Blank Florida Deed Form

Documents used along the form

When transferring property in Florida, several forms and documents often accompany the Florida Deed form. Each of these documents plays a crucial role in ensuring the transaction is legally sound and transparent. Below is a list of common forms that may be used alongside the deed.

- Title Search Report: This document provides a history of the property's ownership and any claims or liens against it. A title search helps ensure that the seller has the legal right to transfer the property.

- Affidavit of Title: This sworn statement confirms that the seller is the rightful owner of the property and that there are no undisclosed liens or claims against it.

- Closing Statement: Also known as a HUD-1 statement, this document outlines all costs and fees associated with the transaction, ensuring that both parties understand their financial obligations.

- Bill of Sale: When personal property is included in the sale, a bill of sale documents the transfer of those items, providing proof of ownership for the buyer.

- Independent Contractor Agreement Form - Essential for establishing the independent status of contractors, ensuring clarity in the working relationship; for more information, visit https://arizonaformspdf.com.

- Property Survey: A survey shows the exact boundaries of the property and any easements or encroachments. This document helps prevent disputes over property lines.

- Mortgage Documents: If the buyer is financing the purchase, various mortgage documents will be required, detailing the terms of the loan and the buyer's obligations.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide information about fees, rules, and regulations that the buyer must adhere to.

- Disclosure Statements: Sellers may be required to provide disclosures about the property's condition, including any known defects or issues, ensuring the buyer is fully informed.

Each of these documents contributes to a smooth and transparent property transfer process in Florida. Understanding their purpose can help buyers and sellers navigate the complexities of real estate transactions with confidence.

Other Popular State-specific Deed Templates

New York State Deed Form - A deed serves as a vital resource for maintaining property records.

Grant Deed in California - This form serves as a foundation for real estate legal transactions.

In order to facilitate a smooth transfer of ownership, it is crucial for both the seller and buyer to utilize an RV Bill of Sale form that accurately reflects the details of the transaction. For those looking for comprehensive resources, Auto Bill of Sale Forms provide valuable templates and guidance to ensure all necessary information is properly documented.

Contract for Deed Texas Template - Different types of deeds serve distinct purposes in property law.

Similar forms

The Florida Deed form shares similarities with the Warranty Deed. Both documents are used to transfer ownership of real property. A Warranty Deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. In contrast, the Florida Deed may not always offer such guarantees, depending on the type of deed being executed. However, both documents require the signature of the grantor and must be recorded to provide public notice of the transfer.

Another document that resembles the Florida Deed is the Quitclaim Deed. This form allows a property owner to transfer their interest in the property without making any warranties about the title. While the Florida Deed may include warranties, the Quitclaim Deed is often used in situations where the parties know each other, such as transfers between family members. Both documents must be executed and recorded to be legally effective.

The Special Purpose Deed is also comparable to the Florida Deed. This type of deed is used for specific situations, such as transferring property to a trust or during a divorce. Like the Florida Deed, it facilitates the transfer of property ownership. However, it may include unique provisions tailored to the specific situation. Both documents require proper execution and recording to ensure the transfer is legally recognized.

The Bargain and Sale Deed is another similar document. This deed transfers property ownership but does not guarantee that the title is clear of liens or encumbrances. It is often used in real estate transactions where the seller is not willing to provide a warranty of title. Similar to the Florida Deed, it requires the grantor's signature and must be recorded to establish the new ownership legally.

The Grant Deed also shares characteristics with the Florida Deed. This document transfers property ownership and implies that the grantor has not transferred the property to anyone else. While the Florida Deed may or may not include such implications, both documents require the grantor's signature and are typically recorded with the appropriate local authority to ensure public notice of the ownership change.

When preparing important documents for property transfers, understanding the variations of deeds can be crucial in ensuring that all parties are protected and informed. Utilizing an editable document download can streamline the process, allowing for tailored agreements that meet specific legal requirements and individual needs.

Finally, the Trustee's Deed is comparable to the Florida Deed in that it is used to transfer property held in a trust. This deed allows a trustee to convey property according to the terms of the trust agreement. While the Florida Deed is more general in its application, both documents require careful execution and recording to ensure the transfer is legally valid and recognized by the public.

