Blank Georgia Loan Agreement Form

Documents used along the form

When entering into a loan agreement in Georgia, several other forms and documents often accompany the main loan agreement. These documents help clarify the terms of the loan, protect the interests of both parties, and ensure compliance with state regulations. Below is a list of commonly used documents alongside the Georgia Loan Agreement form.

- Promissory Note: This is a written promise from the borrower to repay the loan under specified terms. It outlines the loan amount, interest rate, repayment schedule, and consequences of default.

- Security Agreement: If the loan is secured by collateral, this document details the collateral and the rights of the lender in case of default. It provides legal assurance to the lender regarding the asset.

- Loan Disclosure Statement: This document provides essential information about the loan, including the total cost, interest rates, and any fees. It ensures transparency and helps borrowers make informed decisions.

- Personal Guarantee: In some cases, lenders may require a personal guarantee from a third party. This document holds the guarantor responsible for the loan if the borrower defaults.

- Motor Vehicle Bill of Sale: When buying or selling a vehicle, it's essential to complete a Motor Vehicle Bill of Sale, which serves as proof of the transaction and includes details about the vehicle's condition and price. For more information, you can refer to Auto Bill of Sale Forms.

- Amortization Schedule: This schedule outlines each payment's breakdown over the life of the loan, showing how much goes toward principal and interest. It helps borrowers understand their repayment obligations.

- Loan Modification Agreement: If the terms of the loan change after the agreement is signed, this document formalizes those changes. It may include adjustments to the interest rate, payment schedule, or loan amount.

- Default Notice: If a borrower fails to make payments, this document serves as a formal notification of default. It typically outlines the next steps the lender may take, including potential legal action.

- Release of Lien: Once the loan is fully repaid, this document is issued to confirm that the lender has released any claims against the collateral. It clears the borrower's title and signifies the end of the loan obligation.

Understanding these accompanying documents is crucial for both borrowers and lenders. Each serves a specific purpose and contributes to the overall clarity and security of the loan transaction. Properly managing these documents can help avoid disputes and ensure a smoother lending process.

Other Popular State-specific Loan Agreement Templates

Illinois Promissory Note - A written Loan Agreement can facilitate smoother transactions compared to oral agreements.

Understanding the implications of receiving the Texas Notice to Quit form is essential for tenants, as it outlines their responsibilities and the subsequent steps they must take to either vacate the property or remedy any lease violations. This formal notice marks a critical juncture in the eviction process and emphasizes the importance of adhering to the specified timeframes. It is advisable for tenants to familiarize themselves with the details of the document to ensure compliance; you can read more about the document for comprehensive guidance.

Promissory Note Template New York - Understanding the loan agreement's terms can protect both parties' interests.

Similar forms

The Georgia Loan Agreement form shares similarities with the Promissory Note. Both documents outline the terms under which a borrower agrees to repay a lender. A Promissory Note is typically more straightforward, focusing primarily on the borrower's promise to repay the loan amount, along with any interest. In contrast, the Georgia Loan Agreement often includes additional details such as repayment schedules, default conditions, and the rights of both parties, making it more comprehensive in nature.

Another document that resembles the Georgia Loan Agreement is the Mortgage Agreement. While the Loan Agreement outlines the terms of the loan itself, the Mortgage Agreement secures the loan with collateral—usually the property being financed. This means that if the borrower defaults, the lender has the right to take possession of the property. Both documents work together to ensure the lender's interests are protected while providing the borrower with necessary financing.

The Security Agreement is also akin to the Georgia Loan Agreement. This document specifies the collateral that secures a loan. In situations where personal property is used as collateral, the Security Agreement details what items are at stake. While the Georgia Loan Agreement may reference the collateral, the Security Agreement goes into greater detail about the rights and obligations concerning that collateral, ensuring both parties understand their responsibilities.

Similar to the Georgia Loan Agreement is the Loan Disclosure Statement. This document is designed to inform borrowers about the terms of the loan, including interest rates, fees, and the total cost of borrowing. While the Loan Agreement formalizes the terms, the Disclosure Statement serves as a summary that helps borrowers make informed decisions. It is an essential tool for transparency and consumer protection.

The Credit Agreement is another document that parallels the Georgia Loan Agreement. Typically used in business financing, a Credit Agreement outlines the terms under which a lender provides credit to a borrower. It includes details such as credit limits, interest rates, and repayment terms. Like the Georgia Loan Agreement, it establishes a legal framework for the lending relationship, ensuring both parties are aware of their obligations.

The Installment Agreement bears resemblance to the Georgia Loan Agreement as well. This document outlines the repayment terms for a loan that is paid back in installments over time. It specifies the amount of each payment, the frequency of payments, and the total duration of the loan. Both agreements aim to clarify the repayment process, although the Installment Agreement is specifically focused on the payment structure.

Understanding various legal documents is crucial in real estate transactions, and one such document is the Texas Quitclaim Deed. This form facilitates the transfer of property without warranty, making it especially relevant for situations involving unclear titles or transfers between acquaintances. Adequate knowledge of the Quitclaim Deed ensures a seamless transfer of ownership; for more information, visit https://pdftemplates.info/texas-quitclaim-deed-form/.

The Loan Modification Agreement also shares characteristics with the Georgia Loan Agreement. This document is used when the terms of an existing loan need to be changed, such as adjusting the interest rate or extending the repayment period. Like the Georgia Loan Agreement, it requires mutual consent from both parties and formalizes the new terms, ensuring that both the lender and borrower are clear on the revised conditions.

