Blank California Quitclaim Deed Form

Documents used along the form

When transferring property ownership in California, the Quitclaim Deed serves as a vital document. However, it is often accompanied by several other forms and documents that ensure a smooth transaction and compliance with legal requirements. Below is a list of some commonly used documents that may accompany a Quitclaim Deed.

- Grant Deed: This document is used to transfer property while providing certain guarantees about the title. Unlike a Quitclaim Deed, a Grant Deed assures the buyer that the seller has not sold the property to anyone else and that the property is free from undisclosed encumbrances.

- Title Report: A title report outlines the legal status of the property, including any liens, easements, or other claims against it. This document is essential for buyers to understand what they are acquiring and to ensure there are no surprises after the purchase.

- Affidavit of Support: A vital document for sponsorship which showcases the sponsor's financial capability, essential for ensuring the immigrant's self-sufficiency. For more details, visit https://pdftemplates.info/uscis-i-864-form.

- Preliminary Change of Ownership Report: This form is required by the county assessor's office to track property transfers for tax purposes. It helps determine the assessed value of the property and any potential tax implications for the new owner.

- Affidavit of Death: In cases where the property is being transferred due to the death of the owner, this affidavit serves as proof of death. It is often necessary to clear the title and facilitate the transfer of ownership to heirs or beneficiaries.

- Power of Attorney: If the property owner is unable to sign the Quitclaim Deed personally, a Power of Attorney can be used to authorize another individual to act on their behalf. This document must be properly executed to be valid.

- Escrow Instructions: These instructions outline the terms and conditions under which the escrow agent will manage the transaction. They include details about the payment, distribution of documents, and any contingencies that must be met before the sale is finalized.

- Property Tax Statement: This document provides information about the current property tax obligations. It is useful for both buyers and sellers to understand any outstanding taxes that may need to be addressed during the transfer process.

Each of these documents plays a significant role in the property transfer process, ensuring that both parties are protected and informed. Understanding their purposes and requirements can help facilitate a smoother transaction and provide peace of mind for all involved.

Other Popular State-specific Quitclaim Deed Templates

Cost for Quit Claim Deed - Provides an easy way to divvy up inherited property.

When purchasing or selling a trailer in North Carolina, it's crucial to use a North Carolina Trailer Bill of Sale form, as it offers legal protection and legitimacy to the transaction. Proper documentation can ensure all details are clear and agreed upon, reducing the risk of disputes. For those looking for a reliable method to handle this paperwork, many people turn to Auto Bill of Sale Forms, which provide a comprehensive template for creating a valid bill of sale.

Florida Quit Claim Deed - This form allows property owners to issue rights without a lengthy process.

Ohio Quit Claim Deed Form - Even though a Quitclaim Deed is simple, it’s wise to consult with a professional before using one.

Quitclaim Deed Ny - A quitclaim deed does not ensure that the property is free of defects.

Similar forms

The California Quitclaim Deed is often compared to the Grant Deed. Both documents are used to transfer ownership of real property, but they differ in the level of protection they offer. A Grant Deed guarantees that the seller has not only the right to sell the property but also that the property is free from any undisclosed encumbrances. In contrast, a Quitclaim Deed does not provide such assurances. It merely transfers whatever interest the seller has in the property, if any, without any warranties.

Another document similar to the Quitclaim Deed is the Warranty Deed. Like the Grant Deed, a Warranty Deed offers a higher level of protection to the buyer. It assures the buyer that the seller holds clear title to the property and that they will defend against any claims to the contrary. This makes Warranty Deeds more favorable in most transactions, especially when substantial investments are involved. The Quitclaim Deed, lacking such guarantees, is typically used in less formal situations, such as transferring property between family members.

The Bargain and Sale Deed also shares similarities with the Quitclaim Deed. It conveys property ownership but does not guarantee that the title is free from encumbrances. However, unlike the Quitclaim Deed, a Bargain and Sale Deed implies that the seller has some interest in the property and that they are conveying that interest to the buyer. This document is often used in foreclosure sales or tax lien sales, where the seller may not have complete knowledge of the property's title status.

A Deed of Trust is another document that can be likened to a Quitclaim Deed, though it serves a different purpose. A Deed of Trust is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While a Quitclaim Deed transfers ownership, a Deed of Trust provides a security interest in the property. If the borrower defaults, the lender can initiate foreclosure proceedings. This document is crucial in the lending process, ensuring that the lender has a claim to the property until the loan is paid off.

The Special Purpose Deed, such as a Personal Representative Deed, is another document that can resemble a Quitclaim Deed. This type of deed is used when an executor or administrator of an estate transfers property on behalf of a deceased person. While it may not provide warranties like a Grant Deed, it serves the purpose of transferring ownership from the estate to the new owner. This is particularly relevant in probate situations, where property needs to be distributed according to a will or state law.

For those considering the purchase of a recreational vehicle, understanding the nuances of the transaction is vital. To ensure clarity and protection for both parties, utilizing an "official RV Bill of Sale" can document the transfer effectively. This form serves as a safeguard for buyers and sellers alike and can be accessed at this essential RV Bill of Sale resource.