Steps to Filling Out Florida Deed

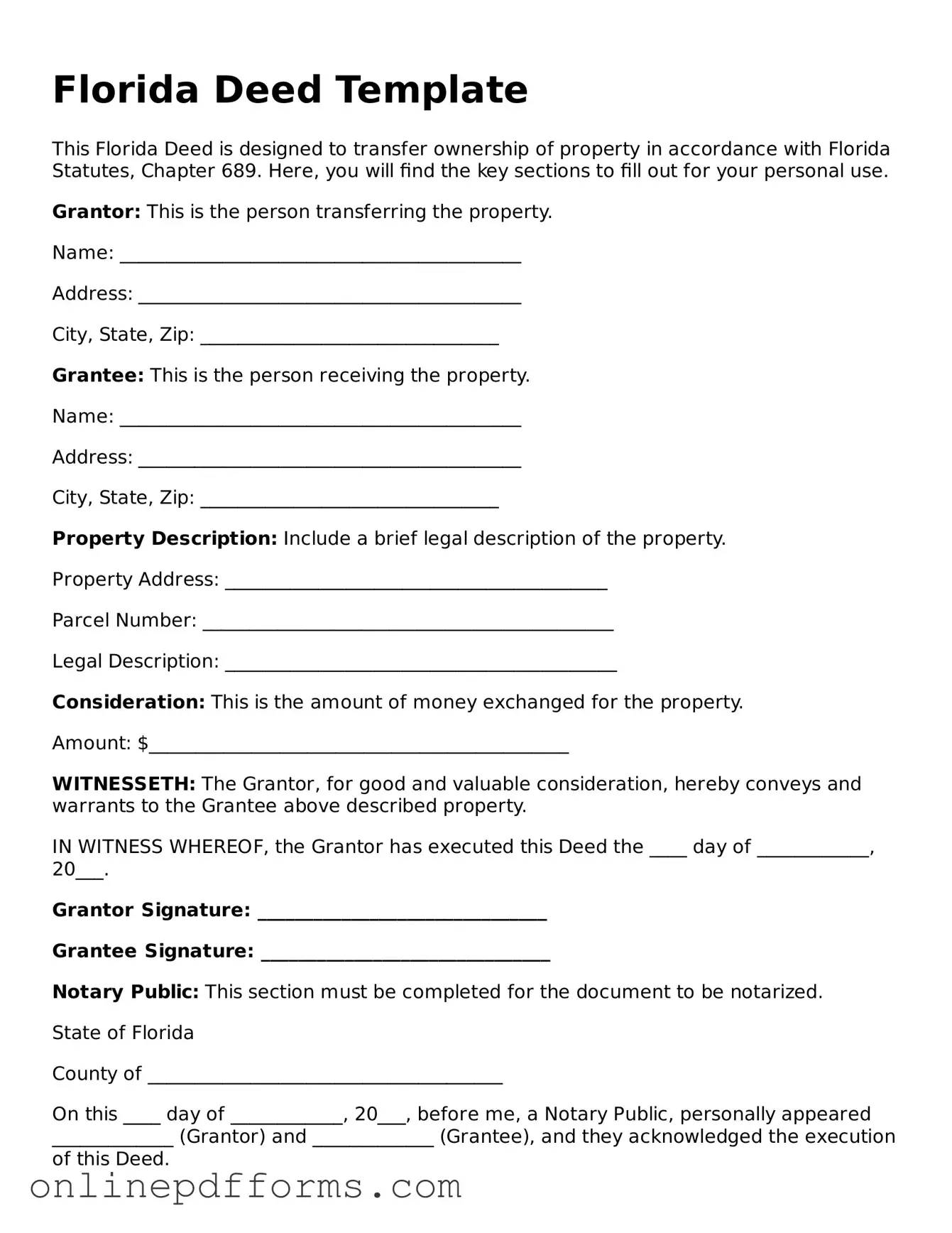

Once you have your Florida Deed form ready, it's time to complete it accurately. This will ensure that the transfer of property is done smoothly and legally. Follow these steps carefully to fill out the form correctly.

- Obtain the Florida Deed form: You can find the form online or at your local county clerk's office.

- Fill in the Grantor's information: Write the full name and address of the person transferring the property. Ensure the name is spelled correctly.

- Provide Grantee's details: Enter the full name and address of the person receiving the property. Double-check for accuracy.

- Describe the property: Include the legal description of the property. This can often be found on the current deed or tax records.

- State the consideration: Indicate the amount of money or value exchanged for the property. If it’s a gift, you can note that as well.

- Sign the form: The Grantor must sign the deed in front of a notary public. Make sure the signature matches the name provided earlier.

- Notarization: Have the deed notarized. This step is essential for the document to be legally binding.

- File the deed: Submit the completed and notarized deed to the county clerk’s office where the property is located. There may be a filing fee.

After completing these steps, the deed will be recorded, and you will receive confirmation. This process ensures that the property transfer is officially recognized. Always keep a copy of the recorded deed for your records.