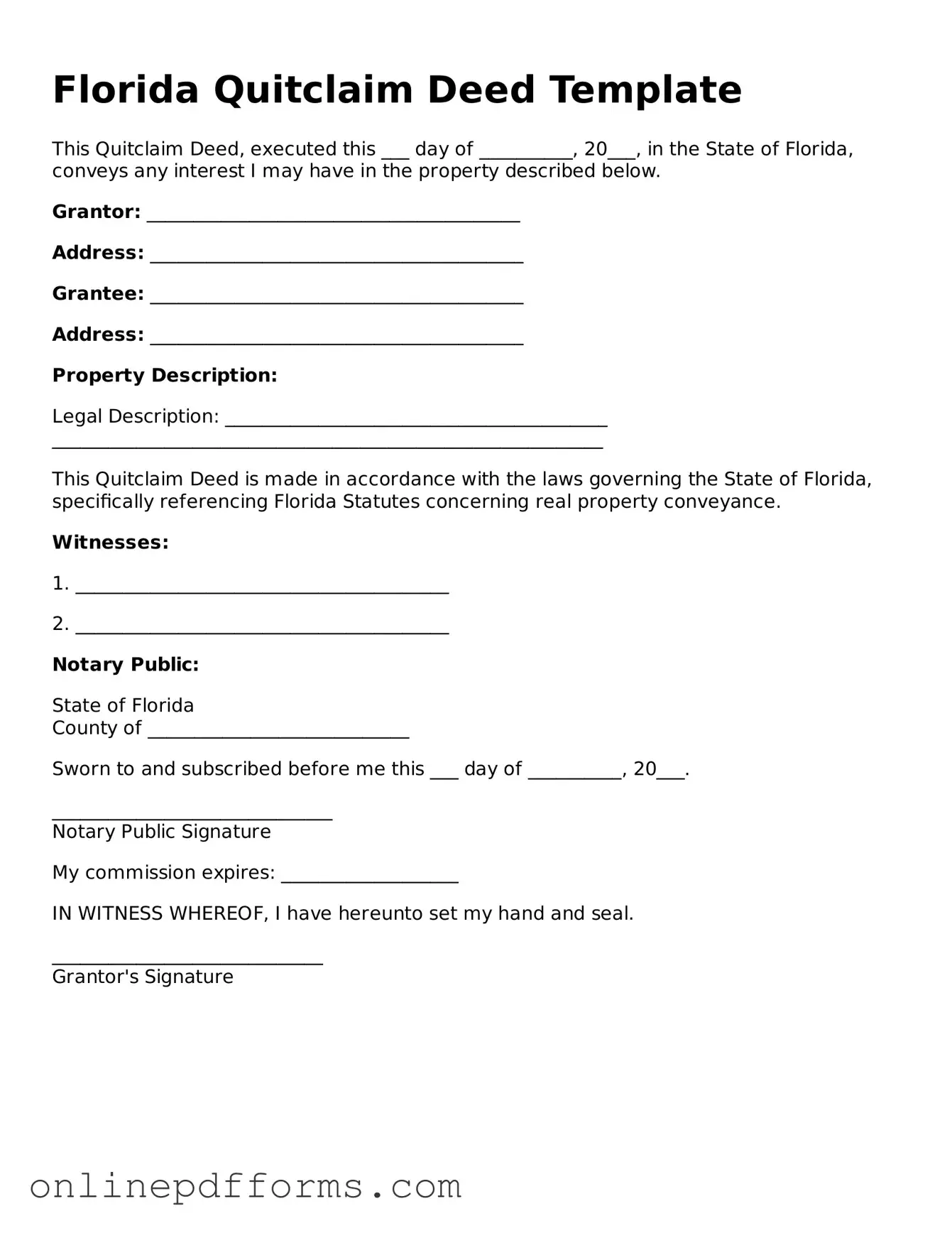

Blank Florida Quitclaim Deed Form

Documents used along the form

The Florida Quitclaim Deed is an important legal document used to transfer property ownership without any warranties. However, it often works in conjunction with several other forms and documents to ensure a smooth transaction. Below is a list of commonly associated documents that may be required or beneficial during the property transfer process.

- Warranty Deed: Unlike a quitclaim deed, a warranty deed guarantees that the seller holds clear title to the property and has the right to sell it. This document provides more protection to the buyer.

- Title Search Report: A title search report outlines the history of ownership for the property. It helps identify any liens, encumbrances, or claims against the property that could affect ownership.

- Affidavit of Title: This sworn statement confirms the seller's ownership and asserts that there are no undisclosed liens or claims against the property. It is often used to provide additional assurance to the buyer.

- Property Transfer Tax Form: In Florida, this form is required to report the transfer of property for tax purposes. It ensures that any applicable transfer taxes are calculated and paid.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document details all the financial aspects of the transaction, including costs, fees, and adjustments. It is reviewed and signed at closing.

- Homestead Exemption Application: If the property will be the primary residence of the buyer, this application may be filed to receive tax benefits. It helps reduce property taxes for homeowners in Florida.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It may be necessary if the seller or buyer cannot be present at closing.

- Loan Documents: If financing is involved, various loan documents, including the mortgage agreement and promissory note, will be required. These outline the terms of the loan and the buyer's obligations.

