Blank Illinois Articles of Incorporation Form

Documents used along the form

When forming a corporation in Illinois, several documents and forms are typically used alongside the Articles of Incorporation. Each of these documents serves a specific purpose in the incorporation process and helps ensure compliance with state regulations. Below is a list of commonly used forms and documents.

- Bylaws: This document outlines the internal rules and regulations for managing the corporation. It includes details about the governance structure, roles of officers, and procedures for meetings.

- Initial Board of Directors Meeting Minutes: These minutes record the decisions made during the first meeting of the board of directors. It often includes the appointment of officers and the adoption of bylaws.

- Employer Identification Number (EIN) Application (Form SS-4): This form is submitted to the IRS to obtain an EIN, which is necessary for tax purposes and hiring employees.

- Statement of Purpose: This document describes the business activities the corporation will engage in. It may be included in the Articles of Incorporation or filed separately.

- Registered Agent Consent Form: This form confirms that the registered agent has agreed to serve in that capacity for the corporation. It is required to designate a registered agent in Illinois.

- Annual Report: Corporations in Illinois must file an annual report to maintain good standing. This report updates the state on the corporation's current status and any changes in information.

- Shareholder Agreement: This agreement outlines the rights and responsibilities of shareholders. It can address issues such as share transfers and decision-making processes.

- Business Licenses and Permits: Depending on the type of business, various local, state, or federal licenses and permits may be required to operate legally.

- Operating Agreement (for LLCs): If the corporation is an LLC, this document outlines the management structure and operating procedures of the business.

Each of these documents plays a vital role in establishing and maintaining a corporation in Illinois. Properly preparing and filing these forms can help ensure that the corporation operates smoothly and remains compliant with state laws.

Other Popular State-specific Articles of Incorporation Templates

State of Florida Division of Corporations - Understanding how to properly complete the Articles can save time and resources during the incorporation process.

New York State Division of Corporations - Allows for the inclusion of any additional provisions relevant to the corporation's operation.

Pennsylvania Department of Corporations - Some states allow businesses to include additional provisions beyond the basics.

File Llc Ohio - The articles should be drafted carefully to reflect true intentions.

Similar forms

The Articles of Organization is a document used by limited liability companies (LLCs) in Illinois. Like the Articles of Incorporation, it establishes the existence of a business entity. Both documents require basic information, such as the name of the business and the registered agent. However, the Articles of Organization focus on the structure of an LLC, which provides personal liability protection to its members while allowing flexibility in management and taxation.

The Certificate of Formation is another document similar to the Articles of Incorporation. This document is often used interchangeably with the Articles of Incorporation in some states. It serves the same purpose of legally establishing a corporation. The Certificate of Formation may include details like the business name, purpose, and information about the directors. Both documents are essential for compliance with state laws.

The Bylaws outline the internal rules and regulations for a corporation. While the Articles of Incorporation establish the corporation's existence, the Bylaws govern its operations. They detail how meetings are conducted, how decisions are made, and the rights of shareholders. Both documents are crucial, but the Bylaws are more about management and governance, whereas the Articles focus on legal formation.

The Operating Agreement is similar to Bylaws but is specifically for LLCs. This document outlines how the LLC will be managed and the responsibilities of its members. Like the Articles of Incorporation, it is essential for defining the structure and operational procedures of the business. It provides clarity on issues such as profit distribution and member roles, ensuring smooth operation.

The Statement of Information is often required after filing the Articles of Incorporation. This document provides updated information about the corporation, including its address and the names of its officers. While the Articles serve as the initial filing to create the entity, the Statement of Information keeps the state informed about the business's current status. Both documents are essential for maintaining compliance with state regulations.

The Certificate of Good Standing is a document that confirms a corporation is legally registered and compliant with state requirements. While it does not establish a business, it is often needed for various transactions, such as applying for loans or entering contracts. This certificate can be seen as a follow-up to the Articles of Incorporation, as it verifies that the corporation is in good standing after its formation.

The Annual Report is a document that corporations must file regularly to update the state on their activities and financial status. This report is similar to the Articles of Incorporation in that it ensures ongoing compliance with state laws. While the Articles of Incorporation are a one-time filing to create the entity, the Annual Report is a recurring requirement that keeps the state informed about the corporation's ongoing operations.

