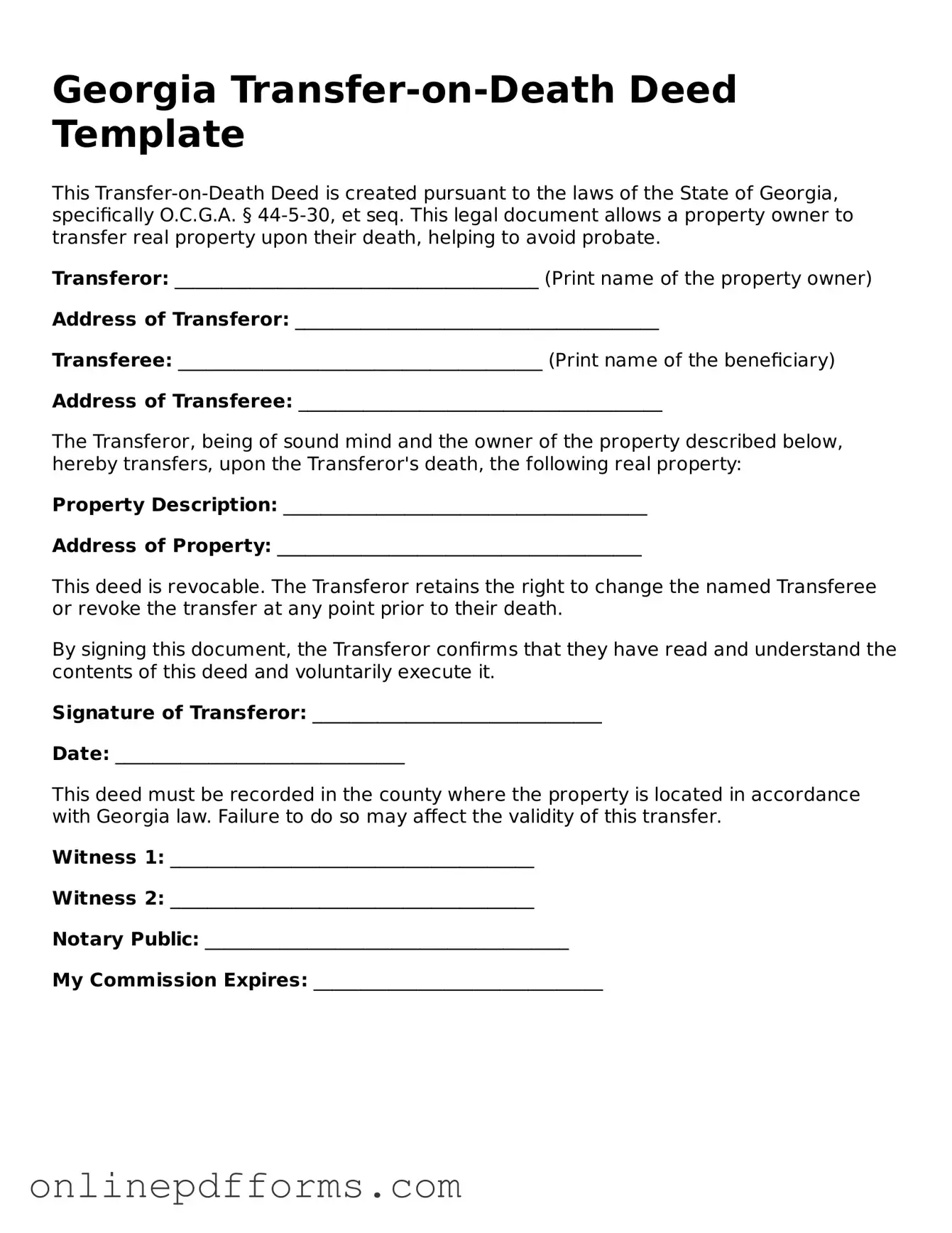

Blank Georgia Transfer-on-Death Deed Form

Documents used along the form

When dealing with property transfers in Georgia, particularly through a Transfer-on-Death Deed, several other forms and documents may be required to ensure a smooth process. Each of these documents serves a specific purpose and helps clarify the intentions of the parties involved. Below is a list of commonly used documents alongside the Transfer-on-Death Deed.

- Property Deed: This is the primary document that establishes ownership of the property. It details the current owner's rights and interests in the property and is essential for any transfer or sale.

- Affidavit of Heirship: This document is often used when a property owner passes away without a will. It helps to establish who the heirs are and their respective shares in the property, which can be crucial for the transfer process.

- Last Will and Testament: If the property owner has a will, this document outlines how their assets, including real estate, should be distributed upon their death. It may interact with the Transfer-on-Death Deed if the property is also mentioned in the will.

