Fill in Your Goodwill donation receipt Template

Documents used along the form

When you make a donation to Goodwill or similar organizations, several documents may accompany your donation. Each of these forms serves a specific purpose, ensuring that both you and the organization have a clear understanding of the transaction. Here’s a list of common documents you might encounter along with a Goodwill donation receipt form.

- Donation Inventory List: This document helps you itemize all the items you are donating. It provides a detailed list that can be useful for tax purposes.

- Appraisal Form: If you are donating high-value items, an appraisal form may be necessary. This form provides a professional valuation of the items, which can be important for tax deductions.

- Tax Deduction Worksheet: This worksheet helps you calculate the value of your donations. It can assist in determining how much you can deduct from your taxes.

- Motorcycle Bill of Sale: To ensure a smooth sale process, refer to the comprehensive motorcycle bill of sale form guide that details essential transaction elements.

- Charitable Contribution Statement: This statement outlines the total amount of your donations over a specific period. It can be helpful for tracking your charitable giving throughout the year.

- Non-Cash Charitable Contribution Form: This form is used to report non-cash donations when filing your taxes. It ensures you comply with IRS requirements.

- Thank You Letter: After your donation, organizations often send a thank you letter. This letter acknowledges your contribution and may include details for tax purposes.

- Proof of Donation: This could be a copy of the receipt or any other documentation that verifies your donation. It’s important for record-keeping and tax deductions.

- Donor Intent Form: This form may be used to specify how you want your donation to be used. It helps the organization understand your wishes regarding the donation.

- Volunteer Agreement: If you plan to volunteer in addition to donating, this agreement outlines the terms of your volunteer work with the organization.

Having these documents on hand can make your donation process smoother and help you maximize your tax benefits. Keeping everything organized ensures you have all the necessary information when you need it.

More PDF Templates

Share Transfer Form - The Stock Transfer Ledger is often maintained by the corporation's secretary or designated officer.

To ensure a smooth transaction when buying or selling a motorcycle in Arkansas, it's essential to utilize the appropriate documentation, such as the Vehicle Bill of Sale Forms, which clearly outlines the responsibilities and rights of both parties involved in the sale.

Dd Form 2870 - The DD 2870 protects your personal health information integrity during transfers.

Creating a Job Application - Explain any convictions if applicable, but know it is not disqualifying.

Similar forms

The Goodwill donation receipt form is similar to a charitable contribution receipt. Both documents serve as proof that a donation has been made to a nonprofit organization. These receipts typically include the name of the donor, the date of the donation, and a description of the items donated. They are essential for individuals who want to claim tax deductions for their charitable contributions. Just like the Goodwill form, a charitable contribution receipt helps ensure that donors have the necessary documentation to support their tax filings.

Another document that shares similarities is the IRS Form 8283, which is used for noncash charitable contributions. This form is required when a donor claims a deduction for items valued over $500. Like the Goodwill receipt, Form 8283 must detail the donated items and their fair market value. Both documents help establish the legitimacy of the donation and provide necessary information for tax purposes, ensuring that donors comply with IRS regulations.

The donation acknowledgment letter from a nonprofit organization is also comparable. This letter is sent to donors to confirm their contributions, similar to how a Goodwill receipt functions. It typically includes the donor’s name, the date of the donation, and a statement indicating whether any goods or services were provided in exchange for the donation. Both documents serve as important records for donors, reinforcing their commitment to charitable giving and supporting their tax claims.

This overview of various charitable donation documents highlights their common purpose of providing proof for tax deductions while ensuring transparency in the donation process. Among these, the Auto Bill of Sale Forms exemplify the importance of clear records in financial transactions, analogous to how donation receipts serve to document contributions and maintain compliance with IRS criteria. The consistency in information provided across different documents emphasizes the necessity for accuracy and clarity to benefit both donors and organizations alike.

In addition, a donor’s tax return can be seen as a related document. While not a receipt itself, it includes the details of all charitable contributions made throughout the year, including those documented by forms like the Goodwill receipt. This ensures that donors can accurately report their charitable deductions to the IRS. Both the tax return and the Goodwill receipt work together to provide a complete picture of an individual’s charitable giving.

The in-kind donation form is another document that resembles the Goodwill donation receipt. This form is often used by organizations to record noncash donations, such as clothing, food, or services. Similar to the Goodwill receipt, it includes details about the items donated and their estimated value. Both documents are crucial for tracking donations and ensuring transparency in charitable activities.

Lastly, a sales receipt from a thrift store or consignment shop can also be compared to the Goodwill donation receipt. While a sales receipt confirms a purchase, it can indirectly relate to donations by showing the value of items that were sold after being donated. Both types of receipts reflect the cycle of charitable giving and the importance of documenting transactions for financial records, whether for donations or purchases.

