Blank Georgia Quitclaim Deed Form

Documents used along the form

When engaging in real estate transactions in Georgia, a Quitclaim Deed is often accompanied by several other important documents. Each of these forms serves a specific purpose, ensuring that the transfer of property rights is clear and legally binding. Below is a list of five common documents that are frequently used alongside the Quitclaim Deed.

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, a warranty deed offers protection to the buyer against any future claims on the property.

- Affidavit of Title: This sworn statement by the seller confirms that they are the rightful owner of the property and that there are no outstanding liens or claims against it. This affidavit helps assure the buyer of the seller's legal standing.

- Title Search Report: Conducted by a title company, this report investigates the history of the property title to ensure it is free of encumbrances. A clean title search is crucial for a smooth transaction.

- Property Transfer Tax Form: This form is required for the payment of transfer taxes when the property changes hands. It is typically submitted to the county tax office and helps ensure compliance with local tax regulations.

- Closing Statement: This document outlines all financial transactions related to the sale, including the purchase price, closing costs, and any adjustments. It serves as a detailed record of the financial aspects of the transaction.

Understanding these additional forms can greatly enhance the clarity and security of property transactions in Georgia. Each document plays a crucial role in ensuring that the rights and responsibilities of all parties are clearly defined and protected.

Other Popular State-specific Quitclaim Deed Templates

Quitclaim Form - It is vital to accurately describe the property being conveyed in the form.

Quitclaim Deed Ny - This deed form eliminates the need for a formal title search.

Similar forms

A Warranty Deed is a document that guarantees the grantor holds clear title to the property and has the right to sell it. Unlike a Quitclaim Deed, which offers no such guarantees, a Warranty Deed provides protection to the buyer against any future claims on the property. This assurance can be crucial for buyers seeking peace of mind in their investment.

A Bargain and Sale Deed transfers property ownership without any warranties against encumbrances. Similar to a Quitclaim Deed, it conveys the interest of the seller but does not guarantee that the title is free from defects. Buyers should be aware that while they receive ownership, they may still face risks regarding the property's title.

An Executor’s Deed is used when a property is transferred from a deceased person's estate. This document is similar to a Quitclaim Deed in that it conveys ownership without guarantees. It is often used to distribute property according to the wishes expressed in a will, providing a straightforward way to transfer assets after death.

A Trustee’s Deed is executed by a trustee to convey property held in a trust. Like a Quitclaim Deed, it transfers ownership but does not provide any warranties regarding the title. This document is important for managing assets in a trust and ensuring that beneficiaries receive their intended inheritance.

A Deed in Lieu of Foreclosure allows a borrower to transfer property to a lender to avoid foreclosure. This document is similar to a Quitclaim Deed as it relinquishes ownership without any warranties. It can be a beneficial option for borrowers facing financial difficulties, providing a way to settle debts without the lengthy foreclosure process.

A Special Purpose Deed is often used for specific transactions, such as transferring property between family members or for tax purposes. It shares similarities with a Quitclaim Deed in that it conveys interest without warranties. This type of deed can simplify the transfer process for unique situations, making it easier for families to manage property.

A Mineral Deed transfers rights to minerals beneath the surface of a property. Similar to a Quitclaim Deed, it conveys interest without guaranteeing ownership of the surface land. This type of deed is essential for those looking to sell or lease mineral rights separately from the property itself.

A Bill of Sale is used to transfer ownership of personal property, such as vehicles or equipment. While it is not a real estate document like a Quitclaim Deed, it shares the characteristic of transferring ownership without warranties. This document is crucial for ensuring that buyers receive clear ownership of personal items, similar to the way Quitclaim Deeds transfer property interests.

A Leasehold Deed conveys the right to use and occupy property for a specified period. While it differs from a Quitclaim Deed in that it does not transfer ownership, it does share the aspect of limited rights. Both documents facilitate the transfer of interests in property, though in different contexts.

Finally, a Power of Attorney can grant someone the authority to act on behalf of another in real estate transactions. While it does not transfer property itself, it can enable the execution of a Quitclaim Deed. This document can be vital for individuals unable to manage their affairs personally, ensuring their property interests are handled according to their wishes.

