Blank Georgia Deed in Lieu of Foreclosure Form

Documents used along the form

When navigating the complexities of real estate transactions, particularly those involving foreclosure, several forms and documents are often utilized alongside the Georgia Deed in Lieu of Foreclosure. Each document serves a specific purpose in ensuring a smooth transition and protecting the interests of all parties involved.

- Loan Modification Agreement: This document outlines the new terms of a loan after negotiations between the borrower and lender. It may include changes to the interest rate, payment schedule, or loan duration.

- Notice of Default: A formal notification sent by the lender to the borrower, indicating that the borrower has failed to meet the obligations of the loan agreement, typically due to missed payments.

- Trailer Bill of Sale: This form is essential for confirming the ownership transfer of a trailer in Washington and can be accessed through https://billofsaleforvehicles.com.

- Foreclosure Complaint: This legal document initiates the foreclosure process. It is filed by the lender in court to seek a judgment against the borrower for defaulting on the mortgage.

- Release of Liability: This document releases the borrower from any further obligation on the mortgage once the deed in lieu is executed. It is crucial for protecting the borrower's credit after the transaction.

- Property Inspection Report: A report documenting the condition of the property prior to the transfer. It can identify any issues that need to be addressed before the deed is executed.

- Title Search Report: This report confirms the legal ownership of the property and identifies any liens or encumbrances that may affect the transfer of ownership.

- Settlement Statement: A detailed account of all costs and fees associated with the transaction, ensuring transparency for both parties regarding the financial aspects of the deed in lieu.

- Power of Attorney: In some cases, this document allows one party to act on behalf of another in legal or financial matters, facilitating the execution of the deed in lieu if the borrower is unable to be present.

Understanding these documents can empower individuals facing foreclosure to make informed decisions. Each piece plays a vital role in the process, ensuring that all parties are protected and that the transition is handled with care and respect.

Other Popular State-specific Deed in Lieu of Foreclosure Templates

Deed in Lieu of Foreclosure Template - Homeowners can demonstrate cooperation by willingly handing over the property to the lender.

A Deed in Lieu of Foreclosure - Homeowners should consider potential impacts on their future borrowing ability when opting for a Deed in Lieu.

In the process of purchasing a vehicle, having the correct documentation is essential, and understanding the significance of the Nevada Motor Vehicle Bill of Sale form is key. This form not only secures the transaction but also protects both parties involved. For those looking to ensure a smooth transfer of ownership, utilizing resources like Auto Bill of Sale Forms can be incredibly beneficial.

Deed in Lieu Vs Foreclosure - This option can help both parties—homeowner and lender—move forward in the aftermath of financial difficulty.

Deed in Lieu of Foreclosure Pa - A Deed in Lieu may absolve a borrower from further personal liability associated with the mortgage.

Similar forms

A similar document to the Georgia Deed in Lieu of Foreclosure is the Mortgage Release. This document allows a borrower to officially release the lender from any claims against the property, often after the mortgage has been paid off or settled. Just like a deed in lieu, a mortgage release signifies that the borrower has fulfilled their obligations, but it typically occurs after the borrower has sold the property or refinanced. Both documents serve to clarify ownership and eliminate any lingering debts associated with the property.

The Texas Motorcycle Bill of Sale form is a crucial document used to transfer ownership of a motorcycle from one party to another in Texas. This form protects both the buyer and seller by providing a clear record of the transaction. To ensure a smooth transfer, fill out the form by clicking the button below. For additional details, visit https://pdftemplates.info/texas-motorcycle-bill-of-sale-form.

Another comparable document is the Short Sale Agreement. In a short sale, the lender agrees to accept less than the full amount owed on the mortgage when the property is sold. Similar to a deed in lieu of foreclosure, a short sale aims to prevent foreclosure and minimize losses for both the lender and the borrower. Both options provide a way for homeowners to avoid the negative consequences of foreclosure, but they involve different processes and outcomes regarding property ownership.

The Forebearance Agreement also shares similarities with the Deed in Lieu of Foreclosure. This document allows borrowers to temporarily pause or reduce their mortgage payments due to financial hardship. While a deed in lieu transfers property ownership to the lender, a forbearance agreement keeps the borrower in their home, providing them time to recover financially. Both documents aim to address financial difficulties while offering solutions to avoid foreclosure.

Lastly, the Loan Modification Agreement is akin to the Deed in Lieu of Foreclosure. This document alters the original terms of a mortgage, often to make payments more manageable for the borrower. Like a deed in lieu, a loan modification can help prevent foreclosure by allowing the borrower to stay in their home while adjusting the loan terms. Both documents reflect the lender's willingness to work with the borrower to find a solution that benefits both parties and avoids the lengthy and costly foreclosure process.