- Loan Agreement Form: A critical document when borrowing money, it details terms such as loan amount and repayment options, ensuring clarity and legal protection for both parties involved, which can be found at californiapdf.com/.

- Disclosure Statements: Sellers may be required to provide disclosure statements that inform the buyer of any known issues with the property, such as structural problems or environmental hazards.

Understanding these documents can facilitate a smoother property transfer process. Each plays a crucial role in ensuring that both parties are protected and that the transaction adheres to legal requirements. Always consider consulting with a legal professional to navigate these forms effectively.

Other Popular State-specific Quitclaim Deed Templates

Quitclaim Deed Georgia - A quitclaim deed may restore rights to a previous owner.

Quitclaim Deed Ny - Quitclaim deeds may be used when gifting property to someone.

Cost for Quit Claim Deed - A Quitclaim Deed transfers ownership rights without warranty.

Utilizing a Quitclaim Deed form for property transfers can significantly streamline the legal process, ensuring that the parties involved understand their rights and obligations without the burden of complex title guarantees.

How Do I File a Quit Claim Deed - Renters may use a Quitclaim Deed to transfer rights in lease agreements.

Similar forms

A Warranty Deed is similar to a Quitclaim Deed in that both are used to transfer property ownership. However, a Warranty Deed offers a guarantee that the seller has clear title to the property and the right to sell it. This means that the seller is responsible for any claims against the property, which provides more security to the buyer compared to a Quitclaim Deed, where no guarantees are made.

A Special Warranty Deed also transfers ownership but limits the seller's liability. The seller guarantees that they have not caused any title issues during their ownership. This is different from a Quitclaim Deed, which makes no warranties about the title. Buyers receive some assurance with a Special Warranty Deed, while a Quitclaim Deed provides none.

A Bargain and Sale Deed is another document that shares similarities with a Quitclaim Deed. It transfers property without warranties, but it implies that the seller has ownership rights. Unlike a Quitclaim Deed, which states that the seller makes no claims, a Bargain and Sale Deed suggests that the seller has the right to sell the property, even if there are no guarantees about the title.

Before proceeding with any property transaction, it is essential to ensure that all necessary documentation is in order, including the Texas Certificate of Insurance. This form serves as proof that a Responsible Master Plumber has the required insurance coverage, which is vital for safeguarding against potential liabilities. For further information on how to successfully complete this important requirement, you can access the document that will guide you through the process.

A Grant Deed is used to transfer property and includes some warranties. The seller guarantees that the property has not been sold to anyone else and that there are no undisclosed liens. This contrasts with a Quitclaim Deed, where the seller makes no such promises, making the Grant Deed a safer option for buyers.

A Deed of Trust is a legal document used in real estate transactions, similar to a Quitclaim Deed in that it involves property transfer. However, a Deed of Trust involves a third party, known as a trustee, who holds the title until the borrower repays the loan. While a Quitclaim Deed simply transfers ownership, a Deed of Trust secures a loan against the property.

A Life Estate Deed allows a property owner to transfer ownership while retaining the right to use the property during their lifetime. This document is similar to a Quitclaim Deed in that it transfers interest in the property but differs in its intent and the rights it grants. The Quitclaim Deed transfers full ownership without retaining any rights, while a Life Estate Deed allows for continued use by the original owner.

An Executor's Deed is used to transfer property from an estate to heirs or beneficiaries. It resembles a Quitclaim Deed in that it can transfer ownership without warranties. However, an Executor's Deed is specifically tied to the probate process, ensuring that the transfer is legal and recognized after a person's death, whereas a Quitclaim Deed can be used in various contexts.

A Trustee's Deed is similar to a Quitclaim Deed in that it transfers property from a trust to a beneficiary. However, it involves a trustee who acts on behalf of the trust. The Quitclaim Deed does not involve a trust structure and is a straightforward transfer of ownership, while a Trustee's Deed ensures that the transfer aligns with the trust's terms.

A Transfer on Death Deed allows an individual to transfer property to a beneficiary upon their death, similar to a Quitclaim Deed in that it transfers ownership. However, a Transfer on Death Deed avoids probate, making it a more streamlined option for passing property. A Quitclaim Deed does not provide this benefit and can require probate to finalize the transfer.

Finally, a Bill of Sale is a document used to transfer ownership of personal property, unlike the Quitclaim Deed, which is specific to real estate. However, both documents serve the purpose of transferring ownership. A Bill of Sale typically includes details about the item being sold, while a Quitclaim Deed focuses on the property and the parties involved in the transaction.

Steps to Filling Out Florida Quitclaim Deed

After completing the Florida Quitclaim Deed form, it is essential to ensure that it is properly executed and filed with the appropriate county clerk's office. This step is crucial for the transfer of property ownership to be legally recognized.

- Obtain the Florida Quitclaim Deed form. You can find it online or at your local county clerk's office.

- Fill in the date at the top of the form.

- In the "Grantor" section, provide the full name and address of the person transferring the property.

- In the "Grantee" section, enter the full name and address of the person receiving the property.

- Describe the property being transferred. Include the legal description, which can typically be found on the property’s deed or tax records.

- Sign the form in the presence of a notary public. The notary will also sign and stamp the document.

- Make copies of the completed deed for your records.

- File the original Quitclaim Deed with the county clerk's office where the property is located. Pay any required filing fees.