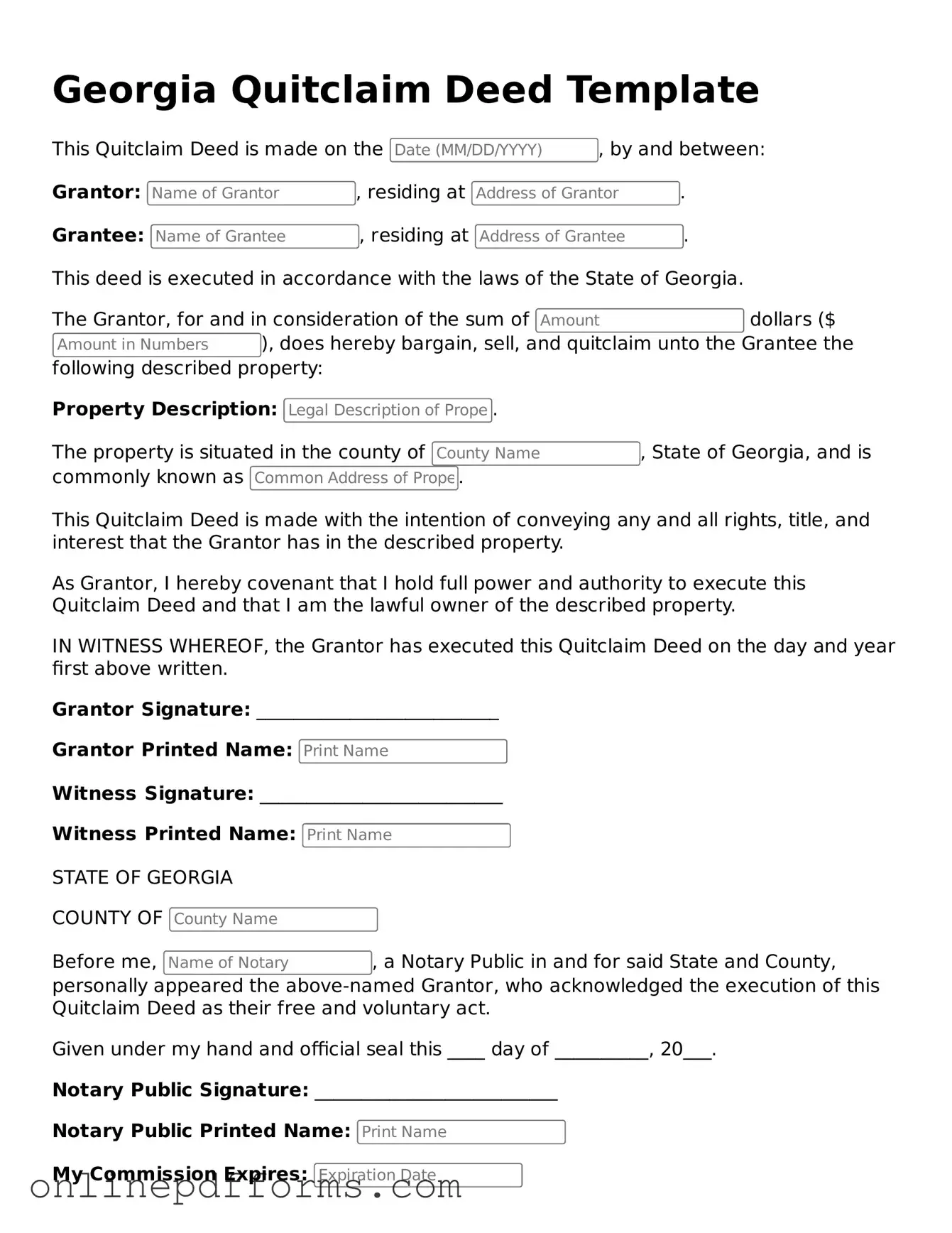

Steps to Filling Out Georgia Quitclaim Deed

Completing a Georgia Quitclaim Deed form is a straightforward process that allows you to transfer property ownership. After filling out the form, it is important to ensure that it is signed and notarized properly to make the transfer valid. Follow these steps carefully to fill out the form correctly.

- Obtain the form: You can find the Georgia Quitclaim Deed form online or at your local county clerk's office.

- Identify the parties: Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Make sure to include their addresses as well.

- Describe the property: Provide a complete legal description of the property being transferred. This may include the address and any relevant parcel numbers.

- State the consideration: Indicate the amount of money or other consideration being exchanged for the property. If it is a gift, you can note that as well.

- Sign the form: The grantor must sign the form in the presence of a notary public. Ensure that the signature is clear and matches the name listed on the form.

- Notarization: After the grantor signs, the notary will complete their section, verifying the identity of the grantor and witnessing the signature.

- File the deed: Submit the completed Quitclaim Deed to the county clerk's office where the property is located. There may be a filing fee, so be prepared to pay that at the time of submission.