Blank Georgia Durable Power of Attorney Form

Documents used along the form

A Durable Power of Attorney (DPOA) is a crucial legal document that allows an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf. In Georgia, there are several other forms and documents that often accompany a DPOA to ensure comprehensive planning for various situations. Below is a list of these important documents.

- Advance Healthcare Directive: This document allows individuals to specify their healthcare preferences in case they become unable to communicate their wishes. It can include instructions on medical treatment and appoint a healthcare agent to make decisions on their behalf.

- Vehicle Bill of Sale Forms: This document records the details of a motorcycle transaction, ensuring the sale is documented properly and legally binding. For more information, visit Vehicle Bill of Sale Forms.

- Living Will: A living will is a specific type of advance directive that outlines an individual's wishes regarding end-of-life care. It addresses whether to use life-sustaining treatments in situations where recovery is not possible.

- HIPAA Authorization: This form grants permission for healthcare providers to share an individual’s medical information with designated persons. It is essential for ensuring that the appointed agent can access necessary health information to make informed decisions.

- Will: A will is a legal document that outlines how an individual's assets will be distributed upon their death. It can also appoint guardians for minor children and address other important matters related to estate management.

Having these documents in place alongside a Durable Power of Attorney can provide peace of mind and ensure that an individual's wishes are respected in various circumstances. It is always advisable to consult with a legal professional to ensure that all documents are correctly prepared and executed according to Georgia law.

Other Popular State-specific Durable Power of Attorney Templates

Durable Power of Attorney Florida Pdf - This power does not end with your incapacitation, ensuring ongoing support.

When engaging in a motorcycle transaction in Arizona, it's important to utilize the Arizona Motorcycle Bill of Sale form, as it serves as a key document for transferring ownership and ensuring that both parties are protected. For more information on how to obtain this essential form, visit https://mypdfform.com/blank-arizona-motorcycle-bill-of-sale/.

Printable Financial Power of Attorney - Simplifying decision-making for your loved ones can greatly reduce emotional burdens during tough times.

Similar forms

The Georgia Durable Power of Attorney (DPOA) form is similar to a General Power of Attorney (GPOA). Both documents allow an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf. However, the key difference lies in durability. While a GPOA may become ineffective if the principal becomes incapacitated, a DPOA remains valid even if the principal loses the ability to make decisions. This feature makes the DPOA particularly useful for long-term planning and health care decisions.

Another document that shares similarities with the DPOA is the Healthcare Power of Attorney. This document specifically focuses on health care decisions. Like the DPOA, it allows an agent to make choices for the principal, but it is limited to medical and health-related matters. If a person becomes incapacitated, the Healthcare Power of Attorney grants the agent the authority to make decisions regarding treatment options, medical procedures, and end-of-life care, ensuring that the principal's health care preferences are honored.

The Living Will is another document closely related to the DPOA. While the DPOA appoints an agent to make decisions, a Living Will outlines the principal’s wishes regarding medical treatment in situations where they cannot communicate. This document provides guidance to health care providers and family members about the principal's preferences for life-sustaining treatments. Together, a Living Will and a DPOA can create a comprehensive approach to health care planning.

A Revocable Trust also bears similarities to the DPOA. Both documents allow for the management of assets, but they serve different purposes. A Revocable Trust is primarily used to manage and distribute assets during the principal's lifetime and after death, while a DPOA focuses on decision-making authority when the principal is incapacitated. However, both can help avoid probate and provide a clear plan for asset management.

The Advance Directive for Health Care is yet another document akin to the DPOA. This document combines the elements of a Living Will and a Healthcare Power of Attorney. It allows individuals to express their wishes regarding medical treatment and appoint an agent to make health care decisions on their behalf. The Advance Directive ensures that both the principal's preferences and the authority of an agent are clearly defined, offering a comprehensive approach to health care planning.

Another document that is comparable to the DPOA is the Financial Power of Attorney. This document specifically grants an agent the authority to manage the principal's financial affairs. While a DPOA can encompass both financial and health care decisions, a Financial Power of Attorney is focused solely on matters like banking, investments, and property management. This distinction is important for individuals looking to delegate financial responsibilities without involving health care decisions.

Exploring the various aspects of property law, understanding the "Quitclaim Deed" usage in real estate transactions can be crucial. It provides insights into how individuals transfer property interests without guarantees, which is particularly useful in personal matters. For more information on how to correctly utilize this form, visit this practical guide to Quitclaim Deed forms.

The Special Power of Attorney is also similar to the DPOA. This document allows the principal to grant specific powers to the agent for particular tasks or transactions. Unlike the DPOA, which provides broad authority, a Special Power of Attorney is limited to designated actions, such as selling a property or managing a specific investment. This can be useful for individuals who want to maintain control over their affairs while still delegating certain responsibilities.

Lastly, the Guardianship document is another legal tool that shares some characteristics with the DPOA. While a DPOA is created voluntarily by the principal, a Guardianship is typically established through court proceedings when an individual is deemed incapacitated and unable to make decisions. A guardian is appointed to make decisions on behalf of the individual. Although both aim to protect individuals who cannot manage their affairs, the process and level of control differ significantly.

