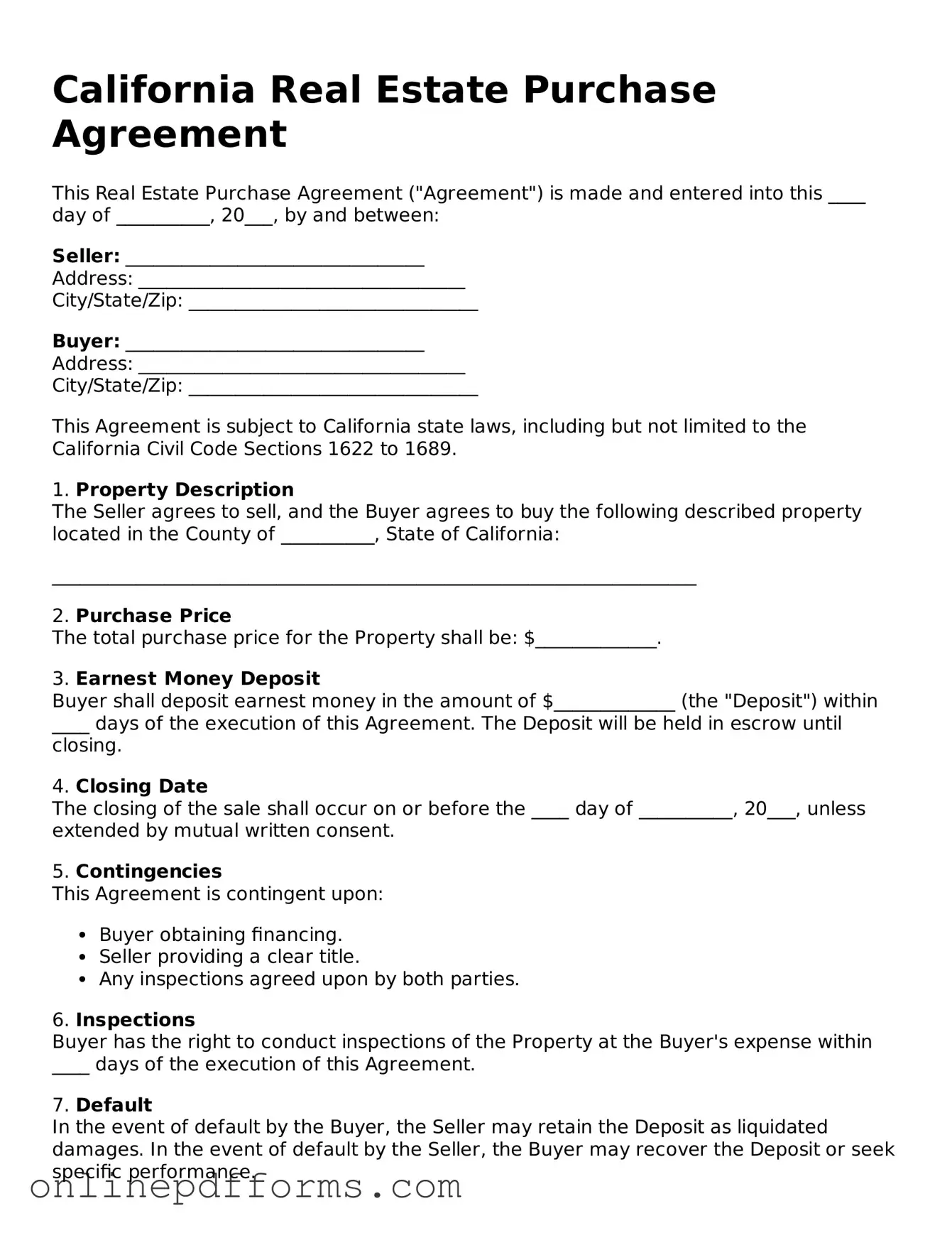

Blank California Real Estate Purchase Agreement Form

Documents used along the form

When engaging in real estate transactions in California, several important documents accompany the California Real Estate Purchase Agreement. These documents help clarify terms, protect the interests of both parties, and ensure compliance with state laws. Below is a list of commonly used forms that are often associated with the purchase agreement.

- Disclosure Statement: This document outlines any known issues with the property, such as structural problems or environmental hazards. Sellers are required to provide this information to potential buyers to promote transparency.

- Preliminary Title Report: This report reveals the current status of the property’s title. It includes information about ownership, liens, and any encumbrances that may affect the sale.

- Trailer Bill of Sale: In the case of trailers, a Auto Bill of Sale Forms document is necessary to record the sale and transfer ownership, ensuring both seller and buyer adhere to legal requirements in North Carolina.

- Counter Offer: If the seller does not accept the initial offer, they may respond with a counter offer. This document outlines the new terms and conditions that the seller proposes to the buyer.

