Blank Georgia Gift Deed Form

Documents used along the form

The Georgia Gift Deed form is a crucial document for individuals wishing to transfer property as a gift without the expectation of payment. However, several other forms and documents often accompany the Gift Deed to ensure a smooth and legally sound transaction. Below is a list of these related documents, each serving a specific purpose in the gifting process.

- Affidavit of Gift: This document provides a sworn statement confirming that the transfer of property is indeed a gift and not a sale. It helps clarify the donor's intent and can be important for tax purposes.

- Property Deed: This is the official record that outlines ownership of the property. A new deed may need to be created to reflect the change in ownership from the donor to the recipient.

- Title Search Report: Conducting a title search ensures that the property is free of liens or encumbrances. This report is vital for the recipient to confirm clear ownership before accepting the gift.

- Gift Tax Return (Form 709): If the value of the gift exceeds the annual exclusion limit, the donor may need to file this federal tax form to report the gift to the IRS.

- Quitclaim Deed: In some cases, a quitclaim deed may be used to transfer ownership. This document releases any claim the donor has to the property, effectively transferring rights to the recipient.

- Power of Attorney: If the donor is unable to sign the Gift Deed personally, a Power of Attorney can authorize another individual to act on their behalf during the transfer process.

- Georgia RV Bill of Sale Form: This document is vital for transferring ownership of recreational vehicles in Georgia, ensuring a clear record of the sale. For more details, refer to Auto Bill of Sale Forms.

- Letter of Intent: This informal document outlines the donor’s intentions regarding the gift. While not legally binding, it can provide clarity on the terms and conditions of the gift.

- Transfer Tax Declaration: Some jurisdictions require this form to report the transfer of property and any associated taxes. It helps local authorities assess tax obligations related to the transfer.

- Beneficiary Designation Form: If the property is part of a trust or estate plan, this form specifies who will receive the property upon the donor's passing, ensuring clarity in future ownership.

Each of these documents plays a role in facilitating a successful property transfer under Georgia law. Understanding their functions can help both donors and recipients navigate the gifting process more effectively.

Other Popular State-specific Gift Deed Templates

Texas Gift Deed Pdf - Once the Gift Deed is executed, the rights to the property shift completely to the recipient.

For those looking to purchase a mobile home, having a reliable document is vital. The necessary Mobile Home Bill of Sale template ensures all aspects of the transfer are properly recorded, safeguarding both the buyer's and seller's interests in the transaction.

How Much Does It Cost to Transfer Property Deeds? - This document can facilitate smooth transfers in family-owned businesses or properties.

Similar forms

The Warranty Deed is a document that transfers ownership of real property from one party to another. Like the Gift Deed, it provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. However, while a Warranty Deed involves a sale or exchange, a Gift Deed is specifically for transferring property without compensation. Both documents require the signature of the grantor and may need to be notarized to be legally binding.

The Quitclaim Deed serves a different purpose but shares some similarities with the Gift Deed. It transfers whatever interest the grantor has in the property without any warranties. This means the grantee receives no guarantees about the title. A Quitclaim Deed can be used in situations where the property is gifted, but it lacks the formal assurance of ownership that a Gift Deed provides. Both documents can be executed without a monetary exchange.

The Bargain and Sale Deed is another document that can be compared to the Gift Deed. This type of deed implies that the grantor has title to the property and the right to sell it, but it does not guarantee that the title is free of defects. While a Gift Deed conveys property without payment, a Bargain and Sale Deed typically involves a transaction. Both documents require the grantor's signature and can be recorded with the county clerk.

If you are considering creating a legal document that outlines your wishes regarding the distribution of your assets and guardianship of minors, you may find it beneficial to utilize resources available online. One helpful tool is the Arizona Last Will and Testament form, which can guide you through the necessary steps. For more information on this essential document, visit https://arizonaformspdf.com/ where you can begin the process of ensuring that your final wishes are legally recognized.

The Special Warranty Deed provides a middle ground between a Warranty Deed and a Quitclaim Deed. It guarantees that the grantor has not encumbered the property during their ownership but does not cover any issues that may have existed before their ownership. In contrast to a Gift Deed, which is a no-cost transfer, a Special Warranty Deed often involves some form of consideration. Both documents require notarization and can be recorded for public notice.

The Deed of Trust is often used in real estate transactions involving loans. While it serves a different function—securing a loan by placing a lien on the property—it shares the commonality of being a legal document that involves property transfer. A Gift Deed, on the other hand, involves the transfer of property without financial exchange. Both documents need to be executed and may require notarization, but their purposes diverge significantly.

Finally, the Leasehold Deed is related to property rights but differs in nature. This document grants a tenant the right to occupy and use a property for a specified time in exchange for rent. While a Gift Deed transfers ownership without payment, a Leasehold Deed involves a contractual relationship with financial obligations. Both documents require signatures and can be recorded, but they serve different purposes in the realm of property rights.