Steps to Filling Out Goodwill donation receipt

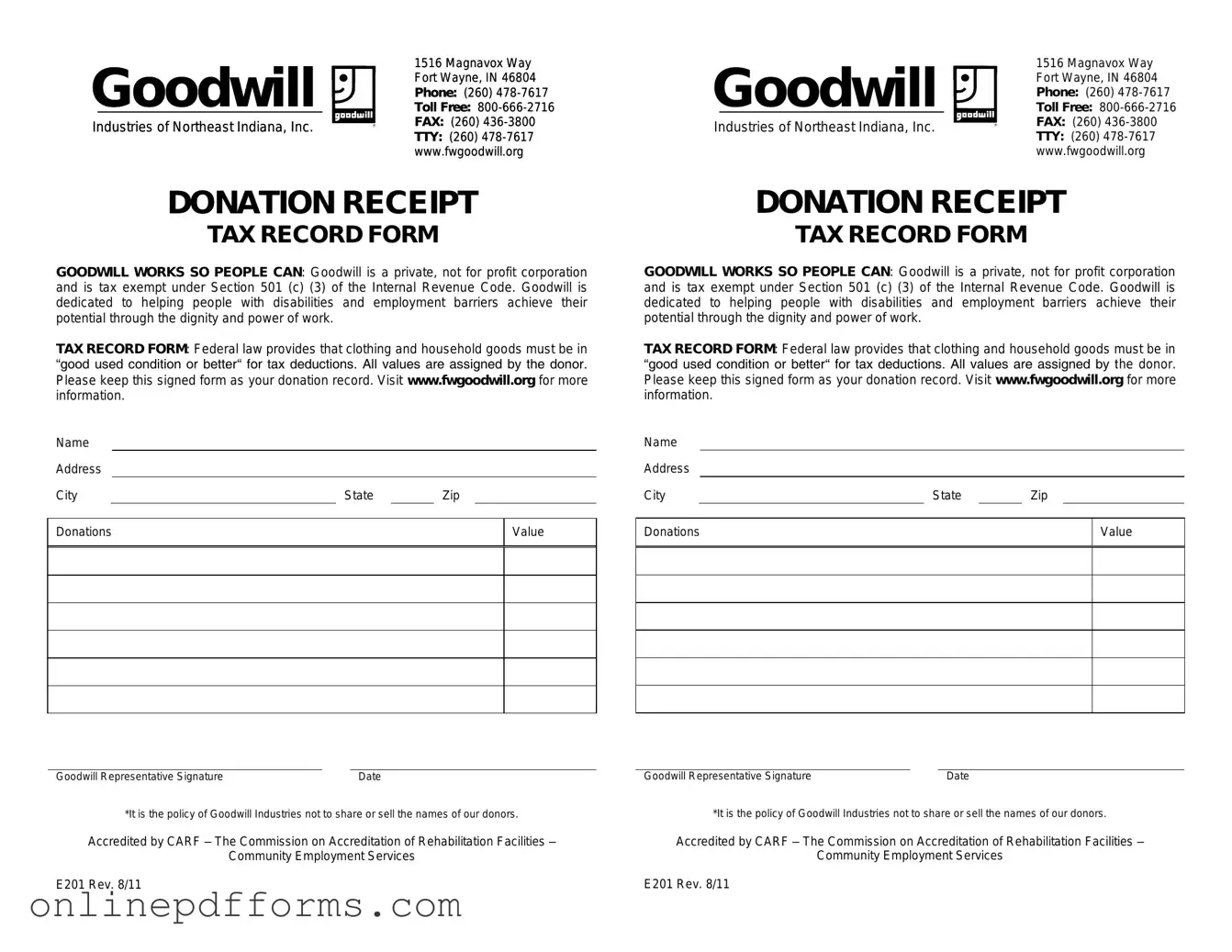

When you decide to donate items to Goodwill, it’s important to keep track of your contributions for tax purposes. Filling out the donation receipt form accurately ensures that you have the necessary documentation when it comes time to file your taxes. Here’s how to complete the form step by step.

- Gather your items: Collect all the items you plan to donate. Ensure they are clean and in good condition.

- Visit a Goodwill location: Take your items to a nearby Goodwill store or donation center.

- Request the receipt form: Ask a Goodwill employee for a donation receipt form when you arrive.

- Fill out your information: Write your name, address, and contact information at the top of the form.

- List your donated items: In the designated section, write down a brief description of each item you are donating.

- Estimate the value: Next to each item, provide an estimated value. Be honest and reasonable in your assessment.

- Sign and date the form: At the bottom of the form, sign your name and include the date of the donation.

- Keep a copy: Make sure to keep a copy of the completed receipt for your records.

After you have filled out the form, keep it in a safe place. This receipt will serve as proof of your charitable donation when you prepare your taxes. It’s a good idea to review your records at the end of the year to ensure everything is in order.