Blank Georgia Promissory Note Form

Documents used along the form

When dealing with a Georgia Promissory Note, several other documents may be needed to support the transaction and clarify the terms. Each of these documents plays a crucial role in ensuring that both parties understand their rights and obligations. Below is a list of commonly used forms and documents that accompany the Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured, this agreement specifies the collateral that backs the loan, detailing the rights of the lender in case of default.

- Personal Guarantee: This document may be required if a business is borrowing money. It holds an individual personally responsible for the debt if the business fails to repay.

- ATV Bill of Sale: This document serves as proof of purchase and establishes the new ownership of an all-terrain vehicle. For those interested in buying or selling an ATV, completing this form is essential. You can find the template for the transaction at 4 Wheeler Bill of Sale.

- Disclosure Statement: This statement provides borrowers with important information about the loan, including total costs, fees, and the annual percentage rate (APR).

- Amortization Schedule: This table breaks down each payment, showing how much goes toward interest and how much goes toward the principal over the life of the loan.

- Default Notice: This document informs the borrower of any missed payments and outlines the potential consequences of defaulting on the loan.

- Release of Liability: Once the loan is paid off, this document releases the borrower from any further obligations and confirms that the debt has been satisfied.

- Payment Receipt: A simple acknowledgment that a payment has been made, which serves as proof of payment for both parties.

Having these documents in place can help prevent misunderstandings and provide clarity throughout the lending process. Each form serves a specific purpose, ensuring that both the lender and borrower are protected and informed.

Other Popular State-specific Promissory Note Templates

New York Promissory Note Requirements - Careful record-keeping is essential when handling multiple promissory notes to track obligations.

An Arizona Deed form is a legal document used to transfer ownership of real property from the current owner (grantor) to a new owner (grantee). This document outlines the specifics of the transaction, including a description of the property, the sale price, and the names of both parties involved. For those interested in acquiring or transferring property in Arizona, completing this form is an essential first step. For more information and to begin the process, visit https://arizonaformspdf.com/.

Promissory Note Form California - A promissory note can be used for personal loans, business loans, or any other borrowing arrangement.

Similar forms

A Georgia Promissory Note is similar to a Loan Agreement, which outlines the terms and conditions under which a borrower receives funds from a lender. Both documents specify the loan amount, interest rate, repayment schedule, and the responsibilities of each party. While a promissory note serves as a promise to pay, a loan agreement often includes additional clauses regarding default, collateral, and other legal considerations, providing a more comprehensive framework for the loan transaction.

Another document akin to the Georgia Promissory Note is a Mortgage Agreement. This document secures a loan by using real property as collateral. Like a promissory note, it details the amount borrowed and the repayment terms. However, a mortgage agreement also includes provisions for foreclosure in the event of non-payment, making it a more complex legal instrument that protects the lender’s interests in the property.

A Personal Guarantee is another document that shares similarities with a promissory note. In a personal guarantee, an individual agrees to be responsible for another party’s debt. This document often accompanies a promissory note, especially in business loans. Both documents create a financial obligation, but a personal guarantee adds a layer of security for the lender by holding an individual accountable for the borrower’s debt.

Additionally, a Secured Loan Agreement resembles a promissory note in that it involves borrowing money with the promise to repay. However, this type of agreement specifies collateral that the lender can claim if the borrower defaults. While a promissory note is primarily focused on the promise to repay, a secured loan agreement emphasizes the security provided to the lender, which can include personal property or other assets.

To navigate the complexities of rental agreements, landlords and tenants should be aware of the importance of proper documentation, such as the Texas Notice to Quit form. This key document not only facilitates clear communication regarding the vacating of premises but also protects the rights of both parties involved. For those looking to ensure compliance and accuracy in completing this form, it is recommended to download the document in pdf for a streamlined process.

Lastly, a Lease Agreement can be compared to a Georgia Promissory Note in that both involve a financial commitment over a specified period. A lease agreement outlines the terms under which one party rents property from another, detailing payment amounts and due dates. While a promissory note focuses on a loan repayment, a lease agreement emphasizes the rental terms, but both create binding obligations that require timely payments from the responsible party.

