Blank California Employment Verification Form

Documents used along the form

When completing the California Employment Verification form, several other documents may be required to provide comprehensive information about employment status and history. Below is a list of commonly used forms and documents that can accompany the verification process.

- W-2 Form: This form reports an employee's annual wages and the taxes withheld from their paycheck. It is often used to verify income and employment for loan applications and other financial matters.

- Pay Stubs: Recent pay stubs provide proof of current earnings and employment status. They typically show gross pay, deductions, and net pay.

- Employment Offer Letter: This document outlines the terms of employment, including job title, salary, and start date. It can serve as evidence of employment status.

- Tax Returns: Personal tax returns may be requested to verify income over a longer period. They provide a comprehensive view of an individual's earnings and tax obligations.

- Social Security Card: This card is often required to confirm an individual's identity and eligibility to work in the United States.

- Driver’s License or State ID: A valid form of identification is necessary to establish identity and residency. It may be requested alongside the employment verification.

- Background Check Authorization: This document allows employers to conduct background checks. It may be required for certain job positions to verify a candidate's history.

- Reference Letters: Letters from previous employers or colleagues can provide additional context regarding an individual's work history and character.

- Separation Notice: If applicable, this document details the circumstances of an employee's departure from a previous job, which can be relevant in verifying employment history.

- Job Description: A detailed description of the employee's role can clarify job responsibilities and help verify the employment status when needed.

These documents can enhance the employment verification process by providing additional proof of income, identity, and employment history. It is advisable to gather all relevant documents to ensure a smooth verification experience.

Other Popular State-specific Employment Verification Templates

Check Employment - This form can facilitate smoother transitions when changing jobs or careers.

Texas Work Verification Letter - Verification is an integral part of maintaining transparency in employee records.

Snap Income Verification - This document plays a crucial role in maintaining workforce integrity.

Sample Employment Verification Letter - The form may require notarization in some cases for additional verification.

Similar forms

The I-9 Form, officially known as the Employment Eligibility Verification form, is a crucial document for employers in the United States. Like the California Employment Verification form, the I-9 is used to confirm an employee's identity and eligibility to work in the country. Both forms require the employee to provide personal information, including their name, address, and Social Security number. Additionally, the I-9 mandates the presentation of specific identification documents, ensuring that employers comply with federal regulations regarding employment eligibility.

The W-4 Form, or Employee's Withholding Certificate, serves a different purpose but shares similarities in its role within the employment process. While the California Employment Verification form focuses on confirming eligibility, the W-4 helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck. Both forms require employees to provide personal information, and they must be completed upon hiring to ensure accurate payroll processing.

The California New Hire Reporting Form is another document that aligns with the California Employment Verification form in the context of employment. This form is used to report newly hired employees to the state’s Employment Development Department. Similar to the Employment Verification form, it collects essential information such as the employee's name, address, and Social Security number. This reporting helps the state track employment for child support enforcement and other purposes.

The Form 1099-MISC is utilized for reporting income earned by independent contractors and freelancers. While it serves a different audience than the California Employment Verification form, both documents are essential for tax purposes. The 1099-MISC requires details about the recipient's identity and the income earned, similar to how the Employment Verification form confirms an employee's identity and eligibility for work.

The California Wage Theft Prevention Act Notice is a document that informs employees of their rights regarding wages and working conditions. Although its primary purpose differs from that of the California Employment Verification form, both documents are essential in the hiring process. The notice provides employees with information about their pay rates, work hours, and other employment details, ensuring transparency and compliance with state laws.

The Job Offer Letter is a formal document that outlines the terms of employment, including job title, salary, and benefits. While the California Employment Verification form is focused on confirming eligibility, the Job Offer Letter is a critical step in the hiring process. Both documents require clear communication of important information to ensure that both the employer and employee are on the same page regarding employment expectations.

The Employee Handbook serves as a comprehensive guide to company policies and procedures. While it does not directly verify employment eligibility like the California Employment Verification form, it plays a vital role in the onboarding process. Both documents help establish a clear understanding of the employer-employee relationship, with the handbook outlining workplace expectations and the Employment Verification form confirming the employee's right to work.

The Offer of Employment form is another document that, like the California Employment Verification form, is part of the hiring process. This form details the job position, salary, and start date, ensuring that the employee understands their new role. While it does not serve the same verification purpose, both documents are essential for formalizing the employment relationship and ensuring that both parties agree to the terms of employment.

Finally, the Direct Deposit Authorization form allows employees to set up direct deposit for their paychecks. While this document is more administrative in nature, it complements the California Employment Verification form by streamlining the payroll process. Both forms require accurate personal information to ensure that employees receive their compensation promptly and correctly, reflecting the importance of clear communication and documentation in the workplace.

