Blank Illinois Deed Form

Documents used along the form

When dealing with property transactions in Illinois, several documents often accompany the deed form. Each of these documents plays a crucial role in ensuring that the transfer of ownership is clear and legally binding. Understanding these documents can help individuals navigate the process more effectively.

- Title Insurance Policy: This document protects the buyer from any potential claims against the property that may arise after the purchase. It ensures that the title is clear and free from disputes.

- Motor Vehicle Bill of Sale: Essential for documenting the ownership transfer of a vehicle, this form captures the buyer's and seller's details, vehicle description, and purchase price, and can be found at https://mypdfform.com/blank-arizona-motor-vehicle-bill-of-sale/.

- Property Disclosure Statement: Sellers are often required to provide this statement, which outlines any known issues or defects with the property. It helps buyers make informed decisions.

- Closing Statement: This document details all financial transactions related to the sale, including the purchase price, closing costs, and any adjustments. It serves as a final account of the transaction.

- Affidavit of Title: This sworn statement confirms that the seller is the rightful owner of the property and has the authority to sell it. It helps establish the legitimacy of the transaction.

- Transfer Tax Declaration: This form is used to report the transfer of property and assess any applicable taxes. It ensures compliance with local tax regulations.

Each of these documents is essential in the property transfer process in Illinois. Being familiar with them can help ensure a smooth transaction and protect the interests of all parties involved.

Other Popular State-specific Deed Templates

Ohio Warranty Deed Form - A Deed is an essential step in closing the sale of real estate.

When engaging in an RV sale in Texas, it is important to utilize the Texas RV Bill of Sale, a document that streamlines the ownership transfer process for both parties involved. This legal form not only acts as proof of transaction but also protects the interests of buyers and sellers alike. For those interested in accessing this essential document, you can find it at pdftemplates.info/texas-rv-bill-of-sale-form/, making it easier to ensure a smooth and legal sale.

What Does a House Deed Look Like in Pa - Can include various forms, such as warranty deeds and quitclaim deeds.

Similar forms

The Illinois Deed form is similar to the Warranty Deed. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it. This type of deed protects the buyer by ensuring that there are no outstanding claims against the property. If any issues arise regarding ownership, the seller is responsible for resolving them, providing peace of mind to the buyer.

Another document akin to the Illinois Deed form is the Quitclaim Deed. Unlike a Warranty Deed, a Quitclaim Deed transfers whatever interest the seller has in the property without making any guarantees. This means that if the seller does not actually own the property, the buyer receives no legal recourse. This type of deed is often used among family members or in situations where the parties trust each other.

When engaging in a property transaction, it's crucial to ensure that all necessary paperwork is in order, particularly the relevant forms for the type of property being sold. For those looking to acquire a Recreational Vehicle, understanding the importance of documentation, such as the Auto Bill of Sale Forms, can safeguard both the buyer's ownership rights and the seller's interests during the transfer process.

The Special Purpose Deed also shares similarities with the Illinois Deed form. This deed is used for specific situations, such as transferring property from a trust or an estate. It may not provide the same level of protection as a Warranty Deed, but it serves its purpose in transferring ownership under unique circumstances, ensuring that the intent of the parties is honored.

A Bargain and Sale Deed is another document that resembles the Illinois Deed form. This type of deed implies that the seller has title to the property and the right to sell it, but it does not guarantee that the title is free of defects. Buyers may find this deed useful when purchasing property at a lower price, but they should be aware of the potential risks involved.

The Grant Deed is similar to the Illinois Deed form in that it transfers property ownership and includes some assurances about the title. The seller guarantees that they have not sold the property to anyone else and that the property is free from undisclosed encumbrances. This provides a bit more security for the buyer than a Quitclaim Deed, while still being less comprehensive than a Warranty Deed.

A Trustee's Deed is another document that can be compared to the Illinois Deed form. This type of deed is used when property is transferred by a trustee, often in the context of a trust or bankruptcy. It serves to convey the property from the trustee to the new owner, ensuring that the transfer complies with the terms of the trust or court order.

The Fiduciary Deed is also similar to the Illinois Deed form. This deed is used when a fiduciary, such as an executor or administrator, transfers property on behalf of another person. The fiduciary must act in the best interest of the estate or trust, and this type of deed helps ensure that the transfer is legally valid and recognized.

The Mineral Deed is another document that shares characteristics with the Illinois Deed form. This deed specifically transfers ownership of mineral rights beneath a property. While it may not convey the surface rights, it allows the buyer to extract minerals such as oil or gas, making it a specialized but important type of deed in real estate transactions.

Lastly, the Easement Deed is similar in that it involves the transfer of rights related to property. An Easement Deed grants someone the right to use a portion of another person's property for a specific purpose, such as access to a road or utility lines. While it does not transfer ownership, it is crucial in defining how property can be used and accessed.

