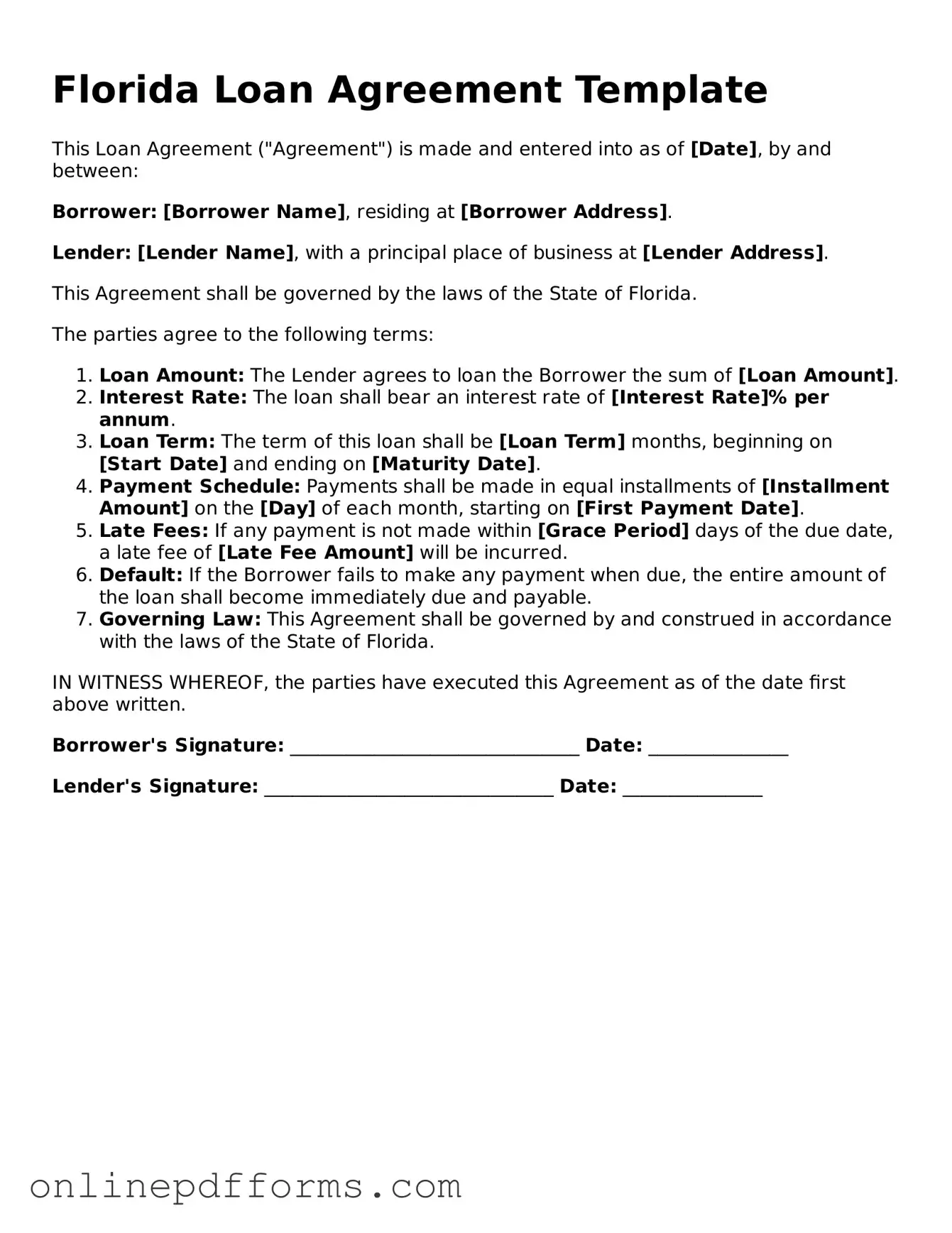

Blank Florida Loan Agreement Form

Documents used along the form

When preparing a Florida Loan Agreement, several other forms and documents may be necessary to support the transaction. Each of these documents serves a specific purpose and helps ensure that both parties understand their rights and obligations. Below is a list of commonly used documents that may accompany a Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms, including the interest rate and repayment schedule.

- Security Agreement: This agreement details the collateral that secures the loan, providing the lender with rights to the collateral in case of default.

- Loan Disclosure Statement: This statement provides important information about the loan, including fees, interest rates, and other terms, ensuring transparency for the borrower.

- Personal Guarantee: If applicable, this document holds a third party responsible for the loan if the borrower defaults, adding an extra layer of security for the lender.

- Credit Report Authorization: This form allows the lender to obtain the borrower's credit report, which helps assess creditworthiness before approving the loan.

- Loan Application: This form collects information about the borrower’s financial situation, helping the lender evaluate the loan request.

- Closing Statement: This document outlines all the costs associated with the loan closing, including fees and disbursements, ensuring all parties are informed of the final amounts.

- Amortization Schedule: This schedule provides a breakdown of each payment over the life of the loan, showing how much goes toward principal and interest.

- Trailer Bill of Sale Form: Essential for documenting the sale of a trailer in Illinois, this form provides a legal record and ensures that both the seller and buyer's interests are protected. For more details, refer to Auto Bill of Sale Forms.

- Default Notice: This document is issued if the borrower fails to meet the loan terms, notifying them of the default and the potential consequences.

