Legal Corrective Deed Form

Documents used along the form

When dealing with property transactions, various forms and documents work in tandem to ensure clarity and legal compliance. The Corrective Deed form is often used to amend or clarify previous deeds. However, several other documents may accompany it to provide a complete picture of the transaction. Here’s a brief overview of some commonly used forms alongside the Corrective Deed.

- Original Deed: This is the initial document that outlines the transfer of property ownership. It contains essential details such as the names of the parties involved, the legal description of the property, and any conditions of the sale.

- Affidavit of Title: This sworn statement assures the buyer that the seller has the legal right to sell the property and that there are no undisclosed liens or claims against it. It provides additional protection in the transaction.

- Title Insurance Policy: This document protects the buyer and lender from any future claims against the property. It covers issues that may arise from defects in the title that were not discovered during the title search.

- Settlement Statement: Also known as a HUD-1, this document outlines all the financial details of the transaction. It includes costs such as closing fees, taxes, and any other expenses related to the sale.

- Deed Form: An essential document for transferring ownership in Arizona, detailing the parties involved and the property description. For more information, visit arizonaformspdf.com/.

- Power of Attorney: This legal document allows one person to act on behalf of another in property transactions. It can be crucial when the seller is unable to be present at closing.

Each of these documents plays a vital role in ensuring that property transactions are conducted smoothly and legally. Understanding their functions can help individuals navigate the complexities of real estate dealings with confidence.

Consider More Types of Corrective Deed Forms

What Is Deed in Lieu - The borrower's willingness to cooperate with the lender can facilitate the Deed in Lieu process.

When preparing to transfer ownership of real property in Georgia, it is essential to utilize the appropriate legal materials. For further information about this important process, you can find the Georgia Deed form here, which will guide you through the necessary steps to ensure a smooth transaction.

How to Get a Quit Claim Deed - An easy way to handle property inheritance among family members.

Similar forms

The Quitclaim Deed is similar to the Corrective Deed in that it transfers ownership of property without any warranties. When a property owner wishes to transfer their interest in a property but does not guarantee the title, they often use a Quitclaim Deed. This document is straightforward and serves to clear up any potential claims or disputes regarding ownership, much like a Corrective Deed aims to rectify errors in previous deeds.

The Warranty Deed provides a more comprehensive guarantee than a Corrective Deed. While a Corrective Deed addresses mistakes in the original deed, a Warranty Deed assures the buyer that the seller holds clear title to the property and has the right to sell it. If issues arise after the sale, the seller is responsible for addressing them, which is not the case with a Corrective Deed.

For those looking to navigate the intricacies of property ownership, understanding the advantages of a comprehensive Texas Deed form can prove beneficial. Access the necessary information by visiting this Texas Deed form guide.

A Special Warranty Deed is another document that shares similarities with the Corrective Deed. It offers a limited warranty, ensuring that the seller has not done anything to harm the title during their ownership. While the Corrective Deed corrects errors in the title, the Special Warranty Deed only guarantees the title for the period of the seller’s ownership, making it a more limited option.

The Bargain and Sale Deed resembles the Corrective Deed in that it implies some level of ownership but does not guarantee a clear title. This type of deed is often used in foreclosures and tax sales, where the seller may not have full knowledge of the property’s title history. Like a Corrective Deed, it can help clarify ownership issues but does not provide full protection to the buyer.

An Affidavit of Title can also be compared to a Corrective Deed. This document is used to confirm the status of a property’s title. It serves as a sworn statement by the seller regarding any liens or claims against the property. While a Corrective Deed rectifies specific errors in documentation, an Affidavit of Title provides additional assurance about the state of the title.

The Deed of Trust, while primarily a security instrument, shares the goal of clarifying property ownership. It involves three parties: the borrower, the lender, and the trustee. The Deed of Trust secures a loan with real estate, similar to how a Corrective Deed aims to clarify ownership issues related to real estate transactions.

The Release of Lien is another document that can relate to the Corrective Deed. It is used to remove a lien from a property title. When a lien is satisfied, a Release of Lien clears the title, similar to how a Corrective Deed addresses errors that may cloud the title. Both documents aim to ensure that the title is clear for future transactions.

The Power of Attorney can also be linked to the Corrective Deed in terms of authority over property transactions. A Power of Attorney allows one person to act on behalf of another in legal matters, including property transfers. If a Corrective Deed is necessary, a Power of Attorney might be used to authorize someone else to sign the document, ensuring that the corrections can be made promptly.

Lastly, the Certificate of Title is relevant as it provides proof of ownership and the status of the property title. Similar to the Corrective Deed, it aims to clarify any issues related to the title. While a Corrective Deed corrects specific errors, a Certificate of Title verifies the accuracy of the title information, ensuring that all parties are informed before any transactions occur.

