Fill in Your Citibank Direct Deposit Template

Documents used along the form

When setting up direct deposit with Citibank, several other forms and documents may be required to ensure a smooth process. Each of these documents serves a specific purpose and helps facilitate the management of your banking and financial needs.

- W-4 Form: This is the Employee's Withholding Certificate. It informs your employer about how much federal income tax to withhold from your paycheck.

- Bank Account Verification Letter: This document confirms your bank account details, such as account number and routing number, ensuring accuracy for direct deposits.

- Employment Verification Letter: This letter, provided by your employer, verifies your employment status and may be required by the bank for account setup.

- Residency Verification Form: To confirm your living status, ensure you complete the Texas Affidavit of Residency documentation necessary for various applications, helping you meet residency requirements effectively.

- Pay Stub: A recent pay stub may be needed to confirm your income and employment details, particularly if you are applying for loans or credit.

- Tax Return: A copy of your most recent tax return may be requested to verify your income, especially for loan applications or financial assessments.

- Direct Deposit Authorization Form: This form authorizes your employer to deposit your paycheck directly into your bank account, detailing the account information.

- Identification Documents: A government-issued ID, such as a driver's license or passport, may be required to verify your identity when setting up direct deposit.

- Social Security Card: This card may be requested to confirm your Social Security number for tax and identification purposes.

- Change of Address Form: If you have recently moved, this form updates your address with your employer and bank to ensure all correspondence is sent to the correct location.

Having these documents ready can streamline the process of setting up your Citibank direct deposit. Each form plays a vital role in ensuring that your banking arrangements are accurate and secure.

More PDF Templates

Employer's Quarterly Federal Tax Return - The form also details tax credits and adjustments relating to payroll taxes.

For those seeking to navigate the rental process effectively, the integral Rental Application form serves as a key resource in assessing potential tenants and ensuring a smooth transaction.

Living Will Requirements - This directive supports your right to make choices about your own health care, reinforcing autonomy.

Apply for Drivers License - Collecting accurate social security and identification information is a legal requirement.

Similar forms

The Citibank Direct Deposit form shares similarities with the Payroll Authorization form. Both documents serve the purpose of allowing an individual’s salary or wages to be deposited directly into their bank account. The Payroll Authorization form typically requires the employee's personal information, banking details, and a signature to confirm consent. This ensures that the employer has the necessary authorization to process the direct deposits accurately and securely, just as the Citibank form does.

When considering the purchase or sale of a motorcycle, it's crucial to have the necessary documentation to protect both the buyer and seller. One essential document to facilitate this process is the Vehicle Bill of Sale Forms, which encapsulates the terms of the transaction and serves as proof of ownership transfer in the state of Georgia.

Another document that resembles the Citibank Direct Deposit form is the Automatic Payment Authorization form. This form is used to set up automatic payments for bills or services directly from a bank account. Like the direct deposit form, it requires the account holder’s banking information and a signature. Both documents facilitate financial transactions without the need for physical checks, streamlining the process and ensuring timely payments or deposits.

Lastly, the Bank Account Verification form can be considered similar to the Citibank Direct Deposit form. This document is often required by financial institutions to confirm the details of a bank account before processing transactions like direct deposits. While the Citibank form focuses on authorizing deposits, the Bank Account Verification form ensures that the information provided is accurate and up-to-date. Both forms play critical roles in facilitating smooth financial operations, highlighting the importance of accuracy in banking information.

