Blank California Promissory Note Form

Documents used along the form

When dealing with a California Promissory Note, several other forms and documents may be required to ensure clarity and legal compliance. Each of these documents serves a specific purpose in the lending process and can help protect the interests of both the lender and borrower.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets that back the loan and the rights of the lender in the event of default.

- Disclosure Statement: This statement provides essential information about the loan, including the total cost, interest rates, and any fees associated with the loan, ensuring transparency for the borrower.

- Payment Schedule: A detailed outline of when payments are due, including the amount and method of payment, helps borrowers manage their repayment obligations effectively.

- Bill of Sale: This form is crucial when transferring ownership of personal property, ensuring proof of purchase and detailing the involved parties. For more information, you can access the form here: https://pdftemplates.info/washington-bill-of-sale-form/.

- Default Notice: This document is issued if the borrower fails to meet the repayment terms, outlining the consequences and potential actions the lender may take.

- Release of Liability: Upon full repayment of the loan, this document releases the borrower from any further obligations related to the loan, providing peace of mind.

- Amendment Agreement: If changes to the original loan terms are necessary, this document formally modifies the existing agreement and requires both parties' consent.

- Guaranty Agreement: In some cases, a third party may guarantee the loan. This document outlines the guarantor's responsibilities should the borrower default.

- Affidavit of Identity: This document confirms the identity of the borrower and may be required to prevent fraud during the loan process.

Understanding these documents can help ensure a smoother transaction process. Each serves to clarify the rights and responsibilities of all parties involved, ultimately contributing to a more secure lending environment.

Other Popular State-specific Promissory Note Templates

New York Promissory Note Requirements - This document includes essential details like the amount, interest rate, and payment schedule.

When planning your estate, it's vital to understand the implications of a well-structured document. The New York Last Will and Testament form guidelines offer clarity on how to effectively communicate your final wishes and ensure your assets are distributed according to your preferences.

Promissory Note Florida Pdf - A promissory note outlines the amount of money loaned, the interest rate, and the repayment schedule.

Similar forms

The California Promissory Note form bears similarity to the Loan Agreement. Both documents outline the terms of a loan, including the principal amount, interest rate, and repayment schedule. However, a Loan Agreement often encompasses broader terms, such as collateral, default provisions, and other obligations of the borrower. While a Promissory Note is a straightforward acknowledgment of the debt, a Loan Agreement provides a more comprehensive framework for the lending relationship.

Another document akin to the California Promissory Note is the Mortgage. A Mortgage secures a loan by placing a lien on real property, ensuring the lender has a claim if the borrower defaults. Like a Promissory Note, it specifies the amount borrowed and the repayment terms. However, a Mortgage typically involves real estate transactions and includes detailed provisions regarding foreclosure and property rights, which are not present in a standard Promissory Note.

The Secured Note is also similar to the California Promissory Note. This document not only outlines the terms of the loan but also provides security to the lender by tying the loan to specific collateral. In contrast to a standard Promissory Note, which is unsecured, a Secured Note offers additional protection for the lender, as it can claim the collateral in case of default.

A Personal Guarantee is another document that relates closely to a Promissory Note. In situations where a business borrows money, a Personal Guarantee may be required from the owners or principals. This document ensures that if the business defaults, the individuals personally agree to repay the debt. While a Promissory Note focuses on the terms of the loan itself, a Personal Guarantee adds a layer of personal accountability from the guarantors.

The IOU, or informal acknowledgment of debt, shares similarities with the California Promissory Note but is less formal. An IOU typically states the amount owed and may include basic repayment terms, but it lacks the detailed structure and legal enforceability of a Promissory Note. While both documents serve as evidence of a debt, an IOU does not provide the same level of protection for the lender.

When engaging in transactions involving trailers, it is crucial to utilize the appropriate documentation to ensure legality and protect all parties involved. The Auto Bill of Sale Forms provide the necessary framework to record the sale and transfer of ownership clearly. By accurately completing these forms, sellers and buyers can confirm the details of the transaction, safeguarding their interests while facilitating a smooth exchange.

A Credit Agreement is another document that parallels the California Promissory Note. It outlines the terms of credit extended to a borrower, including limits, fees, and repayment obligations. While a Promissory Note may be used for a specific loan amount, a Credit Agreement can cover a revolving line of credit, allowing for multiple borrowings and repayments over time. The complexity of a Credit Agreement often exceeds that of a Promissory Note.

The Loan Disclosure Statement is similar in that it provides critical information about the loan terms. This document is typically provided to borrowers to ensure transparency regarding interest rates, fees, and total repayment amounts. While it does not function as a binding agreement like a Promissory Note, it serves as an important tool for borrowers to understand their obligations before signing a Promissory Note or Loan Agreement.

The Debt Settlement Agreement also shares some characteristics with a Promissory Note. This document is used when a borrower negotiates with a lender to settle a debt for less than the full amount owed. It outlines the terms of the settlement, including payment amounts and schedules. While a Promissory Note establishes a debt, a Debt Settlement Agreement modifies the terms of repayment and may lead to debt forgiveness.

Finally, the Forbearance Agreement is related to the California Promissory Note in that it addresses the temporary postponement of loan payments. When a borrower faces financial difficulties, they may enter into a Forbearance Agreement with the lender to delay payments without defaulting. This document specifies the new terms and conditions during the forbearance period, providing a temporary solution to the obligations outlined in the original Promissory Note.

