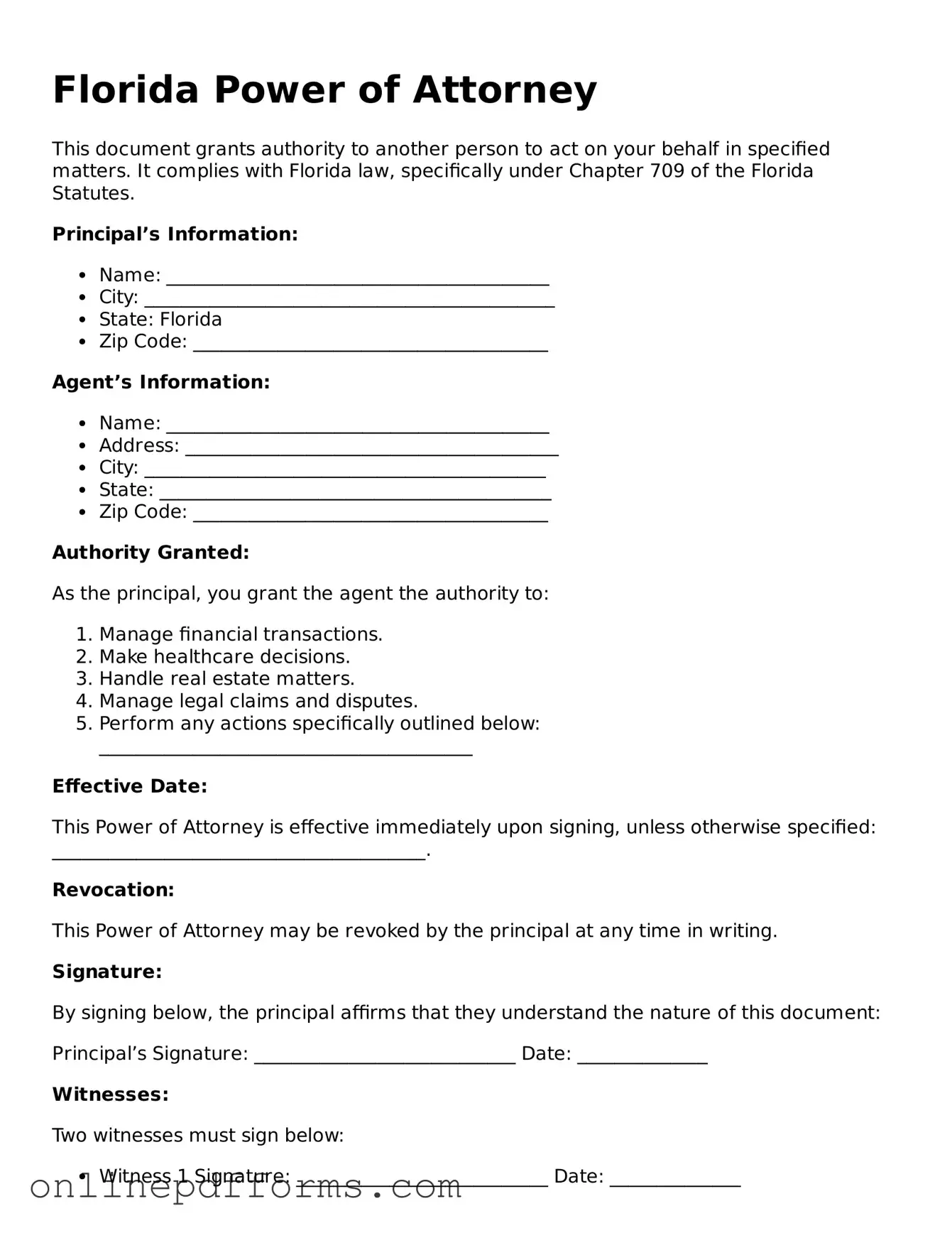

Blank Florida Power of Attorney Form

Documents used along the form

When establishing a Florida Power of Attorney, it is essential to consider several other documents that may complement or enhance the authority granted. These documents can provide clarity, ensure compliance with specific legal requirements, and protect the interests of the principal and the agent. Below is a list of commonly used forms and documents that often accompany a Power of Attorney in Florida.

- Advance Healthcare Directive: This document allows individuals to outline their medical treatment preferences in case they become unable to communicate their wishes. It often includes a living will and a healthcare proxy.

- Living Will: A living will specifies an individual's preferences regarding life-sustaining treatments and end-of-life care. It is crucial for ensuring that medical providers respect the individual's wishes.

