Fill in Your Cg 20 10 07 04 Liability Endorsement Template

Documents used along the form

The CG 20 10 07 04 Liability Endorsement form is an important document for businesses looking to add additional insured parties to their commercial general liability policy. However, there are several other forms and documents that are often used in conjunction with this endorsement. Understanding these documents can help ensure comprehensive coverage and compliance with contractual obligations.

- Commercial General Liability Policy (CGL): This is the main insurance policy that provides coverage for bodily injury, property damage, and personal injury claims. The CG 20 10 07 04 endorsement modifies this policy to include additional insureds.

- Certificate of Insurance (COI): A document that proves insurance coverage. It outlines the types of coverage, limits, and additional insureds, making it essential for contractors and businesses to show compliance with insurance requirements.

- Additional Insured Endorsement: Similar to the CG 20 10 07 04 form, this document specifically adds a party as an additional insured under a policy. It may vary in terms and coverage, depending on the specific needs of the contract.

- Contractor Agreement: This legal document outlines the terms and conditions between the contractor and the client. It often specifies insurance requirements, including the need for additional insured status.

- Waiver of Subrogation: This document prevents the insurance company from pursuing a third party for recovery of damages after a claim is paid. It is often required in contracts to protect the additional insured.

- Vehicle Bill of Sale Forms: When transferring ownership of an all-terrain vehicle (ATV), proper documentation like the Vehicle Bill of Sale Forms is essential to ensure the legality of the transaction.

- Indemnity Agreement: This agreement outlines the responsibilities of one party to compensate another for certain damages or losses. It may require insurance coverage that includes additional insured provisions.

- Endorsement for Completed Operations: This endorsement extends coverage to include liability for damages that occur after a project is completed. It is crucial for contractors to ensure they are protected even after the work is done.

- Claims-Made Policy: This type of policy provides coverage only for claims made during the policy period. Understanding how this interacts with additional insured endorsements is vital for ensuring adequate protection.

By familiarizing yourself with these documents, you can navigate the complexities of insurance coverage more effectively. Ensuring that all necessary forms are in place will help protect your business and meet contractual obligations.

More PDF Templates

What Does a Esa Letter Look Like - Achieve peace of mind knowing your animal is supported legally.

The USCIS I-864 form, also known as the Affidavit of Support, is a crucial document for individuals seeking to sponsor an immigrant. This form demonstrates the sponsor's ability to financially support the immigrant, ensuring that they will not become dependent on government assistance. Understanding the importance of this form is essential for a successful sponsorship process, so consider filling it out by visiting https://pdftemplates.info/uscis-i-864-form.

P45 What Is It - The tax code at the leaving date must be noted to ensure accurate tax deductions at the new job.

Similar forms

The CG 20 10 07 04 Liability Endorsement form is closely related to the Additional Insured Endorsement (CG 20 10). This document also extends coverage to additional parties, typically owners or contractors, for liabilities arising from the named insured’s operations. Like the CG 20 10 07 04, it specifies that the coverage applies only to the extent of the named insured's actions or omissions. Both forms ensure that the additional insured is protected from certain claims, but the CG 20 10 is broader in scope, covering all operations rather than just those listed in a schedule.

Another similar document is the CG 20 37, which provides coverage for additional insureds in the context of completed operations. This endorsement is particularly relevant for contractors who want to protect their clients after a project is finished. While the CG 20 10 07 04 focuses on ongoing operations, the CG 20 37 emphasizes protection for liabilities that may arise once the work is completed, ensuring that the additional insured is covered for incidents that occur post-completion.

The CG 20 11 endorsement is also noteworthy. This form adds additional insured coverage for specific projects or locations, much like the CG 20 10 07 04. However, the CG 20 11 is often used in construction contracts where specific projects require additional insured status. This specificity can provide a clearer understanding of which operations are covered, reducing the potential for disputes over the scope of coverage.

Similar to the CG 20 10 07 04 is the CG 20 14 endorsement, which provides coverage for additional insureds in the context of liability arising from the ongoing operations of the named insured. While both documents serve a similar purpose, the CG 20 14 often applies to broader categories of operations, making it suitable for various industries, including construction and manufacturing. This flexibility can be beneficial for businesses engaging in multiple types of work.

The CG 20 15 endorsement is another relevant document, as it provides coverage for additional insureds but focuses specifically on ongoing operations performed by subcontractors. This endorsement is vital in scenarios where a general contractor hires subcontractors, ensuring that the general contractor is protected from liabilities arising from the work of those subcontractors. This endorsement complements the CG 20 10 07 04 by addressing the layered nature of liability in construction projects.

Next, the CG 20 33 endorsement can be compared, as it extends coverage to additional insureds for liability arising from the named insured’s products. This is particularly relevant for manufacturers and distributors. While the CG 20 10 07 04 focuses on operations, the CG 20 33 emphasizes the importance of product liability, ensuring that additional insureds are protected if claims arise from products sold or distributed by the named insured.

When dealing with the sale or transfer of trailers, it is crucial to have the appropriate documentation in place, such as the Auto Bill of Sale Forms, which provide legal verification and details of the transaction, ensuring that both the buyer and seller are protected throughout the process.

Lastly, the CG 20 26 endorsement is similar in that it provides additional insured status for entities involved in a specific project or contract. This document is often used in real estate transactions and property management, ensuring that landlords and property owners are protected from liabilities that may arise during the duration of a lease or project. Like the CG 20 10 07 04, it emphasizes the importance of clearly defined operations and the need for protection against potential claims.

