Blank Florida Durable Power of Attorney Form

Documents used along the form

When creating a Florida Durable Power of Attorney, it's important to consider other documents that may complement or enhance its effectiveness. These documents can help clarify intentions, provide additional legal authority, or address specific needs. Below is a list of commonly used forms and documents that individuals might utilize alongside a Durable Power of Attorney.

- Living Will: This document outlines an individual's wishes regarding medical treatment in the event they become unable to communicate their preferences. It is particularly important for end-of-life decisions.

- Health Care Surrogate Designation: This form allows a person to appoint someone to make health care decisions on their behalf if they are incapacitated. It works in conjunction with a Living Will.

- Last Will and Testament: A legal document that specifies how an individual's assets should be distributed after their death. It can also appoint guardians for minor children.

- Trust Agreement: This document creates a trust, which can hold assets for the benefit of a beneficiary. It can help avoid probate and provide specific instructions for asset management.

- Financial Power of Attorney: Similar to a Durable Power of Attorney, this document grants someone the authority to handle financial matters. It may be limited in scope or duration.

- Beneficiary Designation Forms: These forms specify who will receive assets such as life insurance policies, retirement accounts, or bank accounts upon the individual's death. They supersede instructions in a Will.

- Property Deed: A legal document that transfers ownership of real estate. If property is to be managed or sold under a Durable Power of Attorney, having clear title documentation is essential.

Each of these documents serves a unique purpose and can work together with a Durable Power of Attorney to ensure that an individual's wishes are respected and that their affairs are managed effectively. It is advisable to consult with a legal professional to ensure that all documents are appropriately tailored to one's needs and comply with Florida law.

Other Popular State-specific Durable Power of Attorney Templates

Illinois Power of Attorney for Property Form - The principal should ensure the agent is someone they fully trust and depend upon.

Free Durable Power of Attorney Form Ohio - Choose a person you trust to handle your affairs when you're not able to do it yourself.

Similar forms

The Florida Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents allow an individual to appoint someone else to manage their financial and legal affairs. However, the key difference lies in the durability aspect. The General Power of Attorney becomes invalid if the principal becomes incapacitated, while the Durable Power of Attorney remains effective even if the principal can no longer make decisions for themselves.

Another document similar to the Florida Durable Power of Attorney is the Medical Power of Attorney. This form specifically grants authority to another person to make medical decisions on behalf of the principal. While the Durable Power of Attorney focuses on financial matters, the Medical Power of Attorney is tailored for healthcare choices, ensuring that the principal’s medical preferences are respected when they cannot communicate them.

The Living Will is another document that complements the Durable Power of Attorney. It outlines an individual's wishes regarding medical treatment in the event of terminal illness or incapacitation. While the Durable Power of Attorney allows someone to make decisions, the Living Will specifies what those decisions should be, providing clear guidance to the appointed agent.

A Health Care Surrogate Designation is also similar to the Durable Power of Attorney. This document appoints a specific person to make health care decisions for the principal if they are unable to do so. While both documents involve decision-making authority, the Health Care Surrogate focuses exclusively on medical issues, whereas the Durable Power of Attorney encompasses a broader range of financial and legal matters.

The Revocable Living Trust bears resemblance to the Durable Power of Attorney in that both can manage assets and facilitate financial decisions. A Revocable Living Trust allows the principal to place their assets into a trust, which can be managed by a trustee. Unlike the Durable Power of Attorney, a Revocable Living Trust can avoid probate, providing a streamlined process for asset distribution upon death.

The Advance Directive is similar in purpose to the Durable Power of Attorney, as both documents are designed to express an individual’s wishes regarding their future care. While the Durable Power of Attorney appoints someone to make decisions, the Advance Directive outlines specific preferences for medical treatment, ensuring that the principal's values are honored when they cannot voice them.

The Guardianship document also shares similarities with the Durable Power of Attorney. Both serve to protect individuals who may be unable to manage their affairs. However, a Guardianship is typically established through court proceedings and may involve more oversight, while a Durable Power of Attorney is created by the principal voluntarily and does not require court approval.

The Financial Power of Attorney is closely aligned with the Durable Power of Attorney. Both documents empower an agent to handle financial matters on behalf of the principal. The Financial Power of Attorney may be more limited in scope, focusing solely on financial transactions, whereas the Durable Power of Attorney can encompass a wider range of authority, including legal and property matters.

Another related document is the Special Power of Attorney. This form grants authority for specific tasks or transactions, unlike the broader powers given in a Durable Power of Attorney. While both documents empower an agent to act on behalf of the principal, the Special Power of Attorney is limited to defined actions, making it a more targeted option for particular situations.

Lastly, the Durable Healthcare Power of Attorney is similar to the Florida Durable Power of Attorney in that it grants authority to make health care decisions. However, it is specifically focused on medical matters and remains effective even if the principal becomes incapacitated. This document ensures that health care preferences are respected while allowing an appointed agent to act when necessary.