- Change of Beneficiary Form: This form is used to update or change the designated beneficiaries on a Transfer-on-Death Deed. It is important to keep this information current to reflect the property owner's wishes.

- Vehicle Bill of Sale: This important document formalizes the transfer of ownership for vehicles, ensuring the seller receives proper compensation and the buyer has proof of ownership. It is advisable to use Vehicle Bill of Sale Forms to complete this transaction smoothly.

- Property Tax Records: These documents provide information about the property’s assessed value and tax obligations. They are often reviewed during the transfer process to ensure there are no outstanding tax issues.

- Title Search Report: A title search verifies the legal ownership of the property and checks for any liens or encumbrances. This report is crucial to ensure that the property can be transferred without legal complications.

Understanding these documents can simplify the process of transferring property in Georgia. Each plays a vital role in ensuring that the transfer is legally sound and reflects the wishes of the property owner.

Other Popular State-specific Transfer-on-Death Deed Templates

Transfer on Death Deed Ohio Pdf - The deed can be revoked or changed at any time by the property owner before their death.

When purchasing an RV in Wisconsin, it's essential to utilize the proper documentation, such as the Wisconsin RV Bill of Sale form. This form is crucial as it officially records the sale and transfer of the recreational vehicle, ensuring that all details of the transaction are recognized legally. For convenience, you may refer to Auto Bill of Sale Forms to assist in this important process.

How Much Does a Beneficiary Deed Cost - This deed can also help streamline the transfer of property in cases of simultaneous deaths.

Ladybird Deed Texas Form - It is important for property owners to follow their state’s specific rules when completing a Transfer-on-Death Deed.

Similar forms

The Georgia Transfer-on-Death Deed (TOD) allows property owners to transfer real estate to beneficiaries upon their death, avoiding probate. This document shares similarities with a Last Will and Testament. Both documents outline the distribution of assets after death. However, unlike a will, which takes effect only after probate, a TOD deed allows for immediate transfer of property rights upon the owner’s death, streamlining the process and keeping the property out of probate court.

For those considering the details of a vehicle sale, understanding the legal protections that various agreements offer is essential. The Texas Vehicle Purchase Agreement form is a crucial document in this process, ensuring clarity and security for both buyers and sellers. By outlining vital information related to the transaction, such as purchase price and vehicle specifics, this form can help mitigate conflicts down the line. To learn more, you can access the form directly here: https://pdftemplates.info/texas-vehicle-purchase-agreement-form.

A Living Trust is another document that parallels the TOD deed. Like the TOD, a living trust allows for the transfer of assets without going through probate. In a living trust, the property is placed into a trust during the owner’s lifetime, and the owner can retain control over it. Upon death, the trust assets are distributed according to the trust terms, similar to how a TOD deed transfers property to named beneficiaries. However, a living trust can cover a broader range of assets beyond just real estate.

Joint Tenancy with Right of Survivorship is another document that serves a similar purpose. This arrangement allows two or more people to own property together. When one owner dies, their share automatically transfers to the surviving owner(s), similar to how a TOD deed operates. The key difference lies in the joint ownership aspect; with a TOD deed, the original owner maintains full control until death, while joint tenancy requires shared ownership during life.

The Beneficiary Designation form is also akin to the TOD deed. This form allows individuals to name beneficiaries for certain accounts, such as life insurance policies or retirement accounts. Upon the account holder’s death, the assets transfer directly to the named beneficiaries, bypassing probate. Both documents facilitate the direct transfer of assets, but the beneficiary designation typically applies to financial accounts rather than real estate.

Lastly, a Life Estate Deed is similar in that it allows for the transfer of property interests. With a life estate, the original owner retains the right to live in and use the property during their lifetime. Upon their death, the property automatically passes to the designated remainderman. Like the TOD deed, a life estate deed avoids probate, but it differs in that the original owner cannot sell or mortgage the property without the remainderman's consent.

Steps to Filling Out Georgia Transfer-on-Death Deed

Once you have the Georgia Transfer-on-Death Deed form ready, it's important to complete it accurately to ensure that your wishes are properly documented. After filling out the form, you will need to sign it in the presence of a notary public. This step is crucial for the deed to be legally recognized.

- Obtain the Georgia Transfer-on-Death Deed form. You can find it online or at your local county clerk's office.

- Fill in your name and address in the designated sections at the top of the form.

- Identify the property you wish to transfer by providing the complete legal description. This can often be found on your property deed.

- List the names and addresses of the beneficiaries who will receive the property upon your passing.

- Include any specific instructions regarding the transfer, if applicable.

- Sign the form in the presence of a notary public. Ensure that the notary acknowledges your signature.

- Make copies of the completed deed for your records and for the beneficiaries.

- File the original deed with the county's land records office where the property is located. Be aware of any filing fees that may apply.