Fill in Your Erc Broker Market Analysis Template

Documents used along the form

The ERC Broker Market Analysis form is an essential document used in real estate transactions to assess a property's market value and condition. Along with this form, several other documents are often utilized to provide a comprehensive overview of the property and its market context. Below is a list of six commonly used forms and documents that complement the ERC Broker Market Analysis form.

- Comparative Market Analysis (CMA): This document analyzes similar properties in the area that have recently sold, are currently on the market, or were previously listed. It helps establish a fair market value for the subject property by comparing it to these comparable listings.

- Property Condition Disclosure Statement: Sellers typically provide this document to disclose known issues or defects in the property. It is crucial for buyers to understand any potential problems before finalizing a purchase.

- Listing Agreement: This contract outlines the terms between the property owner and the real estate agent. It specifies the agent's responsibilities, the commission structure, and the duration of the listing period.

- Purchase Agreement: This legal document serves as a binding contract between the buyer and seller once an offer is accepted. It details the terms of the sale, including the purchase price, contingencies, and closing date.

- Vehicle Purchase Agreement: This document formalizes the agreement between the buyer and seller regarding the sale of a vehicle. It is important for outlining the terms of the sale and includes details such as the purchase price and vehicle identification. Additionally, using forms like the Auto Bill of Sale Forms can help ensure that all legal obligations are met during the transaction.

- Title Report: A title report provides information about the property's ownership history and any liens or encumbrances that may affect the title. It is essential for ensuring that the buyer receives clear ownership upon purchase.

- Home Inspection Report: Conducted by a licensed inspector, this report assesses the property's condition, identifying any significant issues that may require repair. It offers buyers valuable insights into the property's current state.

These documents, when used alongside the ERC Broker Market Analysis form, contribute to a thorough understanding of the property and its market position. Together, they help facilitate informed decisions for both buyers and sellers in real estate transactions.

More PDF Templates

Chicago Title Lien Waiver - Developers often require this form to confirm their financial obligations are met before proceeding with further payments.

For those navigating the complexities of separation, understanding the importance of a well-drafted Marital Separation Agreement is crucial. This form can provide clarity on various matters, such as asset division and responsibilities. To learn more about specific requirements, consider visiting the guide on the process for creating a Marital Separation Agreement.

Trucking Company Lease Agreement - This agreement outlines the relationship between a Carrier and Owner Operator regarding transportation services.

Create Pdf Invoice - Makes it easy to add your logo and business details for personalization.

Similar forms

The Comparative Market Analysis (CMA) is a document that helps real estate agents determine the value of a property by comparing it to similar properties that have recently sold in the area. Like the ERC Broker Market Analysis, a CMA evaluates the condition, location, and features of the subject property. The primary goal is to provide an estimated market value based on comparable sales, making it a crucial tool for sellers and buyers alike. Both documents aim to inform pricing strategies, but a CMA is typically more focused on recent sales data.

The Appraisal Report is another document similar to the ERC Broker Market Analysis. An appraisal is conducted by a licensed appraiser and provides a detailed evaluation of a property's value. While the ERC form offers a market analysis based on the broker's insights, an appraisal follows strict guidelines and standards. Both documents assess property conditions and market factors, but the appraisal is often required by lenders for financing purposes, whereas the ERC form is used primarily for internal assessments.

The Texas Motorcycle Bill of Sale form is an essential document for transferring ownership of a motorcycle in Texas, ensuring that both the buyer and seller have a clear record of the transaction. To find more information and obtain a copy of this form, you can visit pdftemplates.info/texas-motorcycle-bill-of-sale-form.

The Property Inspection Report shares similarities with the ERC Broker Market Analysis, as both documents evaluate the condition of a property. A property inspection report is typically prepared by a licensed inspector and focuses on identifying structural issues, safety concerns, and necessary repairs. While the ERC form considers the property's marketability and pricing, the inspection report provides a more technical overview of the physical condition of the property.

