Blank Georgia Operating Agreement Form

Documents used along the form

When forming a limited liability company (LLC) in Georgia, an Operating Agreement is a key document that outlines the management structure and operating procedures of the business. However, several other forms and documents often accompany the Operating Agreement to ensure compliance with state laws and to clarify the roles and responsibilities of the members. Here’s a list of commonly used documents that may be required or beneficial for LLCs in Georgia:

- Articles of Organization: This is the foundational document that officially establishes the LLC with the state. It includes basic information such as the name of the LLC, its registered agent, and the purpose of the business.

- Operating Agreement: While already mentioned, it’s worth noting that this document outlines the internal governance of the LLC, including member roles, profit sharing, and procedures for decision-making.

- Member Consent Forms: These forms are used to document decisions made by members, especially for significant actions such as admitting new members or changing the Operating Agreement.

- Vehicle Bill of Sale: If you are involved in the sale of an all-terrain vehicle, it is essential to use the Vehicle Bill of Sale Forms to ensure a legal transfer of ownership.

- Initial Resolutions: This document records the initial decisions made by the members at the formation of the LLC, such as appointing officers or approving the Operating Agreement.

- Business Licenses and Permits: Depending on the nature of the business, specific licenses or permits may be required to operate legally in Georgia. These can vary widely based on industry.

- Employer Identification Number (EIN): This is a federal tax ID number required for tax purposes. It is essential for opening a business bank account and hiring employees.

- Bank Resolution: This document authorizes specific individuals to open and manage the LLC's bank accounts, ensuring that financial transactions are conducted properly.

- Annual Reports: While not always required, submitting an annual report helps maintain good standing with the state and provides updated information about the LLC.

These documents collectively help establish a solid foundation for your LLC, ensuring that all members are on the same page and that the business complies with legal requirements. It is advisable to consult with a legal professional to ensure that all necessary forms are completed accurately and in a timely manner.

Other Popular State-specific Operating Agreement Templates

How to Create an Operating Agreement for an Llc - It may include provisions for the sale of a member's interest.

Operating Agreement Llc Florida Sample - The Operating Agreement is beneficial during potential legal evaluations.

For those interested in the process of selling agricultural machinery, the essential form for a Tractor Bill of Sale is crucial. This document facilitates a smooth transfer of ownership, ensuring all necessary information is accurately recorded. To learn more, visit the guidelines for a Tractor Bill of Sale.

File for Llc - An Operating Agreement allows for tailored rules that fit your business.

Similar forms

The Georgia Operating Agreement is similar to the Limited Liability Company (LLC) Articles of Organization. Both documents are essential for establishing an LLC in Georgia. While the Articles of Organization serve as the official formation document filed with the state, the Operating Agreement outlines the internal workings and management structure of the LLC. This agreement specifies the roles of members, decision-making processes, and how profits and losses are distributed, providing clarity and guidance for the members involved.

Another document comparable to the Georgia Operating Agreement is the Partnership Agreement. Like the Operating Agreement, a Partnership Agreement details the relationships and responsibilities among partners in a business. It addresses issues such as profit sharing, decision-making authority, and the procedure for adding or removing partners. Both documents aim to prevent disputes by clearly defining expectations and roles within the business structure.

When dealing with the sale or purchase of a trailer, it's essential to have the right documentation in place, such as the Texas Trailer Bill of Sale form, which provides a formal record of the transaction. This vital document ensures that the ownership of the trailer is properly transferred and serves to eliminate any potential misunderstandings between the buyer and seller. For those looking for comprehensive solutions regarding vehicle sales, resources like Auto Bill of Sale Forms can be invaluable in ensuring that all legal requirements are met effectively.

The Corporate Bylaws share similarities with the Georgia Operating Agreement in that they both govern the internal operations of a business entity. Corporate Bylaws are used for corporations and outline the rules for managing the corporation, including the responsibilities of officers and directors. Just as the Operating Agreement provides a framework for LLCs, Bylaws serve to ensure that corporate governance is conducted smoothly and in accordance with established procedures.

A Shareholders' Agreement is another document that bears resemblance to the Georgia Operating Agreement. This agreement is used by corporations to outline the rights and obligations of shareholders. Similar to how the Operating Agreement addresses the interests of LLC members, the Shareholders' Agreement focuses on issues like share transferability, voting rights, and the management of the corporation, ensuring that all shareholders are on the same page.

The Joint Venture Agreement is akin to the Georgia Operating Agreement, especially when two or more parties come together for a specific business purpose. This agreement outlines the terms of the joint venture, including the contributions of each party, profit-sharing arrangements, and management responsibilities. Both documents serve to clarify the expectations and duties of the parties involved, thereby reducing the potential for misunderstandings.

The Employment Agreement can also be compared to the Georgia Operating Agreement in that it establishes the terms of the relationship between an employer and employee. While the Operating Agreement focuses on the management of the business entity, the Employment Agreement outlines job responsibilities, compensation, and other employment conditions. Both documents aim to provide a clear understanding of roles and expectations, which is crucial for maintaining a harmonious working environment.

