Blank California Transfer-on-Death Deed Form

Documents used along the form

When dealing with property transfer in California, a Transfer-on-Death (TOD) Deed is an important tool. However, it is often used alongside various other forms and documents that facilitate the smooth transition of property ownership. Here’s a list of commonly associated documents that you may encounter.

- Grant Deed: This document is used to transfer ownership of real property. It provides a clear statement of the grantor's intent to transfer the property and includes warranties regarding the title.

- Quitclaim Deed: A quitclaim deed transfers any ownership interest the grantor has in a property without guaranteeing that the title is clear. It is often used among family members or in divorce settlements.

- Will: A will outlines how a person wishes their property to be distributed after their death. It can include instructions for the transfer of real estate and may complement a TOD deed.

- Living Trust: A living trust is a legal entity that holds property for the benefit of the trust's beneficiaries. It can help avoid probate and is often used alongside a TOD deed for estate planning.

- Affidavit of Death: This document serves as proof of a person's death. It may be required to transfer property after the owner has passed away, especially if a TOD deed is involved.

- Trailer Bill of Sale: This document is essential for recording the transfer of ownership for a trailer, detailing key information such as specifications and sale price. For more information, visit https://pdftemplates.info/trailer-bill-of-sale-form/.

- Title Report: A title report provides information about the property’s ownership history and any liens or encumbrances. This report is crucial for ensuring that the property can be transferred without issues.

- Property Tax Records: These records show the current tax status of the property. They can help determine any outstanding taxes that need to be settled before a transfer can occur.

- Change of Ownership Statement: This form is submitted to the county assessor's office to report a change in ownership. It helps update property tax records following a transfer.

- Certificate of Trust: If a property is held in a trust, this document verifies the trust's existence and the authority of the trustee to manage the property.

Understanding these documents can simplify the process of transferring property in California. Each plays a unique role in ensuring that property ownership is transferred legally and efficiently, providing peace of mind for all parties involved.

Other Popular State-specific Transfer-on-Death Deed Templates

Right of Survivorship Deed Pennsylvania - This type of deed may help avoid long wait times associated with traditional probate proceedings.

When dealing with the sale of a trailer in Missouri, it's essential to have the proper documentation to ensure a smooth transaction. The Missouri Trailer Bill of Sale form is one such document that protects both the seller and the buyer, confirming the sale and ownership transfer. For those looking to navigate the paperwork involved, resources like Auto Bill of Sale Forms can provide valuable assistance in completing this process accurately.

Transfer on Death Deed Georgia - Homeowners should consult local laws to understand specific requirements for use.

Similar forms

The California Transfer-on-Death Deed (TOD) is similar to a will in that both documents allow individuals to dictate how their assets will be distributed after their death. A will requires the probate process, where a court oversees the distribution of assets according to the deceased's wishes. In contrast, a TOD deed allows for a more streamlined transfer of property without the need for probate, making it a simpler and often quicker option for transferring real estate to designated beneficiaries.

For those looking to navigate the rental process smoothly, understanding the necessary elements of a Room Rental Agreement is crucial. A detailed guide can be found on this essential Room Rental Agreement resource that provides valuable insights into the rights and responsibilities involved.

An irrevocable trust shares similarities with the TOD deed in that both serve to transfer assets upon death. However, with an irrevocable trust, the grantor relinquishes control over the assets placed in the trust, which can provide benefits such as asset protection and tax advantages. In contrast, a TOD deed allows the grantor to retain full control of the property during their lifetime, making it a more flexible option for property transfer.

