Fill in Your Cash Receipt Template

Documents used along the form

When managing financial transactions, several documents often accompany the Cash Receipt form. Each of these documents plays a vital role in ensuring accurate record-keeping and compliance. Below is a list of common forms and documents that are frequently used alongside the Cash Receipt form.

- Invoice: This document outlines the details of a sale, including items purchased, quantities, and total cost. It serves as a request for payment from the buyer.

- Sales Order: A sales order confirms a purchase agreement between a buyer and seller. It includes information about the products or services ordered and the terms of sale.

- Payment Voucher: This is an internal document used to authorize a payment. It includes details such as the amount to be paid and the purpose of the payment.

- Bank Deposit Slip: This slip is used to deposit cash or checks into a bank account. It provides a record of the transaction and is crucial for reconciling accounts.

- Articles of Incorporation: Essential for establishing a corporation, this document outlines key details about the business. Don’t forget to access the necessary form at pdftemplates.info/wisconsin-articles-of-incorporation-form/ to get started on your entrepreneurial journey.

- Credit Note: Issued to a buyer, this document indicates a reduction in the amount owed. It is often used in cases of returns or adjustments to an invoice.

- Purchase Order: A purchase order is a document sent from a buyer to a seller, detailing the items or services to be provided. It helps track orders and manage inventory.

- Expense Report: This report is used to document and request reimbursement for business-related expenses. It provides details about the expenses incurred and their purpose.

- Receipt Acknowledgment: This document confirms that a payment has been received. It may be signed by the recipient as proof of transaction completion.

- Transaction Log: A record of all financial transactions, this log helps track incoming and outgoing funds. It is essential for maintaining accurate financial records.

Using these documents in conjunction with the Cash Receipt form helps ensure transparency and accuracy in financial dealings. Proper documentation can protect both parties in a transaction and facilitate smoother financial management.

More PDF Templates

Puppy Health Record - Keep track of toenail trims to ensure proper grooming routines.

To facilitate the transfer of vehicle ownership in Washington, it is important to utilize the appropriate paperwork, such as the Auto Bill of Sale Forms, which provide a clear framework for documenting the sale and ensuring a legally binding agreement between the seller and buyer.

Dd Form 2656 March 2022 - Use the DD 2656 to finalize your retirement plan with the military.

Similar forms

The Cash Receipt form is similar to an Invoice in that both documents serve as a record of a transaction. An invoice is typically issued by a seller to request payment for goods or services rendered. It includes details such as the date of the transaction, the items sold, and the total amount due. Like a cash receipt, an invoice provides essential information for both the buyer and seller, helping to keep accurate financial records and ensuring that payments are tracked correctly.

Another document that closely resembles the Cash Receipt form is the Payment Voucher. A payment voucher is used to authorize a payment to a vendor or service provider. It includes similar details like the amount being paid, the purpose of the payment, and the date. Both documents serve as proof of payment and help organizations maintain clear financial records, ensuring that all transactions are accounted for and properly documented.

In the realm of financial documentation, the importance of clarity cannot be overstated, as evidenced by various forms such as the Cash Sale Receipt, Sales Invoice, and Payment Voucher. Each serves a distinct purpose in recording transactions, ensuring that both the payer and recipient maintain an accurate account of exchanges. Furthermore, for those needing guidance on more intricate documents like a General Power of Attorney, resources are available at californiapdf.com/, illustrating the essential nature of proper documentation for all types of financial interactions.

The Deposit Slip is another document akin to the Cash Receipt form. When cash or checks are deposited into a bank account, a deposit slip is filled out to record the transaction. This document captures the amount being deposited and the date of the deposit. Much like a cash receipt, it provides a record of funds received, aiding in financial tracking and reconciliation with bank statements.

A Sales Receipt also shares similarities with the Cash Receipt form. When a customer makes a purchase, a sales receipt is generated to confirm the transaction. This document includes details such as the items purchased, their prices, and the total amount paid. Like a cash receipt, it serves as proof of the transaction and is essential for both the customer and the seller for record-keeping and potential returns or exchanges.

The Purchase Order is another document that has a relationship with the Cash Receipt form. While a purchase order is issued by a buyer to request goods or services, it outlines the details of the order, including quantities and prices. Once the order is fulfilled, a cash receipt may be issued to confirm payment. Both documents play a crucial role in the purchasing process, ensuring that all parties are aligned on the terms of the transaction.

In addition, a Credit Memo can be compared to the Cash Receipt form. A credit memo is issued by a seller to acknowledge a return or adjustment to a previous sale. It provides details on the amount credited back to the buyer and the reason for the adjustment. While a cash receipt confirms payment, a credit memo serves as a record of money being returned, highlighting the dynamic nature of financial transactions.

The Statement of Account is another document that aligns with the Cash Receipt form. This statement summarizes all transactions between a buyer and seller over a specific period. It includes payments received, outstanding balances, and any adjustments made. Both documents help maintain transparency in financial dealings, ensuring that both parties have a clear understanding of their financial relationship.