Steps to Filling Out Cg 20 10 07 04 Liability Endorsement

Filling out the CG 20 10 07 04 Liability Endorsement form is an important step in ensuring that additional insured parties are properly covered under your commercial general liability policy. This form allows you to specify who is included as an additional insured and under what circumstances. Follow the steps below to complete the form accurately.

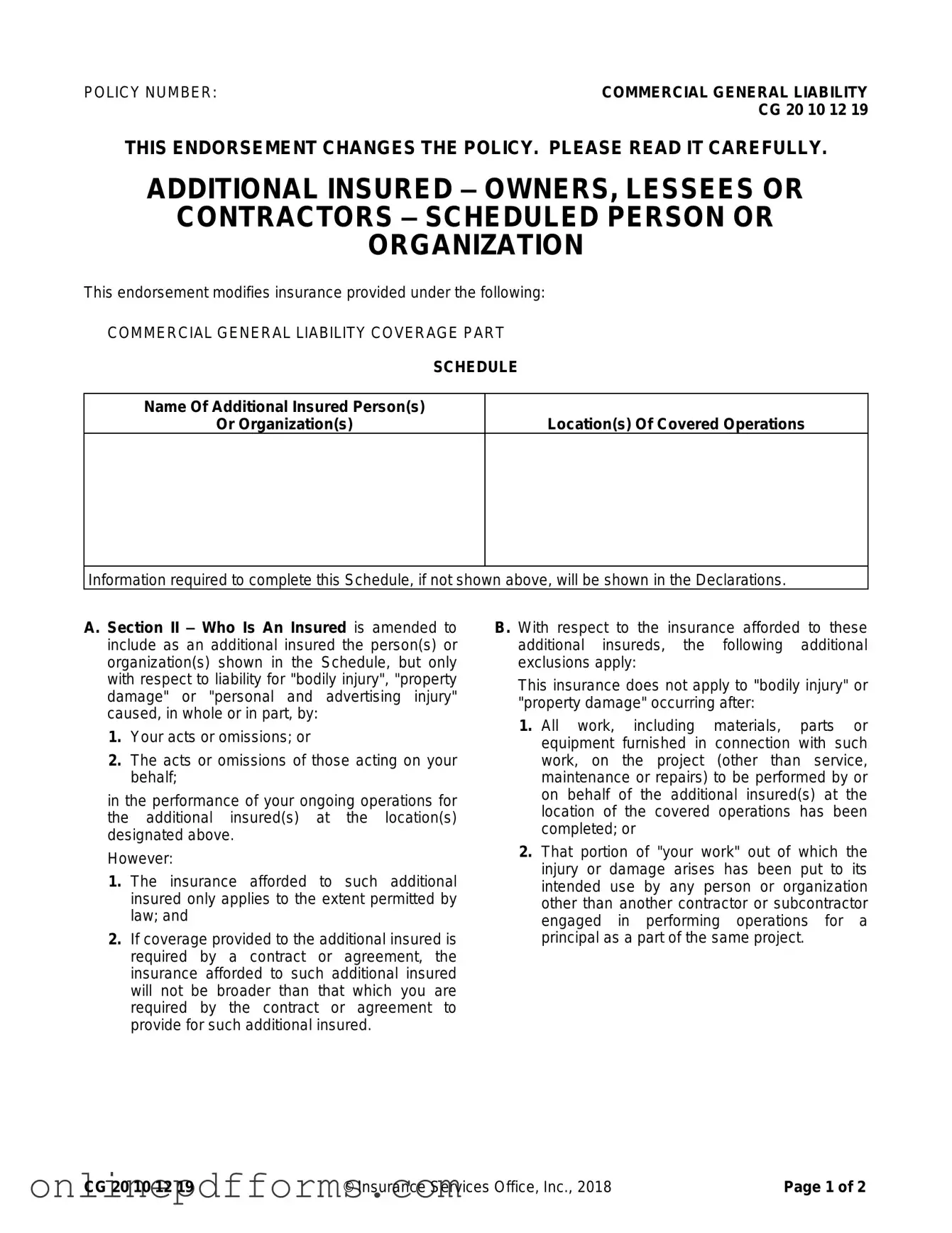

- Locate the Policy Number: At the top of the form, find the section labeled "POLICY NUMBER." Enter your commercial general liability policy number in the designated space.

- Identify Additional Insureds: In the section titled "Name Of Additional Insured Person(s) Or Organization(s)," write the names of the individuals or organizations you wish to add as additional insureds. Be specific and ensure the names are spelled correctly.

- Specify Locations: Next, in the "Location(s) Of Covered Operations" section, list the addresses or locations where the covered operations will take place. This information helps clarify where the coverage applies.

- Review the Declarations: If any information is missing from the schedule, check the Declarations page of your policy. This page may contain additional details required for the endorsement.

- Understand Exclusions: Familiarize yourself with the exclusions mentioned in the form. Specifically, note that coverage does not apply after all work has been completed or if the injury arises from work that has been put to its intended use.

- Check Coverage Limits: Be aware that if the additional insured coverage is required by a contract, the maximum amount payable will be the lesser of what is required by that contract or the limits of your insurance.

- Sign and Date: Finally, sign and date the form at the bottom to validate it. Ensure that all information is correct before submitting.

After completing the form, you can submit it to your insurance provider. They will process the endorsement and update your policy accordingly. This ensures that the additional insured parties are covered as specified. Keep a copy for your records, as it may be important for future reference.