Legal Deed in Lieu of Foreclosure Form

Deed in Lieu of ForeclosureTemplates for Specific States

Documents used along the form

A Deed in Lieu of Foreclosure is a significant step in the process of avoiding foreclosure. When engaging in this process, several other forms and documents may be needed to ensure everything is handled correctly. Below is a list of related documents that often accompany the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines changes to the original loan terms, such as interest rates or payment schedules, to make it more manageable for the borrower.

- Notice of Default: This is a formal notification to the borrower that they have defaulted on their mortgage payments, often preceding foreclosure actions.

- Application Form: If you're looking for a position at Trader Joe's, you will need to complete their employment documentation. For more details on the application requirements, visit the https://pdftemplates.info/trader-joe-s-application-form.

- Foreclosure Notice: A legal document informing the borrower that foreclosure proceedings have been initiated due to missed payments.

- Property Appraisal Report: An assessment of the property's current market value, which helps both parties understand the asset's worth during negotiations.

- Title Search Report: A document that verifies the legal ownership of the property and checks for any liens or claims against it.

- Release of Liability: This document releases the borrower from further obligations related to the mortgage after the deed transfer is completed.

- Settlement Statement: A summary of the financial transactions involved in the deed transfer, including any costs or fees incurred.

- Affidavit of Title: A sworn statement by the seller confirming their ownership and the absence of any undisclosed liens or claims on the property.

- Power of Attorney: A legal document that allows one person to act on behalf of another in legal matters, which may be necessary if the borrower cannot be present.

- Release of Mortgage: This document officially removes the mortgage lien from the property once the deed in lieu is executed.

Understanding these documents can help streamline the process and ensure that all parties are protected. Each form plays a role in the overall transaction and can significantly impact the outcome for the borrower and lender alike.

Consider More Types of Deed in Lieu of Foreclosure Forms

Deed of Gift Property - Use a Gift Deed to designate a specific recipient, ensuring your intentions are clear.

When dealing with the purchase or sale of a trailer in Illinois, it's important to utilize the appropriate documentation to safeguard both parties involved in the transaction. This is where the Illinois Trailer Bill of Sale form comes into play, ensuring a transparent exchange of ownership. Additionally, for those looking for more information, Auto Bill of Sale Forms are available to guide users through the process, highlighting the significance of having all necessary paperwork in order to avoid future disputes.

California Corrective Deed - This form is essential for maintaining the integrity of real estate transactions.

How to Get a Quit Claim Deed - Divides property rights without needing to involve a lawyer typically.

Similar forms

A short sale agreement is similar to a Deed in Lieu of Foreclosure in that both involve the transfer of property ownership to the lender to avoid foreclosure. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage, with the lender’s approval. This process allows the homeowner to mitigate financial losses while also providing the lender with a way to recover some of their investment without going through the lengthy foreclosure process.

A loan modification agreement also shares similarities with a Deed in Lieu of Foreclosure. In this case, the lender and borrower agree to change the terms of the existing loan, such as the interest rate or payment schedule, to make it more manageable for the borrower. While a Deed in Lieu involves relinquishing the property, a loan modification seeks to keep the homeowner in their home by making the mortgage more affordable, thereby avoiding foreclosure altogether.

The Quitclaim Deed form, accessible at arizonaformspdf.com, is an essential tool for property owners wishing to transfer ownership without any guarantees about the title's condition, making it a valuable resource in various real estate transactions.

A foreclosure settlement agreement can be compared to a Deed in Lieu of Foreclosure as both aim to resolve the issue of mortgage default. In a settlement agreement, the lender and borrower negotiate terms that may include a payment plan or a one-time payment to settle the debt. This approach can prevent foreclosure and allow the borrower to retain ownership of the property, unlike a Deed in Lieu where ownership is transferred to the lender.

A forbearance agreement is another document that bears resemblance to a Deed in Lieu of Foreclosure. This arrangement allows the borrower to temporarily pause or reduce mortgage payments for a specified period. During this time, the lender agrees not to initiate foreclosure proceedings. The goal is to provide the borrower with relief while they regain financial stability, contrasting with the immediate transfer of property in a Deed in Lieu.

An assumption of mortgage agreement is similar in that it involves the transfer of mortgage responsibility, but it allows a third party to take over the mortgage payments. The original borrower remains liable for the loan, while the new borrower assumes the payments. This can be a viable alternative to a Deed in Lieu, as it keeps the original borrower from losing their property entirely.

A quitclaim deed is also comparable to a Deed in Lieu of Foreclosure, as both involve the transfer of property rights. However, a quitclaim deed is often used between family members or in divorce situations to transfer ownership without a financial transaction. While it may not directly address mortgage default, it can be part of a strategy to resolve property ownership issues, similar to how a Deed in Lieu resolves mortgage default by transferring ownership to the lender.

A bankruptcy filing can relate to a Deed in Lieu of Foreclosure in that both can provide relief from overwhelming debt. In bankruptcy, the borrower seeks legal protection from creditors, which may include their mortgage lender. While bankruptcy can lead to the discharge of debts, a Deed in Lieu allows the borrower to relinquish the property to the lender as a means of avoiding foreclosure, providing a different but effective route to financial relief.

