Blank Florida Transfer-on-Death Deed Form

Documents used along the form

The Florida Transfer-on-Death Deed form is a useful legal document that allows property owners to transfer real estate to beneficiaries upon their death, bypassing probate. When preparing this deed, several other forms and documents may also be necessary to ensure a smooth and legally compliant transfer of property. Below is a list of related documents that are often used in conjunction with the Transfer-on-Death Deed in Florida.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can complement the Transfer-on-Death Deed by addressing any assets not covered by the deed.

- Virginia Trailer Bill of Sale: This essential document confirms the transfer of ownership of a trailer in Virginia and serves as proof of purchase, ensuring a seamless registration under the new owner's name. For more information, visit https://billofsaleforvehicles.com/.

- Living Will: A living will specifies an individual's healthcare preferences in the event they become incapacitated. While not directly related to property transfer, it can clarify the individual's wishes regarding medical treatment.

- Durable Power of Attorney: This form allows a designated person to make financial and legal decisions on behalf of another if they become unable to do so. It can be important for managing property before the transfer occurs.

- Beneficiary Designation Forms: These forms are used for certain types of accounts, like life insurance or retirement accounts, to designate beneficiaries. They ensure that these assets transfer directly to the named individuals.

- Quitclaim Deed: This deed transfers ownership of property from one person to another without any warranties. It may be used to add or remove individuals from property ownership before the Transfer-on-Death Deed takes effect.

- Affidavit of Heirship: This document can be used to establish the heirs of a deceased person, particularly when there is no will. It may help clarify the beneficiaries in relation to the Transfer-on-Death Deed.

- Property Tax Exemption Application: This form is necessary for claiming certain property tax exemptions, which may be relevant for beneficiaries receiving property through a Transfer-on-Death Deed.

- Notice of Transfer: This document may be filed to inform relevant parties, including local authorities, about the transfer of property under the Transfer-on-Death Deed.

Understanding these documents can help ensure that property transfers are handled effectively and according to the wishes of the property owner. Each form plays a unique role in the overall process, contributing to a comprehensive estate plan.

Other Popular State-specific Transfer-on-Death Deed Templates

Transfer on Death Deed Georgia - Lawyers recommend this option for straightforward property transfers among family members.

Right of Survivorship Deed Pennsylvania - The Transfer-on-Death Deed is an opportunity to reflect the owner's wishes clearly in their estate plan.

Completing the necessary documentation for a motorcycle sale is essential for a smooth transaction, and one valuable resource for this is the Auto Bill of Sale Forms, which provides templates and guidance tailored for South Carolina residents.

Ladybird Deed Texas Form - When preparing this deed, owners should ensure they fully understand the implications it has on their overall estate plan.

Similar forms

The Florida Transfer-on-Death Deed (TODD) is similar to a Last Will and Testament in that both documents allow individuals to dictate the distribution of their property after their death. A will requires probate, a legal process that validates the document and oversees the distribution of assets. In contrast, a TODD bypasses probate, allowing for a more straightforward transfer of property directly to the named beneficiaries upon the owner's death. This feature can simplify the estate settlement process and reduce associated costs.

Another document comparable to the TODD is a Revocable Living Trust. Like the TODD, a revocable living trust facilitates the transfer of assets outside of probate. However, a living trust allows the creator to maintain control over the assets during their lifetime, with the ability to amend or revoke the trust as circumstances change. Upon the creator's death, the assets within the trust are distributed according to the terms set forth in the trust document, making it a flexible estate planning tool.

The TODD also shares similarities with a Beneficiary Designation form, often used for financial accounts such as bank accounts or retirement plans. Both documents allow individuals to name beneficiaries who will receive assets upon their death. However, while beneficiary designations are limited to specific accounts and financial assets, the TODD applies to real property, making it a unique option for real estate transfers.

A Joint Tenancy with Right of Survivorship agreement is another document that parallels the TODD. This arrangement allows two or more individuals to hold title to property jointly, with the surviving owner(s) automatically inheriting the deceased owner's share upon death. While both documents facilitate the transfer of property without probate, a joint tenancy requires all parties to be involved in the ownership during the owner's lifetime, whereas a TODD allows the original owner to retain full control until death.

The TODD is also akin to a Life Estate Deed, which grants an individual the right to use and occupy a property during their lifetime, with the property passing to another party upon their death. Both documents provide a means of transferring property while retaining certain rights during the owner's life. However, a life estate deed typically involves more complex rights and responsibilities, including maintenance and tax obligations, which are not present in a straightforward TODD.

Another similar document is the Power of Attorney, which allows individuals to designate someone to make decisions on their behalf while they are alive. Although a power of attorney ceases upon the principal's death, it can be used to manage real estate and other assets before death. While the TODD is focused on transferring property after death, the power of attorney can play a crucial role in managing those assets during the owner's lifetime.

The TODD can also be compared to a Quitclaim Deed. A quitclaim deed transfers ownership of property from one party to another without warranties. While both documents facilitate property transfer, a quitclaim deed is often used for immediate transfers and does not have the same provisions for posthumous transfers as a TODD. The quitclaim deed does not provide the same level of clarity regarding the intent to transfer property upon death.

Additionally, a Family Settlement Agreement can be seen as similar to the TODD in that it addresses the distribution of assets among family members. Such agreements are typically reached after a death and can help resolve disputes regarding property distribution. However, unlike the TODD, which allows for a clear and direct transfer of property before death, a family settlement agreement often arises from the complexities of probate and the need to negotiate among heirs.

If you are dealing with the legalities of vehicle transactions in Texas, it’s important to have the correct documentation, such as the Texas Motor Vehicle Power of Attorney form. This document allows individuals to manage vehicle-related matters on behalf of others, which can be particularly useful for those unable to attend to these affairs personally. For further details, you can visit pdftemplates.info/texas-motor-vehicle-power-of-attorney-form.

