Blank California Durable Power of Attorney Form

Documents used along the form

The California Durable Power of Attorney form is a crucial document that allows individuals to designate someone to manage their financial and legal affairs in the event they become incapacitated. Along with this form, several other documents may be used to ensure comprehensive planning and protection of an individual's interests. Below is a list of commonly used forms and documents that complement the Durable Power of Attorney.

- Advance Healthcare Directive: This document allows individuals to specify their healthcare preferences and appoint someone to make medical decisions on their behalf if they are unable to do so. It provides clarity on treatment options and end-of-life care.

- Living Trust: A living trust is a legal entity that holds an individual's assets during their lifetime and specifies how those assets should be distributed after their death. It helps avoid probate and can provide for asset management in case of incapacity.

- Will: A will outlines how an individual's assets should be distributed upon their death. It also allows for the appointment of guardians for minor children. Having a will ensures that personal wishes are honored and can simplify the probate process.

- HIPAA Release Form: This form authorizes healthcare providers to share an individual's medical information with designated persons. It is essential for ensuring that the appointed healthcare agent can access necessary medical records when making decisions.

Using these documents in conjunction with the California Durable Power of Attorney can provide a comprehensive framework for managing personal, financial, and healthcare decisions. It is advisable to consult with a legal professional to ensure that all documents are properly executed and aligned with individual needs.

Other Popular State-specific Durable Power of Attorney Templates

General Power of Attorney Form Pennsylvania - It can provide clarity and direction during difficult times, ensuring that your financial matters are handled appropriately.

Illinois Power of Attorney for Property Form - Careful consideration should be given to the selection of the agent to ensure alignment with personal values.

Similar forms

The California Durable Power of Attorney (DPOA) form is similar to the General Power of Attorney (GPOA) in that both documents allow an individual to designate someone else to act on their behalf. The GPOA, however, becomes invalid if the principal becomes incapacitated, whereas the DPOA remains effective under such circumstances. This distinction is crucial for individuals who want to ensure their financial or medical decisions can be managed by a trusted person even if they are unable to make those decisions themselves.

Another document that shares similarities with the DPOA is the Medical Power of Attorney (MPOA). Like the DPOA, the MPOA allows a person to appoint an agent to make decisions on their behalf. However, the MPOA specifically focuses on medical and healthcare decisions, including treatment preferences and end-of-life care. This document is vital for individuals who want to ensure their healthcare wishes are respected when they cannot communicate those wishes directly.

The Living Will is akin to the DPOA in that both address situations where individuals may be incapacitated. A Living Will outlines specific healthcare preferences, particularly regarding life-sustaining treatments, while the DPOA appoints an agent to make decisions. While the DPOA can cover a broad range of financial and healthcare decisions, the Living Will is more focused and can provide clear guidance to healthcare providers and family members about the individual's wishes.

The Revocable Trust can also be compared to the DPOA. Both documents allow for the management of assets during a person’s lifetime and can help avoid probate after death. However, a Revocable Trust involves transferring ownership of assets into the trust, while a DPOA authorizes an agent to manage assets without changing ownership. This can provide a flexible option for individuals who want to maintain control over their assets while still preparing for potential incapacity.

The Advance Healthcare Directive (AHD) is similar to the DPOA in that it combines elements of both the MPOA and the Living Will. An AHD allows individuals to specify their healthcare preferences and appoint an agent to make decisions on their behalf. This dual function ensures that both specific medical wishes and the appointment of a trusted decision-maker are addressed, providing comprehensive guidance during times of incapacity.

A Health Insurance Portability and Accountability Act (HIPAA) Authorization is related to the DPOA as it allows an individual to designate someone to access their medical records and make healthcare decisions. While the DPOA focuses on appointing an agent for broader decision-making, the HIPAA Authorization specifically addresses the sharing of medical information, ensuring that the appointed person can effectively communicate with healthcare providers.

The Financial Power of Attorney is another document that resembles the DPOA, specifically in its focus on financial matters. Both documents allow someone to manage financial affairs on behalf of the principal. However, the Financial Power of Attorney may not include healthcare decisions, making it more limited in scope compared to the DPOA, which can encompass both financial and healthcare choices.

The Special Power of Attorney can also be compared to the DPOA. This document allows an individual to grant authority for specific tasks or transactions, rather than a broad range of powers. While the DPOA is comprehensive and can cover various aspects of decision-making, the Special Power of Attorney is tailored for particular situations, providing a more focused approach to delegating authority.

The Guardianship document is similar to the DPOA in that both can address situations where an individual is unable to make decisions. Guardianship involves a court appointment to manage the affairs of a minor or incapacitated adult, whereas the DPOA allows individuals to choose their own agents without court intervention. This autonomy in the DPOA can be a more straightforward option for individuals planning for potential incapacity.

Finally, the Will can be seen as related to the DPOA, particularly in how both documents deal with an individual’s wishes regarding their affairs. A Will dictates how assets should be distributed after death, while the DPOA provides guidance on managing those assets during the individual’s lifetime. Both documents are essential for comprehensive estate planning, ensuring that an individual’s desires are honored both before and after their passing.