Lastly, a property settlement agreement in a divorce can be likened to a Deed in Lieu of Foreclosure. This document outlines how marital property will be divided, which may include transferring ownership of a home. While a Deed in Lieu is focused on resolving mortgage default, both documents facilitate the transfer of property rights, often in challenging financial circumstances.

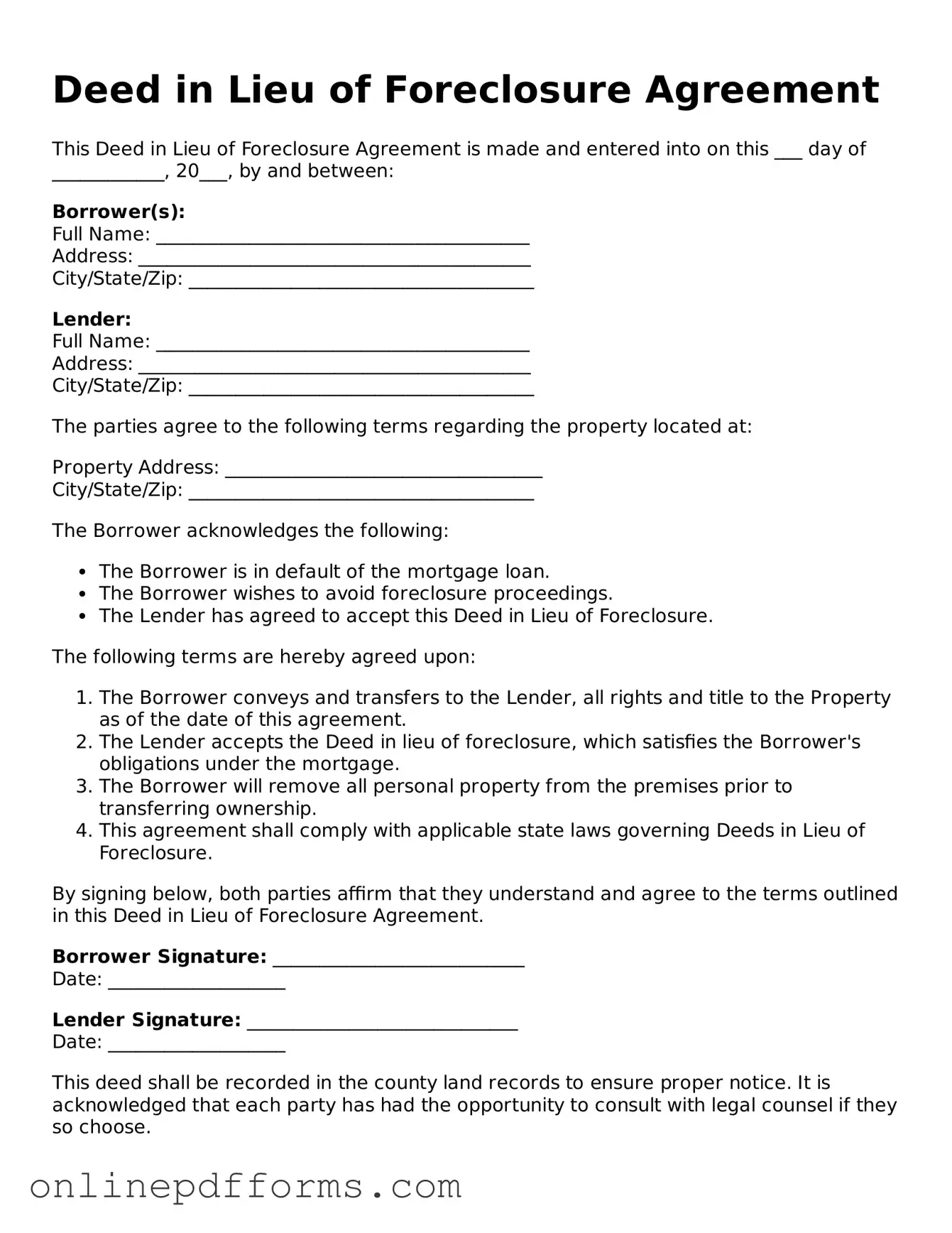

Steps to Filling Out Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, you will need to submit it to your lender. They will review the document and determine the next steps in the process. Ensure you keep copies of all submitted documents for your records.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Provide the names of all parties involved in the transaction. This includes the borrower(s) and the lender.

- Fill in the property address. Ensure that it is complete and accurate, including the street number, street name, city, state, and zip code.

- Include the legal description of the property. This can often be found on the original mortgage documents or property deed.

- State the reason for the deed in lieu of foreclosure. Be clear and concise about your situation.

- Sign and date the form. All parties involved must sign it for it to be valid.

- Have the signatures notarized. This adds a layer of authenticity to the document.

- Make copies of the completed and notarized form for your records.

- Submit the original form to your lender along with any additional required documents.