The Forbearance Agreement is another document that can be compared to the Georgia Loan Agreement. This agreement is used when a lender allows a borrower to temporarily stop making payments or to make reduced payments. It outlines the terms of the forbearance period, including how the missed payments will be handled afterward. Both agreements aim to provide a clear understanding of the borrower’s obligations, especially during challenging financial times.

Lastly, the Lease Agreement can be likened to the Georgia Loan Agreement in certain contexts, particularly when financing is involved in leasing property. A Lease Agreement outlines the terms under which one party rents property from another. It includes payment terms, duration, and responsibilities. When a loan is taken to finance a lease, the Loan Agreement would detail the financing terms, while the Lease Agreement governs the rental terms, creating a comprehensive understanding of both financial and occupancy responsibilities.

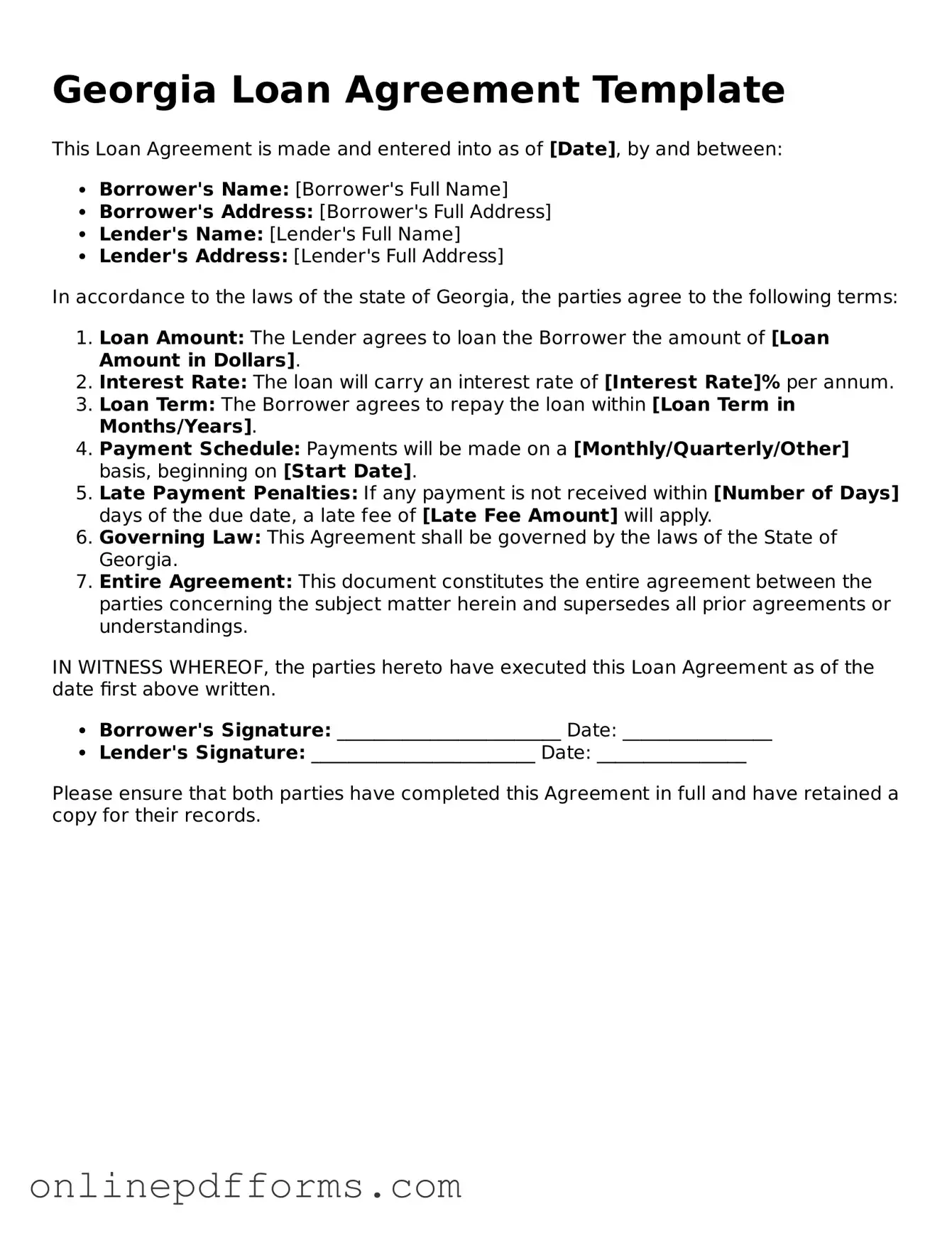

Steps to Filling Out Georgia Loan Agreement

Filling out the Georgia Loan Agreement form is an essential step in formalizing a loan between parties. The process is straightforward, but attention to detail is crucial to ensure all necessary information is accurately provided. Follow these steps to complete the form correctly.

- Begin with the date at the top of the form. Write the month, day, and year when the agreement is being signed.

- Identify the lender. Fill in the full name and address of the person or entity providing the loan.

- Next, enter the borrower's information. Include the full name and address of the individual or business receiving the loan.

- Specify the loan amount. Clearly state the total sum being borrowed, ensuring it is written in both numerical and word form for clarity.

- Outline the interest rate. Indicate the percentage rate that will apply to the loan, and clarify whether it is fixed or variable.

- Define the repayment terms. Specify the duration of the loan and the frequency of payments (e.g., monthly, quarterly).

- Include any collateral information if applicable. Describe any assets that will secure the loan.

- Detail any fees associated with the loan. Mention origination fees or any other costs that may be incurred.

- Provide space for signatures. Both the lender and borrower should sign and date the form to validate the agreement.

After completing the form, review it carefully to ensure all information is accurate and complete. Both parties should retain a copy for their records. This helps maintain clarity and accountability throughout the loan period.