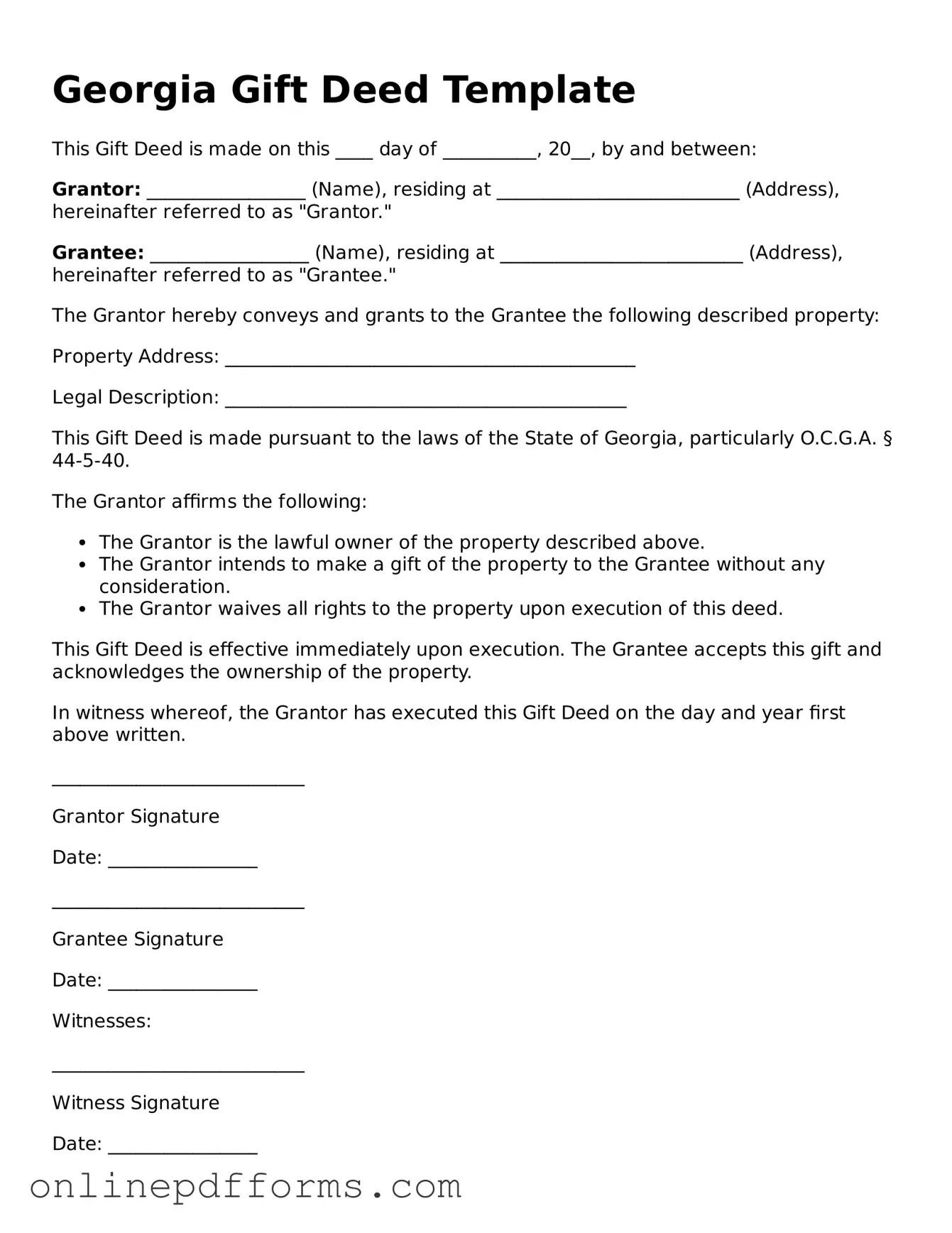

Steps to Filling Out Georgia Gift Deed

Once you have the Georgia Gift Deed form in hand, you can begin the process of completing it. This form is essential for transferring property as a gift from one individual to another without any exchange of money. After filling out the form, you will need to sign it in front of a notary public and then file it with the appropriate county office.

- Begin by entering the full names of the grantor (the person giving the gift) and the grantee (the person receiving the gift) at the top of the form.

- Provide the complete address of the property being gifted. This should include the street address, city, county, and zip code.

- Next, describe the property in detail. This may include the type of property, its size, and any identifying features, such as parcel numbers.

- Indicate the relationship between the grantor and the grantee. This could be a family member, friend, or other relationship.

- Fill in the date on which the gift is being made.

- Both the grantor and grantee should sign the form. Make sure to do this in the presence of a notary public.

- After notarization, make a copy of the completed form for your records.

- Finally, submit the original signed and notarized form to the local county clerk's office where the property is located.