Fill in Your Childcare Receipt Template

Documents used along the form

When managing childcare services, several documents accompany the Childcare Receipt form to ensure clarity and compliance for both parents and providers. Each of these forms plays a vital role in maintaining accurate records, facilitating communication, and supporting financial transactions. Below is a list of commonly used forms alongside the Childcare Receipt form.

- Childcare Enrollment Form: This document collects essential information about the child, including personal details, emergency contacts, and any special needs. It establishes a formal agreement between the provider and the parents.

- Childcare Contract: A written agreement that outlines the terms of service, payment structure, and responsibilities of both parties. This contract helps prevent misunderstandings regarding services provided.

- Bill of Sale for Snowmobiles: An essential document for transferring ownership of a snowmobile, providing details on the sale, including the description and price, ensuring a smooth transactional process. For more details, refer to the Bill of Sale for Snowmobiles.

- Payment Agreement: This form details the payment schedule, including due dates and accepted payment methods. It ensures both parties are clear on financial expectations.

- Tax Identification Form: This document is often necessary for tax purposes. It includes the provider's tax ID number, which parents may need for claiming childcare expenses on their taxes.

- Daily Log or Attendance Record: A log that tracks the child's daily attendance, activities, and any incidents that may occur. This form helps maintain a comprehensive record of the child's time in care.

- Emergency Contact Form: This form provides essential contact information for parents and authorized individuals who can be reached in case of emergencies. It ensures the safety of the child.

- Health and Immunization Records: Documentation of the child's health status and vaccination history. This information is crucial for ensuring the child's well-being and compliance with local regulations.

- Authorization for Medication: A form that allows parents to grant permission for the childcare provider to administer medication to their child. It specifies dosage and timing, ensuring safety and compliance.

- Incident Report Form: A document used to record any accidents or unusual occurrences involving a child. This form helps maintain transparency and provides a record for both the provider and the parents.

In conclusion, these forms collectively support the effective operation of childcare services. They foster communication, ensure compliance with regulations, and help both providers and parents manage their responsibilities effectively. Understanding these documents can enhance the overall experience for everyone involved in childcare arrangements.

More PDF Templates

Legal Lease Agreement - Each tenant is accountable for adhering to the agreement as stated in Clause 1, regardless of individual occupancy levels.

For those looking to navigate the complexities of acquiring or renewing their identification, it's essential to understand the specifics of the California Identification Card, as detailed on californiapdf.com/. This resource offers valuable insights into the necessary steps and requirements, ensuring that all applicants can effectively manage their application process.

Printable Mar - Lines for each hour create a systematic approach to administration timing.

Similar forms

The Childcare Receipt form shares similarities with a Tuition Receipt form, which is used by educational institutions to acknowledge payment for tuition fees. Like the childcare receipt, the tuition receipt includes essential details such as the date of payment, the amount received, and the name of the student. Both documents serve as proof of payment, helping parents keep track of their financial obligations. Furthermore, they both require a signature from the provider, whether that be a childcare provider or a school official, adding an element of authenticity to the transaction.

Another document comparable to the Childcare Receipt is the Medical Receipt form. This form is issued by healthcare providers to confirm that a patient has paid for medical services rendered. Similar to the childcare receipt, it includes the date of service, the amount paid, and the name of the patient. Both receipts are important for record-keeping and may be necessary for insurance reimbursement purposes. The presence of a signature from the medical provider also parallels the signature requirement found in childcare receipts.

The Rental Payment Receipt is yet another document that mirrors the structure and purpose of the Childcare Receipt form. Landlords provide this receipt to tenants as evidence of rent payment. It contains details such as the date, the amount received, and the tenant's name, much like the childcare receipt. Both documents serve to protect the interests of both parties, providing proof of payment and maintaining transparency in financial transactions.

A similar document is the Donation Receipt, which charities issue to acknowledge contributions made by donors. This receipt includes the date of the donation, the amount given, and the donor's name, paralleling the information found on a childcare receipt. Both documents are essential for record-keeping, especially for tax purposes, as they provide evidence of financial transactions that may be deductible.

The Invoice is another document that shares characteristics with the Childcare Receipt. Invoices are often issued by service providers to request payment for services rendered. They typically include the date, the amount due, and the recipient's name. While invoices request payment, receipts confirm that payment has been made. Both documents are crucial for maintaining accurate financial records and ensuring that both parties are aware of their financial commitments.

The Sales Receipt is also similar to the Childcare Receipt, as it is provided by retailers to customers after a purchase. It includes the date, the total amount paid, and the buyer's information. Just like the childcare receipt, the sales receipt serves as proof of payment and can be used for returns or exchanges. Both documents help consumers keep track of their expenditures, facilitating better financial management.

For those needing to verify their financial transactions related to childcare, ensuring the proper documentation is essential. To facilitate this process, individuals can get the document that confirms payment details and serves to provide proof of the services rendered. Properly filled forms help maintain transparency and accountability in financial discussions.

