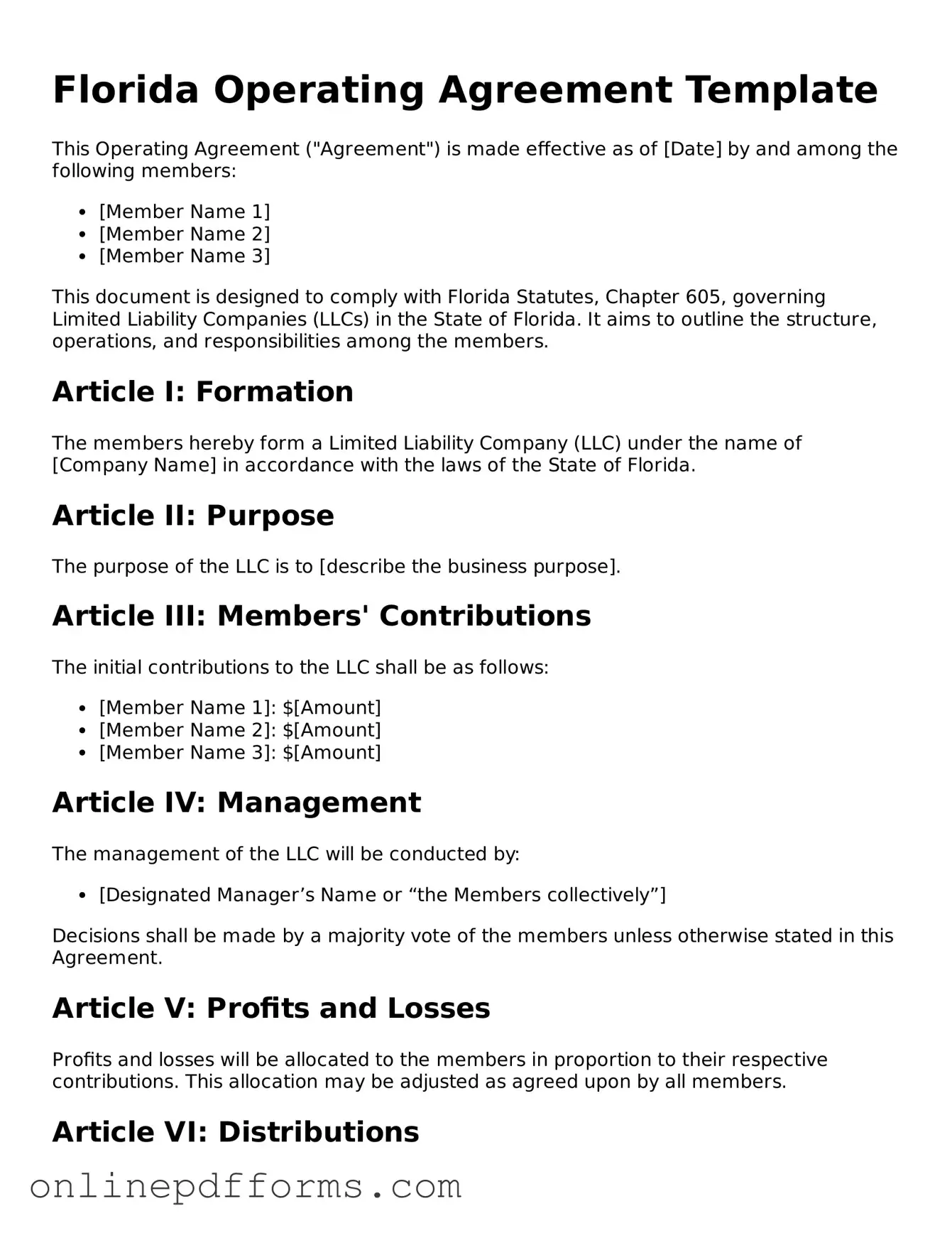

Blank Florida Operating Agreement Form

Documents used along the form

When forming a Limited Liability Company (LLC) in Florida, several documents work in tandem with the Florida Operating Agreement to establish and manage the business effectively. Each of these documents serves a specific purpose and helps clarify the roles, responsibilities, and procedures within the company. Here’s a list of common forms and documents you may encounter.

- Articles of Organization: This is the primary document filed with the state to officially create your LLC. It includes basic information about the business, such as its name, address, and the names of its members.

- Member Consent Form: This document outlines the agreement among members regarding the formation and operation of the LLC. It often includes the initial capital contributions and ownership percentages of each member.

- Bylaws: While not always required for LLCs, bylaws can help define the internal rules and procedures for managing the company. They typically cover topics like voting rights and meeting procedures.

- Initial Resolution: This document records the decisions made by the members at the time of formation, such as the appointment of managers or the opening of a bank account.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company.

- Operating Procedures: This document provides detailed guidelines on how the LLC will conduct its business operations, including day-to-day activities and decision-making processes.

- Tax Election Forms: Depending on how the LLC chooses to be taxed, members may need to file specific forms with the IRS, such as Form 8832 to elect corporate tax treatment.

- Non-Disclosure Agreement (NDA): This agreement protects sensitive information shared between members or with external parties. It ensures that confidential business information remains secure.

- Employment Agreements: If the LLC hires employees, these agreements outline the terms of employment, including duties, compensation, and termination conditions.