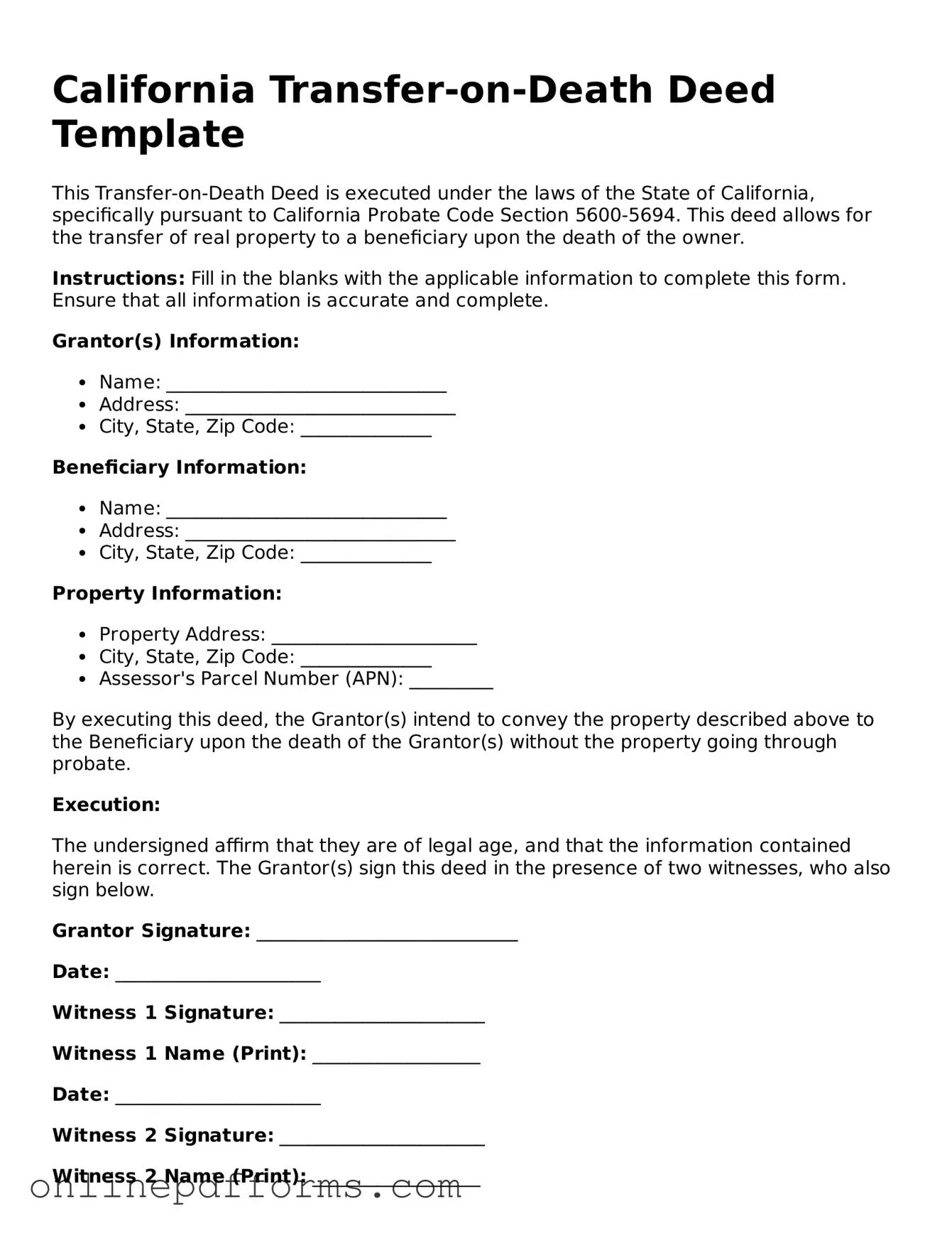

Steps to Filling Out California Transfer-on-Death Deed

After obtaining the California Transfer-on-Death Deed form, follow these steps to complete it accurately. Make sure to have all necessary information ready before starting. This process will help ensure that the deed is filled out correctly for future property transfer.

- Begin by entering the name of the property owner(s) in the designated section. Ensure that the names match those on the property title.

- Provide the address of the property. Include the street address, city, state, and zip code.

- List the legal description of the property. This can typically be found on the property’s title or deed.

- Identify the beneficiary or beneficiaries who will receive the property upon the owner's death. Include their full names and addresses.

- Indicate whether the property will be transferred to one beneficiary or multiple beneficiaries. If multiple, specify how the property will be divided.

- Sign the form in the presence of a notary public. The signature must be dated as well.

- Have the notary public complete their section, verifying your identity and witnessing your signature.

- Make copies of the completed and notarized form for your records.

- File the original deed with the county recorder's office where the property is located. Be aware of any filing fees that may apply.