Fill in Your DD 2656 Template

Documents used along the form

The DD 2656 form is primarily used for the application for retirement pay and benefits for members of the military. However, there are several other forms and documents that often accompany it to ensure that all necessary information is collected and processed efficiently. Below is a list of these documents, along with brief descriptions of each.

- DD Form 214: This document serves as a certificate of release or discharge from active duty. It provides essential information about a service member's military service, including dates of service and type of discharge.

- SF 2800: This is the application for death benefits for federal employees. It is relevant for survivors of military personnel who are entitled to benefits following the member's death.

- DD Form 1172: This form is used to apply for a uniformed services identification card and is essential for family members seeking benefits and healthcare services.

- Loan Agreement Form: To outline the terms of borrowing money, refer to the comprehensive Loan Agreement documentation that details repayment schedules and obligations.

- DD Form 149: This application for correction of military records is used by individuals who wish to correct their service records, which may affect their benefits.

- VA Form 21-526EZ: This is the application for disability compensation and related compensation benefits through the Department of Veterans Affairs. It is often filed concurrently with the DD 2656 for those seeking disability benefits.

- DD Form 2656-6: This form is used to designate beneficiaries for unpaid retired pay. It ensures that any outstanding payments are directed to the appropriate parties after a service member's passing.

- SF 3104: This is the application for death benefits under the Federal Employees Retirement System. It is applicable for survivors of service members who were also federal employees.

- VA Form 21-534EZ: This form is for applying for Dependency and Indemnity Compensation (DIC) and is relevant for survivors of veterans who died from service-related injuries or conditions.

- DD Form 2656-7: This form is used to provide information about a retiree's marital status and dependent children, which can impact retirement benefits and entitlements.

These documents play a critical role in ensuring that service members and their families receive the benefits they are entitled to upon retirement or in the event of a service member's death. Properly completing and submitting these forms can help streamline the process and facilitate access to necessary support and resources.

More PDF Templates

Share Transfer Form - It can be used as evidence in any potential litigation regarding stock ownership.

Salary Advance Format - Filling out the Employee Advance form is the first step in receiving help.

To ensure a smooth transaction, it's essential to use the proper documentation when selling a motorcycle in South Carolina. A valid South Carolina Motorcycle Bill of Sale form can be acquired through resources such as Auto Bill of Sale Forms, which provide a clear template to record the details of the sale, including information about the motorcycle, the sale price, and the parties involved. This not only protects both the buyer and seller but also confirms the ownership transfer legally.

Direction to Pay - Ensure timely repairs by providing your insurance with direction through this authorization form.

Similar forms

The DD Form 214 is a document issued to military service members upon separation or discharge from active duty. It serves as a comprehensive record of a service member's military service, including dates of service, awards, and any other relevant information. Like the DD 2656, which is used to apply for retired pay, the DD Form 214 is crucial for establishing eligibility for various benefits and services. Both forms require accurate personal information and are essential for transitioning from military to civilian life.

The SF 50, or Notification of Personnel Action, is a form used by federal agencies to document employment actions such as hiring, promotions, and separations. Similar to the DD 2656, the SF 50 provides important information regarding an individual's employment status and benefits. Both documents require detailed personal information and are used to verify eligibility for certain benefits, including retirement and health insurance. They play a vital role in the administration of federal employment and retirement systems.

The VA Form 21-526EZ is an application for disability compensation and related benefits for veterans. This form is similar to the DD 2656 in that it is used to initiate a claim for benefits. Both forms require detailed personal information and documentation to support the application process. The VA Form 21-526EZ focuses specifically on disability claims, while the DD 2656 is geared towards retirement benefits, but both are essential for veterans seeking to secure their rightful entitlements.

When completing the necessary forms for veterans' benefits, including the billofsaleforvehicles.com for title transfers, it is crucial to provide accurate and comprehensive information to facilitate a smooth application process. Each document, from the VA Form 21-526EZ to the VA Form 21-686c, plays a significant role in determining eligibility and ensuring veterans receive the support they deserve.

The IRS Form W-4 is used by employees to indicate their tax withholding preferences. While it serves a different purpose than the DD 2656, both forms require personal information and can impact financial outcomes. The DD 2656 is focused on retirement pay, while the W-4 is concerned with income tax withholding. Understanding the implications of both forms is important for managing finances effectively, especially during transitions like retirement.

The Form SF 1199A is used to authorize electronic payments for federal benefits. This form is similar to the DD 2656 in that it is often completed during the retirement process to ensure timely payment of benefits. Both forms require personal and banking information to facilitate the disbursement of funds. Properly completing these forms is crucial for ensuring that retirees receive their benefits without delay.

