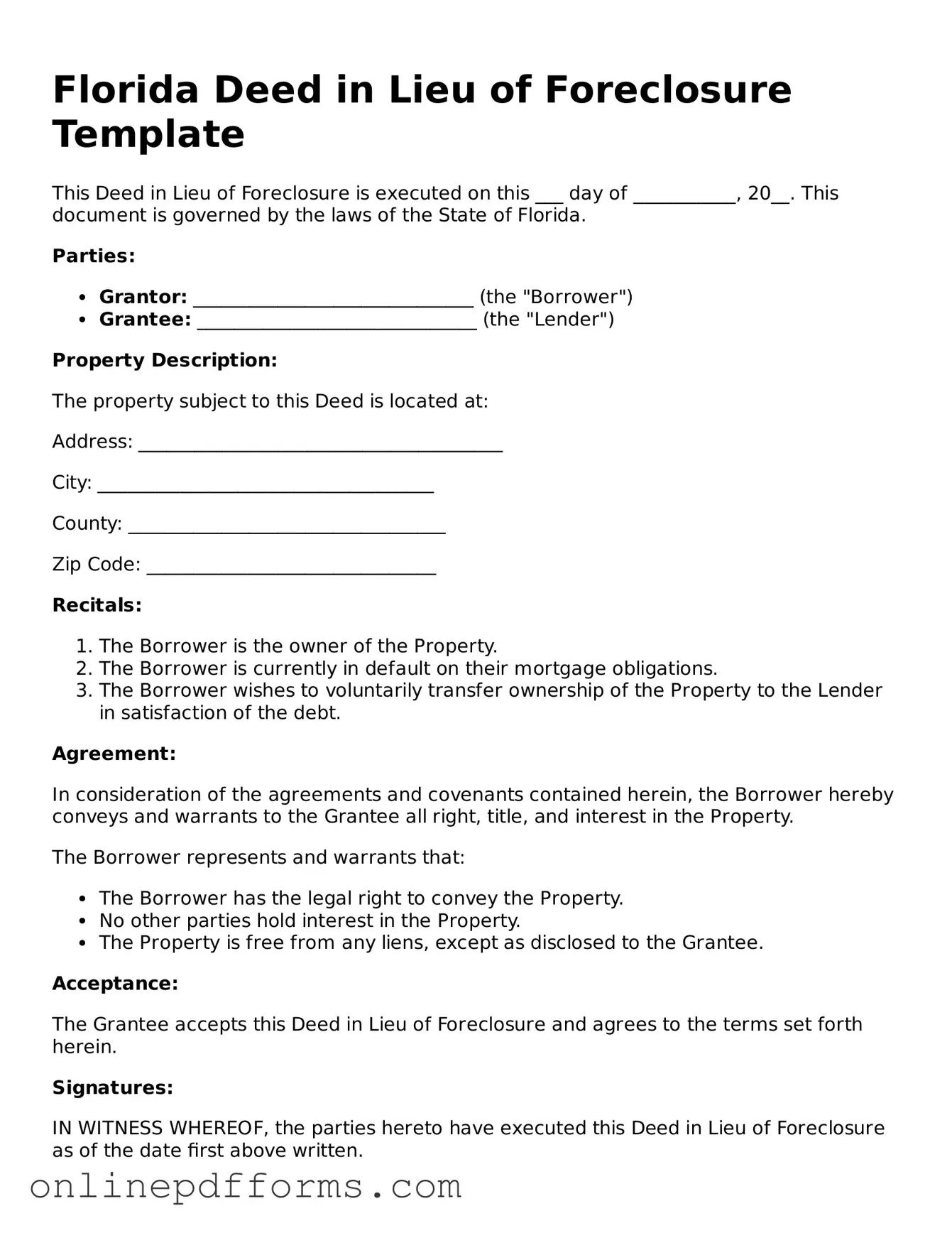

Blank Florida Deed in Lieu of Foreclosure Form

Documents used along the form

A Deed in Lieu of Foreclosure is often accompanied by several other documents to ensure a smooth process. These documents help clarify the agreement between the borrower and the lender, making it easier to handle the transfer of property. Below is a list of commonly used forms and documents.

- Letter of Intent: This document outlines the borrower's intention to transfer the property back to the lender. It serves as a formal notification of the borrower's decision.

- Arizona Agent Form: This form is essential for businesses in Arizona to designate a statutory agent responsible for receiving legal documents. For more information, visit https://arizonaformspdf.com.

- Property Condition Disclosure: The borrower provides information about the condition of the property. This disclosure helps the lender understand any potential issues before accepting the deed.

- Release of Liability: This form releases the borrower from any further financial obligations related to the mortgage. It ensures that once the deed is transferred, the borrower is no longer responsible for the loan.

- Settlement Statement: This document details the financial aspects of the transaction. It includes any costs or credits associated with the transfer of the property.

- Power of Attorney: If the borrower cannot be present for the transfer, a power of attorney may be used. This document allows another person to act on the borrower’s behalf during the process.

- Affidavit of Title: This sworn statement confirms that the borrower holds clear title to the property. It assures the lender that there are no undisclosed liens or claims against the property.

These documents play important roles in the Deed in Lieu of Foreclosure process. They help both parties understand their rights and responsibilities, facilitating a smoother transition of property ownership.