- Durable Power of Attorney: Similar to a standard Power of Attorney, this document remains effective even if the principal becomes incapacitated. It is particularly important for long-term planning.

- Financial Power of Attorney: This form grants an agent the authority to handle financial matters, such as managing bank accounts, paying bills, and making investment decisions on behalf of the principal.

- Trust Document: A trust can be established to manage assets during the principal's lifetime and after their death. This document outlines the terms of the trust and the responsibilities of the trustee.

- Will: A will outlines how an individual's assets will be distributed upon their death. It is essential for ensuring that the principal's wishes are honored after they pass away.

- HIPAA Release Form: This form allows the designated agent to access the principal's medical records and information, ensuring they can make informed healthcare decisions.

- Real Estate Power of Attorney: This specialized form grants an agent authority to manage real estate transactions, such as buying, selling, or leasing property on behalf of the principal.

- Asset Inventory List: This document provides a detailed account of the principal's assets, making it easier for the agent to manage and distribute them as needed.

Understanding these documents is vital for anyone considering a Power of Attorney in Florida. Each form plays a unique role in ensuring that personal, financial, and medical decisions align with the principal's wishes. Consulting with a qualified professional can help navigate these options effectively.

Other Popular State-specific Power of Attorney Templates

General Power of Attorney California - The form can help ensure continuity in managing your affairs during temporary absences.

Power of Attorney Form Illinois - Power of Attorney is an important tool for delegating responsibilities when someone is unable to act on their own.

Georgia Power of Attorney Form - The agent has a fiduciary duty to act in the principal's best interest.

New York Power of Attorney Form - This legal tool can ensure continuity of care and financial management in emergencies.

Similar forms

The Florida Power of Attorney (POA) form shares similarities with a Living Will. Both documents allow individuals to express their wishes regarding medical treatment and personal affairs. While a POA designates someone to make decisions on your behalf if you become incapacitated, a Living Will specifically outlines your preferences for medical care in end-of-life situations. This makes the Living Will a crucial complement to a POA, ensuring that your healthcare choices are honored even when you cannot communicate them yourself.

Another document akin to the Florida Power of Attorney is the Healthcare Proxy. This legal tool appoints someone to make healthcare decisions for you when you are unable to do so. Like the POA, it empowers a trusted individual to act on your behalf. However, the Healthcare Proxy focuses solely on medical decisions, whereas a POA can cover a broader range of financial and legal matters. Both documents are essential for ensuring your wishes are respected during times of incapacity.

The Advance Directive is also similar to the Florida Power of Attorney. This document combines elements of both the Living Will and the Healthcare Proxy. It allows individuals to outline their medical treatment preferences and designate a person to make healthcare decisions. The Advance Directive provides a comprehensive approach to healthcare planning, ensuring that your values and wishes are clear to your loved ones and medical providers, much like the POA does for financial and legal matters.

Additionally, the Guardianship document bears resemblance to the Florida Power of Attorney. While a POA allows you to choose someone to act on your behalf voluntarily, a Guardianship is typically established by a court when an individual is deemed unable to manage their affairs. This legal arrangement appoints a guardian to make decisions for the incapacitated person. Although both documents serve to protect individuals, the POA is often preferred for its flexibility and the ability to retain control over who makes decisions.

Lastly, the Trust Agreement is another document that parallels the Florida Power of Attorney. A Trust allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after death. Like a POA, a Trust can help avoid probate and provide a clear plan for managing financial affairs. However, while a POA is effective during a person's lifetime, a Trust often continues to operate even after the individual passes away, making it a powerful tool for estate planning.

Steps to Filling Out Florida Power of Attorney

Once you have the Florida Power of Attorney form, it's important to fill it out correctly to ensure it serves its intended purpose. Follow these steps to complete the form accurately.

- Obtain the Form: Get the Florida Power of Attorney form from a reliable source, such as a legal website or office supply store.

- Identify the Principal: In the first section, write your full name as the person granting the power of attorney.

- Choose an Agent: Specify the name of the person you are appointing as your agent. This person will act on your behalf.

- Provide Agent's Information: Include the agent’s address and phone number for clarity.

- Define Powers: Clearly list the specific powers you are granting to your agent. Be as detailed as possible.

- Set Effective Date: Indicate when the power of attorney will take effect. You can choose immediately or at a later date.

- Sign the Form: As the principal, sign and date the form. Make sure to do this in front of a notary public.

- Notarization: Have the form notarized. This step is crucial for the document to be legally valid.

- Distribute Copies: Provide copies of the signed and notarized form to your agent and any relevant institutions.