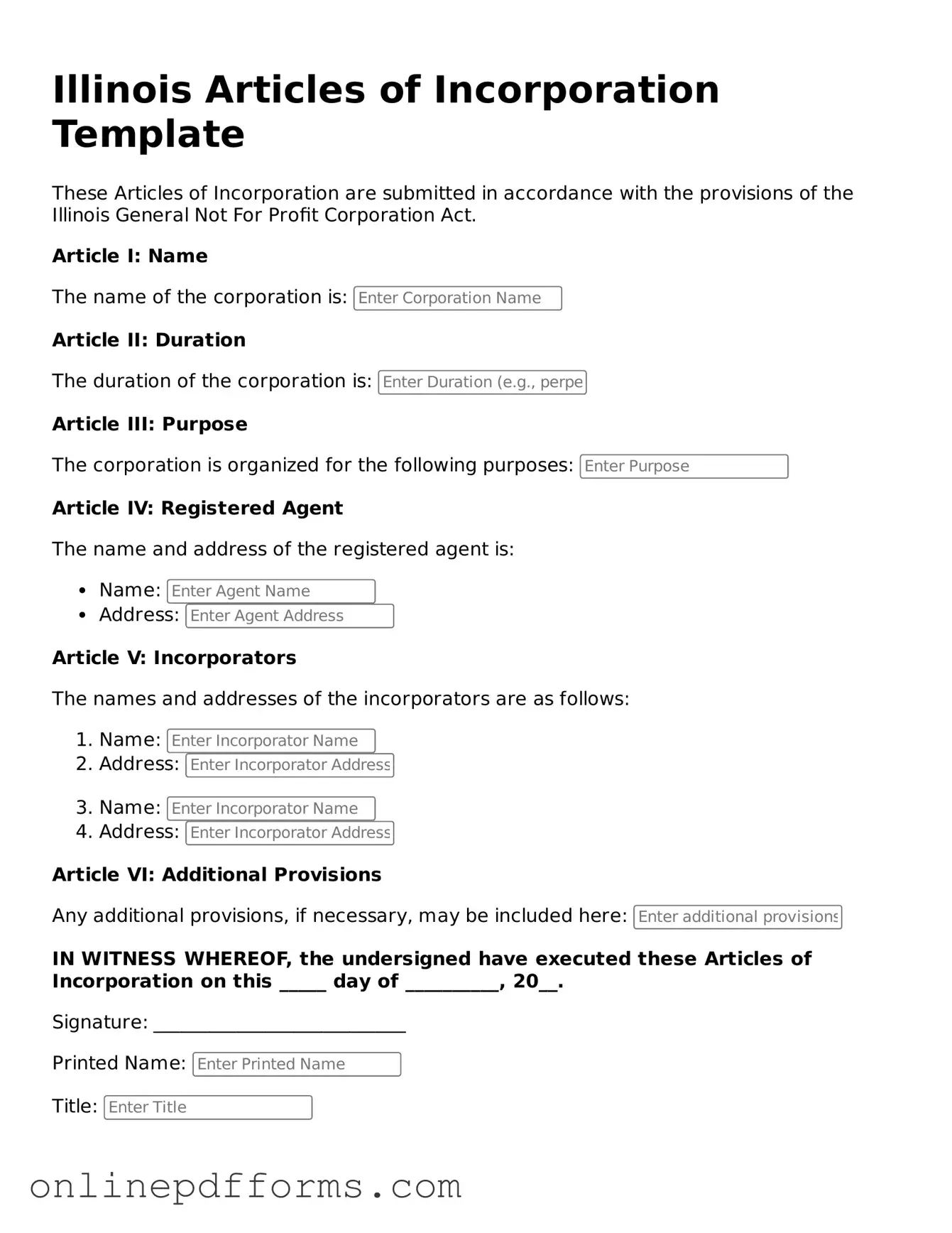

Steps to Filling Out Illinois Articles of Incorporation

After completing the Illinois Articles of Incorporation form, you will need to submit it to the appropriate state office along with the required filing fee. This process officially establishes your corporation in Illinois. Follow these steps to ensure that you fill out the form correctly.

- Obtain the Articles of Incorporation form from the Illinois Secretary of State's website or office.

- Enter the name of your corporation. Ensure it complies with Illinois naming rules.

- Provide the purpose of your corporation. Be clear and concise about your business activities.

- List the registered agent's name and address. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the number of shares your corporation is authorized to issue. Specify the class of shares if applicable.

- Fill in the duration of the corporation. Most corporations are perpetual unless stated otherwise.

- Include the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Sign and date the form. Ensure that the signatures are from the incorporators listed.

- Review the form for accuracy and completeness before submission.

- Prepare the filing fee. Check the current fee amount on the Illinois Secretary of State's website.

- Submit the completed form and payment to the Illinois Secretary of State's office by mail or in person.