Legal Durable Power of Attorney Form

Durable Power of AttorneyTemplates for Specific States

Documents used along the form

A Durable Power of Attorney (DPOA) is a crucial document that allows you to designate someone to make decisions on your behalf if you become unable to do so. However, it often works best when paired with other important legal documents. Here are four forms you might consider using alongside a DPOA:

- Health Care Proxy: This document allows you to appoint someone to make medical decisions for you if you are incapacitated. It ensures that your healthcare preferences are honored when you cannot communicate them yourself.

- Living Will: A Living Will outlines your wishes regarding medical treatment and end-of-life care. It provides guidance to your health care proxy and medical professionals about your preferences, especially concerning life-sustaining treatments.

- Last Will and Testament: This document details how you want your assets distributed after your death. It can also name guardians for any minor children, ensuring your wishes are followed regarding your estate and family.

- Revocable Living Trust: A revocable living trust allows you to place your assets into a trust during your lifetime. You maintain control over the assets, and upon your passing, they can be distributed to your beneficiaries without going through probate, simplifying the process for your loved ones.

By considering these documents in conjunction with your Durable Power of Attorney, you can create a comprehensive plan that addresses both your financial and healthcare needs, providing peace of mind for you and your loved ones.

Consider More Types of Durable Power of Attorney Forms

What Does a Power of Attorney Form Look Like - The form grants specified authority to handle real estate transactions, including signing documents.

Reg 260 Pdf - Authorize a trusted individual to take care of your vehicle-related responsibilities.

Power of Attorney Florida for Child - Every detail about the duration of the authority can be customized in this form.

Similar forms

A Healthcare Power of Attorney is a document that allows an individual to designate someone to make medical decisions on their behalf if they become unable to do so. Like a Durable Power of Attorney, this form empowers a trusted person to act in the best interest of the individual. Both documents require careful consideration of whom to appoint, as the chosen agent will have significant authority over important decisions. While a Durable Power of Attorney typically covers financial matters, the Healthcare Power of Attorney focuses specifically on health-related decisions, ensuring that medical preferences are honored when the individual cannot communicate them directly.

A Living Will is another important document that complements the Durable Power of Attorney. This legal document outlines an individual’s preferences regarding end-of-life care and medical treatments. While a Durable Power of Attorney grants authority to an agent to make decisions, a Living Will provides clear instructions about the types of medical interventions a person does or does not want. Both documents serve to protect an individual's wishes and ensure that their values are respected in times of medical crisis.

A Revocable Trust is similar to a Durable Power of Attorney in that it allows for the management of assets during a person's lifetime and after death. This document enables individuals to place their assets into a trust, which can be managed by a trustee. Like a Durable Power of Attorney, a Revocable Trust can help avoid probate, providing a streamlined process for asset distribution. However, while a Durable Power of Attorney is focused on decision-making authority, a Revocable Trust centers on asset management and distribution.

A Financial Power of Attorney is closely related to a Durable Power of Attorney, as both documents authorize someone to manage financial matters on behalf of another person. The Financial Power of Attorney is specifically tailored to financial decisions, such as handling bank accounts, paying bills, and managing investments. In contrast, a Durable Power of Attorney can encompass a broader range of responsibilities, potentially including healthcare and legal matters. Both documents require trust in the appointed agent, as they will have access to sensitive financial information.

An Advance Directive combines elements of both a Living Will and a Healthcare Power of Attorney. It allows individuals to express their healthcare preferences and designate someone to make decisions if they become incapacitated. Like the Durable Power of Attorney, an Advance Directive ensures that a person’s wishes are respected during critical health situations. This document helps clarify medical choices, reducing the burden on family members during emotionally challenging times.

A Guardianship document is another legal instrument that can be compared to a Durable Power of Attorney. While a Durable Power of Attorney allows individuals to choose someone to make decisions on their behalf, a Guardianship is typically established through a court when an individual is deemed incapable of managing their own affairs. Guardianship can cover both personal and financial matters, but it often involves a more formal process and oversight. This distinction highlights the importance of planning ahead with a Durable Power of Attorney to avoid the need for court intervention later on.

