Blank California Gift Deed Form

Documents used along the form

When executing a California Gift Deed, several other forms and documents may be necessary to ensure a smooth transfer of property. Each document serves a specific purpose in the process, helping to clarify intentions and protect the interests of all parties involved.

- Grant Deed: This document is often used to transfer property ownership. It provides a guarantee that the grantor has not previously transferred the same property to someone else.

- Quitclaim Deed: A quitclaim deed allows a person to transfer their interest in a property without making any guarantees about the title. It is often used among family members or in situations where the property title is not in dispute.

- Affidavit of Identity: This affidavit helps confirm the identity of the parties involved in the transaction. It may be required to prevent fraud and ensure the legitimacy of the gift.

- Property Tax Exemption Form: In California, certain gifts may qualify for property tax exemptions. This form is used to apply for such exemptions, ensuring that the recipient does not face unexpected tax liabilities.

- Change of Ownership Statement: This document must be filed with the county assessor's office to notify them of the change in property ownership. It is essential for updating public records.

- Letter of Gift: A letter outlining the details of the gift can help clarify the intentions of the donor. This document can serve as additional evidence of the gift's nature and terms.

- Title Insurance Policy: This policy protects the new owner from any claims against the property that may arise after the transfer. It provides peace of mind regarding the title's validity.

- Power of Attorney: In some cases, a power of attorney may be necessary if the donor cannot be present to sign the Gift Deed. This document allows another person to act on behalf of the donor.

- Marital Separation Agreement: This form is essential for couples in Arizona who wish to clearly define the terms of their separation. For more details, you can visit https://arizonaformspdf.com.

- Escrow Instructions: If the transfer involves an escrow company, specific instructions will be needed. These instructions outline how the transaction should be handled and the responsibilities of each party.

Understanding these documents can help facilitate a successful property transfer and ensure that all legal requirements are met. It is advisable to consult with a legal professional to navigate this process effectively.

Other Popular State-specific Gift Deed Templates

How to Transfer Property Deed in Georgia - The document can detail any conditions or restrictions regarding the use of the gifted property.

When engaging in the sale of a recreational vehicle, it's essential to have all necessary documents prepared, and one key form to consider is the Auto Bill of Sale Forms, particularly tailored for South Carolina. This form not only facilitates the transfer of ownership but also helps to protect both parties involved in the transaction. By documenting the sale, it ensures that both the seller and buyer are clear on the terms, which is vital for a smooth and legally recognized exchange.

Similar forms

The California Gift Deed is similar to a Quitclaim Deed. Both documents transfer ownership of property, but the Quitclaim Deed does so without any guarantees. When a person uses a Quitclaim Deed, they are essentially relinquishing any claim they may have to the property. This means that the recipient receives whatever interest the grantor had, if any. In contrast, the Gift Deed explicitly states that the transfer is a gift, and it may include certain assurances about the property’s title. While both documents serve to convey property rights, the Quitclaim Deed does so with less certainty regarding the property’s status.

Another document comparable to the Gift Deed is the Warranty Deed. A Warranty Deed provides a stronger guarantee of ownership than both the Gift Deed and Quitclaim Deed. When a property owner uses a Warranty Deed, they assure the buyer that they hold clear title to the property and have the right to sell it. This means that if any issues arise regarding the title, the grantor is responsible for resolving them. Unlike the Gift Deed, which is used for transferring property without consideration, a Warranty Deed typically involves a sale or exchange of value.

The California Gift Deed also shares similarities with a Bargain and Sale Deed. This type of deed transfers property ownership but does not provide warranties against defects in the title. While it implies that the grantor has an interest in the property, it does not guarantee that the title is free of claims. Like the Gift Deed, a Bargain and Sale Deed can be used in situations where the transfer is made without monetary compensation. However, the key difference lies in the implications of ownership rights and the level of assurance provided to the grantee.

A fourth document that resembles the Gift Deed is a Trust Deed. While a Trust Deed is primarily used in real estate financing, it also involves the transfer of property rights. In this case, the property is transferred to a trustee who holds it for the benefit of the borrower. Although the purpose of a Trust Deed is different, both documents involve a transfer of property and can be executed without monetary exchange. The main distinction is that a Trust Deed establishes a fiduciary relationship, whereas a Gift Deed simply conveys ownership as a gift.

Understanding the various forms of property transfer, including the pdftemplates.info/texas-vehicle-purchase-agreement-form, is essential for ensuring legal clarity and protecting the interests of both parties involved in a transaction.

Finally, the Gift Deed is akin to a Deed of Gift. This document is specifically designed for the transfer of property as a gift, similar to the Gift Deed. The Deed of Gift typically includes a description of the property and the intent of the grantor to make a gift. While both documents serve the same primary purpose, the Deed of Gift may be more commonly used in certain jurisdictions or contexts. Both documents require the grantor's intent to gift the property without expectation of return, emphasizing the voluntary nature of the transfer.

