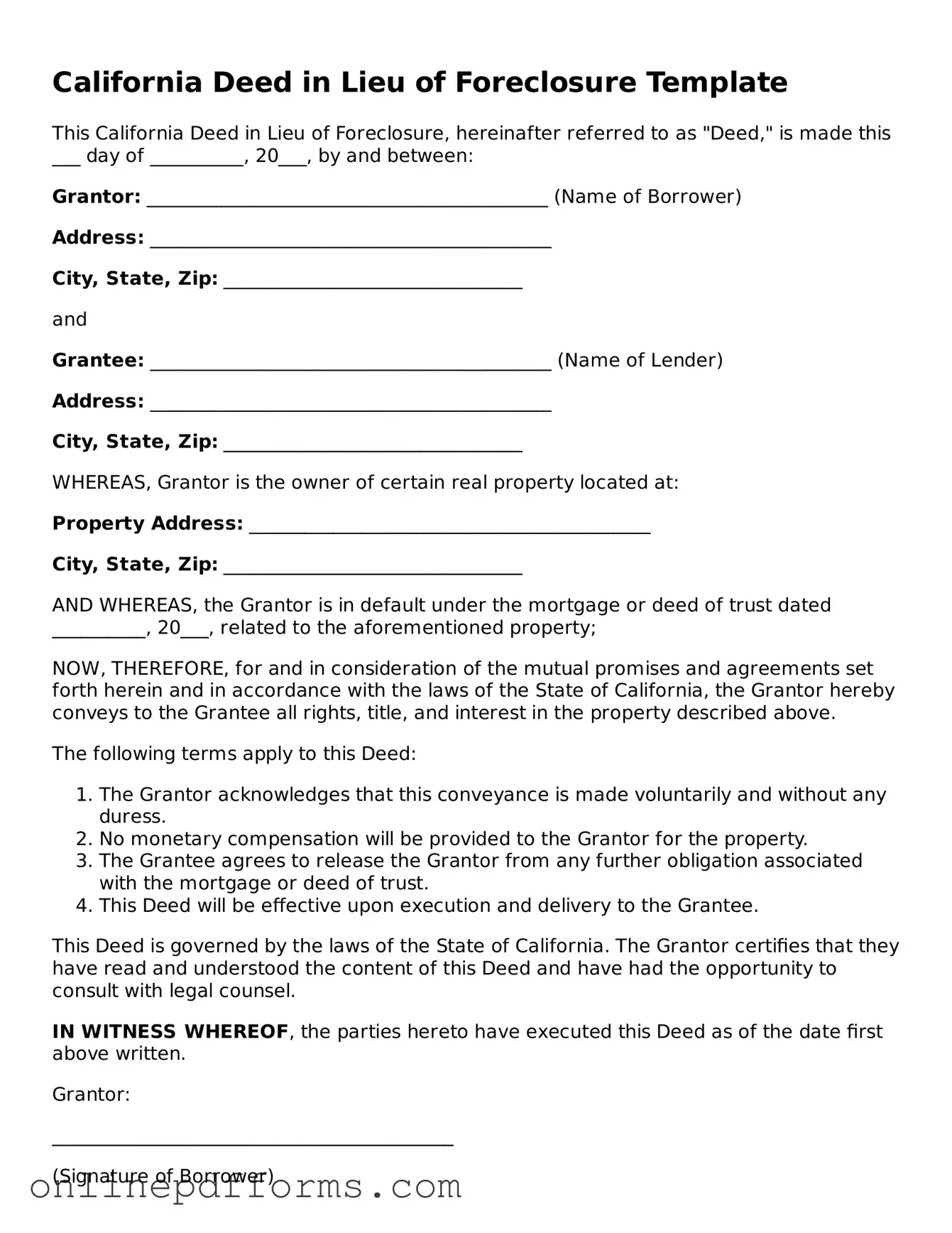

After deciding to proceed with a Deed in Lieu of Foreclosure, the next step involves accurately completing the required form. This document will serve as a formal transfer of property ownership from the borrower to the lender, allowing the lender to take possession of the property without going through the foreclosure process. It is essential to ensure that all sections of the form are filled out correctly to avoid any potential complications.

- Begin by obtaining the California Deed in Lieu of Foreclosure form. This can typically be found on the website of your lender or through legal resources online.

- At the top of the form, fill in the name of the borrower. This should match the name on the original mortgage documents.

- Next, provide the address of the property that is being transferred. Include the complete street address, city, state, and zip code.

- In the designated section, enter the name of the lender who will receive the property. This is usually the bank or financial institution that holds the mortgage.

- Specify the date on which the deed is being executed. This is the date when you are signing the document.

- Review the section regarding any outstanding obligations. If there are any liens or other claims against the property, they should be noted here.

- Sign the form in the space provided. Make sure to use your legal name as it appears on the mortgage documents.

- Have the signature notarized. A notary public will need to witness your signature and provide their seal on the document.

- Once notarized, make copies of the signed form for your records and for the lender.

- Submit the completed and notarized form to the lender. Ensure that you follow any specific submission guidelines they may have.