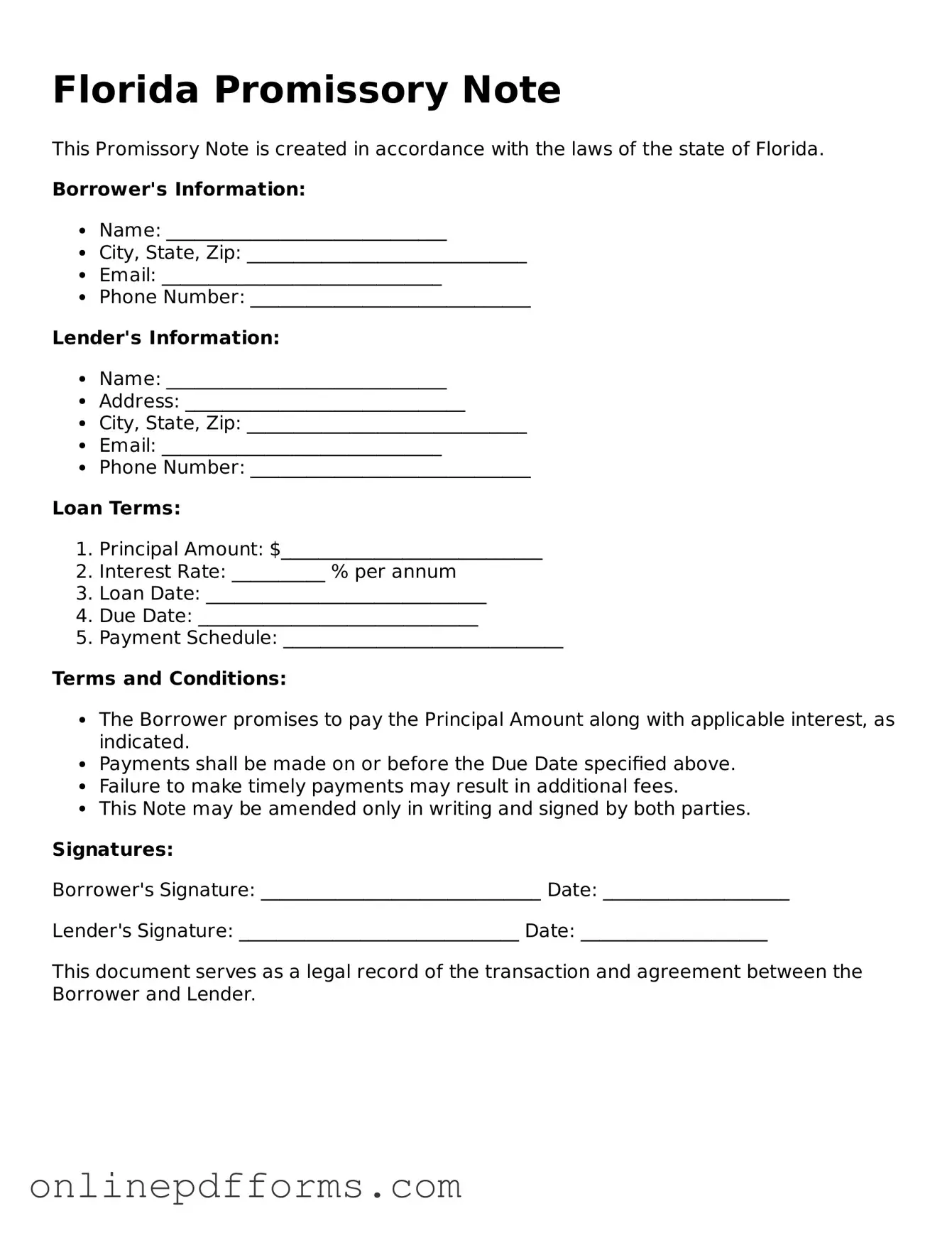

Blank Florida Promissory Note Form

Documents used along the form

When dealing with a Florida Promissory Note, several other forms and documents may be necessary to ensure a complete and legally binding agreement. Each document serves a specific purpose in the transaction, providing clarity and protection for all parties involved.