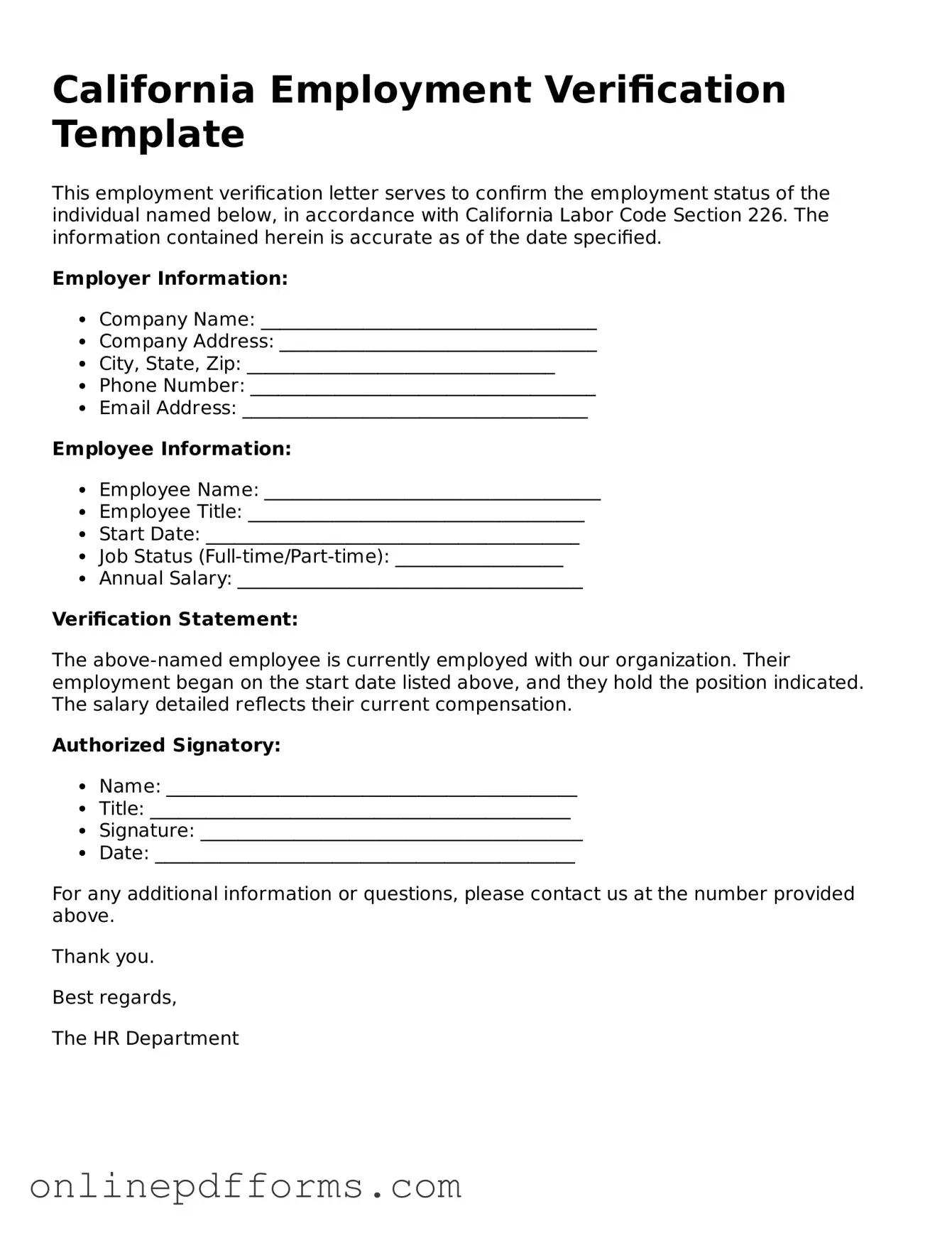

Steps to Filling Out California Employment Verification

Once you have the California Employment Verification form ready, you can proceed to fill it out. Ensure you have all necessary information at hand, including details about the employee and their employment history. Follow the steps below to complete the form accurately.

- Start with the employee's personal information. Fill in their full name, address, and contact details.

- Provide the employee's Social Security Number. Make sure to double-check for accuracy.

- Enter the employer's name and address. This should be the company the employee works for or worked for.

- Fill in the employee's job title and the dates of employment. Include both the start and end dates, if applicable.

- Indicate the employee's work status. Specify whether they are currently employed or if their employment has ended.

- Complete any additional sections required by the form, such as salary information or job duties.

- Review all the information for completeness and accuracy. Make any necessary corrections.

- Sign and date the form at the bottom. This confirms that the information provided is true and correct.

After filling out the form, ensure you submit it to the appropriate party as directed. Keep a copy for your records in case any follow-up is needed.