The TODD also resembles a Deed of Gift, which is used to transfer property as a gift during the owner's lifetime. Both documents facilitate the transfer of property; however, a deed of gift is irrevocable, meaning once the property is transferred, the original owner cannot reclaim it. In contrast, the TODD allows the owner to retain control of the property until death, providing flexibility in estate planning.

Finally, the TODD is similar to an Affidavit of Heirship, which is a legal document that establishes the heirs of a deceased individual. While an affidavit of heirship is typically used to clarify ownership and facilitate the transfer of property after death, it does not provide the same proactive approach as a TODD, which allows the property owner to designate beneficiaries in advance, thereby simplifying the transfer process.

Steps to Filling Out Florida Transfer-on-Death Deed

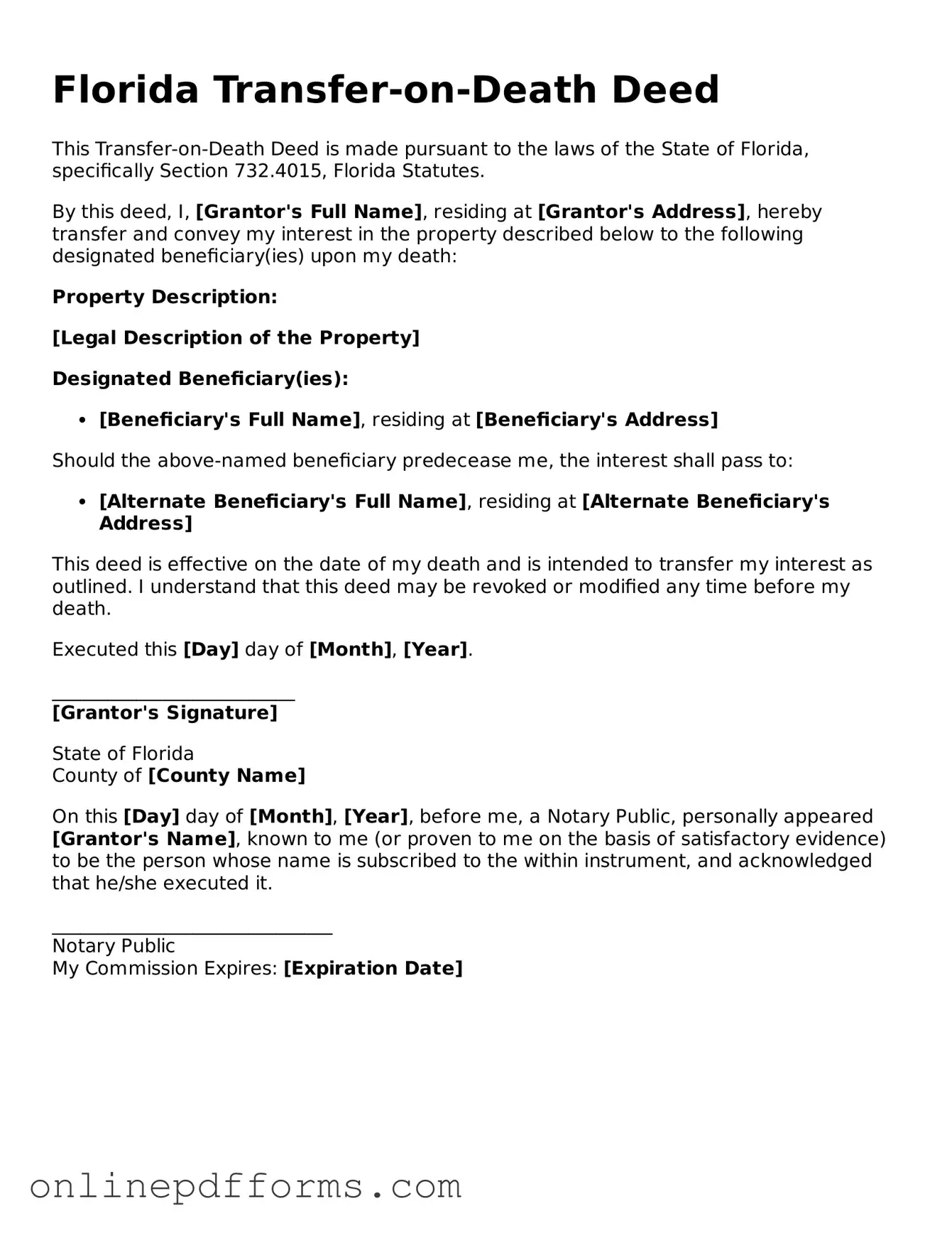

Filling out the Florida Transfer-on-Death Deed form requires careful attention to detail. Once completed, this form will allow you to designate a beneficiary who will receive your property upon your passing, simplifying the transfer process. Here are the steps to fill out the form accurately:

- Begin by entering your name as the grantor at the top of the form.

- Provide your address, including the city, state, and ZIP code.

- Identify the property you wish to transfer. This includes the legal description of the property, which can typically be found on your property tax bill or deed.

- Clearly state the name of the beneficiary or beneficiaries who will receive the property.

- Include the address of each beneficiary. If there are multiple beneficiaries, ensure you list them in the order of preference.

- Sign and date the form in the presence of a notary public. Ensure that the notary public also signs and stamps the form.

- Make copies of the completed form for your records.

- File the original deed with the appropriate county clerk's office where the property is located.

After submitting the form, it is advisable to keep a copy for your records and inform your beneficiaries about the transfer. This ensures that everyone is aware of the arrangement and can act accordingly when the time comes.