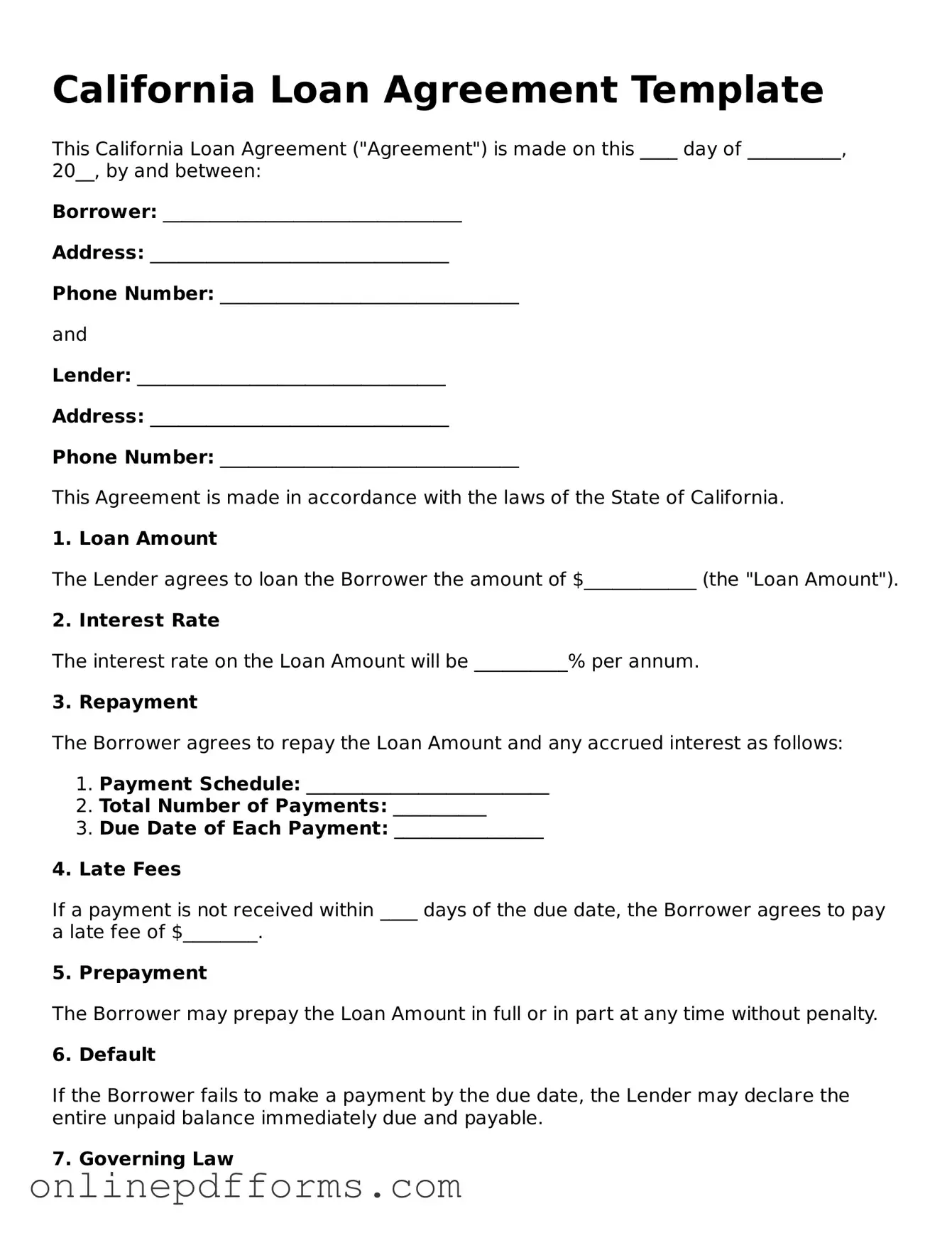

Blank California Loan Agreement Form

Documents used along the form

When entering into a loan agreement in California, several other forms and documents may be necessary to ensure all parties are protected and informed. Below is a list of commonly used documents that complement the California Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, and repayment schedule.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets that back the loan. It protects the lender's interests in case of default.

- Loan Disclosure Statement: This form provides essential information about the loan terms, including fees and interest rates. It ensures transparency for the borrower.

- Personal Guarantee: This document is often required when a business takes out a loan. It holds an individual personally responsible for the loan if the business defaults.

- Credit Application: This form collects information about the borrower’s financial history and creditworthiness. Lenders use it to assess risk before approving the loan.

- Room Rental Agreement: For a smooth rental experience, use our detailed Room Rental Agreement template to establish clear terms between landlords and tenants.

- Amortization Schedule: This document details each payment's breakdown over the loan's term, showing how much goes toward principal and interest. It helps borrowers understand their repayment obligations.

Having these documents prepared and reviewed can facilitate a smoother loan process. Ensure you understand each document's purpose and implications before proceeding.

Other Popular State-specific Loan Agreement Templates

Promissory Note Florida Pdf - The terms for loan processing and disbursement timelines are specified.

When engaging in the sale of a motorcycle in Arkansas, it is essential to utilize the appropriate documentation to ensure a smooth transaction. Utilizing the Arkansas Motorcycle Bill of Sale not only provides a clear record of the sale but also safeguards the interests of both parties involved. For those interested in acquiring a formalized document, consider visiting Vehicle Bill of Sale Forms to access the necessary forms and streamline the process.

