Fill in Your Gift Letter Template

Documents used along the form

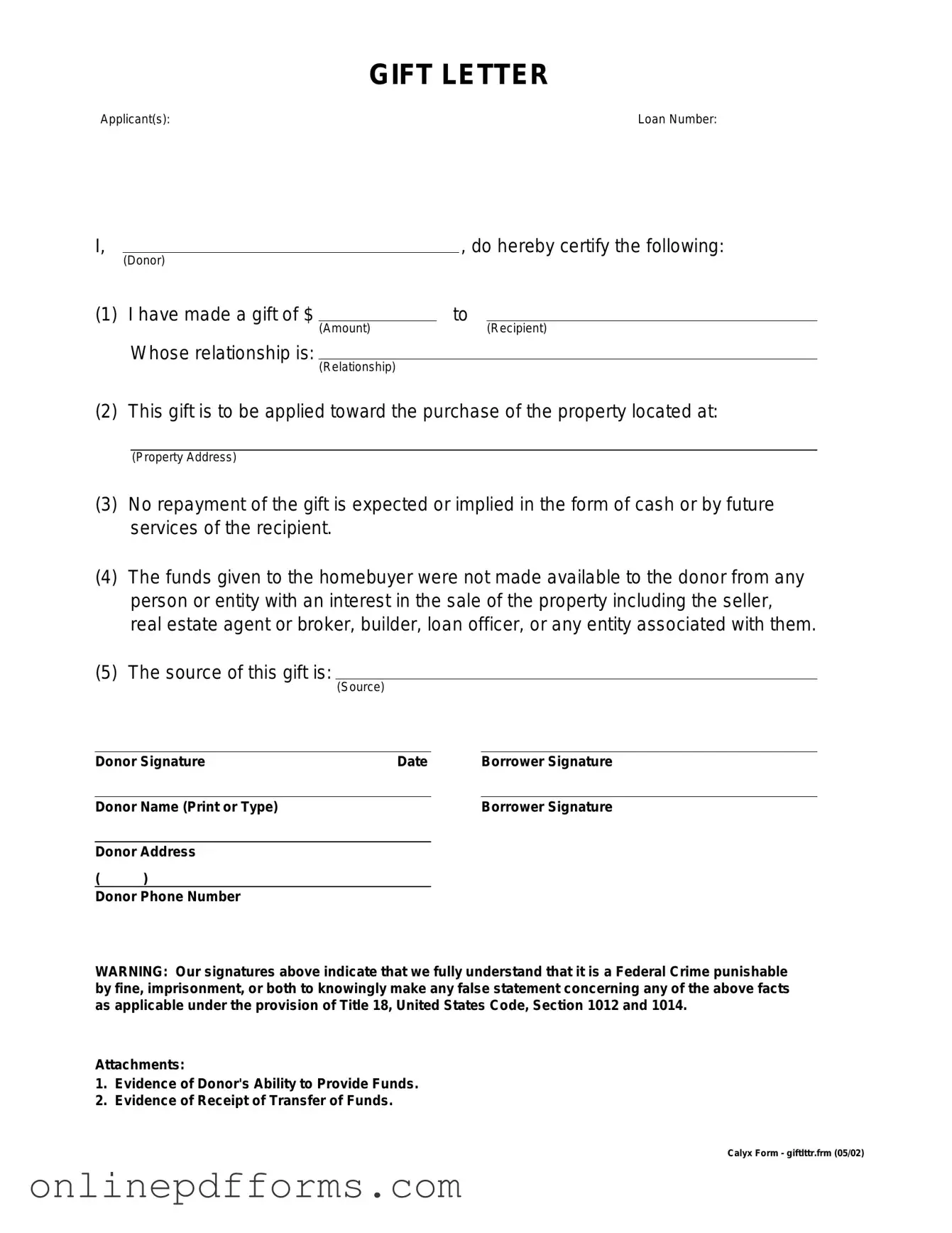

When individuals receive financial gifts to assist with a home purchase, several documents may accompany the Gift Letter form. Each of these documents plays a crucial role in verifying the legitimacy of the gift and ensuring compliance with lending requirements. Below is a list of common forms and documents that are often used in conjunction with the Gift Letter.

- Bank Statement: This document provides evidence of the donor's financial capacity to give the gift. It shows the funds available in the donor's account, confirming that the money is not borrowed.

- Gift Declaration Form: Similar to the Gift Letter, this form explicitly states the amount of the gift and the relationship between the donor and the recipient. It helps clarify the nature of the transaction.

- Articles of Incorporation: This document is essential for establishing a corporation in Wisconsin, detailing crucial information about the business entity, such as its name and purpose. To get started, visit pdftemplates.info/wisconsin-articles-of-incorporation-form/.