Finally, the Non-Disclosure Agreement (NDA) shares some similarities with the Georgia Operating Agreement in terms of protecting sensitive information. While the Operating Agreement governs the internal operations of an LLC, an NDA ensures that confidential information shared between parties remains protected. Both documents are essential in fostering trust and security within business relationships, allowing members and partners to engage openly without fear of unauthorized disclosure.

Steps to Filling Out Georgia Operating Agreement

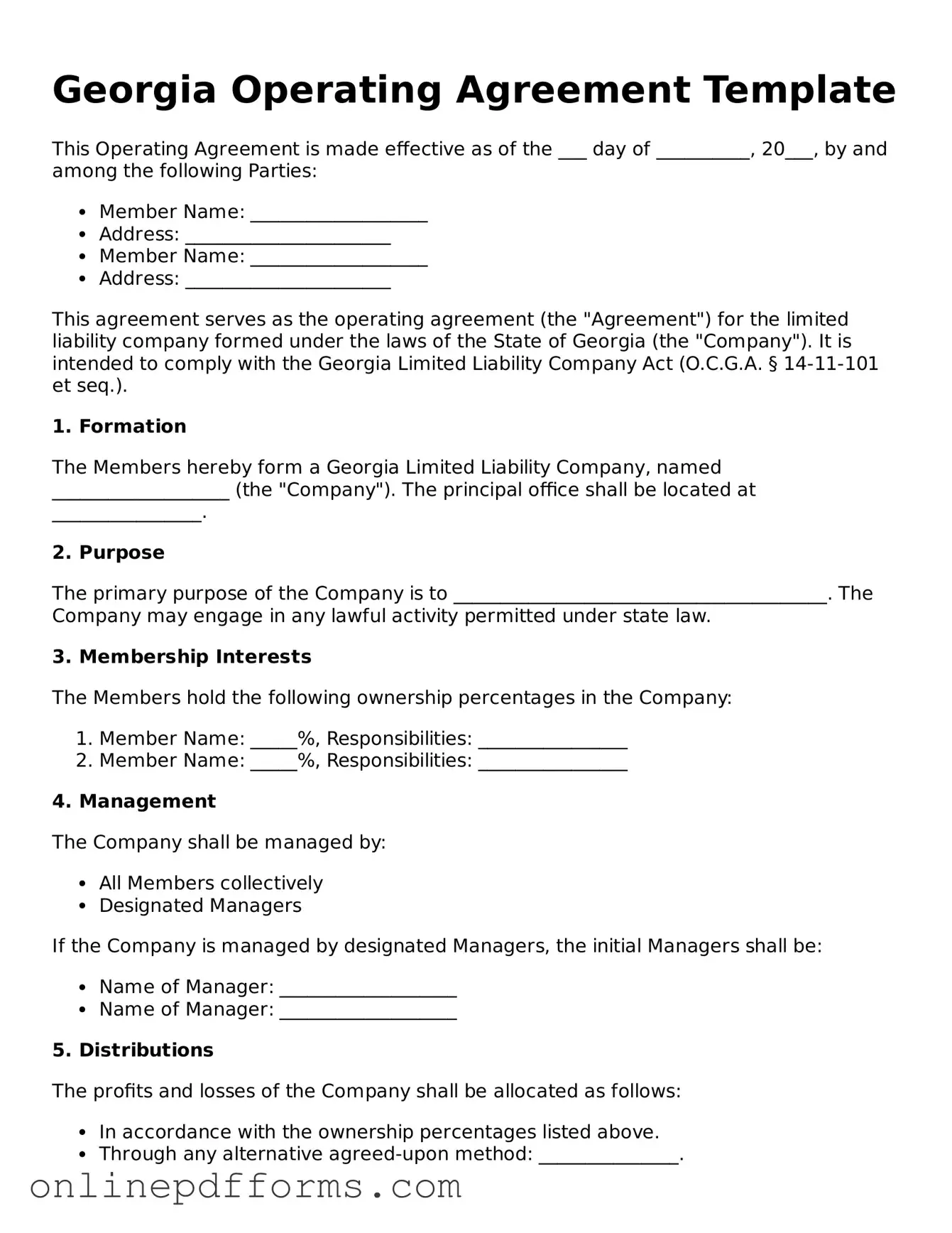

Once you have the Georgia Operating Agreement form, you will need to complete it accurately to ensure compliance with state requirements. Follow these steps carefully to fill out the form correctly.

- Begin by entering the name of your LLC at the top of the form. Ensure the name matches the one registered with the state.

- Provide the principal office address of the LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Include their roles and ownership percentages.

- Outline the purpose of the LLC. Be clear and concise about the business activities it will engage in.

- Specify the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Detail the voting rights of each member. Clarify how decisions will be made within the LLC.

- Include provisions for adding or removing members. State the process for handling changes in membership.

- Address profit and loss distribution. Clearly state how profits and losses will be allocated among members.

- Sign and date the form. All members should sign to indicate their agreement to the terms outlined.