Steps to Filling Out Illinois Deed

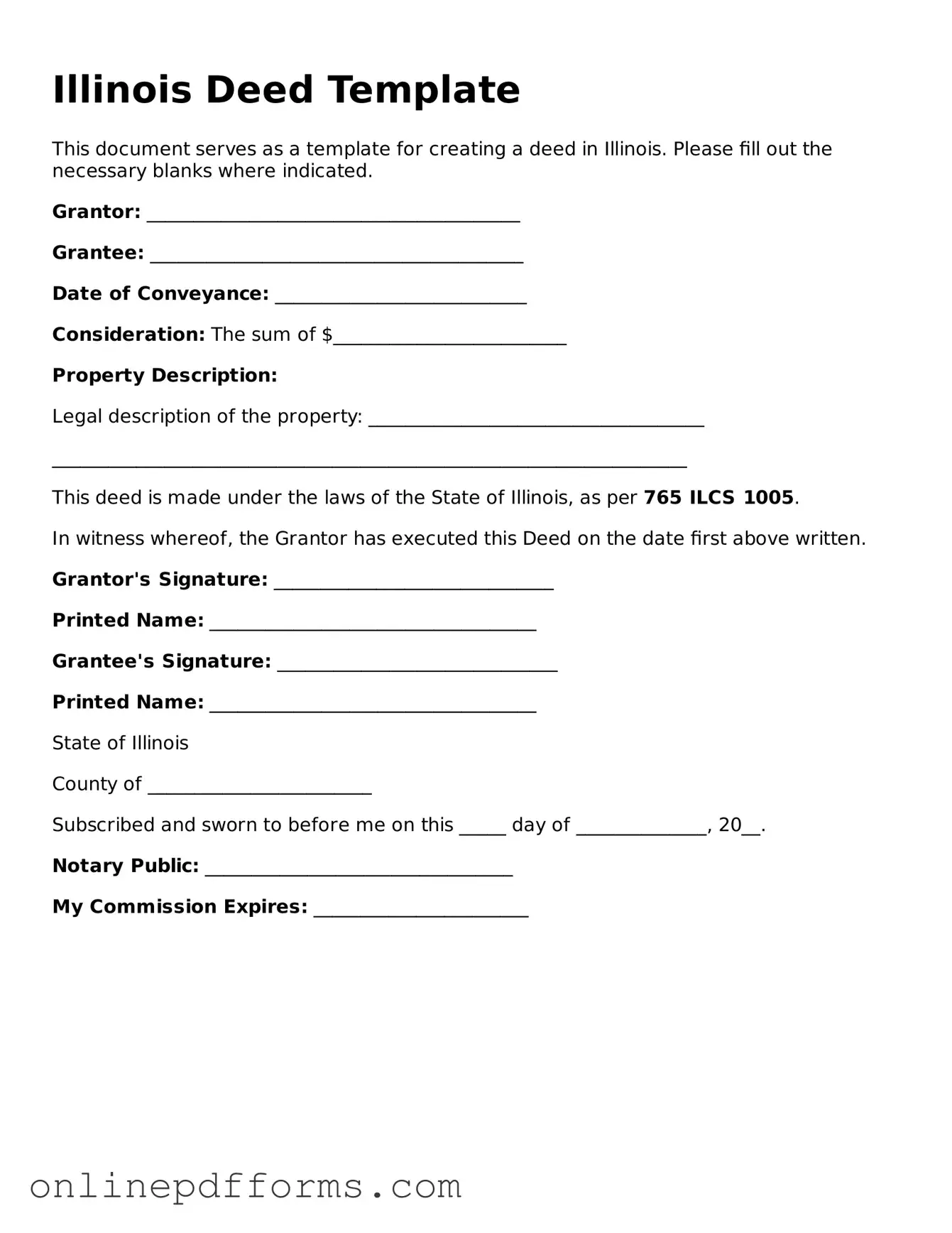

Once you have obtained the Illinois Deed form, the next step involves accurately completing it to ensure a valid transfer of property ownership. Careful attention to detail is essential throughout the process.

- Begin by entering the date at the top of the form.

- Identify the grantor (the person transferring the property). Provide their full name and address.

- Next, enter the name and address of the grantee (the person receiving the property).

- Clearly describe the property being transferred. Include the legal description, which can typically be found on the property’s previous deed or tax records.

- Specify the consideration (the value exchanged for the property). This is often the sale price or another form of compensation.

- Include any additional terms or conditions of the transfer, if applicable.

- Have the grantor sign the form in the designated area. Ensure that the signature is notarized to validate the document.

- Finally, make copies of the completed deed for your records before submitting it for recording with the appropriate county office.