Lastly, the Affidavit of Death can be seen as related to the Quitclaim Deed in specific contexts. While it does not transfer ownership by itself, it serves as a legal document that can accompany a Quitclaim Deed when a property owner passes away. This affidavit provides proof of death, which is often necessary for transferring property title to heirs. It ensures that the Quitclaim Deed can be executed smoothly, allowing heirs to claim their rights to the property without unnecessary delays.

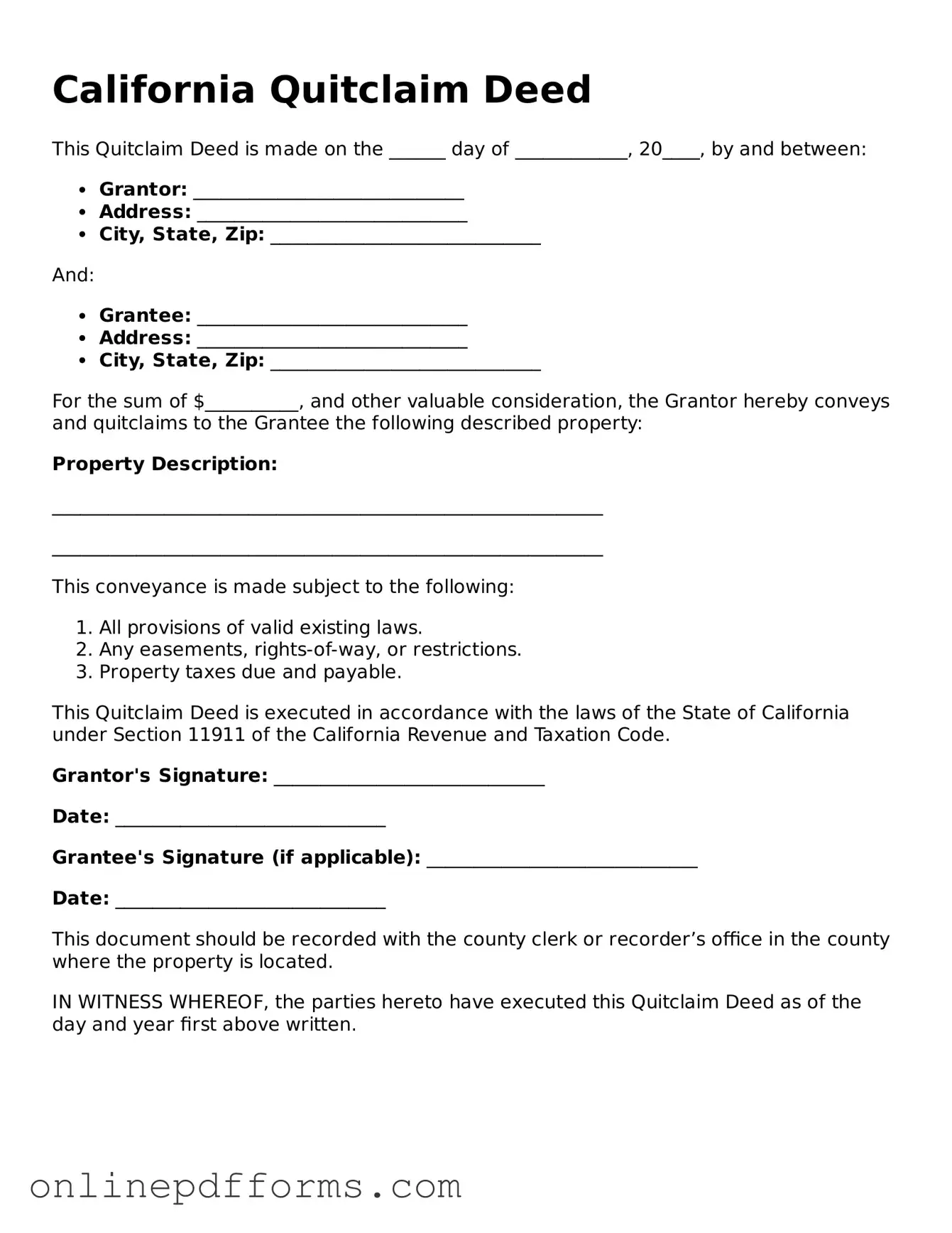

Steps to Filling Out California Quitclaim Deed

Once you have the California Quitclaim Deed form, you can begin filling it out. Make sure to have all necessary information on hand, including the names of the parties involved and property details. Follow these steps carefully to complete the form accurately.

- At the top of the form, write the name of the county where the property is located.

- In the section labeled "Grantor," enter the name of the person transferring the property.

- Next, in the "Grantee" section, fill in the name of the person receiving the property.

- Provide the current address of the grantee.

- Include a legal description of the property. This may require a separate document if the description is lengthy.

- Fill in the Assessor's Parcel Number (APN) if applicable.

- Sign and date the form in the designated area. The grantor must sign the document.

- Have the signature notarized. A notary public will need to witness the signing.

- Make copies of the completed and notarized form for your records.

- File the original Quitclaim Deed with the county recorder’s office where the property is located.