Other Popular State-specific Deed in Lieu of Foreclosure Templates

A Deed in Lieu of Foreclosure - By opting for a Deed in Lieu, the homeowner may limit additional financial strains on their family.

California Pre-foreclosure Property Transfer - A document that transfers property ownership from the borrower to the lender to avoid foreclosure.

Deed in Lieu of Mortgage - Homeowners may still need to vacate the property upon completion of the Deed in Lieu transaction.

It is vital to understand the comprehensive Florida Medical Power of Attorney form, as it designates an individual to make crucial healthcare decisions on your behalf when you’re unable to do so, ensuring that your medical wishes are followed. This arrangement affords clarity in healthcare planning, ultimately easing the decision-making burden on your loved ones during difficult times.

Georgia Foreclosure - Homeowners can use this form to step away from property management responsibilities.

Similar forms

A mortgage release is a document that signifies the termination of a mortgage agreement between a borrower and a lender. Similar to a deed in lieu of foreclosure, it allows the borrower to relinquish their rights to the property, thereby freeing them from their financial obligations. In both cases, the lender agrees to accept the property in satisfaction of the debt, which can help the borrower avoid a lengthy foreclosure process. The key difference lies in the specific circumstances under which each document is executed, with the mortgage release typically occurring after the borrower has paid off the mortgage in full.

A short sale agreement involves the sale of a property for less than the amount owed on the mortgage. Like a deed in lieu of foreclosure, a short sale allows the borrower to avoid the negative consequences of foreclosure. The lender must approve the sale, which can be a lengthy process. In both scenarios, the borrower seeks to mitigate financial loss and protect their credit score, but a short sale requires finding a buyer, while a deed in lieu transfers ownership directly to the lender.

A loan modification agreement alters the terms of an existing loan, often to make payments more manageable for the borrower. This document shares similarities with a deed in lieu of foreclosure in that both aim to help the borrower maintain ownership of the property and avoid foreclosure. However, while a deed in lieu results in the transfer of property ownership to the lender, a loan modification keeps the borrower in their home under revised terms, allowing them to continue making payments.

A foreclosure notice is a legal document that informs a borrower that their lender intends to initiate foreclosure proceedings due to missed payments. This document serves as a precursor to a foreclosure and shares a connection with a deed in lieu of foreclosure, as both involve the lender's right to reclaim the property. However, a deed in lieu is a voluntary agreement that allows the borrower to surrender the property without going through the foreclosure process, which can be lengthy and damaging to credit.

A bankruptcy filing can also relate to a deed in lieu of foreclosure. When individuals face overwhelming debt, they may choose to file for bankruptcy as a way to reorganize or eliminate their financial obligations. Both options can provide relief from foreclosure, but bankruptcy is a more formal legal process that may involve court proceedings and a repayment plan, while a deed in lieu is a direct agreement between the borrower and lender to transfer property ownership.

A quitclaim deed is a legal instrument used to transfer interest in real property. This document can be similar to a deed in lieu of foreclosure in that it allows for the transfer of property rights. However, a quitclaim deed does not involve a financial settlement or debt forgiveness; it simply conveys whatever interest the grantor has in the property. In contrast, a deed in lieu of foreclosure is specifically tied to the resolution of a mortgage debt.

If you're looking for a reliable way to document the sale of a motorcycle, the Texas Motorcycle Bill of Sale form is essential. This legal document captures all necessary details of the transaction, including buyer and seller information, ensuring clear ownership transfer. To simplify your experience, the document is available here for your convenience.

A real estate settlement statement outlines the financial details of a real estate transaction, including all costs and fees involved. While it is not a direct substitute for a deed in lieu of foreclosure, it shares the goal of clarifying the financial implications of transferring property. Both documents aim to ensure transparency in the transaction process, but a settlement statement typically occurs in the context of a sale, while a deed in lieu addresses the transfer of property ownership to resolve a mortgage default.

Finally, a property deed serves as the official document that conveys ownership of real estate. While a deed in lieu of foreclosure is a specific type of property deed that involves the voluntary transfer of ownership to a lender, it is distinguished by its purpose of resolving a mortgage obligation. Both documents fulfill the fundamental function of transferring property rights, but a deed in lieu is specifically tied to the context of foreclosure and debt resolution.

Steps to Filling Out Florida Deed in Lieu of Foreclosure

Once you have decided to proceed with a Deed in Lieu of Foreclosure, you will need to fill out the appropriate form accurately. This process involves providing specific information about yourself, the property, and your lender. Following these steps will help ensure that the form is completed correctly.

- Obtain the Form: Download the Florida Deed in Lieu of Foreclosure form from a reliable source or request it from your lender.

- Fill in Your Information: Enter your name, address, and contact information in the designated fields. Ensure that this information is accurate.

- Property Details: Provide the legal description of the property. This can usually be found on your mortgage documents or property tax records.

- Lender Information: Include the name and address of your lender. Make sure to spell everything correctly.

- Sign the Document: Sign the form in the designated area. Your signature indicates your agreement to the terms.

- Notarization: Have the document notarized. This step is crucial for the validity of the deed.

- Submit the Form: Send the completed and notarized form to your lender. Keep a copy for your records.

After submitting the form, your lender will review it. They may contact you for further information or clarification. Be prepared to follow up and provide any additional documentation they may require.