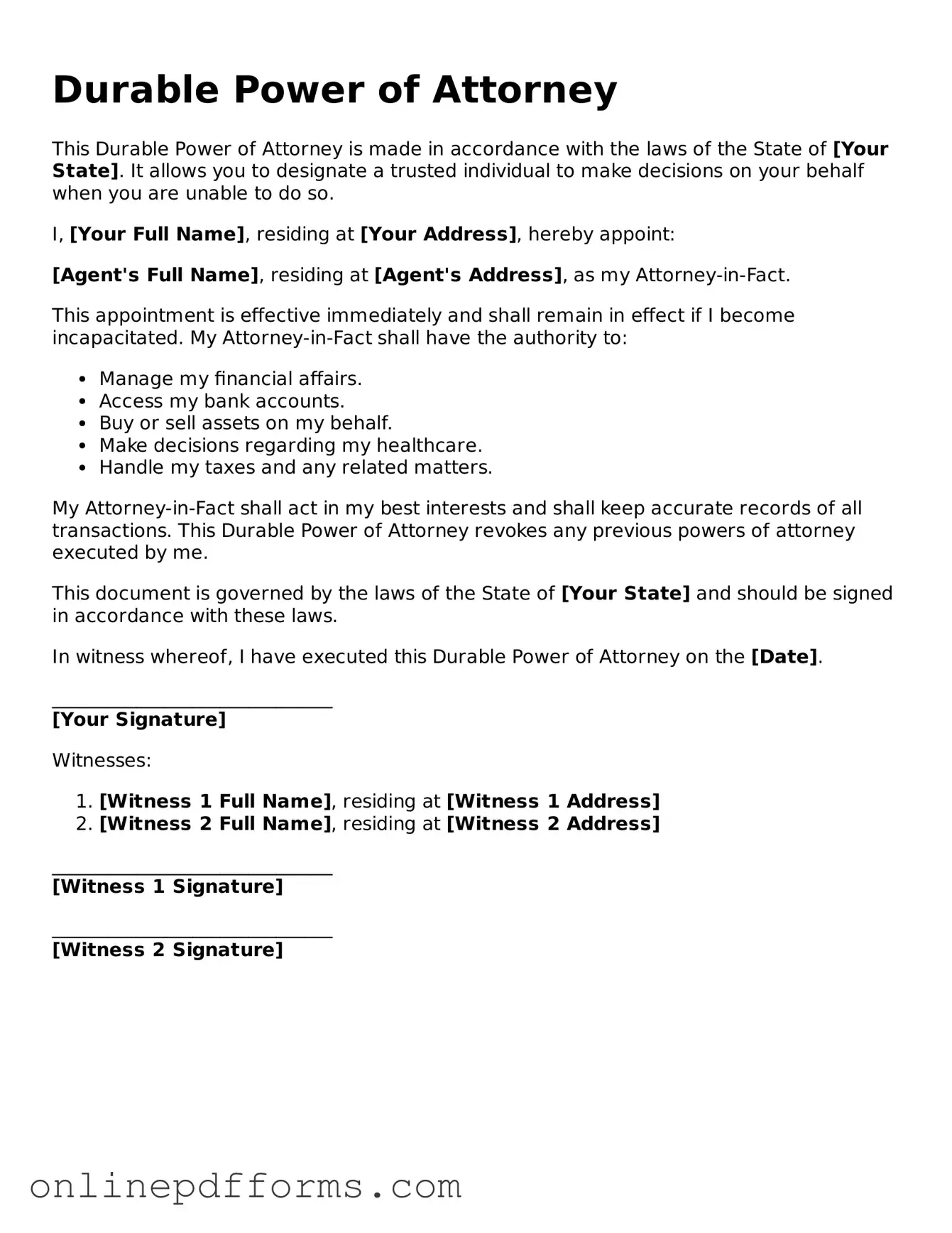

Steps to Filling Out Durable Power of Attorney

Filling out a Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are handled according to your wishes. After completing the form, it should be signed and dated, and may need to be notarized or witnessed, depending on your state’s requirements.

- Begin by downloading the Durable Power of Attorney form from a reliable source or obtain a physical copy from a legal office.

- Read through the entire form carefully to understand the sections that need to be filled out.

- In the designated area, enter your full legal name and address as the principal.

- Next, provide the name and address of the person you are appointing as your agent or attorney-in-fact.

- Specify the powers you wish to grant to your agent. This may include financial decisions, real estate transactions, and other specific authorities.

- Indicate the duration of the powers granted. You can choose to make it effective immediately or upon a specific event.

- Sign and date the form in the appropriate section. Ensure that your signature matches the name provided at the beginning.

- If required, have the form notarized or signed by witnesses according to your state’s regulations.

- Make copies of the completed form for your records and provide copies to your agent and any relevant institutions.