- Donor's Identification: A copy of the donor's identification, such as a driver's license or passport, may be required to verify their identity and confirm their relationship to the recipient.

- Settlement Statement: This document outlines the final details of the real estate transaction, including the source of the funds. It may include the gift as part of the overall financing picture.

- Loan Application: The recipient's loan application will detail their financial situation and is often reviewed alongside the Gift Letter to assess overall eligibility for the mortgage.

- Proof of Relationship: Documentation that establishes the relationship between the donor and recipient, such as a birth certificate or marriage license, may be necessary to substantiate the claim of a legitimate gift.

- Tax Returns: In some cases, lenders may request the donor's recent tax returns to further verify their financial stability and the legitimacy of the gift.

- Gift Tax Form (IRS Form 709): If the gift exceeds a certain amount, the donor may need to file this form with the IRS, indicating that a gift was made and ensuring compliance with tax regulations.

These documents collectively help to create a clear and transparent picture of the financial transaction, ensuring that all parties involved understand the implications of the gift. By providing thorough documentation, recipients can facilitate a smoother home-buying process and adhere to lender requirements.

More PDF Templates

What Is Asurion - A guide for setting up a men's wardrobe inventory.

When preparing for the adoption process, it is important for families to have access to the necessary resources and forms. One such resource is the Arizona PDF Forms, which provides essential documentation needed to ensure a smooth and compliant adoption journey, particularly with regard to the completion of the AN-048 form.

Fedex Frt - Shippers can create their Bills of Lading online, simplifying the preparation and submission steps.

Similar forms

A Gift Letter form is often compared to a Loan Gift Agreement. While both documents serve to clarify the nature of financial assistance, a Loan Gift Agreement specifically outlines the terms under which a loan is provided, including repayment expectations. This agreement can help prevent misunderstandings between the giver and the recipient, ensuring that both parties are on the same page regarding the financial arrangement.

Another similar document is the Affidavit of Support. This form is commonly used in immigration cases to demonstrate that an individual has adequate financial support. Like a Gift Letter, it confirms that funds are being provided without expectation of repayment. However, the Affidavit of Support typically requires the sponsor to prove their financial ability to support the immigrant, adding an additional layer of responsibility.

The Financial Gift Declaration is another document that resembles a Gift Letter. This declaration is often used in situations where one party wishes to declare that a transfer of funds is a gift rather than income. Both documents aim to clarify the intent behind the financial transaction, but the Financial Gift Declaration may also include tax implications and other financial disclosures.

A Promissory Note can also be compared to a Gift Letter, though it typically involves a loan rather than a gift. This document outlines the borrower's promise to repay a specific amount of money under agreed-upon terms. While a Gift Letter states that the funds are a gift with no repayment required, a Promissory Note establishes a legal obligation for repayment.

The Contribution Agreement shares similarities with a Gift Letter as well. This document outlines the terms of a financial contribution made by one party to another, often for specific purposes, such as funding a project or business venture. While both documents confirm that funds are being provided, a Contribution Agreement may include stipulations about how the funds can be used, which is not typically addressed in a Gift Letter.

In the realm of vehicle transactions, it is crucial to ensure that all aspects of the sale are clearly documented to avoid any misunderstandings. As with various financial agreements, the use of standardized forms can greatly aid in this process. One such vital document, the Auto Bill of Sale Forms, serves to facilitate the transfer of ownership, providing both the buyer and seller with a clear legal record of the transaction. By utilizing this form, parties can contribute to a seamless transition, equivalent to the clarity offered by a Gift Letter in financial dealings.

Lastly, a Charitable Donation Receipt can be likened to a Gift Letter in that both documents serve to confirm the transfer of funds. However, a Charitable Donation Receipt is specifically used for donations made to non-profit organizations. This receipt provides proof for tax purposes, whereas a Gift Letter is more personal and often used in family or friend transactions without tax implications.

Steps to Filling Out Gift Letter

Once you have gathered the necessary information, you are ready to fill out the Gift Letter form. This form is important for documenting the financial support you are receiving. Follow the steps below to complete it accurately.

- Begin by entering the date at the top of the form.

- Provide the name of the donor. This should be the person giving the gift.

- Include the donor's address. Make sure this is complete and accurate.

- Next, write the recipient's name. This is the person receiving the gift.

- Fill in the recipient's address. Ensure this is also complete and correct.

- State the amount of the gift. Be specific about the total value.

- Describe the nature of the gift. Clearly indicate that it is a gift and not a loan.

- Both the donor and the recipient should sign and date the form at the bottom.

After completing the form, keep a copy for your records. Make sure to provide the signed original to the relevant party as needed.