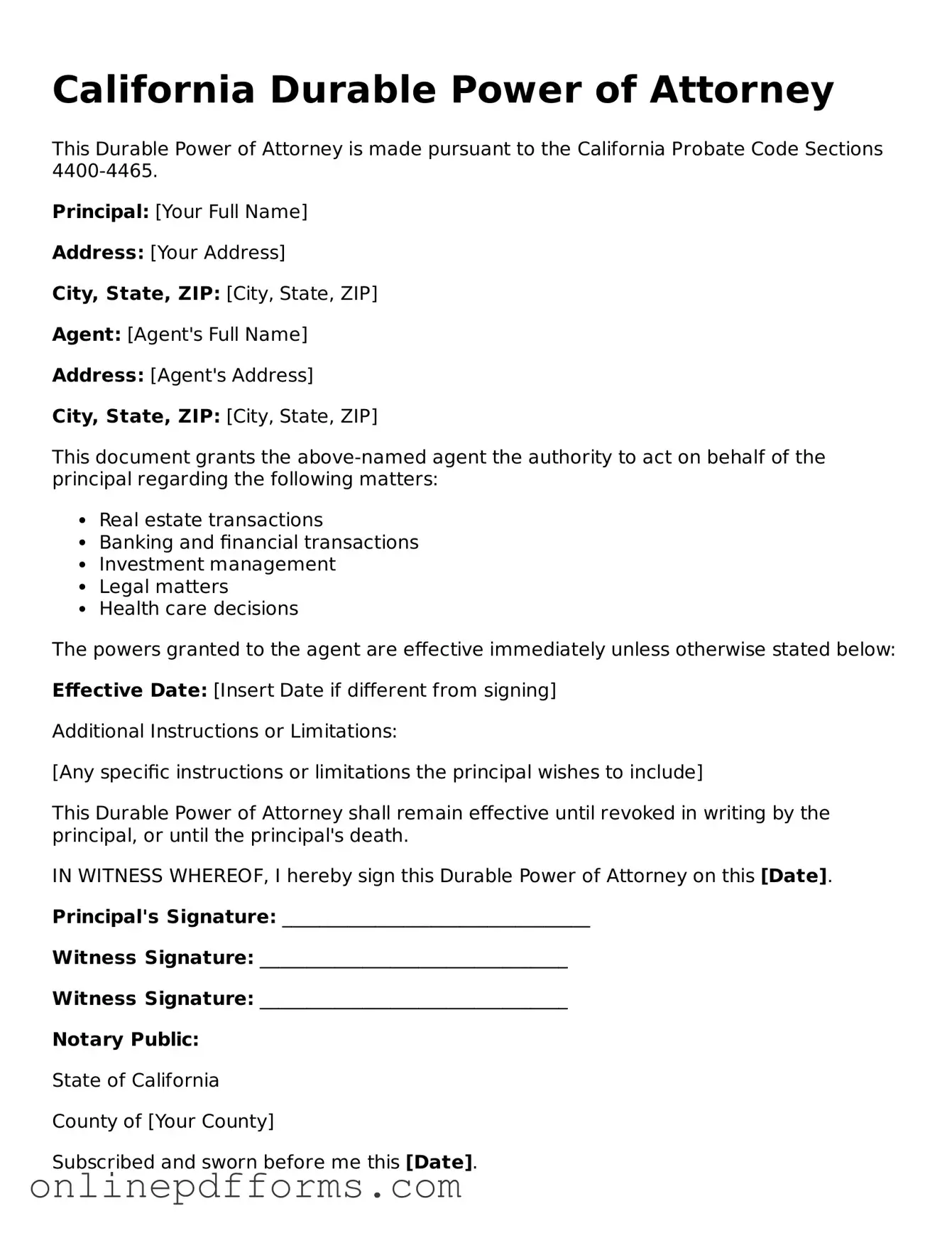

Steps to Filling Out California Durable Power of Attorney

Filling out the California Durable Power of Attorney form requires careful attention to detail. Once completed, the form allows you to designate someone to manage your financial affairs in the event that you become unable to do so yourself. Follow these steps to ensure the form is filled out correctly.

- Obtain a copy of the California Durable Power of Attorney form. You can find this form online or at legal supply stores.

- Begin by entering your name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This individual will act on your behalf.

- Specify the powers you wish to grant your agent. You can either choose to give them broad authority or limit their powers to specific tasks.

- Indicate any limitations or special instructions you want to include regarding the agent’s authority.

- Sign and date the form in the designated area. Your signature must be made while you are of sound mind.

- Have the form notarized. California law requires that your signature be notarized for the document to be valid.

- Provide copies of the completed form to your agent and any relevant financial institutions or healthcare providers.

After completing these steps, ensure you keep the original document in a safe place. It is important to inform your agent about where to find the document and discuss your wishes regarding its use.