Legal Employee Loan Agreement Form

Documents used along the form

When handling an Employee Loan Agreement, several other documents may be necessary to ensure clarity and compliance. Each of these documents plays a critical role in the overall process, providing additional context or legal backing. Below is a list of forms commonly used alongside the Employee Loan Agreement.

- Loan Application Form: This document allows the employee to formally request a loan. It typically includes personal information, the loan amount requested, and the purpose of the loan.

- Promissory Note: This is a written promise from the employee to repay the loan under specified terms. It outlines the repayment schedule, interest rate, and consequences of default.

- Texas Loan Agreement Form: For comprehensive loan documentation, refer to our essential Texas Loan Agreement form resources to ensure all terms are clearly outlined and understood.

- Employment Verification Letter: This letter confirms the employee's status, position, and salary. It is often required by lenders to assess the employee's ability to repay the loan.

- Repayment Schedule: This document details the timeline for loan repayment, including due dates and amounts. It serves as a clear reference for both parties.

- Loan Disbursement Agreement: This agreement outlines the terms under which the loan funds will be released to the employee. It may specify conditions that must be met before disbursement.

- Termination Agreement: In the event of employment termination, this document outlines how the remaining loan balance will be handled. It is essential for protecting both the employer's and employee's interests.

These documents work together to create a comprehensive framework for managing employee loans. Ensuring all necessary forms are in place can help prevent misunderstandings and protect both parties involved.

Similar forms

The Employee Loan Agreement form shares similarities with a Personal Loan Agreement. Both documents outline the terms under which one party lends money to another. They specify the loan amount, interest rate, repayment schedule, and any collateral involved. Just like an Employee Loan Agreement, a Personal Loan Agreement aims to protect the lender’s rights while ensuring the borrower understands their obligations. Both agreements help establish clear expectations to prevent misunderstandings down the line.

Another document that resembles the Employee Loan Agreement is the Promissory Note. This is a written promise to pay a specified amount of money to a designated person at a specific time. Like the Employee Loan Agreement, a Promissory Note includes key details such as the loan amount, interest rate, and repayment terms. However, a Promissory Note is often simpler and may not include the same level of detail regarding the relationship between the lender and borrower, making it a more straightforward option for personal loans.

The Employee Loan Agreement is akin to a Personal Loan Agreement. Both documents serve as contracts between a borrower and a lender, detailing the terms of repayment, interest rates, and the amount borrowed. A Personal Loan Agreement typically applies to loans for personal use, while the Employee Loan Agreement is specifically designed for loans given to employees by their employers. The emphasis on repayment terms and the obligations of both parties remains consistent in both documents. For those looking to formalize their loans in Florida, tools like Florida PDF Forms can provide essential templates and guidance.

The Loan Agreement is also comparable to the Employee Loan Agreement. This document is typically used in more formal lending situations, such as banks or financial institutions. It includes detailed terms and conditions, including default clauses and legal rights. Both agreements aim to protect the interests of the lender while providing clarity for the borrower. The Loan Agreement may be more complex, but it serves the same fundamental purpose of defining the lending relationship.

Lastly, the Credit Agreement shares common ground with the Employee Loan Agreement. This document is often used in business contexts where a lender extends credit to a borrower. Similar to the Employee Loan Agreement, it outlines the terms of borrowing, including limits on credit, repayment terms, and interest rates. Both documents are designed to ensure that both parties are aware of their responsibilities and rights, fostering a transparent lending process.