The Listing Agreement is another relevant document. This agreement outlines the terms under which a real estate agent will represent a seller in the sale of their property. Like the ERC Broker Market Analysis, it includes information about the property and its condition. However, the listing agreement is more focused on the contractual relationship between the seller and the agent, while the ERC form is a tool for analyzing market conditions and pricing strategies.

The Seller Disclosure Statement is similar in purpose to the ERC Broker Market Analysis, as both involve the seller providing information about the property. This document requires sellers to disclose any known issues or defects with the property. While the ERC form assesses marketability and pricing, the seller disclosure statement ensures transparency and protects buyers from unforeseen problems after the sale.

The Rental Market Analysis (RMA) is also comparable to the ERC Broker Market Analysis. An RMA evaluates rental properties to determine appropriate rental pricing based on comparable rental listings and market conditions. Both documents analyze property features and market trends, but the RMA focuses specifically on the rental market, while the ERC form is geared toward sales pricing.

The Market Conditions Report offers insights into the broader real estate market and shares similarities with the ERC Broker Market Analysis. This report examines trends such as inventory levels, average days on the market, and price fluctuations. While the ERC form focuses on a specific property, the Market Conditions Report provides context for understanding the overall market dynamics, which can influence the pricing strategy of the subject property.

The Closing Disclosure is another document that bears resemblance to the ERC Broker Market Analysis. This form outlines the final terms and costs associated with a real estate transaction. While the ERC form is primarily concerned with market analysis and pricing, the Closing Disclosure provides a detailed breakdown of all financial aspects of the sale, ensuring that both parties understand their obligations and costs before finalizing the transaction.

Finally, the Home Warranty Agreement can be seen as similar in that it provides assurances about the condition of a property. This document outlines the coverage and protections offered to buyers in case of unexpected repairs or issues after the sale. While the ERC Broker Market Analysis assesses market conditions and property value, the Home Warranty Agreement offers peace of mind regarding the property's ongoing condition and potential costs, making it a valuable companion to the analysis.