- Release of Lien: Once the loan is paid off, this document is used to formally remove the lender's claim on the collateral, clearing the borrower's title.

Understanding these documents can help both borrowers and lenders navigate the loan process more effectively. Each document plays a vital role in ensuring that the terms of the loan are clear and enforceable, protecting the interests of both parties involved.

Other Popular State-specific Loan Agreement Templates

Promissory Note Template Georgia - Future changes to terms must typically be documented in writing.

The Trader Joe's application form is a crucial document for individuals seeking employment at one of the popular grocery store chain's locations. This form collects essential information about the applicant's background, skills, and availability as part of the hiring process. If you're interested in joining the Trader Joe's team, consider filling out the form by clicking the button below, or you can find more details at https://pdftemplates.info/trader-joe-s-application-form/.

Promissory Note Template New York - The form can establish a timeline for disbursement of funds.

Illinois Promissory Note - The document may also require the borrower to provide financial statements to assess creditworthiness.

Similar forms

The Florida Loan Agreement form shares similarities with a Promissory Note. Both documents serve as a written promise to repay borrowed funds. A Promissory Note outlines the terms of the loan, including the interest rate, repayment schedule, and consequences of default. While the Loan Agreement may include additional terms and conditions, the core purpose of both documents is to establish a clear understanding between the borrower and lender regarding repayment obligations.

Another document that resembles the Florida Loan Agreement is the Mortgage Agreement. While a Loan Agreement generally focuses on the terms of the loan itself, a Mortgage Agreement secures the loan with the property being financed. In this case, the borrower pledges the property as collateral, which means that if they fail to repay the loan, the lender has the right to take possession of the property. Both documents are essential in real estate transactions and ensure that the lender has a legal claim to the collateral should the borrower default.

The Florida Loan Agreement is also akin to a Secured Loan Agreement. In both cases, the borrower provides collateral to secure the loan. This collateral can be any asset of value, such as a vehicle or real estate. By securing the loan, the lender reduces their risk, knowing they can claim the collateral if the borrower defaults. The terms regarding the collateral, including its value and the rights of the lender, are clearly defined in both documents.

Another similar document is the Unsecured Loan Agreement. Unlike the secured version, an Unsecured Loan Agreement does not require collateral. Instead, it relies solely on the borrower’s creditworthiness. Both agreements outline the loan amount, interest rate, and repayment terms. While the risks for lenders differ, the fundamental structure and intent of the agreements remain similar, focusing on the repayment of borrowed funds.

The Florida Loan Agreement can also be compared to a Line of Credit Agreement. This document allows borrowers to access funds up to a certain limit, similar to a credit card. While a traditional loan provides a lump sum, a Line of Credit allows for flexibility in borrowing and repayment. Both agreements stipulate the terms of borrowing, including interest rates and repayment schedules, but the Line of Credit Agreement typically includes provisions for ongoing access to funds.

A further comparison can be made with an Installment Loan Agreement. This document establishes a loan that is repaid through a series of scheduled payments over time. Both the Florida Loan Agreement and the Installment Loan Agreement specify the total loan amount, interest rate, and payment schedule. The primary difference lies in the specific terms and conditions that may vary based on the type of loan and the lender’s policies.

The Florida Loan Agreement is also similar to a Business Loan Agreement, which is specifically designed for business financing. While both documents outline the terms of borrowing, a Business Loan Agreement often includes additional clauses related to business operations, financial reporting, and use of funds. Both agreements aim to protect the interests of the lender while ensuring that the borrower understands their obligations.

Another document that bears resemblance is the Personal Loan Agreement. This type of agreement is typically used for loans between individuals rather than financial institutions. Like the Florida Loan Agreement, it details the loan amount, interest rate, and repayment terms. The key difference lies in the nature of the parties involved; Personal Loan Agreements often rely more on trust and personal relationships than formal credit evaluations.

In consideration of various financial agreements and their nuances, couples may also find it beneficial to explore the Arizona Prenuptial Agreement form, as it serves to clearly delineate asset ownership and responsibilities before marriage. This document, like the others mentioned, aims to reduce ambiguity and protect the interests of both parties, ultimately fostering a sense of security in their union. For more information on accessing this important legal document, visit https://arizonaformspdf.com/.

Lastly, the Florida Loan Agreement can be compared to a Credit Agreement, which is often used in more complex financial transactions involving multiple parties. A Credit Agreement outlines the terms of borrowing for a specific purpose, such as a corporate loan or syndicated loan. While both documents serve to clarify the terms of the loan, a Credit Agreement may include additional provisions regarding covenants, representations, and warranties that are not typically found in a standard Loan Agreement.

Steps to Filling Out Florida Loan Agreement

Once you have your Florida Loan Agreement form ready, it’s time to fill it out accurately. Follow these steps to ensure that all necessary information is included and correctly presented.

- Identify the Parties: Write the full legal names of the borrower and lender at the top of the form.

- Loan Amount: Clearly state the total amount being loaned.

- Interest Rate: Indicate the interest rate for the loan. Specify whether it is fixed or variable.

- Payment Terms: Detail the repayment schedule, including the frequency of payments (monthly, bi-weekly, etc.) and the due date.

- Loan Purpose: Briefly describe the purpose of the loan.

- Collateral: If applicable, list any collateral securing the loan.

- Signatures: Ensure both parties sign and date the agreement at the bottom of the form.

After completing the form, review it for accuracy and completeness. Both parties should keep a copy for their records.