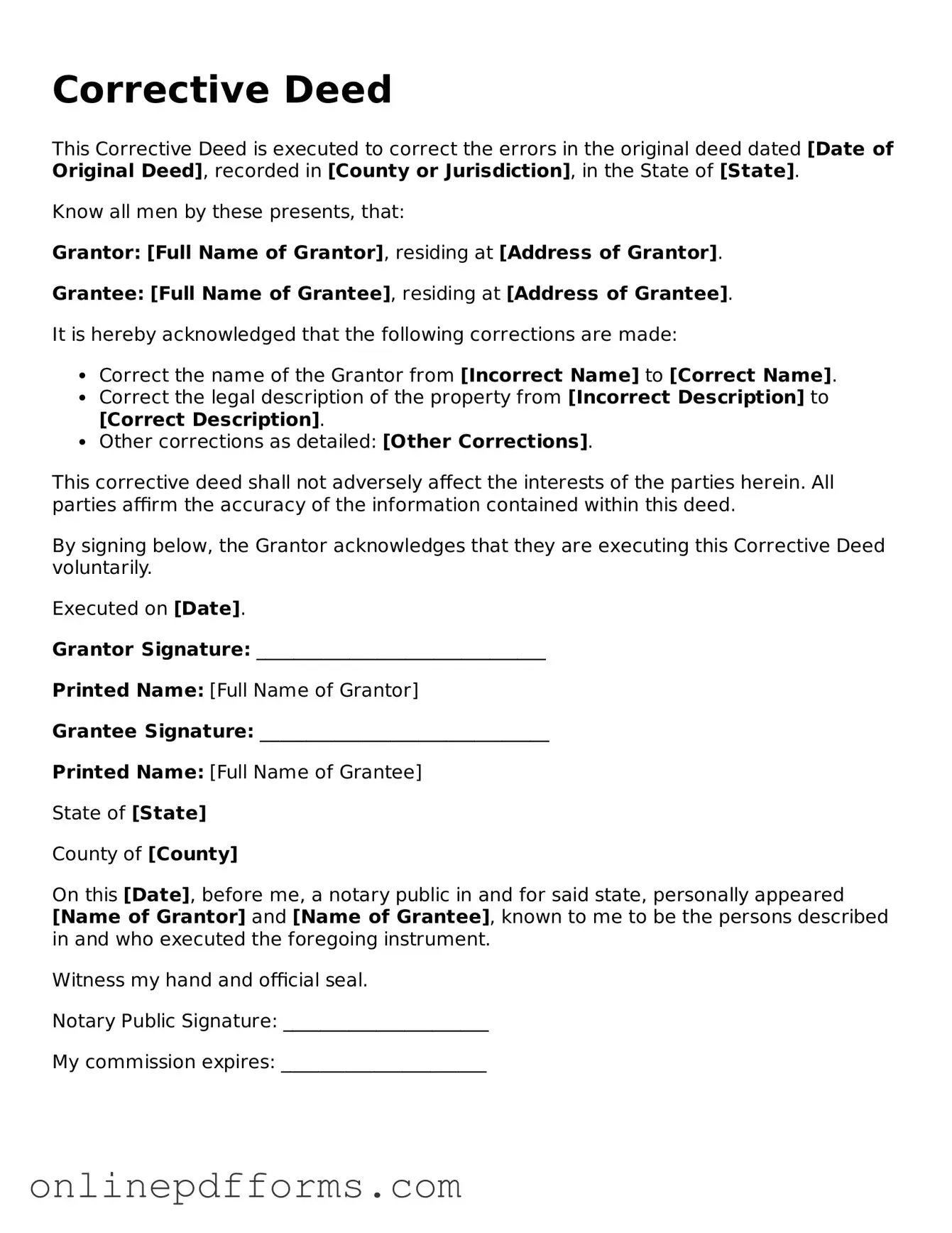

Steps to Filling Out Corrective Deed

Once you have the Corrective Deed form in hand, you can begin the process of filling it out. This form is essential for making necessary changes to a previously recorded deed. Ensure that you have all relevant information ready, as accuracy is important for the validity of the document.

- Start by entering the date at the top of the form. This should be the date you are completing the form.

- Provide the names of all parties involved in the deed. This includes the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Next, include the legal description of the property. This should match the description in the original deed. You may need to refer to that document for accuracy.

- Indicate the reason for the correction. Be clear and concise about what needs to be changed.

- Sign the form where indicated. All parties involved must sign to validate the changes.

- Have the form notarized. A notary public will verify the identities of the signers and provide their official seal.

- Finally, submit the completed form to the appropriate local government office for recording. This is typically the county recorder's office.