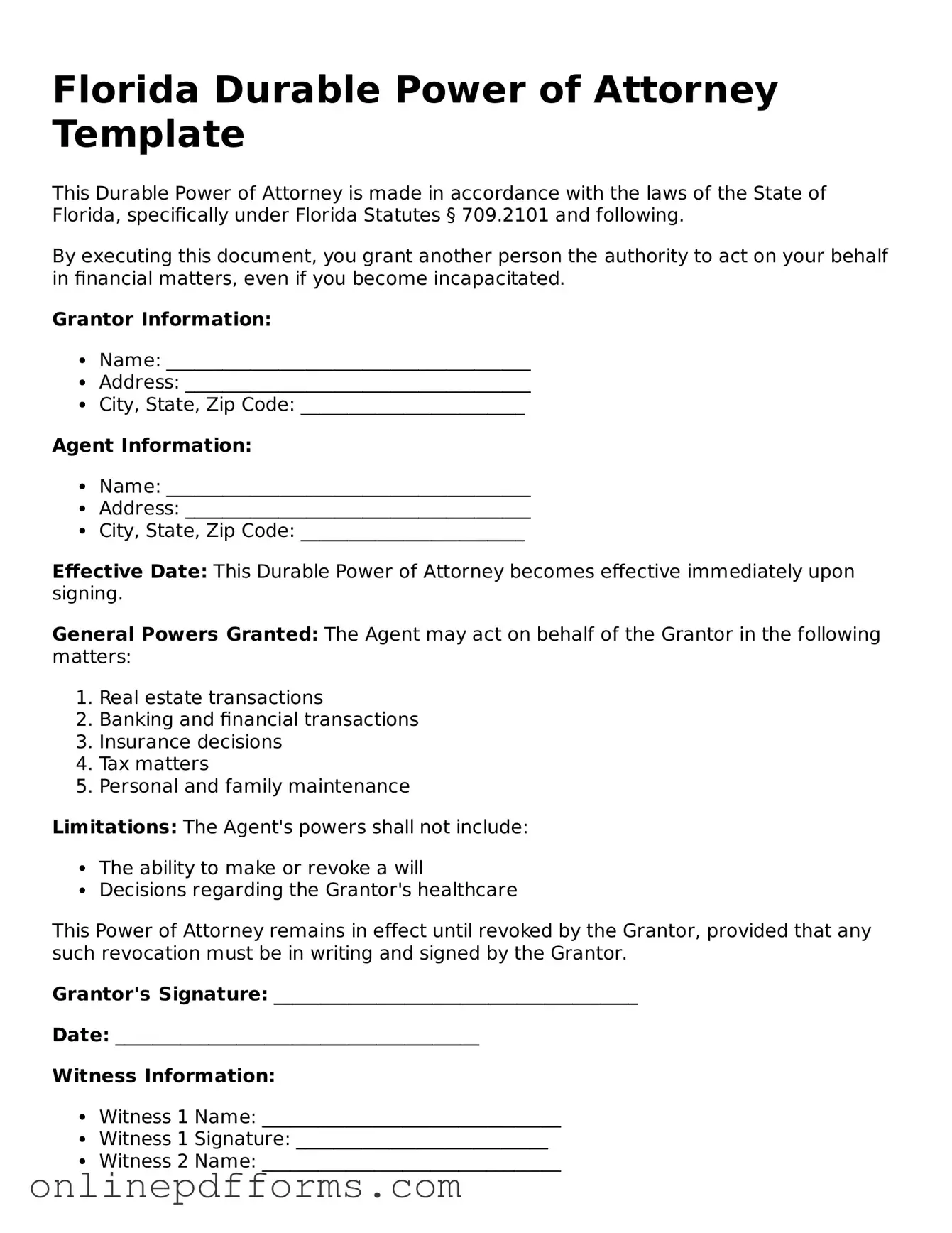

Steps to Filling Out Florida Durable Power of Attorney

Completing the Florida Durable Power of Attorney form requires careful attention to detail. This document allows an individual to designate another person to make decisions on their behalf. Below are the steps to accurately fill out the form.

- Obtain the Florida Durable Power of Attorney form. This can be found online or through legal offices.

- Read the instructions provided with the form to understand the requirements.

- Enter the name and address of the principal, the person granting the authority.

- Provide the name and address of the agent, the person who will act on behalf of the principal.

- Specify the powers granted to the agent. This can include financial decisions, healthcare decisions, or other specific powers.

- Indicate whether the power of attorney becomes effective immediately or upon a specific event, such as incapacitation.

- Include any limitations or specific instructions regarding the agent’s authority, if applicable.

- Sign and date the form in the presence of a notary public. The notary will verify the identity of the principal and witness the signing.

- Provide copies of the signed form to the agent and any relevant institutions or individuals.