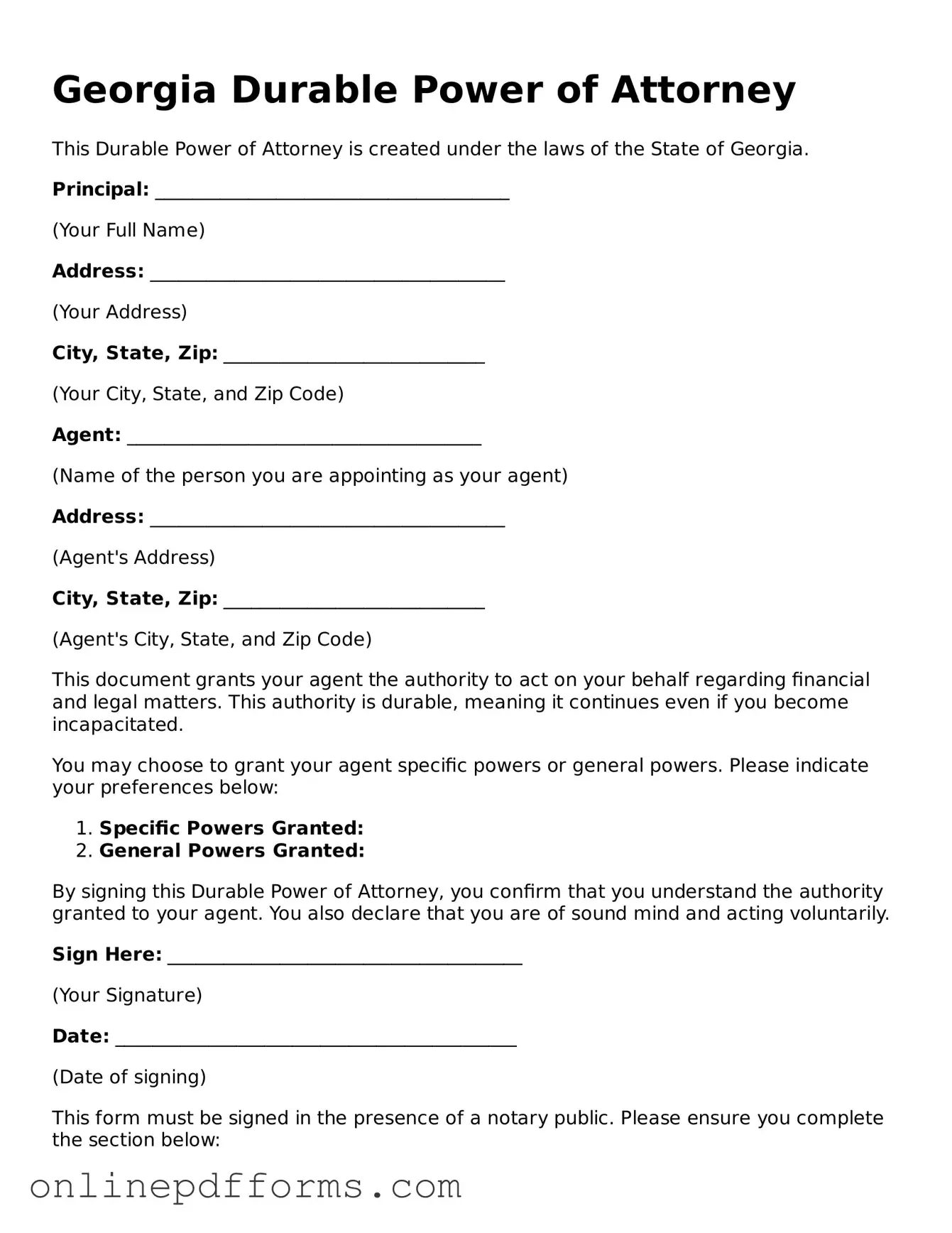

Steps to Filling Out Georgia Durable Power of Attorney

Filling out the Georgia Durable Power of Attorney form is an important step in designating someone to make decisions on your behalf in various matters. After you have completed the form, it will need to be signed and possibly notarized, depending on your specific needs and circumstances. Below are the steps to guide you through the process of filling out the form accurately.

- Begin by obtaining the Georgia Durable Power of Attorney form. You can find it online or request a copy from a legal professional.

- Carefully read through the entire form to understand the sections and requirements.

- In the first section, enter your full name and address. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. Ensure that this person is trustworthy and capable of handling your affairs.

- Specify the powers you wish to grant to your agent. You can choose broad powers or limit them to specific areas, such as financial decisions or healthcare matters.

- Indicate whether the powers granted will begin immediately or if they will only become effective upon a certain event, such as your incapacitation.

- Include any additional instructions or limitations you want to impose on your agent's authority.

- Sign and date the form in the designated area. Your signature should be witnessed by at least one person, and it may need to be notarized to be legally valid.

- Provide copies of the completed form to your agent and any relevant institutions, such as banks or healthcare providers.