Steps to Filling Out Georgia Deed in Lieu of Foreclosure

After completing the Georgia Deed in Lieu of Foreclosure form, you'll need to take a few additional steps to ensure everything is processed correctly. Make sure to review the form for accuracy, gather any necessary supporting documents, and then submit it to the appropriate parties. This will help facilitate the transfer of property ownership.

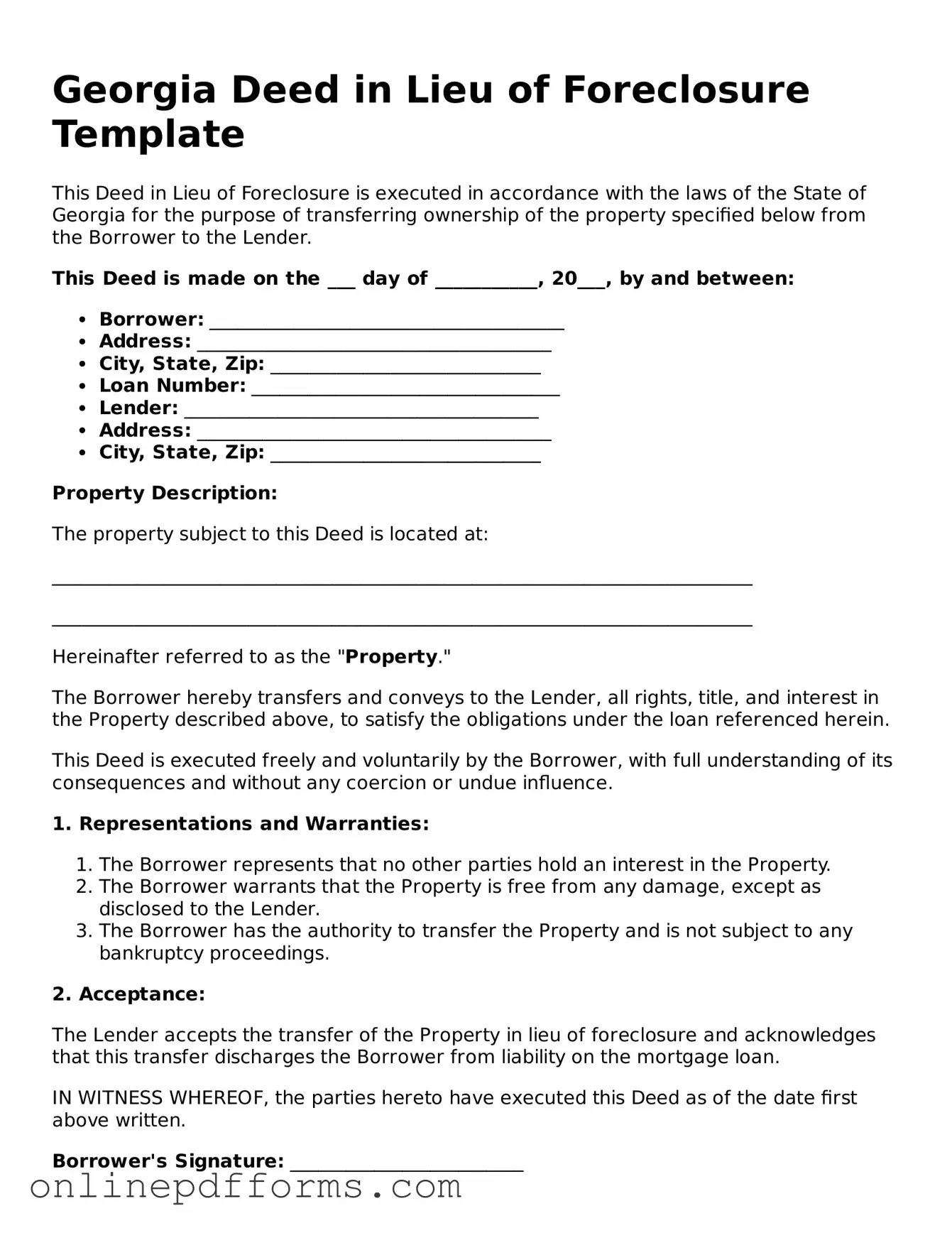

- Begin by downloading the Georgia Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the date at the top of the form.

- Provide the name and address of the borrower, ensuring that it matches the information on the mortgage documents.

- Enter the name and address of the lender or mortgage company.

- Clearly describe the property being transferred, including the street address and any legal description if available.

- Specify the reasons for the deed in lieu of foreclosure, if required.

- Sign the form in the designated area. Ensure that all required parties sign, including co-borrowers if applicable.

- Have the signatures notarized. This is often a requirement for the form to be valid.

- Make copies of the completed form for your records.

- Submit the original form to the lender and keep a record of the submission method and date.