Blank Georgia Deed Form

Documents used along the form

When completing a property transaction in Georgia, several forms and documents are commonly used alongside the Georgia Deed form. Each of these documents plays a crucial role in ensuring a smooth transfer of property ownership. Understanding their purpose can help clarify the process.

- Property Transfer Tax Form: This form is required to report the transfer of real estate and calculate any applicable transfer taxes. It must be filed with the county tax office at the time of the deed recording.

- Affidavit of Consideration: This document provides details about the sale price of the property. It is often required to determine the tax implications of the transaction and verify that the stated amount reflects the true value of the property.

- Title Search Report: A title search report outlines the ownership history of the property. It identifies any liens, encumbrances, or claims against the property, ensuring that the seller has the right to transfer ownership.

- Closing Statement (HUD-1): This document itemizes all the costs associated with the real estate transaction. It provides a clear breakdown of fees, taxes, and other expenses that both the buyer and seller will incur during the closing process.

- Power of Attorney: In some cases, a power of attorney may be necessary to authorize someone to act on behalf of the buyer or seller during the transaction. This document allows designated individuals to sign documents and make decisions regarding the property transfer.

Each of these documents serves an important function in the property transfer process in Georgia. Ensuring that they are completed accurately and filed correctly can help avoid complications and facilitate a successful transaction.

Other Popular State-specific Deed Templates

New York State Deed Form - A written agreement facilitating the transition of property rights.

Ohio Warranty Deed Form - A Deed formally records the sale of residential or commercial property.

What Does a House Deed Look Like in Pa - A deed is a crucial element in real estate due diligence processes.

How Long Does It Take to Record a Deed in Florida - Deeds can reflect a variety of ownership types, from individual ownership to complex trust arrangements.

Similar forms

The Georgia Warranty Deed is similar to the Georgia Deed form in that both documents transfer ownership of real estate. A Warranty Deed, however, provides a guarantee that the seller holds clear title to the property and has the right to sell it. This means that if any issues arise regarding the title, the seller is responsible for resolving them. In contrast, the Georgia Deed form may not always include such guarantees, making it essential to understand the differences when transferring property.

The Quitclaim Deed is another document that shares similarities with the Georgia Deed form. Like the Georgia Deed, a Quitclaim Deed transfers ownership of property. However, it does not provide any warranties about the title. This means that if there are any claims or liens against the property, the new owner takes on those risks. Quitclaim Deeds are often used between family members or in divorce settlements, where trust between parties is higher.

The Special Warranty Deed also resembles the Georgia Deed form. Both documents are used to convey real estate, but the Special Warranty Deed only guarantees that the seller has not caused any title issues during their ownership. This means that while the seller provides some level of assurance, it does not cover any problems that may have existed before they acquired the property. This limited protection can be an important consideration for buyers.

The Bargain and Sale Deed is another type of deed that is similar to the Georgia Deed form. It transfers property without any warranties about the title. This means that while the seller is conveying their interest in the property, the buyer assumes the risk of any title defects. Bargain and Sale Deeds are often used in foreclosure sales or tax sales, where the seller may not have complete knowledge of the property's history.

The Grant Deed is also comparable to the Georgia Deed form. Both documents serve to transfer ownership of real estate, but a Grant Deed includes some assurances about the title. Specifically, it guarantees that the seller has not transferred the property to anyone else and that the property is free from undisclosed encumbrances. This added layer of protection can be beneficial for buyers, offering more confidence in their purchase.

The Trustee's Deed is another document that shares characteristics with the Georgia Deed form. It is used when a property is transferred by a trustee, often in the context of a trust or bankruptcy. While it serves the same purpose of transferring ownership, the Trustee's Deed may not provide the same level of warranty as other deeds. Buyers should be aware of this distinction when considering properties transferred through a trust.

The Deed of Trust is somewhat different but still related to the Georgia Deed form. It is used to secure a loan on real estate, involving three parties: the borrower, the lender, and a trustee. The property is transferred to the trustee until the loan is paid off. While this document does not transfer ownership in the same way as a Georgia Deed, it is an important part of the real estate transaction process and can affect ownership rights.

The Leasehold Deed, while primarily used for leasing property, shares some similarities with the Georgia Deed form. It conveys the right to use and occupy a property for a specified period. However, unlike a deed that transfers ownership, a Leasehold Deed only grants temporary rights. Understanding the differences between these documents is crucial for anyone involved in real estate transactions.

Lastly, the Affidavit of Title is not a deed but relates closely to the Georgia Deed form. This document is often used in conjunction with a deed to affirm the seller's ownership and the absence of any liens or claims against the property. While it doesn't transfer ownership itself, it provides essential information that can protect the buyer during the transaction process.