Steps to Filling Out Employee Loan Agreement

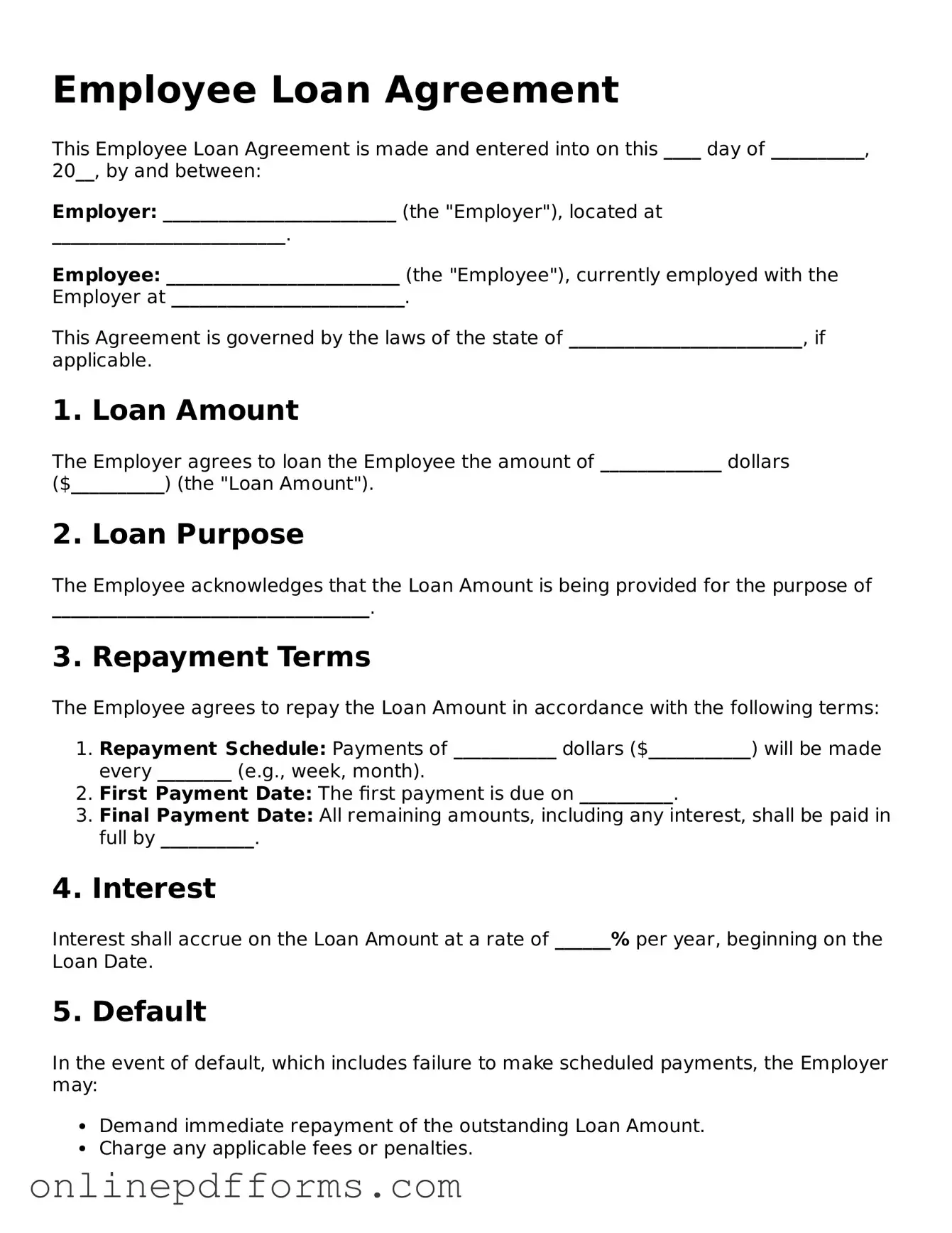

Completing the Employee Loan Agreement form is an important step in formalizing the terms of a loan between an employer and an employee. This process ensures that both parties understand their obligations and rights. Follow these steps carefully to fill out the form accurately.

- Start by entering the date at the top of the form. This is the date when the agreement is being executed.

- Fill in the name of the employee receiving the loan. Ensure that the name is spelled correctly.

- Provide the employee's job title and department. This information helps to identify the employee within the organization.

- Enter the total loan amount being provided to the employee. Make sure to double-check the figure for accuracy.

- Specify the interest rate applicable to the loan. If the loan is interest-free, indicate that clearly.

- Detail the repayment schedule. Include the frequency of payments (e.g., weekly, bi-weekly, monthly) and the total duration of the loan.

- Include any additional terms or conditions that apply to the loan. This may cover late fees, prepayment options, or other relevant details.

- Have both the employee and an authorized representative of the company sign the form. Each party should date their signature to confirm the agreement.