Blank Georgia Employment Verification Form

Documents used along the form

When completing the Georgia Employment Verification form, several other documents may be required to provide additional context or support. These documents help clarify employment status, income, and other relevant details. Here is a list of commonly used forms and documents:

- Pay Stubs: Recent pay stubs serve as proof of income and employment. They show the employee's earnings and deductions for a specific pay period.

- RV Bill of Sale: This document serves as proof of the transaction between the buyer and seller when an RV is sold in South Carolina. For more information, visit https://billofsaleforvehicles.com/.

- W-2 Forms: These forms summarize an employee's annual wages and taxes withheld. They are essential for verifying income over the past year.

- Tax Returns: Personal tax returns can provide a comprehensive view of an individual’s financial situation, including income from various sources.

- Employment Offer Letters: These letters outline the terms of employment, including job title, salary, and start date, confirming the individual's employment status.

- Job Descriptions: Detailed job descriptions can clarify the roles and responsibilities associated with the position held by the employee.

- Letters of Recommendation: These letters can provide insight into the employee's work ethic and performance from previous employers or supervisors.

- Direct Deposit Authorizations: This document shows how an employee receives their pay, confirming ongoing employment and financial transactions.

- State Identification: A valid state ID or driver’s license may be required to verify the identity of the employee and match it with employment records.

Gathering these documents can streamline the verification process and ensure all necessary information is readily available. This approach helps both employers and employees navigate employment verification efficiently.

Other Popular State-specific Employment Verification Templates

Check Employment - Proof of employment can enhance a candidate’s standing in competitive job markets.

Sample Employment Verification Letter - Previous employers may take time to respond, so early submission is advised.

The Texas Motor Vehicle Power of Attorney form is crucial for anyone needing assistance with vehicle transactions when they cannot personally manage their affairs. This legal document not only facilitates various motor vehicle dealings but also ensures seamless management of responsibilities, allowing for a smoother process. For those interested in acquiring or completing this form, more information can be found at pdftemplates.info/texas-motor-vehicle-power-of-attorney-form/.

Texas Work Verification Letter - It may also include the responsibilities of the employee and achievements during employment.

Uscis Form I-9 - Often needed when applying for professional licenses.

Similar forms

The I-9 form, officially known as the Employment Eligibility Verification form, is a document used by employers in the United States to verify the identity and employment authorization of individuals hired for employment. Like the Georgia Employment Verification form, the I-9 requires information about the employee's identity, such as name, address, and social security number. Both forms aim to confirm that the employee is legally allowed to work in the U.S. The I-9 also necessitates supporting documentation, which must be presented by the employee, similar to the requirements of the Georgia form.

In addition to the various employment verification forms discussed, it is essential for those involved in motorcycle transactions to have a clear understanding of the necessary documentation. A critical element in such transactions is the Auto Bill of Sale Forms, which ensures that both buyers and sellers have a legal record of the motorcycle's sale and the transfer of ownership, preserving the integrity and legality of the exchange.

The W-2 form, or Wage and Tax Statement, is another document that shares similarities with the Georgia Employment Verification form. While the W-2 is primarily used for tax reporting purposes, it also contains essential information about an employee's earnings and tax withholdings. Both forms require accurate employee information, including name and social security number. Employers use the W-2 to report wages paid to employees, while the Georgia form serves to verify employment status, making both documents crucial in the employment lifecycle.

The Social Security Administration (SSA) form, used for reporting wages and earnings, also bears similarities to the Georgia Employment Verification form. This form is essential for ensuring that employees' earnings are accurately recorded for Social Security benefits. Both documents require personal identification details and serve to confirm an employee's work status. The SSA form, like the Georgia form, plays a role in maintaining accurate employment records, which are vital for tax and benefit purposes.

The Federal Employment Verification form (E-Verify) is an electronic system that allows employers to confirm an employee's eligibility to work in the United States. Similar to the Georgia Employment Verification form, E-Verify requires information about the employee's identity and work authorization. Both processes aim to prevent unauthorized employment and ensure compliance with federal laws. While the Georgia form is often used at the state level, E-Verify operates on a national scale, providing a comprehensive approach to employment verification.