Steps to Filling Out Georgia Deed

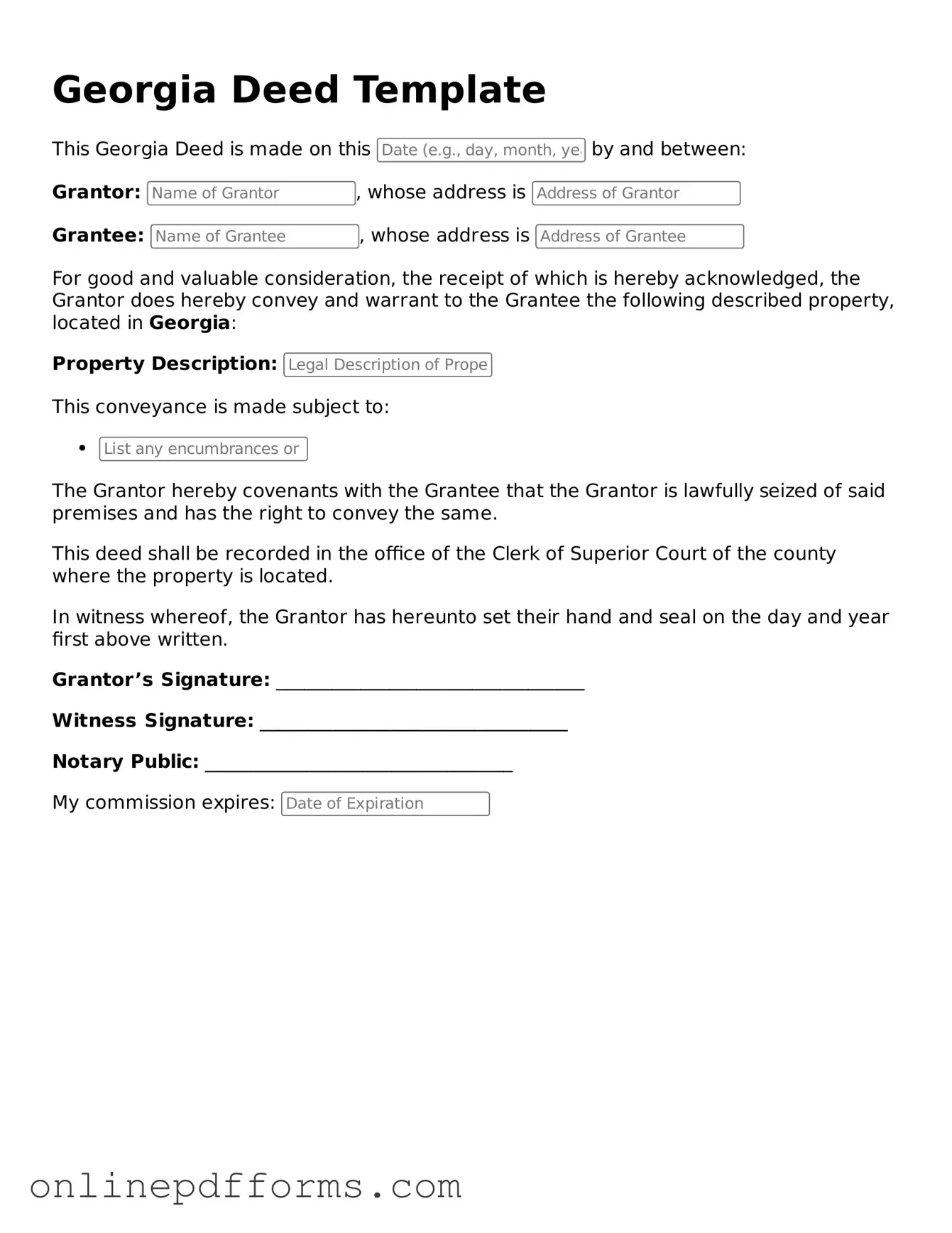

Once you have the Georgia Deed form in hand, it's important to fill it out accurately to ensure a smooth transfer of property. Follow these steps carefully to complete the form correctly.

- Begin by entering the date at the top of the form.

- Provide the names of the grantor(s) (the person or entity transferring the property). Include their full legal names.

- Next, list the names of the grantee(s) (the person or entity receiving the property). Again, use full legal names.

- Describe the property being transferred. This includes the address and any identifying information, such as a parcel number.

- Indicate the consideration amount, which is the price or value exchanged for the property.

- Sign the form where indicated. The grantor(s) must sign in front of a notary public.

- Have the form notarized. The notary will verify the identities of the signers and provide their seal.

- Finally, submit the completed deed to the appropriate county office for recording.

After filling out the form, ensure you keep a copy for your records. Recording the deed will make the transfer official and protect your ownership rights.