Lastly, the Expense Report bears some resemblance to the Cash Receipt form. An expense report is submitted by employees to request reimbursement for business-related expenses. It lists the amounts spent, the purpose of the expenses, and includes receipts as proof of payment. While the cash receipt confirms income received, an expense report validates outgoing funds, showcasing the flow of money in and out of an organization.

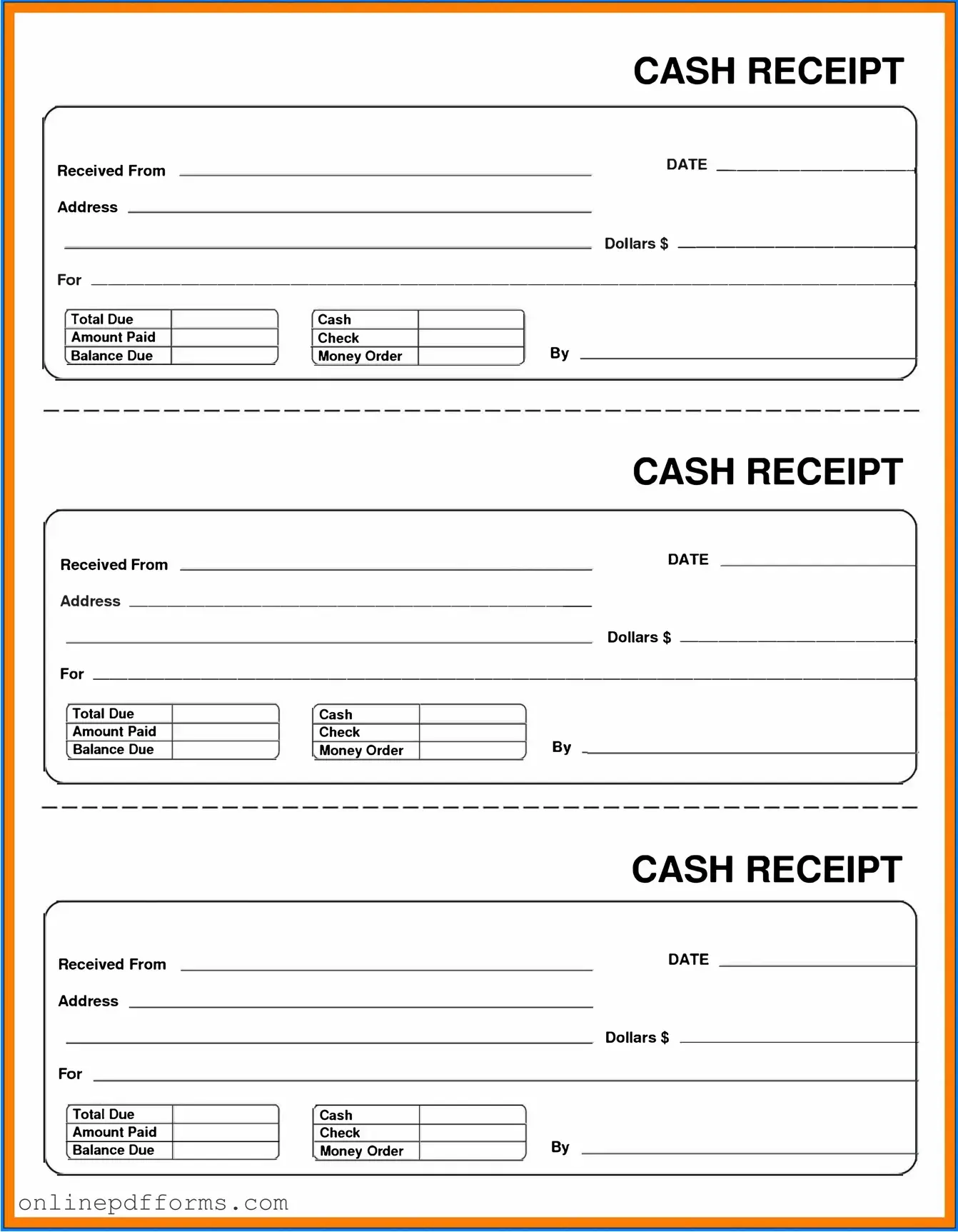

Steps to Filling Out Cash Receipt

After obtaining the Cash Receipt form, it is essential to complete it accurately to ensure proper documentation of the transaction. This form will be submitted for processing, and all necessary information must be provided to avoid any delays.

- Begin by entering the date of the transaction in the designated field.

- Fill in the name of the individual or organization making the payment.

- Provide a detailed description of the purpose of the payment.

- Enter the amount received in the appropriate currency format.

- Indicate the method of payment, such as cash, check, or credit card.

- Include any reference number associated with the payment, if applicable.

- Sign and date the form at the bottom to certify the information is correct.

Once completed, the form should be submitted to the appropriate department for further processing. Ensure that a copy is retained for your records.