Legal Gift Deed Form

Gift DeedTemplates for Specific States

Documents used along the form

A Gift Deed is an important document used to transfer property or assets from one person to another without any exchange of money. However, there are several other forms and documents that may be used in conjunction with a Gift Deed to ensure a smooth transfer process. Below is a list of these documents along with brief descriptions of each.

- Affidavit of Gift: This document serves as a sworn statement confirming the intent to give a gift. It may be required to verify the donor's wishes and intentions.

- Title Transfer Form: This form is used to officially change the title of the property from the donor to the recipient. It is often required by state authorities.

- Gift Tax Return (Form 709): If the value of the gift exceeds a certain amount, the donor may need to file this tax form with the IRS to report the gift.

- Deed of Trust: In some cases, a Deed of Trust may be used if the property is being gifted with certain conditions or if it involves financing arrangements.

- Power of Attorney: This document allows someone to act on behalf of the donor if they are unable to complete the gift transaction themselves.

- Property Appraisal: An appraisal may be necessary to determine the fair market value of the property being gifted, which can be important for tax purposes.

- Notice of Gift: This notice informs relevant parties, such as family members or financial institutions, about the gift and its details.

- RV Bill of Sale Form: This form is crucial for documenting the sale of a recreational vehicle in Texas; find it at https://pdftemplates.info/texas-rv-bill-of-sale-form/.

- Beneficiary Designation Form: If the gift involves financial accounts or insurance policies, this form may be needed to designate the recipient as the new beneficiary.

- Consent Form: If the gift involves minor children or requires consent from a spouse, this form can provide the necessary approvals for the transaction.

Each of these documents plays a vital role in ensuring that the gift is properly executed and that all legal requirements are met. It is advisable to consult with a legal professional to determine which forms are necessary for a specific situation.

Consider More Types of Gift Deed Forms

Title Companies and Transfer on Death Deeds - Customizing a Transfer-on-Death Deed allows you to tailor it to your estate needs and family circumstances.

When engaging in the sale of a Recreational Vehicle, it's crucial to utilize an RV Bill of Sale form, which not only serves as a legal record of the transaction but also safeguards the interests of both the buyer and the seller. To ensure a smooth transfer of ownership, you can find the necessary documentation through resources like Auto Bill of Sale Forms, which provide all the required details such as the purchase price, RV description, and sale date.

California Corrective Deed - Creating a Corrective Deed is often a quicker alternative compared to other legal remedies.

Similar forms

A Gift Deed is similar to a Will in that both documents involve the transfer of property or assets. However, a Will takes effect only after the death of the individual, whereas a Gift Deed transfers ownership immediately while the donor is still alive. This immediate transfer can be beneficial for both parties, allowing the recipient to enjoy the benefits of the property right away, while the donor can witness the positive impact of their gift.

Another document akin to a Gift Deed is a Trust. A Trust allows a person to manage their assets during their lifetime and specifies how those assets should be distributed after their death. While a Gift Deed is a straightforward transfer of ownership, a Trust can provide more control over how and when the assets are distributed. This can be particularly useful for individuals who wish to set conditions on their gifts or provide for beneficiaries over time.

A Quitclaim Deed also shares similarities with a Gift Deed. This document transfers ownership of property without guaranteeing that the title is clear. In a Quitclaim Deed, the grantor relinquishes any claim they have to the property, making it a quick way to transfer ownership. Unlike a Gift Deed, which typically involves a gift without consideration, a Quitclaim Deed can sometimes involve a transaction between family members or friends.

In many ways, a Sale Deed resembles a Gift Deed, but with a crucial difference: a Sale Deed involves a transaction where the buyer pays the seller for the property. Both documents serve the purpose of transferring ownership, but a Sale Deed requires payment and often includes more legal formalities. The urgency in executing a Sale Deed often stems from the buyer’s need to secure financing or meet specific deadlines.

A Lease Agreement can be compared to a Gift Deed in that both involve the use of property. However, a Lease Agreement allows one party to use another party's property for a specified time in exchange for rent. While a Gift Deed transfers ownership permanently, a Lease Agreement is temporary and does not transfer ownership rights. This distinction is essential for individuals considering their long-term property needs.

Similar to a Gift Deed, a Power of Attorney allows one person to act on behalf of another in legal matters, including property transactions. While a Gift Deed is a specific document for transferring property, a Power of Attorney can authorize someone to make various decisions, including gifting property. This can be particularly useful if the donor is unable to handle their affairs due to illness or other circumstances.

A Deed of Trust bears resemblance to a Gift Deed as it involves the transfer of property rights, but it serves a different purpose. A Deed of Trust is often used in real estate transactions to secure a loan. The property is held in trust until the borrower repays the loan. This document is crucial for lenders and borrowers, ensuring that the lender has a claim to the property if the borrower defaults.

Another document that aligns with a Gift Deed is a Beneficiary Designation form. This form allows individuals to name beneficiaries for certain assets, such as life insurance policies or retirement accounts. While a Gift Deed formally transfers ownership of property, a Beneficiary Designation ensures that assets pass directly to named individuals upon the owner’s death. This can simplify the transfer process and avoid probate.

