Fill in Your Generic Direct Deposit Template

Documents used along the form

The Generic Direct Deposit form is an essential document for individuals wishing to have their pay or other funds deposited directly into their bank accounts. However, it is often accompanied by several other forms and documents that facilitate the direct deposit process. Below are some commonly used forms that may be required alongside the Generic Direct Deposit form.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from an employee's paycheck. Completing this form accurately ensures that the correct amount is deposited into the employee's account after tax deductions.

- Bank Account Verification Form: Some employers require this form to confirm the details of the employee's bank account. It typically includes the account holder's name, account number, and routing number. This verification helps prevent errors in the direct deposit process.

- Payroll Authorization Form: This document authorizes the employer to deposit wages directly into the employee's bank account. It may also outline specific terms regarding the frequency and amount of deposits, ensuring clarity between the employer and employee.

- Vehicle Bill of Sale Form: To ensure proper documentation of your motorcycle sale, it is essential to fill out the Vehicle Bill of Sale Forms, which record the transaction details between the seller and buyer, providing legal protection for both parties.

- Change of Direct Deposit Form: If an employee wishes to change their bank account information for direct deposits, this form is necessary. It allows them to update their account details while ensuring that the employer has the most current information for future deposits.

These forms work together with the Generic Direct Deposit form to ensure a smooth and efficient payment process. Properly completing and submitting all required documents helps to avoid delays and ensures that funds are deposited accurately and on time.

More PDF Templates

Free Voucher - Gift certificates never go out of style!

How to Make a Fake Insurance Card - The effective date indicates when your policy began.

Understanding the importance of a Quitclaim Deed in property transactions can be vital, especially when personal relationships are involved. For more details, you can refer to this resource on how to effectively use a Quitclaim Deed form during such transfers: complete guide to Quitclaim Deed usage.

P45 What Is It - The form facilitates a smooth transition in pay and tax processing between different employments.

Similar forms

The W-4 form, officially known as the Employee's Withholding Certificate, is similar to the Generic Direct Deposit form in that it requires personal information from the employee. Both documents are essential for processing payroll. The W-4 form determines the amount of federal income tax to withhold from an employee's paycheck, while the Direct Deposit form specifies where the paycheck should be deposited. Both forms necessitate the employee's signature to authorize the requested actions, ensuring that the information provided is accurate and valid.

The I-9 form, or Employment Eligibility Verification, is another document that shares similarities with the Generic Direct Deposit form. Like the Direct Deposit form, the I-9 requires the employee to provide personal identification information, including their name and Social Security number. The purpose of the I-9 is to verify the employee's eligibility to work in the United States. Both forms must be completed accurately to comply with legal requirements, and both require the employee's signature to confirm the information provided.

In the context of motorcycle transactions, having the proper documentation is essential, much like financial forms such as the Generic Direct Deposit form. The Arizona Motorcycle Bill of Sale serves to protect both parties involved by clearly outlining the terms of the sale and ensuring that ownership is accurately transferred. For those seeking a reliable template, this document can be accessed at mypdfform.com/blank-arizona-motorcycle-bill-of-sale, providing peace of mind during the sale process.

The 1099 form, specifically the 1099-MISC or 1099-NEC, is comparable to the Generic Direct Deposit form in that it is used for reporting income. While the Direct Deposit form facilitates the deposit of funds, the 1099 form documents the income received by independent contractors or freelancers. Both forms require the recipient's taxpayer identification number, which is crucial for tax reporting purposes. Additionally, both forms must be filled out with care to ensure compliance with tax laws.

The ACH Authorization form is another document that closely resembles the Generic Direct Deposit form. This form is used to authorize electronic payments or deposits directly into a bank account. Similar to the Direct Deposit form, it requires the individual's banking information, including the account number and routing number. Both forms are designed to streamline the payment process, allowing for quick and secure transfers of funds while ensuring that the individual has authorized the transactions.

The Payroll Deduction Authorization form also shares characteristics with the Generic Direct Deposit form. This document allows employees to authorize deductions from their paychecks for various purposes, such as health insurance or retirement savings. Like the Direct Deposit form, it requires the employee's personal information and signature. Both forms serve as a means of managing financial transactions related to employment, ensuring that the employee is aware of and agrees to the deductions being made.

The Health Savings Account (HSA) Contribution form is similar to the Generic Direct Deposit form in that it facilitates the management of funds. The HSA Contribution form allows employees to designate contributions to their health savings accounts directly from their paychecks. Both forms require the employee's banking information and signature to authorize the transactions. The aim is to ensure that contributions are made accurately and consistently, supporting the employee's financial planning for healthcare expenses.

The Flexible Spending Account (FSA) Enrollment form also parallels the Generic Direct Deposit form. This document allows employees to set aside pre-tax dollars from their paychecks to cover eligible medical expenses. Like the Direct Deposit form, it requires personal information and the employee's signature for authorization. Both forms play a role in managing the employee's financial benefits, ensuring that funds are allocated correctly for tax-advantaged spending.

Lastly, the Retirement Plan Enrollment form is akin to the Generic Direct Deposit form in its function of managing employee finances. This form allows employees to enroll in retirement savings plans, specifying how much they wish to contribute from their paychecks. Similar to the Direct Deposit form, it requires personal information and a signature to authorize the contributions. Both documents are integral to an employee's financial management, enabling them to plan for their future while ensuring that their preferences are accurately recorded and executed.