Steps to Filling Out DD 2656

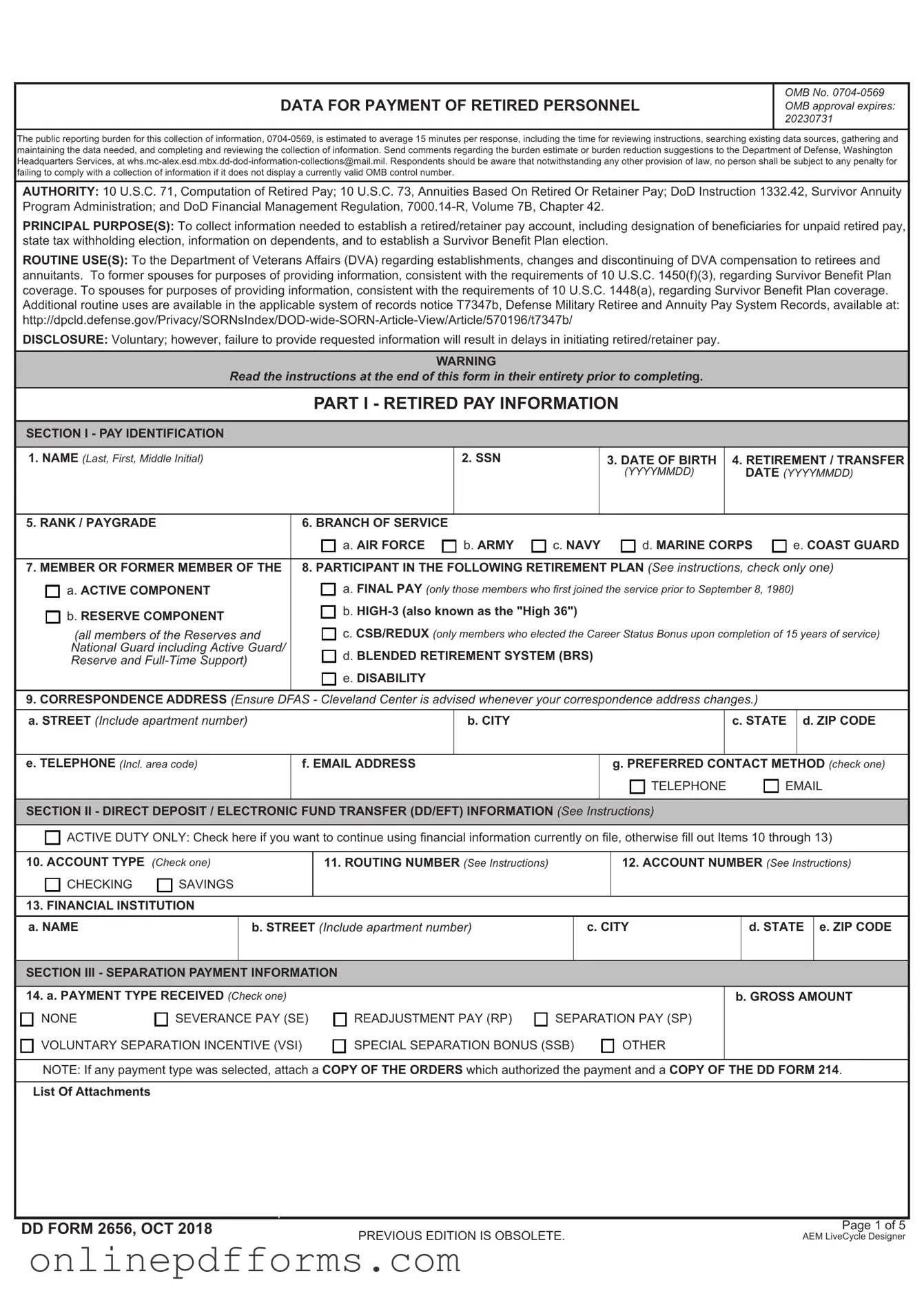

After gathering the necessary personal information and documentation, you are ready to complete the DD 2656 form. This form is essential for ensuring that your benefits are processed correctly. Follow these steps to accurately fill it out.

- Begin by entering your full name in the designated section at the top of the form.

- Provide your Social Security Number (SSN) in the next field.

- Fill in your date of birth in the specified format (MM/DD/YYYY).

- Indicate your gender by checking the appropriate box.

- Complete your mailing address, including street, city, state, and ZIP code.

- List your phone number, including the area code.

- In the next section, provide your service details, including branch of service and dates of active duty.

- Fill in the information regarding your marital status and dependents, if applicable.

- Sign and date the form at the bottom to certify that the information provided is accurate.

- Review the completed form to ensure all sections are filled out correctly before submission.

Once the form is filled out, it should be submitted according to the instructions provided, ensuring that all required documents are included for processing.