For those looking to navigate the process of mobile home transactions, a resource detailing the comprehensive Mobile Home Bill of Sale form can be invaluable. This document not only facilitates a smooth transfer of ownership but also provides clarity on the transaction details, ensuring protection for both the buyer and seller involved in the sale.

Finally, a Charitable Donation Receipt is similar to a Gift Deed in that both involve giving away property or assets. However, a Charitable Donation Receipt is specifically for donations made to nonprofit organizations. This document serves as proof of the donation for tax purposes. Unlike a Gift Deed, which may involve personal relationships, a Charitable Donation Receipt formalizes the act of giving to a cause or organization.

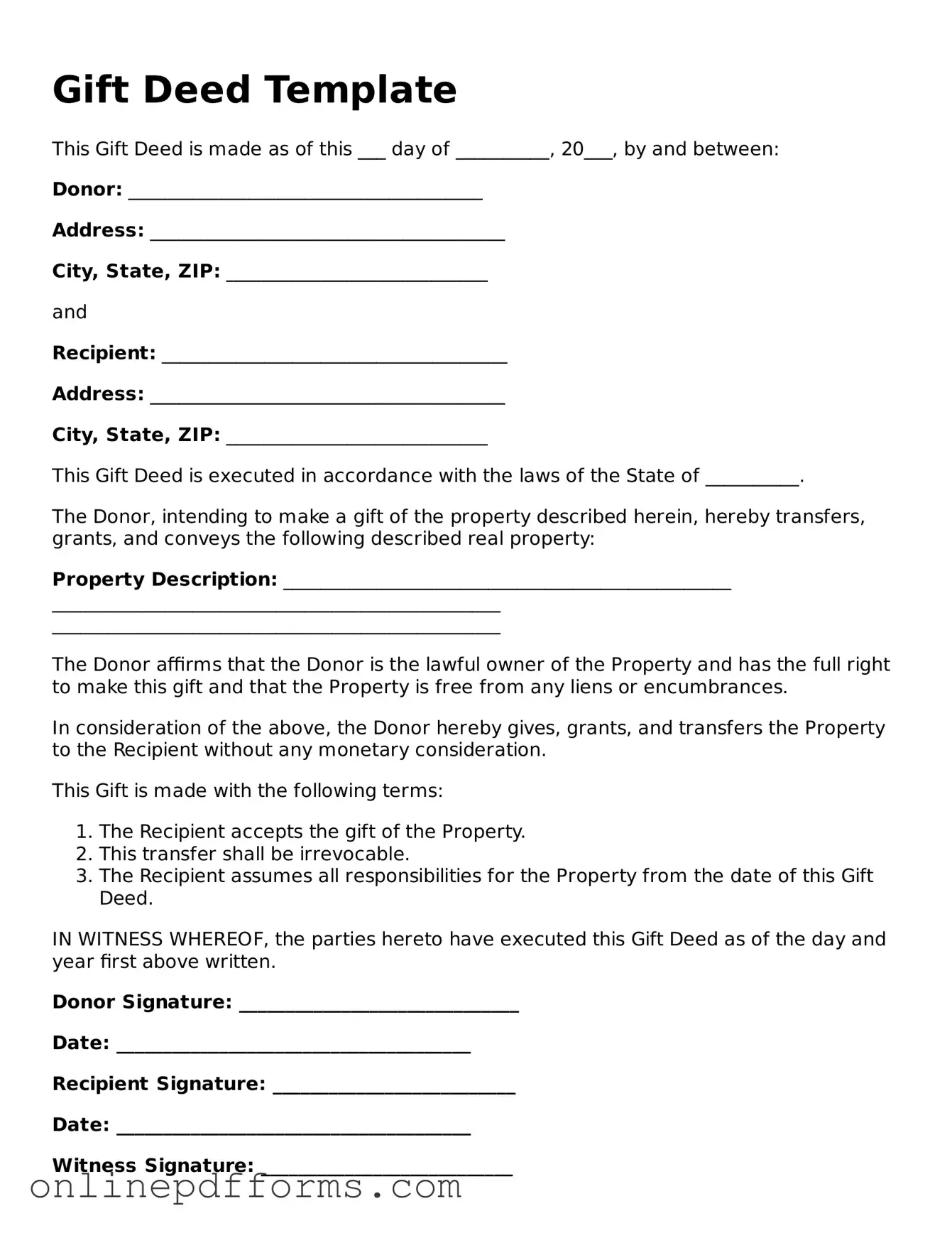

Steps to Filling Out Gift Deed

Completing a Gift Deed form is a straightforward process that requires careful attention to detail. Once you have filled out the form, you will typically need to sign it in front of a notary public to ensure its validity. After that, you may need to file it with your local county office, depending on your state’s requirements.

- Begin by obtaining the Gift Deed form from a reliable source, such as a legal website or your local government office.

- Read through the entire form to understand what information is required.

- Fill in the names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Provide a detailed description of the property being gifted. Include specifics like location, type of property, and any identifying features.

- Indicate the date of the gift. This is usually the date when the donor intends to transfer ownership.

- Include any conditions or terms related to the gift, if applicable. This may involve stipulations about how the property can be used.

- Sign the form in the designated area. Ensure that the signature matches the name printed on the form.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- Make copies of the completed and notarized form for your records.

- Submit the original Gift Deed to the appropriate local government office, if required by your state.