- Escrow Instructions: This set of instructions guides the escrow company on how to handle the transaction. It specifies the responsibilities of all parties involved and outlines the conditions that must be met before the sale is finalized.

- Closing Statement: Also known as a settlement statement, this document details all the financial transactions related to the sale. It summarizes the costs, fees, and credits involved in the closing process.

These documents play a critical role in ensuring a smooth real estate transaction. Each serves a specific purpose, helping both buyers and sellers navigate the complexities of property transfer in California.

Other Popular State-specific Real Estate Purchase Agreement Templates

Real-estate Sale Contract - Specifies the legal recourse available in case of a breach.

Georgia Residential Purchase Agreement - The purchase agreement supports an organized home buying process.

Purchasing Agreement - Buyers may gain insights about how to handle disputes through the terms outlined in this contract.

For those navigating the immigration process, it is vital to familiarize yourself with the USCIS I-864 form, which serves as the Affidavit of Support. This document is essential for sponsors to prove their financial capability to support the immigrant, preventing any reliance on public benefits. To learn more about this important form and access it directly, you can visit https://pdftemplates.info/uscis-i-864-form/.

Residential Purchase Agreement - The agreement might address any existing insurance policies related to the property.

Similar forms

The California Real Estate Purchase Agreement (REPA) shares similarities with the Residential Purchase Agreement. Both documents outline the terms and conditions under which a buyer agrees to purchase a residential property. They include essential details such as the purchase price, financing terms, and contingencies. Additionally, both agreements require the signatures of the buyer and seller, making them legally binding once executed. The Residential Purchase Agreement is specifically tailored for residential properties, ensuring that all pertinent information is included for such transactions.

Another document that resembles the REPA is the Commercial Purchase Agreement. This agreement is used for the sale of commercial properties and contains many of the same elements as the REPA, such as purchase price, terms of sale, and contingencies. However, the Commercial Purchase Agreement also addresses specific aspects relevant to commercial transactions, like zoning regulations and tenant leases. Both agreements serve to protect the interests of both parties involved in the sale.

The Lease Agreement is another document that shares similarities with the REPA. While the REPA is focused on the sale of property, the Lease Agreement outlines the terms under which a property is rented. Both documents specify critical terms, including duration, payment amounts, and responsibilities of the parties. They ensure that both landlords and tenants understand their rights and obligations, creating a clear framework for the property arrangement.

The Option to Purchase Agreement is closely related to the REPA as well. This document grants a potential buyer the right to purchase a property at a specified price within a certain timeframe. Like the REPA, it includes terms regarding price and conditions for exercising the option. Both agreements protect the interests of the parties and provide a structured approach to property transactions, albeit with different end goals.

The Seller's Disclosure Statement is another document that complements the REPA. It provides crucial information about the property’s condition and any known defects. While the REPA outlines the transaction terms, the Seller's Disclosure Statement ensures that buyers are fully informed about what they are purchasing. This transparency helps prevent disputes and fosters trust between the buyer and seller.

In navigating various real estate agreements, it's important for prospective buyers and sellers to be informed about all necessary documentation, including foundational forms such as the California Identification Card. This can be particularly essential for verifying identity during transactions. For thorough guidance on obtaining or renewing this ID, you can visit https://californiapdf.com for detailed instructions and resources.

Finally, the Escrow Agreement is similar to the REPA in that it involves the handling of funds and documents during a real estate transaction. This document outlines the responsibilities of the escrow agent, who holds funds and documents until all conditions of the sale are met. Both the Escrow Agreement and the REPA work together to facilitate a smooth transaction, ensuring that all parties fulfill their obligations before the transfer of property ownership occurs.

Steps to Filling Out California Real Estate Purchase Agreement

Filling out the California Real Estate Purchase Agreement form is a crucial step in the home buying process. This document outlines the terms of the sale and protects the interests of both the buyer and seller. After completing the form, you will move forward with negotiations and potentially closing the deal on your new property.

- Obtain the form: Download the California Real Estate Purchase Agreement form from a reliable source or obtain it from a real estate agent.

- Fill in the date: Write the date on which the agreement is being signed at the top of the form.

- Identify the parties: Clearly state the names and contact information of the buyer(s) and seller(s).

- Describe the property: Provide the complete address and legal description of the property being sold.

- Specify the purchase price: Enter the agreed-upon purchase price for the property.

- Outline financing terms: Indicate how the buyer intends to finance the purchase, whether through a mortgage, cash, or other means.

- Include contingencies: List any contingencies that must be met before the sale can proceed, such as inspections or financing approvals.

- Set the closing date: Specify the desired closing date for the transaction.

- Signatures: Ensure all parties sign and date the agreement to make it legally binding.