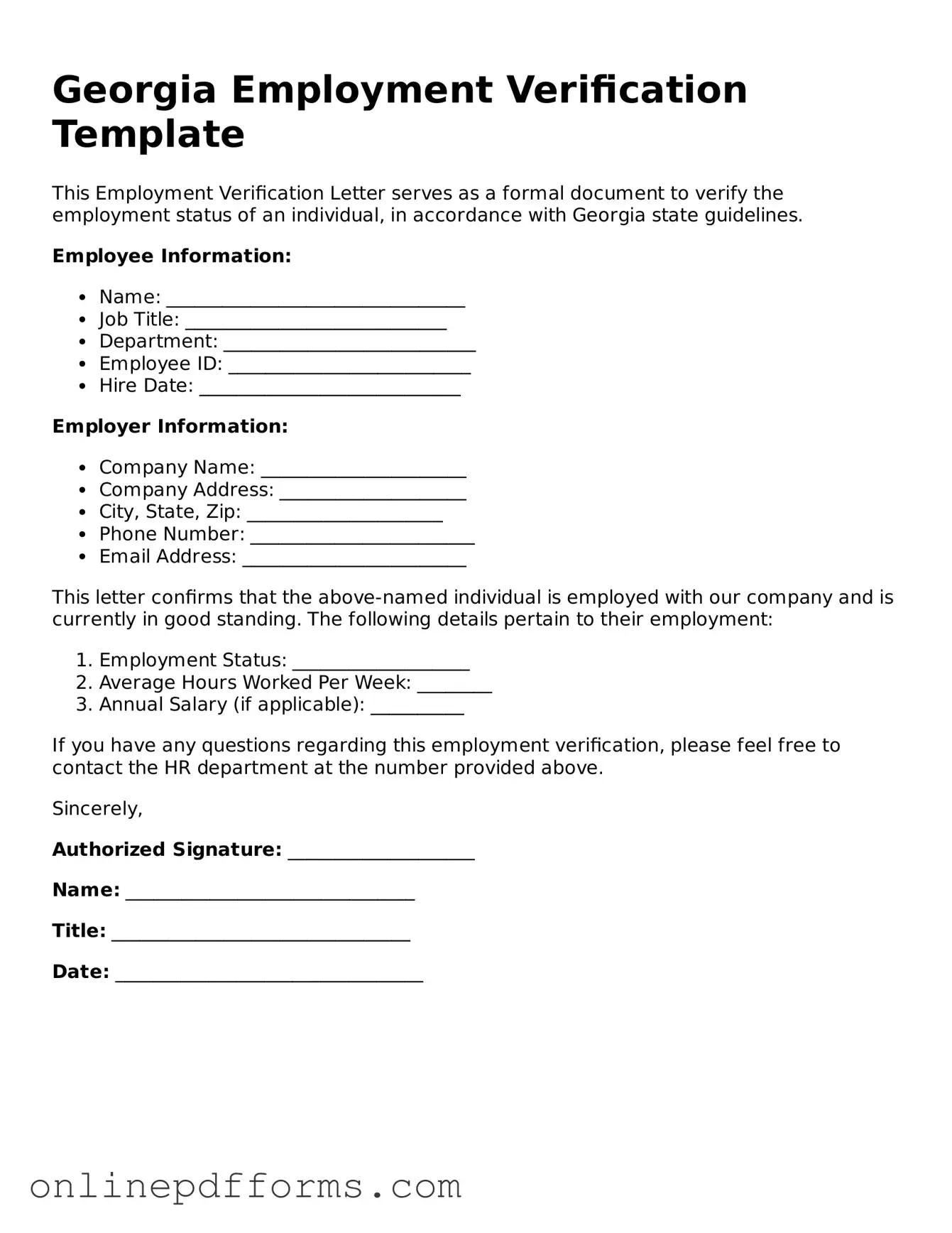

Steps to Filling Out Georgia Employment Verification

Completing the Georgia Employment Verification form requires attention to detail. After filling out the form, it is typically submitted to the appropriate agency or employer for processing. Ensure that all information is accurate to avoid delays.

- Obtain the Georgia Employment Verification form from the appropriate source, such as your employer or the official website.

- Read through the form carefully to understand the required information.

- Fill in your personal details, including your full name, address, and contact information.

- Provide your employment details, including your job title, start date, and current employment status.

- Include the name and contact information of your employer or human resources representative.

- Sign and date the form to certify that the information provided is true and accurate.

- Review the completed form for any errors or omissions.

- Submit the form to the designated recipient, either by mail, email, or in person, as instructed.