Steps to Filling Out Citibank Direct Deposit

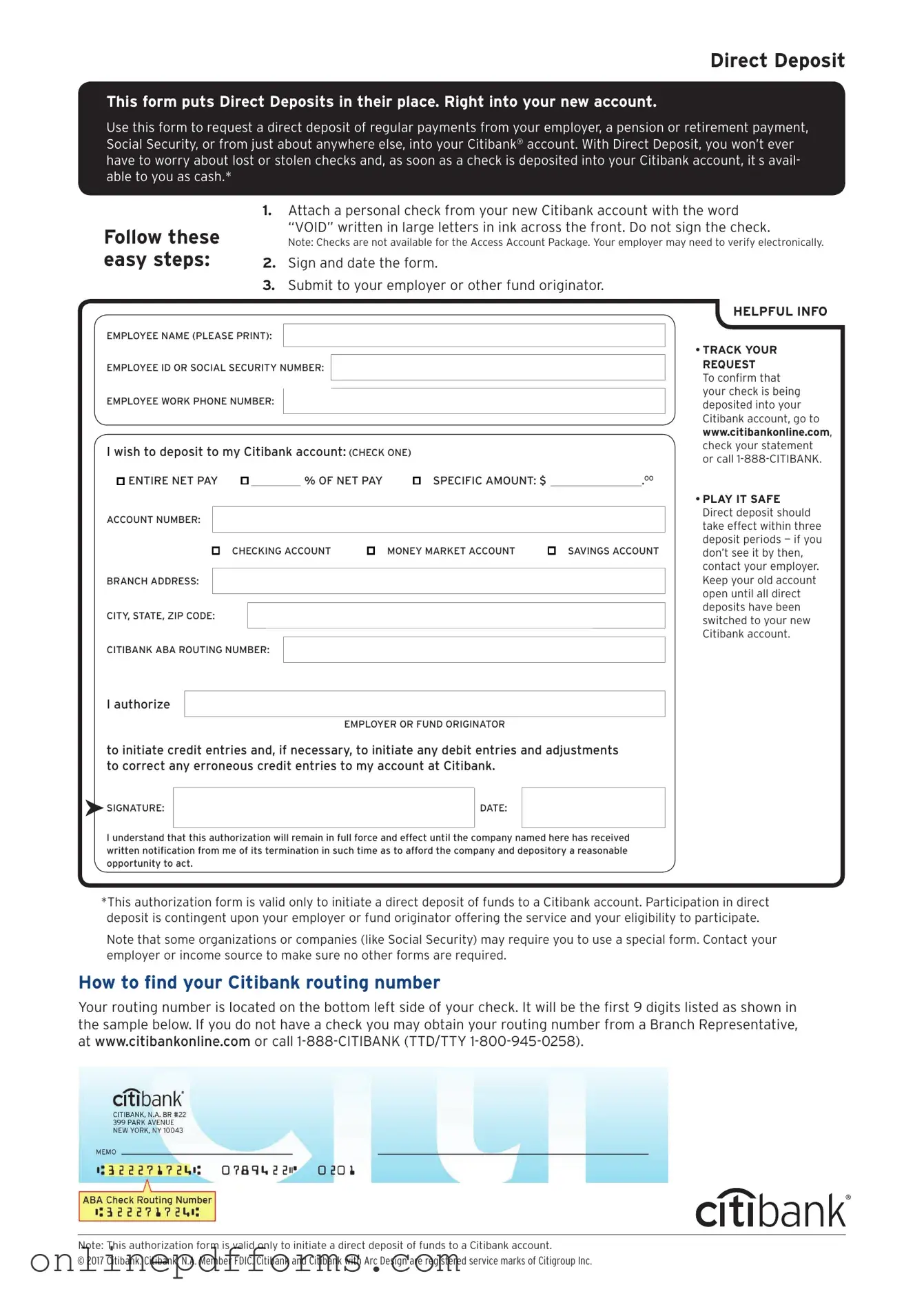

Once you have the Citibank Direct Deposit form in hand, you will need to complete it accurately to ensure your funds are deposited directly into your account. Follow the steps below to fill out the form correctly.

- Begin by entering your personal information. This includes your full name, address, and Social Security number.

- Next, provide your Citibank account details. Write down your account number and select the type of account (checking or savings).

- Indicate the name of your employer or the organization making the deposits. This information is essential for processing your request.

- Fill in the routing number for your bank. You can find this number on your checks or by contacting Citibank directly.

- Review all the information you have entered to ensure accuracy. Mistakes can delay your direct deposit.

- Finally, sign and date the form at the bottom. This signature authorizes your employer to deposit funds into your account.

After completing the form, submit it to your employer’s payroll department or the designated office responsible for handling direct deposit requests. Ensure you keep a copy for your records.