Steps to Filling Out Georgia Promissory Note

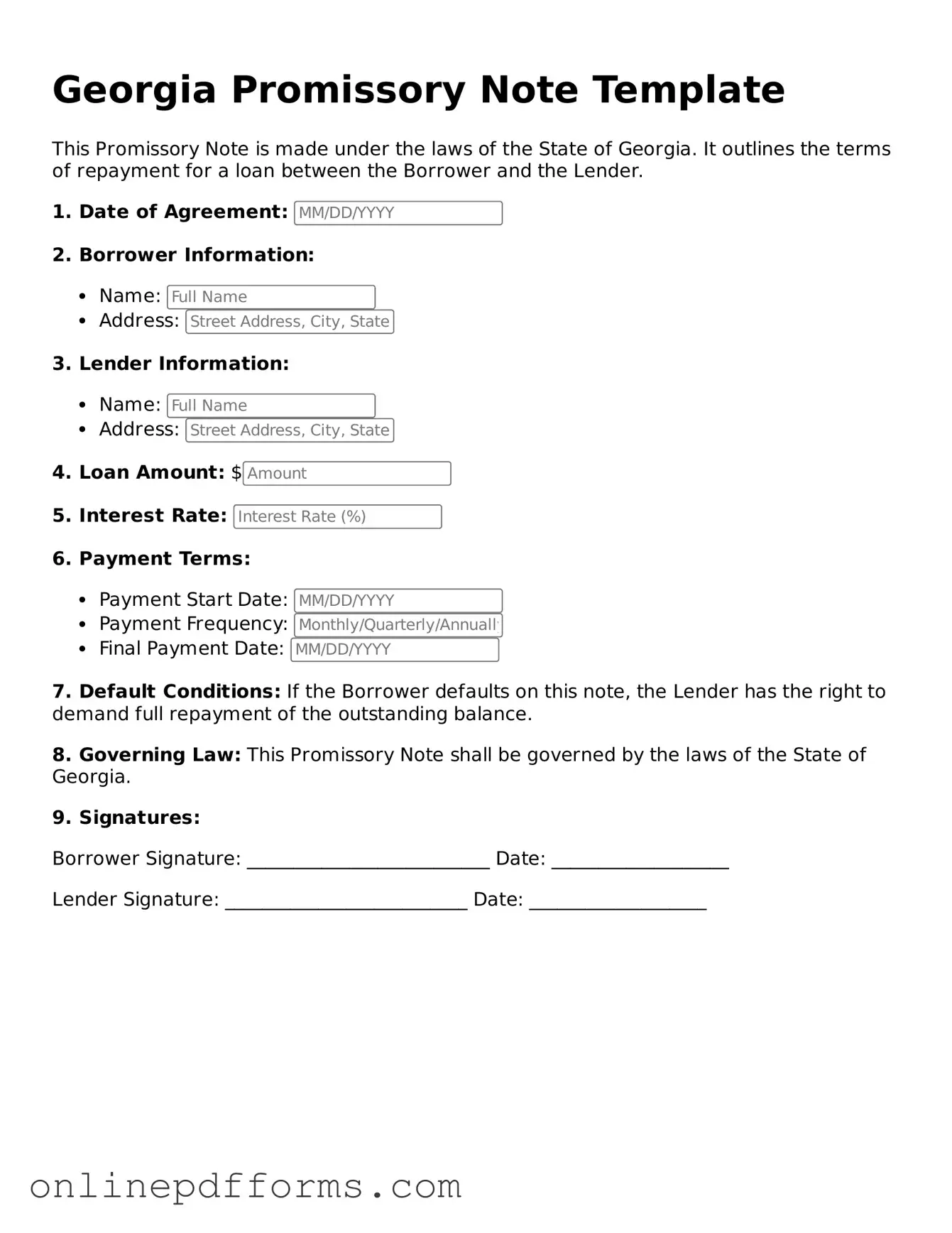

After obtaining the Georgia Promissory Note form, you will need to complete it carefully to ensure all necessary information is accurately provided. Once the form is filled out, it will be ready for signing by both parties involved in the agreement.

- Begin by entering the date at the top of the form. Use the format Month/Day/Year.

- In the first section, write the name and address of the borrower. Ensure that all details are correct and complete.

- Next, provide the lender's name and address in the designated area.

- Specify the principal amount being borrowed. This is the total amount of money that the borrower is agreeing to repay.

- Indicate the interest rate, if applicable. If no interest is charged, you may leave this section blank or specify “0%.”

- Fill in the repayment terms. Clearly state how and when the borrower will make payments. Include the frequency of payments (e.g., monthly, quarterly) and the final due date.

- Include any late fees or penalties for missed payments, if applicable. Be specific about the amounts and conditions.

- In the next section, outline any prepayment options. Indicate whether the borrower can pay off the loan early without penalties.

- Both parties should sign and date the form at the bottom. Ensure that signatures are in the designated areas.

- Finally, make copies of the completed form for both the borrower and the lender for their records.