- Security Agreement: This document outlines the collateral securing the loan. It specifies what property or assets the borrower is pledging to the lender as security for repayment. If the borrower defaults, the lender has the right to seize the collateral.

- Loan Agreement: This is a comprehensive document that details the terms of the loan, including the amount, interest rate, repayment schedule, and any fees. It serves as a formal contract between the borrower and lender, outlining each party's obligations.

- Personal Guarantee: If the borrower is a business entity, a personal guarantee may be required from an individual, usually an owner or officer. This document holds the individual personally responsible for the loan if the business defaults.

- Tractor Bill of Sale Form: When completing a tractor transaction, ensure you have the comprehensive Tractor Bill of Sale documentation to facilitate legal ownership transfer.

- Amortization Schedule: This schedule provides a detailed breakdown of each payment over the life of the loan. It shows how much of each payment goes toward interest and how much goes toward reducing the principal balance.

- Disclosure Statement: This document informs the borrower of all relevant loan terms and conditions. It includes details about fees, interest rates, and the total cost of the loan, ensuring transparency in the lending process.

Understanding these additional forms and documents can enhance the effectiveness of a Florida Promissory Note. They help clarify the terms of the loan and protect the interests of both the borrower and lender.

Other Popular State-specific Promissory Note Templates

Free Loan Agreement Template Texas - It includes details such as the principal amount, interest rate, and payment schedule.

When dealing with the transfer of a trailer, it is important to have the appropriate documentation, such as the Texas Trailer Bill of Sale form, which can be found through various resources like Auto Bill of Sale Forms. This form ensures that both parties have a clear understanding of the sale and provides legal proof of ownership transfer.

Blank Promissory Note - Borrowers should understand all terms before signing the document.

Similar forms

The Florida Promissory Note form shares similarities with a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rates, and repayment schedules. A Loan Agreement often includes additional details, such as covenants and conditions that the borrower must adhere to, which may not be present in a simple Promissory Note. However, the core purpose of both documents remains the same: to formalize the borrowing arrangement between the lender and the borrower.

Another document that resembles the Florida Promissory Note is a Mortgage. While a Promissory Note serves as a promise to repay a loan, a Mortgage is a security instrument that pledges property as collateral for the loan. Both documents are essential in real estate transactions. The Mortgage provides the lender with a legal claim to the property if the borrower defaults, while the Promissory Note details the borrower's obligation to repay the loan amount.

A third similar document is a Personal Guarantee. This document is often used in business transactions where an individual agrees to be personally liable for the debt of a business. Like a Promissory Note, a Personal Guarantee establishes a clear obligation to repay a specified amount. However, the key difference lies in the context; a Promissory Note is primarily used for loans, whereas a Personal Guarantee is tied to the financial obligations of a business entity.

When considering rental applications, landlords often seek reliable and efficient methods to manage the process, much like how a well-crafted https://californiapdf.com/ can streamline the collection of essential information. This ensures that all potential tenants are evaluated fairly and thoroughly, resembling the careful assessments made in various financial agreements.

Lastly, a Secured Note is another document that bears resemblance to the Florida Promissory Note. A Secured Note includes a promise to pay, similar to a Promissory Note, but it is backed by collateral. This means that if the borrower fails to make payments, the lender has the right to seize the collateral. Both documents serve to protect the lender's interests, but the Secured Note provides an additional layer of security through the collateral involved.

Steps to Filling Out Florida Promissory Note

After obtaining the Florida Promissory Note form, you are ready to fill it out. Completing this form accurately is essential for both the lender and borrower. Follow the steps below to ensure all necessary information is included.

- Identify the parties: Write the full legal names of both the lender and the borrower at the top of the form.

- Specify the loan amount: Clearly state the total amount being borrowed in both numeric and written form.

- Set the interest rate: Indicate the annual interest rate applicable to the loan, if any.

- Define the repayment schedule: Outline the frequency of payments (monthly, quarterly, etc.) and the start date for payments.

- Include the due date: Specify when the total amount will be due, including the final payment date.

- Detail any late fees: If applicable, describe the penalties for late payments.

- Sign the document: Both parties must sign and date the form at the designated spaces to validate the agreement.

- Notarization (if required): Consider having the document notarized for added legal protection, depending on your situation.