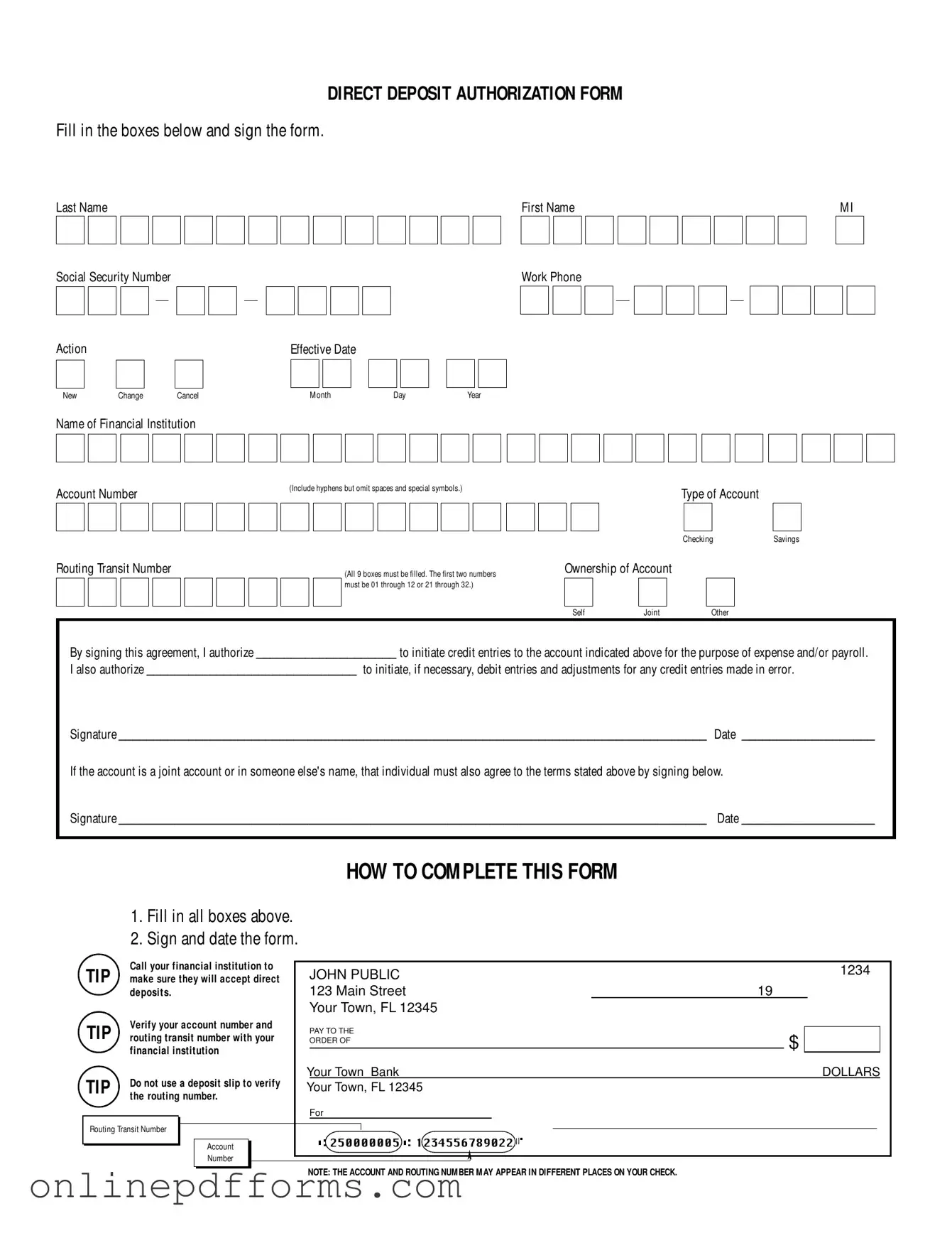

Steps to Filling Out Generic Direct Deposit

Completing the Generic Direct Deposit form is a straightforward process. Once you have filled out the form, you will be able to authorize your employer or financial institution to deposit funds directly into your bank account. This can streamline your payment process and ensure timely access to your funds.

- Fill in your last name, first name, and middle initial in the designated boxes.

- Enter your Social Security Number in the format of XXX-XX-XXXX.

- Select the action you wish to take: New, Change, or Cancel.

- Provide the effective date by entering the month, day, and year.

- Fill in your work phone number in the format of XXX-XXX-XXXX.

- Write the name of your financial institution in the appropriate box.

- Input your account number, including hyphens but omitting spaces and special symbols.

- Indicate the type of account by checking either Savings or Checking.

- Enter the routing transit number, ensuring all nine boxes are filled correctly. The first two digits must be between 01-12 or 21-32.

- Indicate the ownership of the account by checking the appropriate box: Self, Joint, or Other.

- Sign the form to authorize the credit entries to your account.

- Provide the date of your signature.

- If the account is a joint account, the other account holder must also sign and date the form.

Before submitting the form, consider verifying your account and routing numbers with your financial institution to avoid any errors. This small step can help ensure that your direct deposits are processed smoothly.