Texas Promissory Note Requirements - The document can outline any prepayment penalties associated with early repayment.

Similar forms

The California Loan Agreement form is similar to a Promissory Note, which is a written promise to pay a specified amount of money to a designated party. Both documents outline the terms of the loan, including the interest rate, repayment schedule, and consequences for default. While the Loan Agreement may provide more detailed terms and conditions, the Promissory Note serves as a simpler, standalone document that focuses primarily on the borrower's commitment to repay the loan.

Another comparable document is the Security Agreement. This document is used when a loan is secured by collateral. Like the Loan Agreement, it details the terms of the loan but emphasizes the rights of the lender in the event of default. Both documents protect the lender's interests, but the Security Agreement specifically outlines the collateral involved, whereas the Loan Agreement may not include such specifics.

The Mortgage Agreement is also similar to the California Loan Agreement form. This document is used in real estate transactions where the property serves as collateral for the loan. Both agreements detail the loan amount, interest rate, and repayment terms. However, the Mortgage Agreement includes additional provisions regarding the property itself, such as maintenance responsibilities and conditions for foreclosure, which are not typically found in a standard Loan Agreement.

A Lease Agreement shares similarities with the Loan Agreement in that both involve the transfer of value and outline terms of repayment. In a Lease Agreement, the lessee pays for the use of property over time. Both documents specify payment amounts and timelines, but the Lease Agreement focuses on rental terms rather than a direct loan. Additionally, the Lease Agreement includes terms related to property use and maintenance, which are not relevant to a Loan Agreement.

The Installment Sale Agreement is another document that resembles the California Loan Agreement. This agreement allows a buyer to purchase property through a series of installment payments. Like the Loan Agreement, it specifies payment terms and consequences for default. However, the Installment Sale Agreement transfers ownership to the buyer once the final payment is made, while the Loan Agreement typically retains ownership with the lender until the loan is fully repaid.

A Credit Agreement is also similar in nature. It outlines the terms under which a lender will extend credit to a borrower. Both documents specify the loan amount, interest rate, and repayment terms. The Credit Agreement may cover revolving credit lines, while the Loan Agreement often pertains to a specific loan amount. Both protect the lender's interests and set forth the borrower's obligations.

The Personal Guarantee is another relevant document. It is often included in Loan Agreements to provide additional security for the lender. A Personal Guarantee holds an individual personally responsible for the debt if the borrowing entity defaults. While the Loan Agreement outlines the loan terms, the Personal Guarantee adds an extra layer of accountability, ensuring that the lender has recourse against the guarantor's personal assets.

The Forbearance Agreement is also worth mentioning. This document is used when a borrower is struggling to make payments and seeks temporary relief from the lender. Similar to the Loan Agreement, it details the loan terms but focuses on modifying those terms to accommodate the borrower's current financial situation. Both agreements aim to protect the lender's interests while providing flexibility for the borrower.

In addition to various financial agreements, understanding the use of bills of sale is essential for anyone involved in buying or selling vehicles and trailers. The Missouri Trailer Bill of Sale form is particularly important, as it legally documents the transfer of ownership for a trailer in Missouri. For those interested in broader applications, resources like Auto Bill of Sale Forms provide comprehensive templates and guidance on creating effective bills of sale for different types of vehicles, ensuring a smooth transaction and clarity for both parties involved.

The Debt Settlement Agreement is another document that shares similarities. It is used when a borrower negotiates to pay less than the total amount owed. While the Loan Agreement typically outlines the original terms of the loan, the Debt Settlement Agreement reflects a new arrangement between the borrower and lender. Both documents address the borrower's obligations, but the Debt Settlement Agreement aims to resolve the debt for less than the full amount.

Lastly, the Loan Modification Agreement is similar to the California Loan Agreement in that it involves changes to the original loan terms. This document is used when a borrower seeks to alter the interest rate, repayment schedule, or other conditions of the loan due to financial hardship. Both documents serve to protect the lender's interests while providing a framework for the borrower to meet their obligations more comfortably.

Steps to Filling Out California Loan Agreement

Filling out the California Loan Agreement form is a straightforward process. By following these steps, you can ensure that all necessary information is provided accurately. Make sure to have all required details ready before you begin.

- Start with the title of the form at the top. Ensure it clearly states "California Loan Agreement."

- Fill in the names of the borrower and lender. Include full legal names as they appear on official documents.

- Provide the addresses for both the borrower and lender. This should include street address, city, state, and zip code.

- Enter the loan amount. Clearly state the total amount being borrowed.

- Specify the interest rate. This should be expressed as a percentage.

- Indicate the loan term. State how long the borrower has to repay the loan, in months or years.

- Include payment details. Specify how often payments will be made (e.g., monthly, bi-weekly).

- Fill in any late fees or penalties. Clearly outline any additional charges that may apply if payments are missed.

- Sign and date the agreement. Both the borrower and lender should sign, indicating their agreement to the terms.

Once you have completed the form, review it for accuracy. Ensure that all sections are filled out correctly and that both parties have signed. Keep a copy for your records and provide a copy to the other party involved in the loan.