Steps to Filling Out California Gift Deed

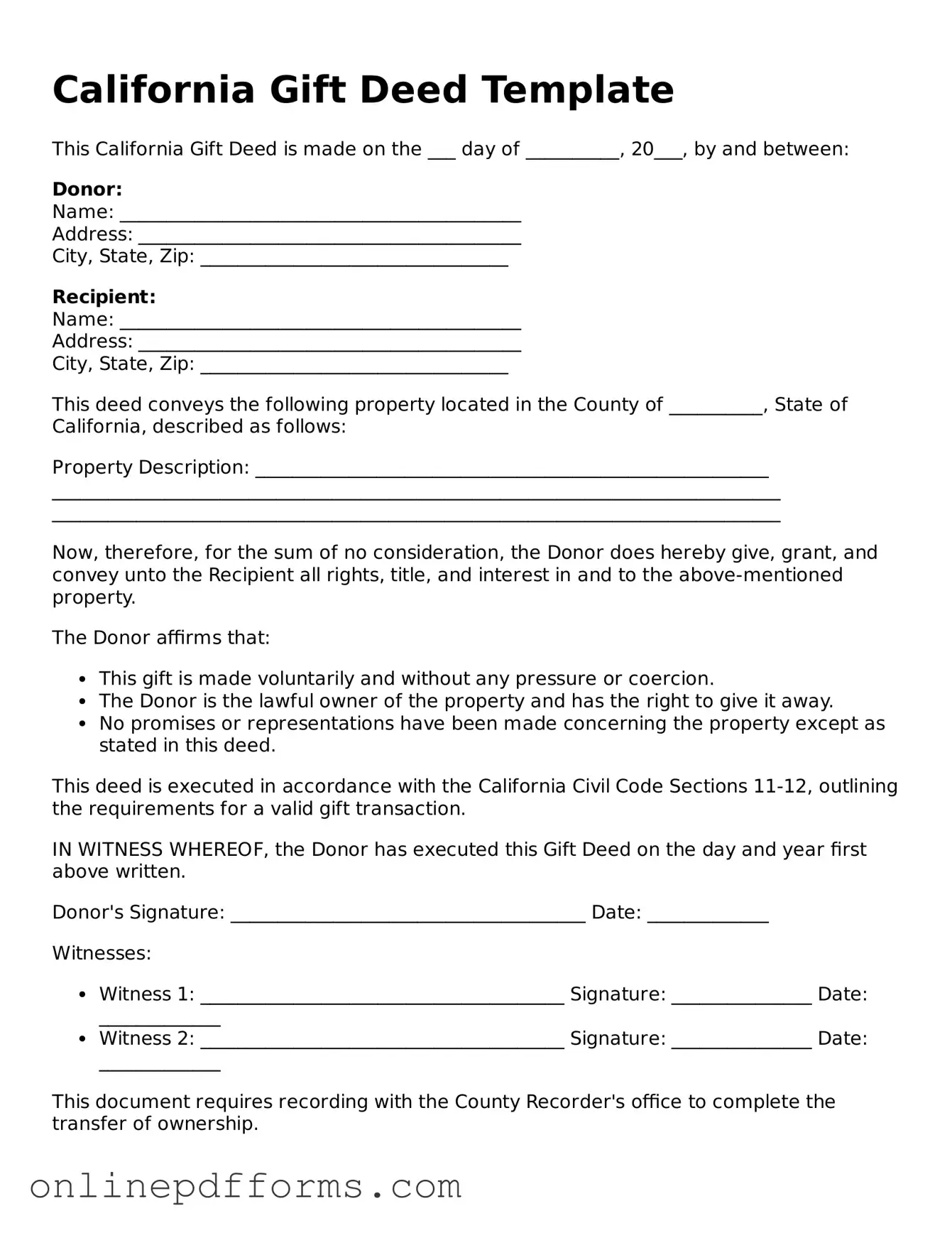

Filling out a California Gift Deed form is a straightforward process. Once completed, this form allows you to officially transfer property ownership without any exchange of money. It’s essential to ensure that all information is accurate and complete to avoid any issues later on.

- Obtain the Form: You can download the California Gift Deed form from a reputable legal website or obtain a hard copy from a local office supply store.

- Identify the Parties: Fill in the names and addresses of the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Describe the Property: Provide a detailed description of the property being gifted. Include the address and any relevant legal descriptions.

- Specify the Gift: Clearly state that the transfer is a gift and indicate whether it includes any conditions or restrictions.

- Sign the Form: The donor must sign the form in front of a notary public. This step is crucial for the document to be legally binding.

- Notarization: Have the notary public complete their section, verifying the identity of the donor and witnessing the signature.

- Record the Deed: Submit the completed and notarized Gift Deed to the county recorder’s office where the property is located. This step makes the transfer official.

After following these steps, keep a copy of the recorded Gift Deed for your records. This will serve as proof of the property transfer and can be important for future reference or legal matters.