Lastly, the Service Receipt is comparable to the Childcare Receipt in that it confirms payment for services provided by various professionals, such as mechanics or electricians. This document includes the date of service, the amount charged, and the client's name. Similar to the childcare receipt, it serves as proof of payment and can be important for warranty claims or future service needs. Both receipts help maintain clear communication between service providers and their clients regarding financial transactions.

Steps to Filling Out Childcare Receipt

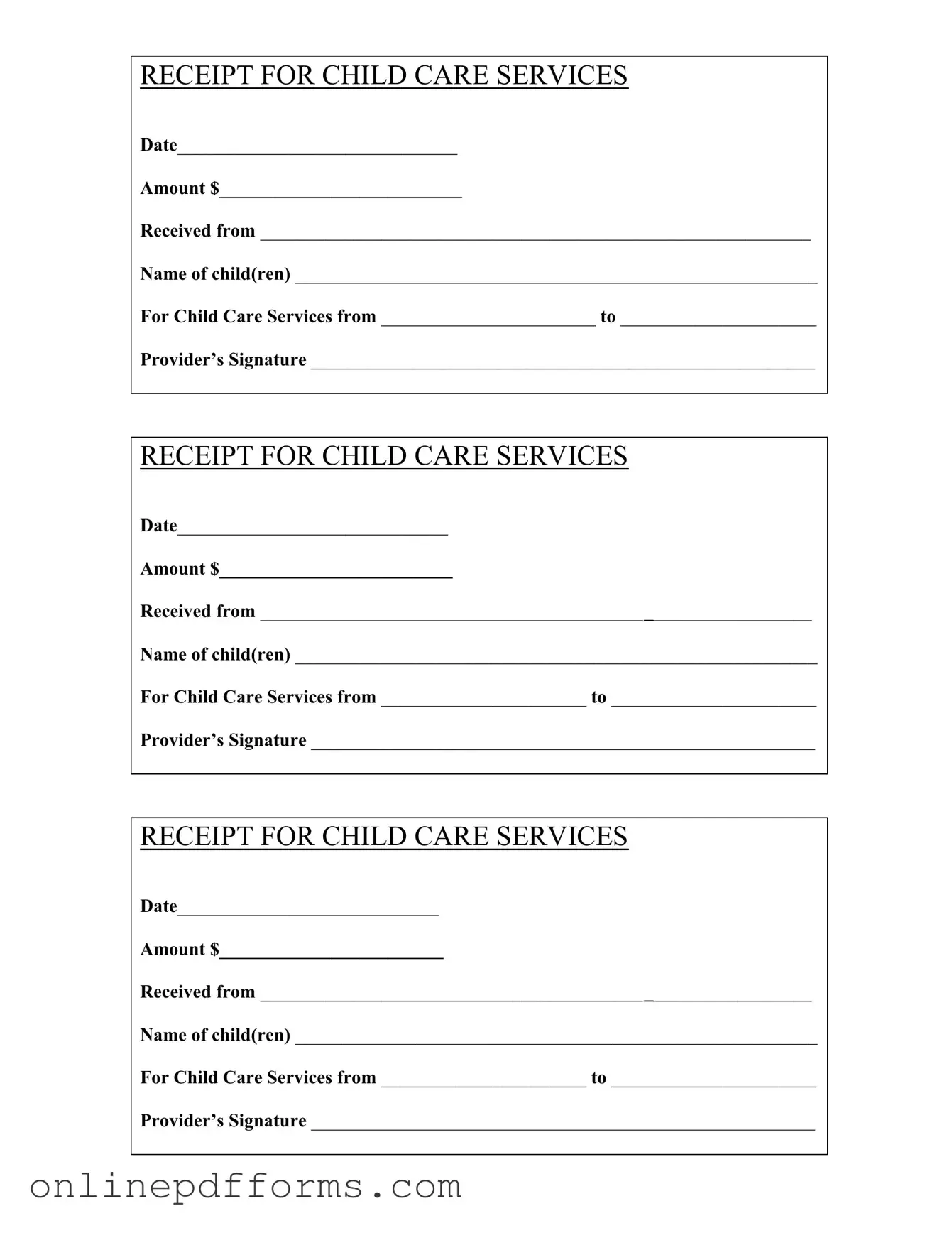

Completing the Childcare Receipt form is a straightforward process that requires attention to detail. After filling out the form, it should be retained for your records, as it serves as proof of payment for childcare services. Here are the steps to ensure the form is filled out correctly:

- Date: Write the date on which the payment is made in the designated space.

- Amount: Enter the total amount paid for childcare services in the appropriate box.

- Received from: Fill in the name of the individual or entity making the payment.

- Name of child(ren): List the names of the child or children receiving care.

- For Child Care Services from: Indicate the start date of the childcare services in the specified area.

- to: Write the end date of the childcare services in the next box.

- Provider’s Signature: The childcare provider must sign the form to validate the receipt.