Steps to Filling Out California Promissory Note

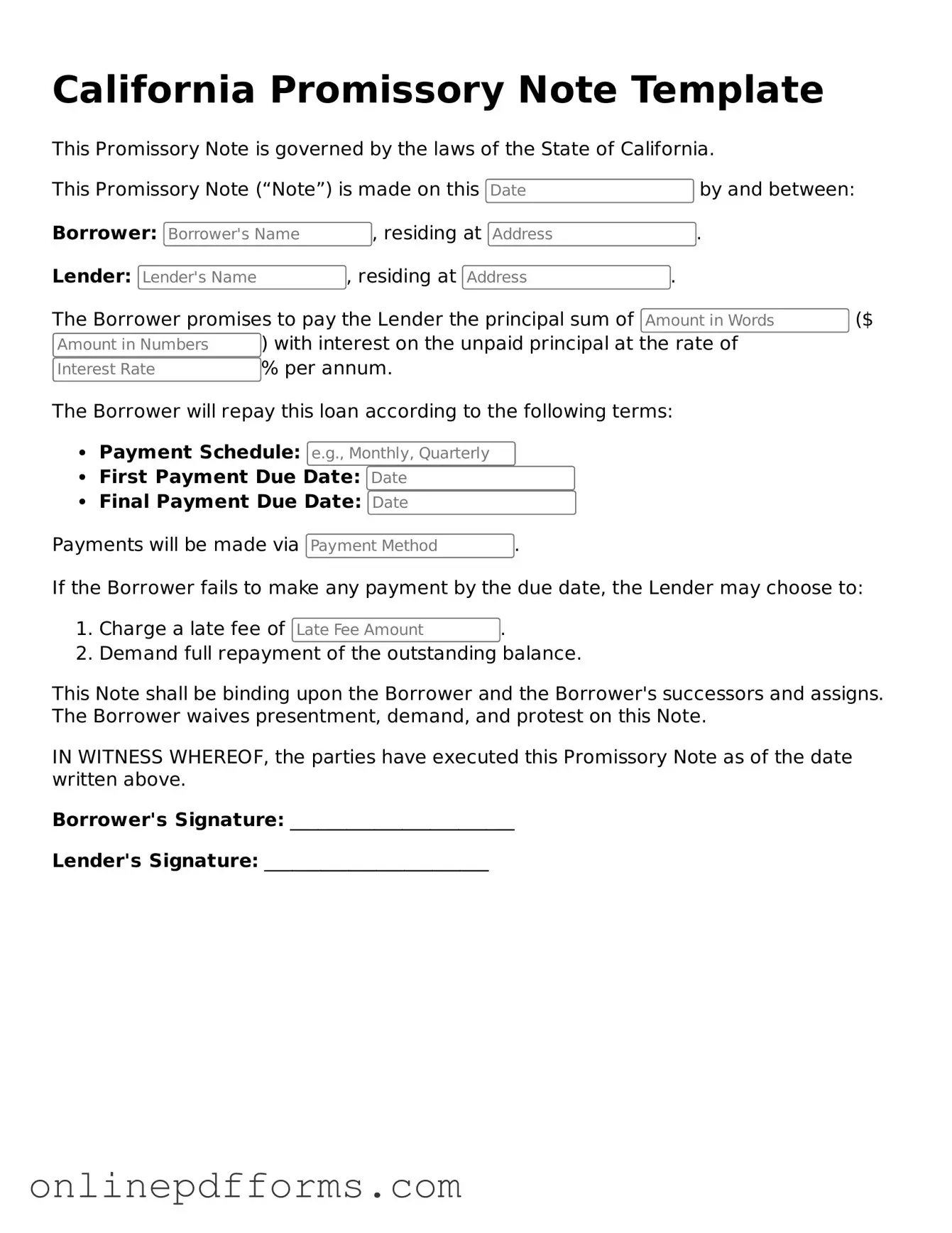

Once you have the California Promissory Note form in hand, it's time to fill it out accurately. This document will serve as a written promise to pay a specific amount of money under agreed-upon terms. Follow these steps carefully to ensure everything is completed correctly.

- Gather Necessary Information: Collect all relevant details, including the names and addresses of both the borrower and the lender, the loan amount, interest rate, and payment schedule.

- Fill in the Date: Write the date when the note is being created at the top of the form.

- Enter Borrower Information: Clearly print the full name and address of the borrower in the designated section.

- Enter Lender Information: Provide the full name and address of the lender in the appropriate area.

- Specify Loan Amount: Write the total amount of money being borrowed in both numerical and written form.

- Detail Interest Rate: Indicate the interest rate that will apply to the loan, ensuring clarity on whether it is fixed or variable.

- Outline Payment Terms: Clearly state the payment schedule, including how often payments are due (monthly, quarterly, etc.) and the duration of the loan.

- Include Late Fees: If applicable, specify any late fees that will be charged if payments are not made on time.

- Sign the Document: Both the borrower and lender must sign and date the form to validate it. Ensure all signatures are in the designated areas.

- Make Copies: After completing the form, make copies for both parties to keep for their records.

With the form filled out and signed, you are ready to proceed with the next steps in your agreement. Ensure that both parties understand the terms and conditions outlined in the note before moving forward.