Steps to Filling Out Erc Broker Market Analysis

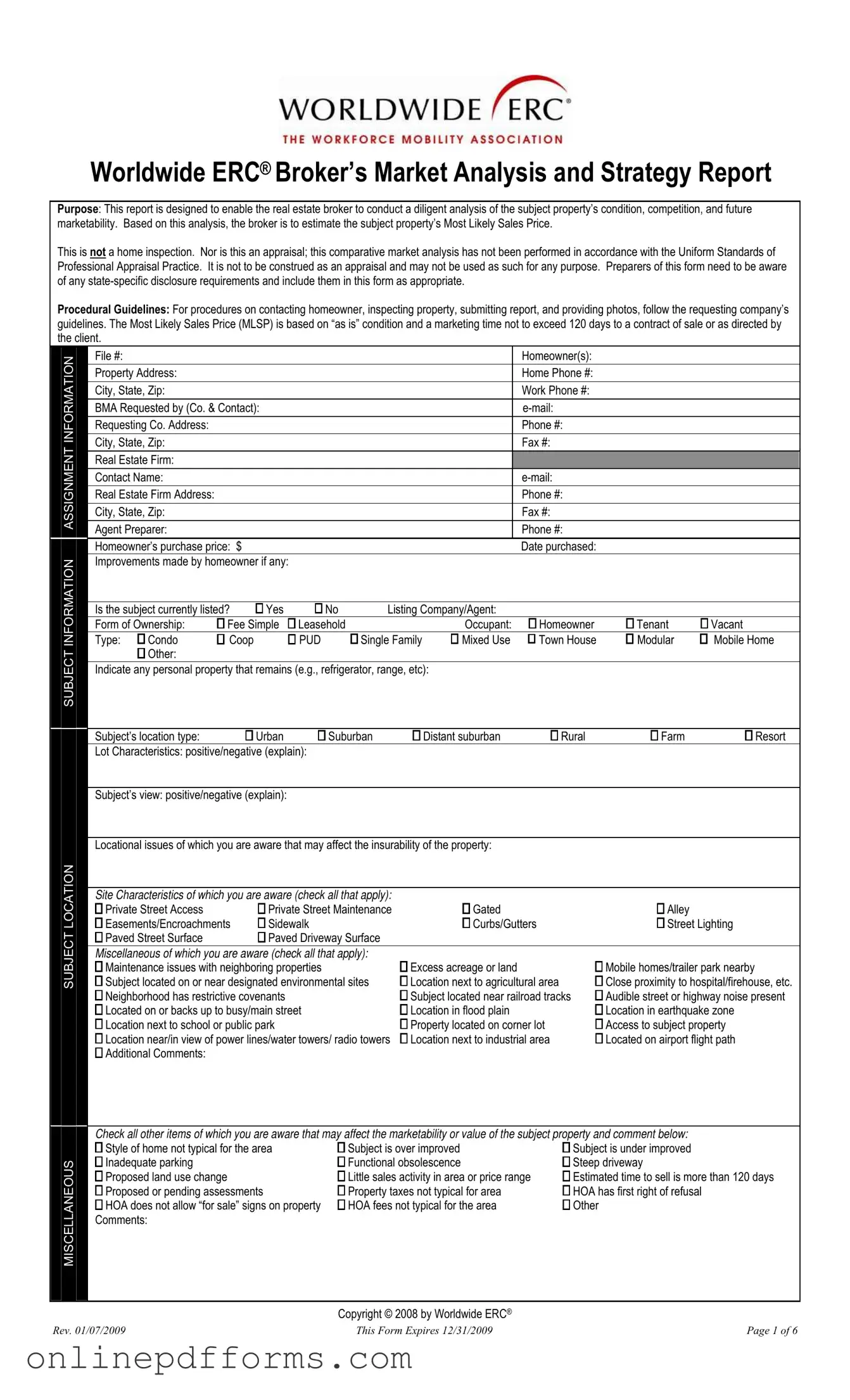

Completing the ERC Broker Market Analysis form is a critical task that requires careful attention to detail. This form serves as a tool for real estate brokers to analyze various aspects of a property, including its condition, competition, and marketability. It is essential to follow the outlined steps to ensure accurate and comprehensive data collection, as this will ultimately aid in estimating the property’s Most Likely Sales Price.

- Begin by entering the File #, Homeowner(s), and Property Address at the top of the form.

- Fill in the Home Phone #, Work Phone #, and e-mail of the homeowner.

- Provide the details of the Requesting Company, including Company Name, Contact Person, Address, and Phone #.

- In the ASSIGNMENT section, input the Real Estate Firm name, Contact Name, and their e-mail.

- Document the Agent Preparer and their Phone #.

- Record the Homeowner’s purchase price and Date purchased.

- Note any Improvements made by homeowner in the designated space.

- Indicate whether the property is currently listed by checking Yes or No.

- Specify the Form of Ownership and the Occupant type.

- Describe the Type of property (e.g., Condo, Single Family, etc.) and any personal property that remains.

- Assess the Subject’s location type and provide details on Lot Characteristics and Subject’s view.

- List any Locational issues that may affect the property’s insurability.

- Check all applicable Site Characteristics and Miscellaneous

- Provide a thorough description of the Property Condition based on observations during the property viewing.

- Estimate costs for Recommended Repairs and Improvements for both interior and exterior items.

- List any required, customary, and additional inspections needed for the property.

- Identify the most probable means of financing and describe any necessary financing concessions.

- Address any anticipated issues affecting the ability to secure financing.

- Define the Subject Neighborhood and gather relevant statistics reflecting the market area.

- Calculate the months supply of inventory and describe any marketing concessions for competing properties.

- Analyze the broader market area and any specific issues that may affect the sale of the subject property.

- Complete the COMPETING LISTINGS section by entering data for up to three comparable listings.

- Fill out the COMPARABLE SALES section with relevant information for up to three comparable sales.

- Review the entire form for completeness and accuracy before submission.