Fill in Your Cash Drawer Count Sheet Template

Documents used along the form

When managing cash transactions, particularly in retail or service environments, various forms and documents accompany the Cash Drawer Count Sheet. Each of these documents plays a crucial role in ensuring accurate financial reporting and accountability. Below is a list of common forms used alongside the Cash Drawer Count Sheet, providing a brief description of each.

- Daily Sales Report: This document summarizes all sales made during a specific day. It typically includes details about total sales, returns, discounts, and payment methods, providing a comprehensive overview of daily revenue.

- Deposit Slip: A deposit slip is used when cash is taken to the bank. It outlines the amount being deposited and may include details about the cash drawer count, ensuring that the amount matches the cash recorded in the Cash Drawer Count Sheet.

- Cash Register Tape: This tape is generated by the cash register and serves as a record of all transactions processed during a shift. It often includes timestamps, itemized sales, and payment methods, which can help reconcile cash counts.

- Refund Request Form: When a customer returns a product, this form documents the request for a refund. It provides essential details such as the reason for the return and the transaction reference, which can be useful for tracking cash flow.

- Inventory Adjustment Form: This form records any changes made to inventory levels, whether due to sales, returns, or loss. Accurate inventory records are vital for understanding the financial health of a business.

- Employee Cash Handling Agreement: This agreement outlines the responsibilities of employees who handle cash. It ensures that they understand the procedures and policies related to cash management, thereby reducing the risk of errors or theft.

- Texas Certificate of Insurance Form: This essential document verifies that a Responsible Master Plumber in Texas has the required general liability insurance. For more details, you can visit this page.

- End-of-Shift Report: This report is completed at the end of a shift and summarizes cash transactions, discrepancies, and any issues encountered. It serves as a final check before closing the cash drawer for the day.

- Cash Reconciliation Form: This form is used to compare the cash counted in the drawer against the expected amount based on sales and other transactions. It helps identify any discrepancies that may need to be addressed.

Utilizing these documents in conjunction with the Cash Drawer Count Sheet fosters a structured approach to cash management. Each form serves a specific purpose, contributing to a comprehensive understanding of financial transactions and ensuring that all cash handling processes are transparent and accountable.

More PDF Templates

How to Estimate Roof Replacement Cost - Indicate any specific concerns you have regarding the project.

Guardianship Paperwork - The form can be modified to reflect changes in circumstances affecting custody.

Filing the Wisconsin Articles of Incorporation form is an essential step for entrepreneurs aiming to set up their business legally; to assist in this process, you can find the necessary resources at pdftemplates.info/wisconsin-articles-of-incorporation-form, ensuring that your corporation is established correctly and efficiently.

Da - Facilitates requests for additional supplies or updates to existing inventory.

Similar forms

The Cash Register Reconciliation Form serves a similar purpose to the Cash Drawer Count Sheet. Both documents are designed to ensure that the cash on hand matches the sales recorded during a specific period. The reconciliation form typically includes sections for recording total sales, cash received, and discrepancies. By comparing the cash register totals with the actual cash, businesses can identify any errors or theft, ensuring financial integrity.

The Daily Sales Report is another document closely related to the Cash Drawer Count Sheet. This report summarizes the total sales made during the day and often includes breakdowns by payment method, such as cash, credit, and debit. While the Cash Drawer Count Sheet focuses specifically on cash, the Daily Sales Report provides a broader overview of all sales activities. Both documents are essential for tracking revenue and managing cash flow effectively.

The Petty Cash Log is similar in that it also tracks cash transactions, but it focuses on smaller, incidental expenses rather than sales. This log records each petty cash disbursement and replenishment, ensuring that the petty cash fund remains balanced. Like the Cash Drawer Count Sheet, it helps prevent mismanagement of funds and promotes accountability within the organization.

The Bank Deposit Slip is another document that shares similarities with the Cash Drawer Count Sheet. This slip is used when depositing cash and checks into a bank account, requiring an accurate count of the cash being deposited. Both documents necessitate careful counting and verification of cash amounts, making them vital for maintaining accurate financial records and ensuring that all cash transactions are properly documented.

The Cash Flow Statement provides a broader financial overview, detailing the inflow and outflow of cash within a business over a specific period. While the Cash Drawer Count Sheet focuses on cash on hand at a particular moment, the Cash Flow Statement tracks cash movements over time. Both documents are crucial for understanding a business's financial health and ensuring sufficient liquidity for operations.

The Expense Report is similar in that it documents cash outflows, detailing expenses incurred by employees or the business itself. While the Cash Drawer Count Sheet is concerned with cash on hand and sales, the Expense Report tracks how cash is spent. Both documents are essential for maintaining accurate financial records and ensuring that all cash transactions are accounted for.

In addition to the various financial documents mentioned, it's important to consider the legal aspects of financial power, such as granting authority through a General Power of Attorney. This type of document can be crucial for businesses, ensuring that someone can act on their behalf in significant matters. To learn more about how to create an effective General Power of Attorney, you can visit https://californiapdf.com/.