- Vehicle Bill of Sale: When selling a motorcycle in Georgia, it's important to have the proper documentation in place. Consider using the Vehicle Bill of Sale Forms to ensure a smooth and legal transaction.

- Annual Reports: Florida requires LLCs to file annual reports to maintain good standing. This document updates the state on the company’s current information, such as its address and management structure.

Understanding these documents can help ensure that your LLC operates smoothly and meets all legal requirements. Each form plays a vital role in the overall structure and function of your business, so it's important to consider them carefully during the formation process.

Other Popular State-specific Operating Agreement Templates

Creating an Operating Agreement - Members use the Operating Agreement to establish guidelines for decision-making.

To facilitate the rental process, landlords often seek an effective document like the New York Rental Application form, which provides a comprehensive view of potential tenants. For further guidance, explore the necessary components of the rental application.

How to Create an Operating Agreement for an Llc - This document ensures compliance with state laws governing LLCs.

Similar forms

The Florida Operating Agreement is similar to a Partnership Agreement, which outlines the terms and conditions of a partnership between two or more individuals. Both documents detail the roles, responsibilities, and profit-sharing arrangements of the partners involved. Just as an Operating Agreement governs the internal workings of an LLC, a Partnership Agreement serves to clarify how decisions will be made, how profits will be distributed, and how disputes will be resolved among partners.

Another comparable document is the Bylaws of a corporation. While Bylaws govern the internal management of a corporation, they share the same purpose as an Operating Agreement in that they establish the rules and procedures for the organization. Both documents define the roles of members or directors, outline meeting protocols, and set forth guidelines for amendments, ensuring that the organization operates smoothly and effectively.

The Shareholders Agreement is also similar, as it outlines the rights and obligations of shareholders in a corporation. Like the Operating Agreement, it addresses issues such as ownership structure, voting rights, and the process for buying or selling shares. Both documents aim to protect the interests of the stakeholders and provide a framework for decision-making within the entity.

Another document that shares similarities is the Limited Partnership Agreement. This agreement is specifically for limited partnerships and outlines the roles of general and limited partners. Like the Operating Agreement, it details how profits and losses will be distributed and provides guidelines for management and decision-making, ensuring clarity in the partnership's operations.

The Joint Venture Agreement also bears resemblance to the Operating Agreement. This document outlines the terms of a temporary partnership between two or more parties for a specific project or purpose. Both agreements define the contributions of each party, profit-sharing arrangements, and the management structure, ensuring that all parties are aligned in their objectives and responsibilities.

A Non-Disclosure Agreement (NDA) can also be seen as similar in terms of protecting sensitive information. While it serves a different purpose, both documents establish clear guidelines and expectations among parties. An NDA ensures that confidential information shared between members remains protected, just as an Operating Agreement outlines how internal matters should be handled to maintain the integrity of the business.

The Employment Agreement is another document that shares some similarities with the Operating Agreement. While it focuses on the relationship between an employer and an employee, it also outlines roles, responsibilities, and expectations. Both documents aim to establish a clear understanding of the parties' obligations, contributing to a harmonious working environment.

For those venturing into motorcycle ownership or sales in Arizona, it's vital to have the proper documentation in place, such as the Arizona Motorcycle Bill of Sale, which serves to facilitate this transfer clearly and legally. This essential document can be found at mypdfform.com/blank-arizona-motorcycle-bill-of-sale/, ensuring that all parties involved are protected and aware of the transaction details.

The Franchise Agreement is akin to the Operating Agreement in that it sets the terms for a business relationship. This document outlines the rights and responsibilities of both the franchisor and the franchisee. Like an Operating Agreement, it details operational guidelines, fees, and other important aspects of the business relationship, ensuring that both parties understand their roles and responsibilities.

The Membership Agreement is another document that serves a similar purpose. It outlines the rights and responsibilities of members in a membership-based organization. Much like an Operating Agreement, it defines how decisions will be made, how profits will be shared, and what happens if a member wishes to leave, ensuring that all members are on the same page regarding their roles and contributions.

Lastly, the Articles of Organization is related in that it is a foundational document for an LLC. While the Articles of Organization are filed with the state to officially form the LLC, the Operating Agreement provides the internal rules for how the LLC will operate. Both documents are essential for establishing the legal structure of the business and ensuring compliance with state laws.

Steps to Filling Out Florida Operating Agreement

Filling out the Florida Operating Agreement form is a crucial step for any business. This document will help clarify the roles and responsibilities of the members involved. Follow these steps carefully to ensure that you complete the form correctly.

- Begin by entering the name of your LLC at the top of the form.

- Provide the principal address of the LLC. This should be a physical address, not a P.O. Box.

- List the names of all members of the LLC. Include their addresses and any ownership percentages.

- Detail the management structure of the LLC. Indicate whether it will be member-managed or manager-managed.

- Outline the purpose of the LLC. Clearly state what the business will do.

- Include provisions for adding or removing members. Specify how this process will work.

- Describe how profits and losses will be distributed among members. Be specific about percentages or amounts.

- State the duration of the LLC. Indicate whether it is perpetual or for a specific term.

- Sign and date the form. All members should sign to confirm their agreement.

After completing the form, make sure to keep a copy for your records. It’s important to store this document safely, as it serves as a reference for the operation of your LLC.