Finally, the Inventory Count Sheet, while primarily focused on physical goods, shares a common goal with the Cash Drawer Count Sheet: accuracy in financial reporting. This document tracks the quantity and value of inventory on hand, which can impact cash flow and sales. Both forms require diligent counting and verification to ensure that the business has a clear picture of its financial standing.

Steps to Filling Out Cash Drawer Count Sheet

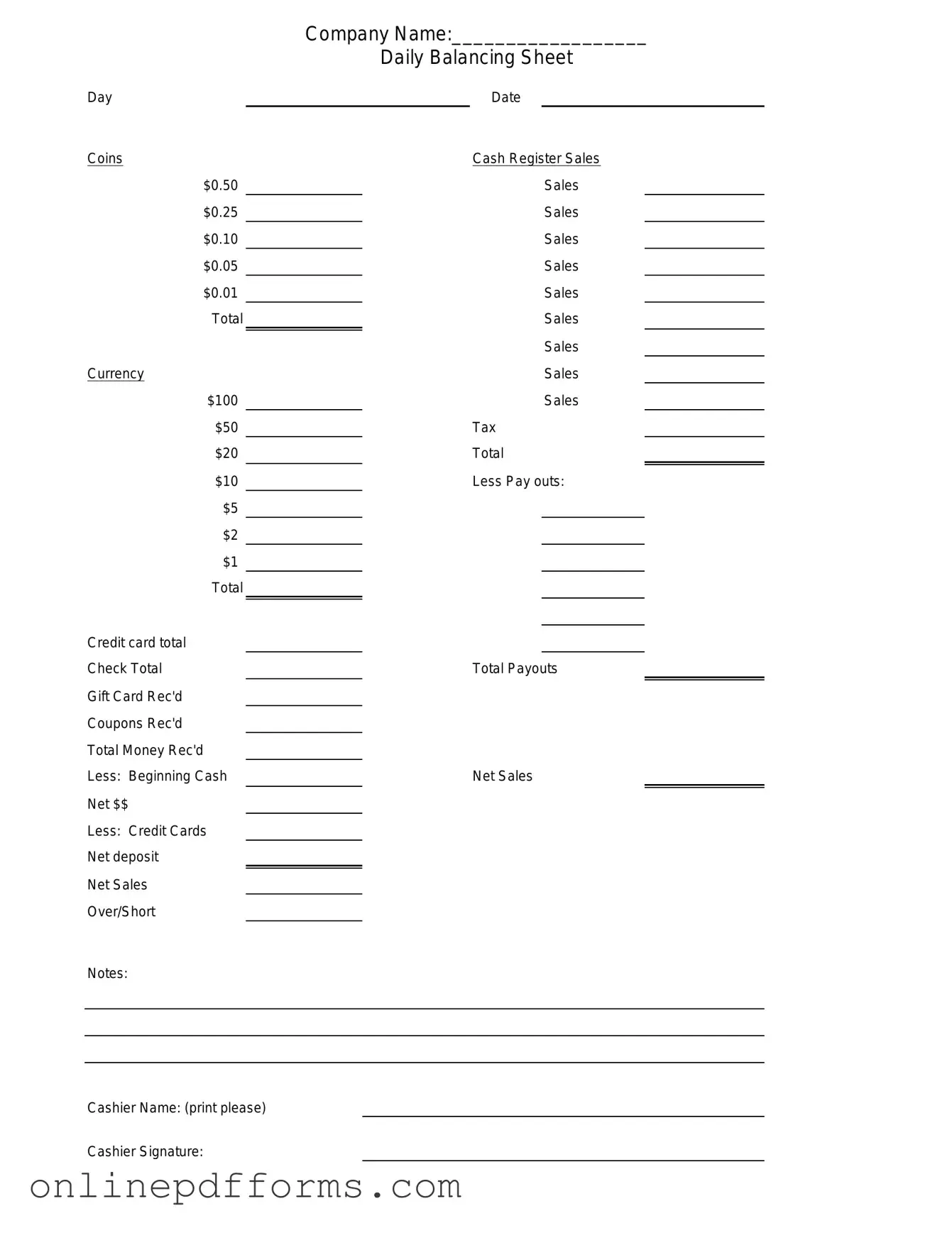

Completing the Cash Drawer Count Sheet form is essential for accurate cash management. After filling out the form, it will be submitted to the appropriate department for verification and record-keeping. Follow these steps carefully to ensure all information is accurately captured.

- Begin by entering the date at the top of the form.

- Write down your name or the name of the person responsible for the cash drawer.

- Identify the location of the cash drawer, such as the store or register number.

- List all denominations of cash in the designated sections, including bills and coins.

- Count the total amount of cash for each denomination and enter the totals in the corresponding boxes.

- Calculate the grand total of all cash and write it in the total section.

- Sign and date the form at the bottom to confirm that the count is accurate.